Dynamic ATR TP Ratio

- Utilitys

- Nana Yaw Osei

- Version: 1.1

- Aktualisiert: 25 April 2025

Dynamic ATR TP Ratio

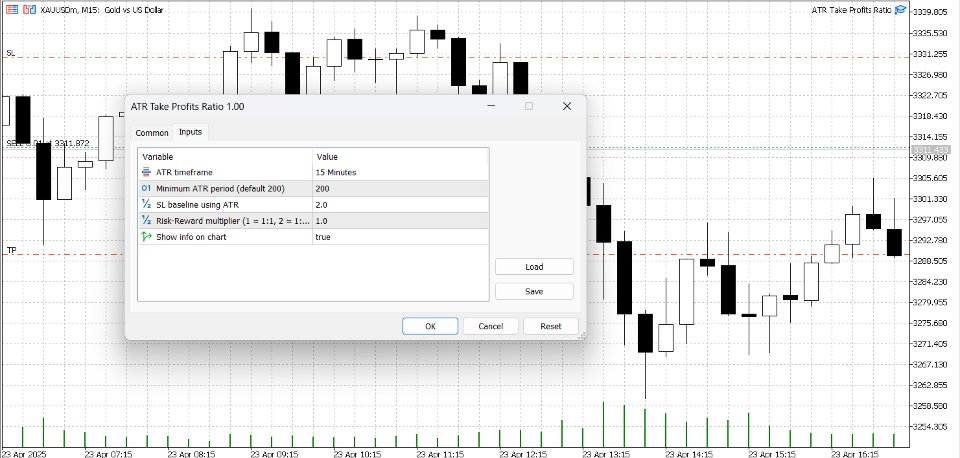

The ATR Take Profit Manager Expert Advisor (EA) automatically calculates and adjusts the take profit (TP) level for your open trades, based on market volatility. This EA uses the Average True Range (ATR) indicator, which measures market volatility, to set your TP level, ensuring it adapts to the current market conditions.

What is ATR? The Average True Range (ATR) is a technical indicator that shows the volatility of an asset over a specific period. It measures how much the price of an asset fluctuates on average within a certain timeframe. When the market is more volatile, the ATR value will be higher, suggesting that the price may move more. The ATR Take Profit Manager uses this to adjust your take profit levels accordingly.

Key Features:

-

Dynamic TP Calculation: The EA calculates your TP level using the ATR, which means it adjusts to market volatility. The EA uses the higher of two ATR periods (14 or 200) to provide a more accurate reading of market volatility.

-

Customizable Settings:

-

ATR Timeframe: Choose the time frame for the ATR calculation (default is 15 minutes).

-

ATR Multiplier: Adjust the TP level by multiplying the ATR value (default is 2.0). A higher multiplier will increase your TP level, while a lower multiplier will reduce it.

-

Risk-Reward Multiplier: Set your risk-reward ratio (default is 1.0), which automatically adjusts the TP level based on your chosen ratio. This allows you to balance the potential profit relative to the risk you're willing to take.

-

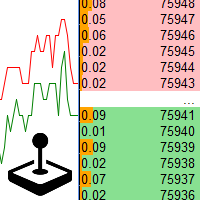

Show Info on Chart: Display ATR information directly on your chart for easy reference, so you can always keep track of how the market volatility is influencing your TP.

-

-

No Modification to Stop Loss: This EA only adjusts the TP, leaving your stop loss (SL) unchanged. This means you have full control over your risk while benefiting from a more adaptive TP strategy.

How It Works: The EA calculates the TP based on the ATR value, with a built-in multiplier to determine the optimal TP level based on market conditions. If the ATR is too low (below the 14-period ATR), it automatically uses the 200-period ATR for a more stable TP calculation, ensuring that the TP level remains realistic and effective even in quieter market conditions.

Benefits:

-

Auto-adjusted TP: The EA ensures that your TP adapts to the current market conditions, reducing the need for you to manually adjust it as volatility changes.

-

Fully Customizable: You can adjust the settings for ATR timeframes, periods, and multipliers, allowing you to tailor the EA to your personal trading style.

-

Clear Info Displayed: ATR and TP values are displayed directly on your chart, giving you an easy way to monitor your trades and make informed decisions.

Best For:

-

Traders who want to automatically adjust their TP levels based on market volatility.

-

Users looking for a reliable tool to optimize TP without affecting their stop loss.

-

Anyone who values a customizable, data-driven approach to setting TP levels.