All In One SRES Channel

- Indikatoren

- Libertas LLC

- Version: 1.4

- Aktualisiert: 1 Dezember 2021

- Aktivierungen: 20

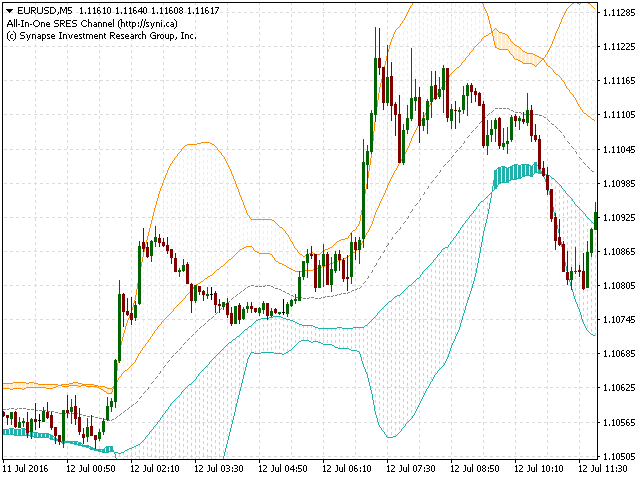

Automate your charting with the All-In-One SRES channel indicator. This is a complete package designed to address 3 questions: (1) when to enter a trade, (2) what is a good exit point, and (3) what is the probabilistic likelihood of success of the trade.

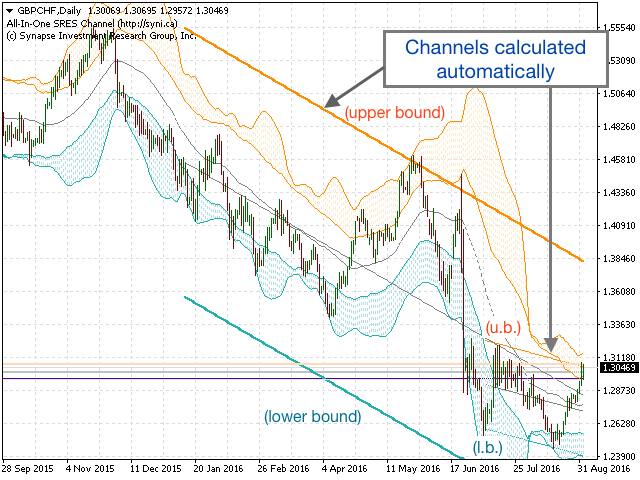

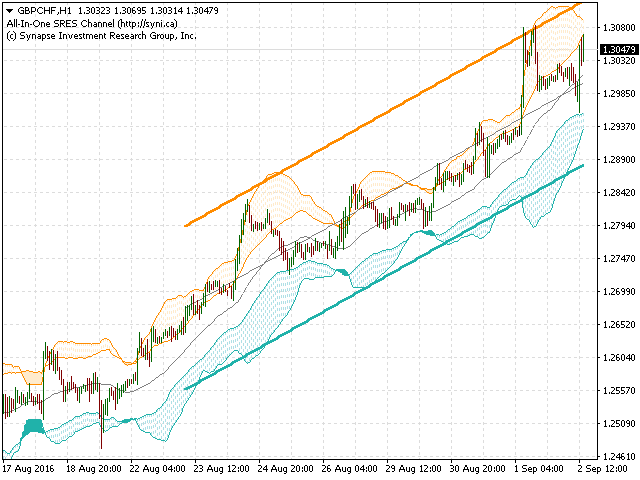

Longevity and Flexibility: The All-In-One SRES calculates and charts Support, Resistance, Expected range, and a Squeeze channel, and is enormously flexible for many trading strategies. Each option is customizable to fit your strategy, and can be turned on/off at any time. Easily switch between preset color schemes.

Features

Support and resistance lines:

- Multiple linear regression analyses calculate short-term and long-term channels in real time, which is particularly useful for range-bound trading, as well as major and minor points of support and resistance. Especially helpful for capturing trends in different periods that are easy to miss, and for saving you time scanning/drawing lines and allowing you to focus on the price action.

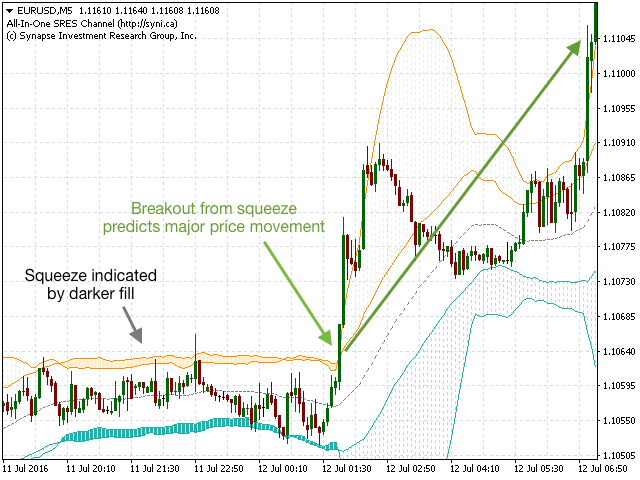

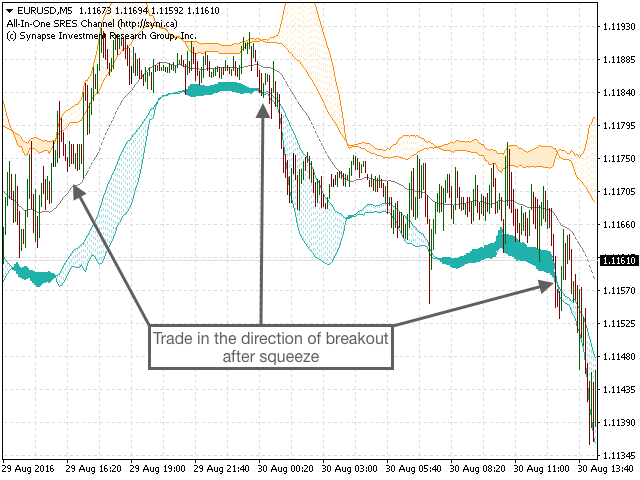

Squeeze channel (with email alerts):

- Uses stdev and modified ATR-based ranges. StDev bands inside ATR bands marks a 'squeeze,' and indicates a likely major upcoming price movement. The space between StDev and ATR bands indicates headroom for directional movement.

High, low, and open:

- The high, low, and open is automatically plotted as lines of support/resistance, and the period can be specified (i.e., hourly, daily, weekly, etc.)

Expected range:

- Based on historical price movement, plots the probabilistically expected upward and downward price movement. This is adjusted over time, and is useful for entering a trade with probability on your side. Ex., if the average asset daily range (high-low) is 120 pips, and so far today the price has moved up +110 pips from open, the probability of further large movements upward (more than ~10 pips) is decreased. This is automatically indicated on the chart.

Sample Trading Strategy

- Wait for squeeze that lasts more than 4 candles using squeeze channel. When squeeze is released, trade in the direction of price movement

- Using expected range check how much upward or downward price movement is likely for the day, based on historical averages. There should be > 10 pips of expected range remaining in the direction of trade to be entered

- Use multiple linear regression short-term and long-term support and resistance lines as potential exit points after entering the trade, and to see the larger trend (do not trade against the trend)

- Use high, low, and open lines as strong support/resistance (particularly high and low)

Parameters

- Color Scheme: Select from one of three pre-set color schemes

- StDATR: Plot StD/ATR channel squeeze: True=plot squeeze channel

- StDATR: Channel Period (Default=34): # bars used to calculate channel

- StDATR: Channel Shift (Default=0): Shifts channel N bars forward (+ value) or backward (- value) in time

- StDATR: Channel Deviations (Default=2.5): # stdev from the mean for calculating StD channel

- StDATR: Squeeze release alerts: True=alerts when squeeze is released

- StDATR: Turn on alerts message: Alert triggers a message box

- StDATR: Turn on alerts sound: Alert triggers a sound

- StDATR: Turn on alerts email: Alert sends an email (SMTP must be set up in MT4 options)

- LinReg: Plot short term support/resistance: True=plots short-term regression channel

- LinReg: Plot long term support/resistance: True=plots long-term regression channel

- LinReg: Short length (Default=50): # bars to calculate short-term channel

- LinReg: Long length (Default=200): # bars to calculate long-term channel

- LinReg: Use CLOSE (instead of high/low) (Default=true): Use C instead of H/L price in calculating channels

- HiLo: Plot daily H/L/O: True=plots a horizontal line that indicates the current high/low/open values of a specified period (default is daily)

- HiLo: Plot expected high/low/headroom remaining: True=plots lines and fill between the current high/low values of a specified period, and the probabilistically expected high/low values

- HiLo: Period (in min) for high/low/open lines (Default=1440): Specifies period used for all HiLo calculations, in min. 0=current timeframe, 1m; 5m; 15m; 30min; 60=1hr; 240=4hrs; 1440=1 day; 10080=1 wk; 43200=1 mnth

A very useful indicator