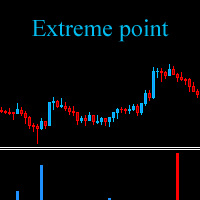

Extreme point

- Indikatoren

- Ilya Fomin

- Version: 1.1

- Aktualisiert: 8 Dezember 2017

- Aktivierungen: 10

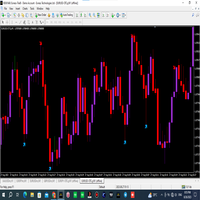

The Extreme point indicator helps in determining the probable price reversal points on the chart.

The indicator facilitates the search for points to enter the market with greater accuracy. The indicator displays certain impulses, after which there is a high probability of the price continuing its movement in the same direction.

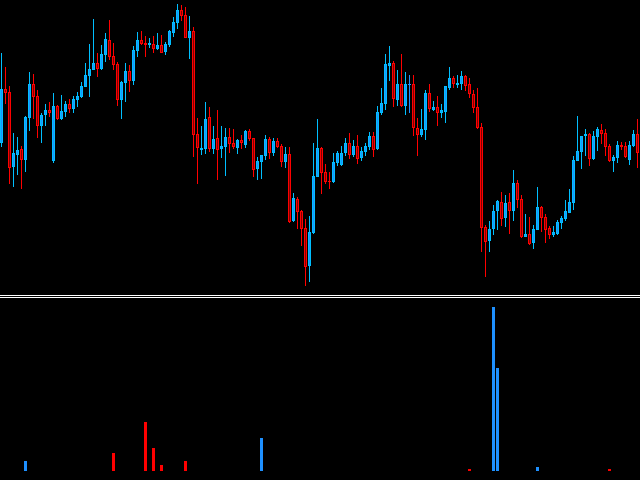

The indicator can be used in conjunction with other indicators for a more accurate detection of the position entry points. The indicator can also be used independently.

For example: the indicator can be used with the conventional Moving Average with a period of 200 to determine the trend. In this system, the buy signals are considered when the price is above the MA 200 (uptrend), while the sell signals are ignored. Similarly, the sell signals are considered when the price is below the MA 200 (downtrend), while the buy signals are ignored.

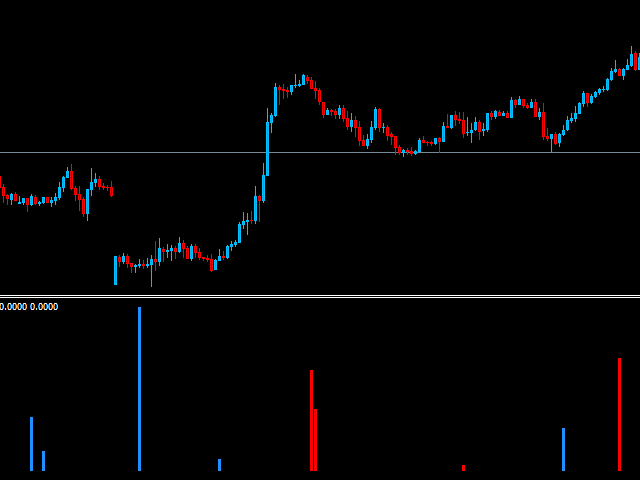

This indicator is able to work on any timeframe and any currency pair. However, it is recommended to use a timeframe from M5 to W1 (from five-minute to weekly).

You can also use different timeframes simultaneously to obtain stronger signals or to confirm a signal on the other timeframes. The ideal situation is when a signal is generated in the same direction on multiple timeframes, this signal is the strongest. And the potential profit from a trade based on this signal is increased.

Indicator Parameters

- Period 1 - period used for the indicator calculation. Suitable values are from 1 to 30.

- Period 2 - period used for the indicator calculation. Suitable values are from 1 to 20.

- Period 3 - period used for the indicator calculation. Suitable values are from 1 to 10.