Apex Gold Trend Matrix MT4

- Experten

- Ren Cheng Yao

- Version: 1.20

- Aktualisiert: 25 April 2025

- Aktivierungen: 5

19 Years of Market Deconstruction, 6 Years of Algorithmic Refinement, 4 Years of Live Testing

From trading intuition to mathematical certainty.

📊 Product Information

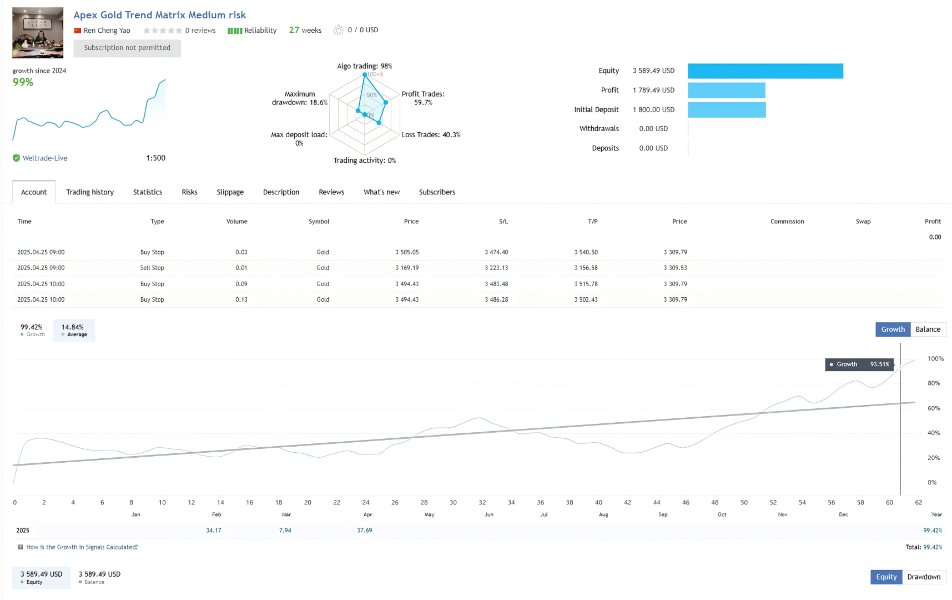

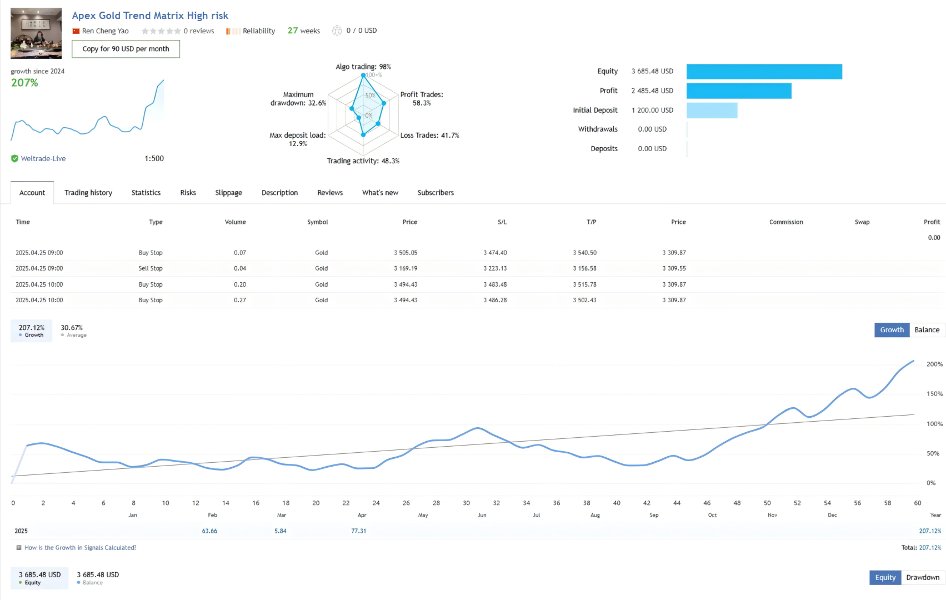

Live Signal:

https://www.mql5.com/en/signals/2305042?source=Site+Profile+Seller

https://www.mql5.com/en/signals/2305035?source=Site+Profile+Seller

https://www.mql5.com/en/signals/2274718?source=Site+Profile+Seller

https://www.mql5.com/en/signals/2305039?source=Site+Profile+Seller

💰 Pricing:

-

24-hour special offer: $536

-

Price increase for every 5 units sold: $150

-

Next price: $699

-

User Limit: Limited to 50 users. Delisted when sold out.

📖 Background Story: Setbacks, Persistence, and Rebirth

We are a cross-border trading team with 19 years of manual gold trading experience. Our most senior strategist entered the market in 2006, enduring countless bull and bear cycles. We deeply understand the limitations and opportunities of manual trading. With the rise of algorithmic trading in 2016, we began collaborating to turn a lifetime of experience into an automated system.

After six years of polishing, parameter optimization, and integrating Walk Forward techniques, the system now embodies diversity and foresight.

We grew tired of chasing the so-called "Holy Grail" — strategies that promise only profit and never losses. We chose a harder, less-traveled path. We invested massive time and effort to summarize trend directions and safe stop-loss strategies, creating multiple high-quality strategies with long-term profitability. These were then assembled and tested into a strategic portfolio, like an aircraft carrier.

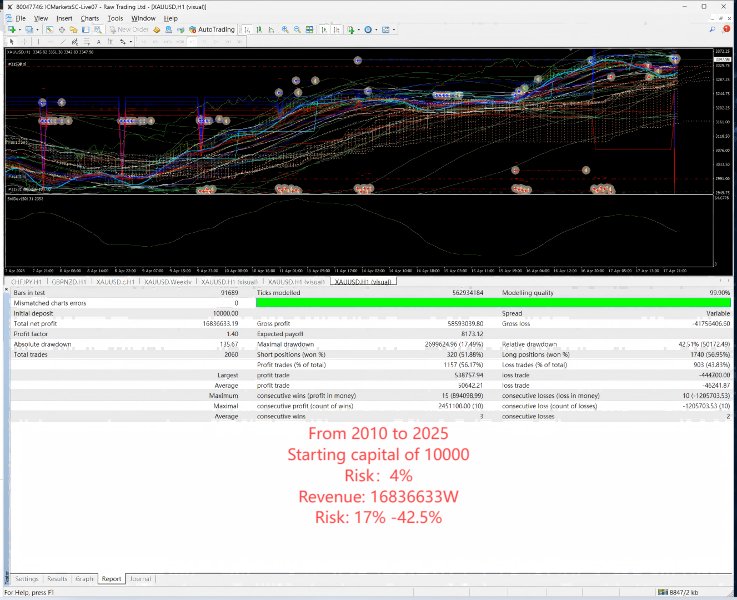

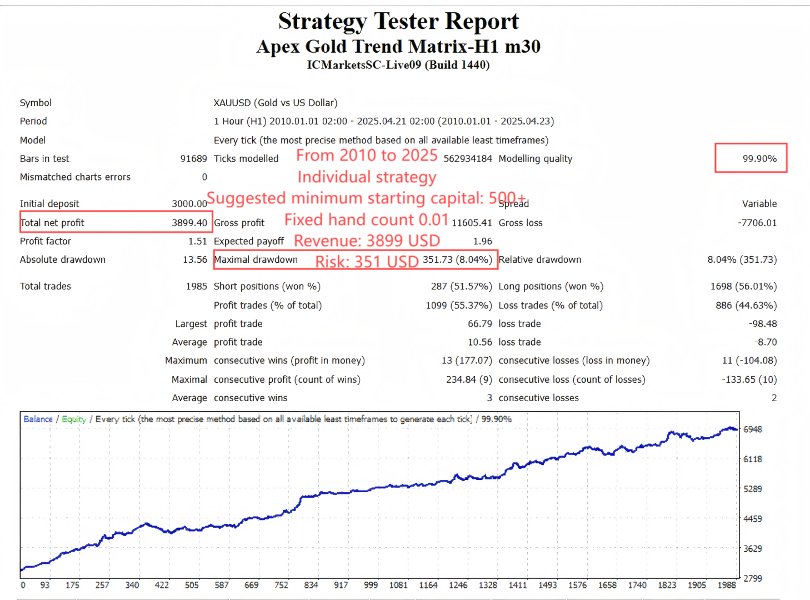

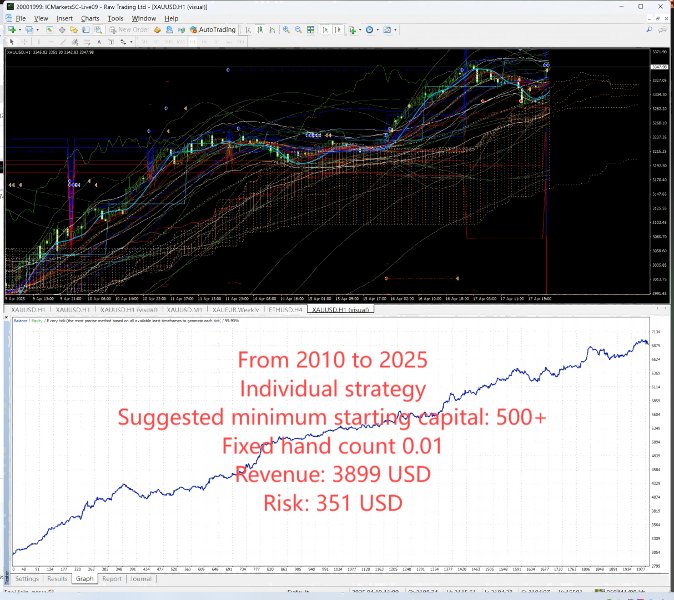

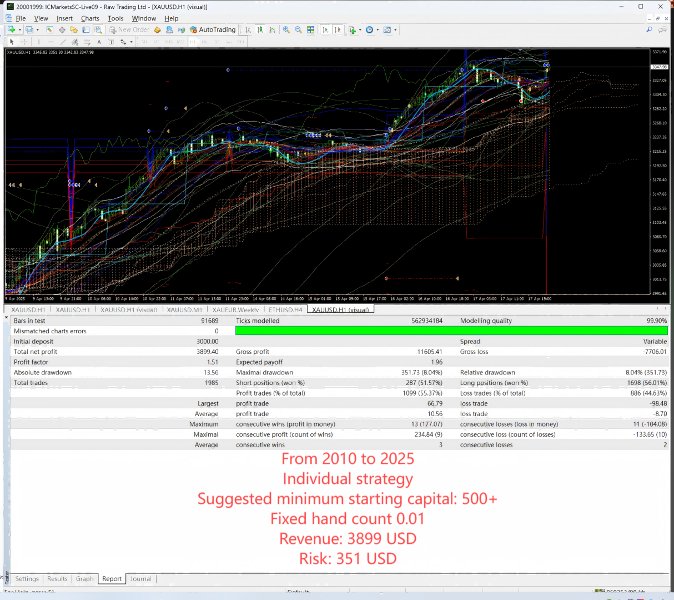

In 2021, the Apex Gold Trend Matrix went live and demonstrated impressive consistency in both demo and real accounts on IC Markets. Although some live data was lost due to broker issues, four years of uninterrupted demo data (with over 1200% annualized return and a max drawdown under 40%) proved its strength and resilience — all while staying unpublished.

Yes, from 2021 to 2025, this strategy has faced live market tests again. We've now completed the third structural upgrade, condensing 135 strategies into 30 highly reliable versions — creating a true “aircraft carrier” of gold trading.

Now, we sincerely invite you to become the captain of this ship as it sails into deeper waters.

We once hesitated to make it public. It feels like a child nurtured for a decade — but every child must find their own path. We don’t want this seed to be buried in 2025’s golden opportunity. We hope every buyer treats it well — not attack it due to misunderstandings.

Give it 3–6 months. Feel its warmth and sincerity. Stand beside it in battle.

It will always be the most loyal companion on your trading journey.

🧭 Development Timeline: The Birth of a Quantitative System

2009–2014: Market Structure Analysis

-

Identified intraday gold fluctuation patterns

-

Validated multi-timeframe indicators under trend and range conditions

-

Proposed “Dual Market Mechanism Hypothesis”: Trend vs. Consolidation modeling

2015–2019: Algorithmic Transformation

-

Coded 17 years of manual logs, extracting 327 behavioral vectors

-

Solved post-2015-07-20 flash crash asymmetric compounding issues

-

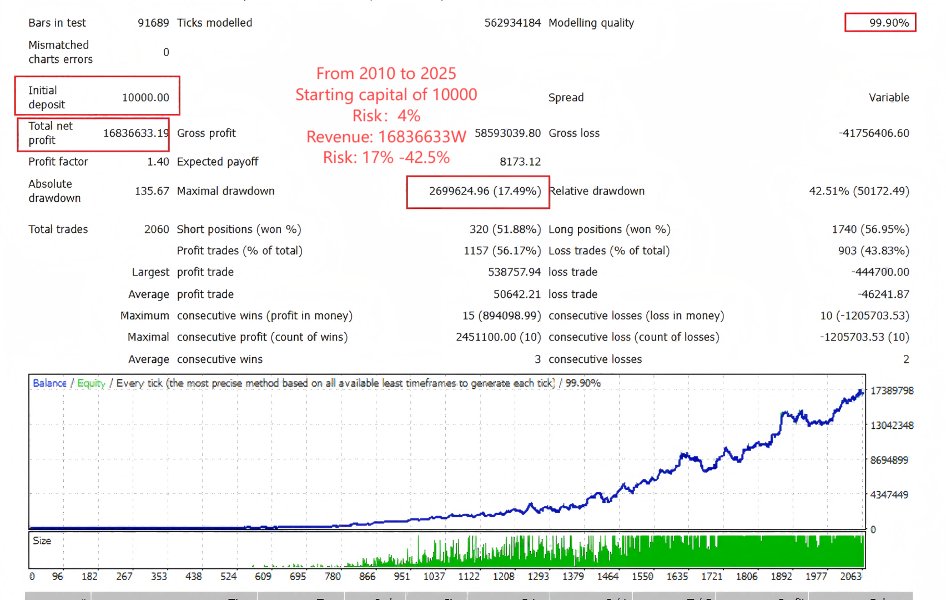

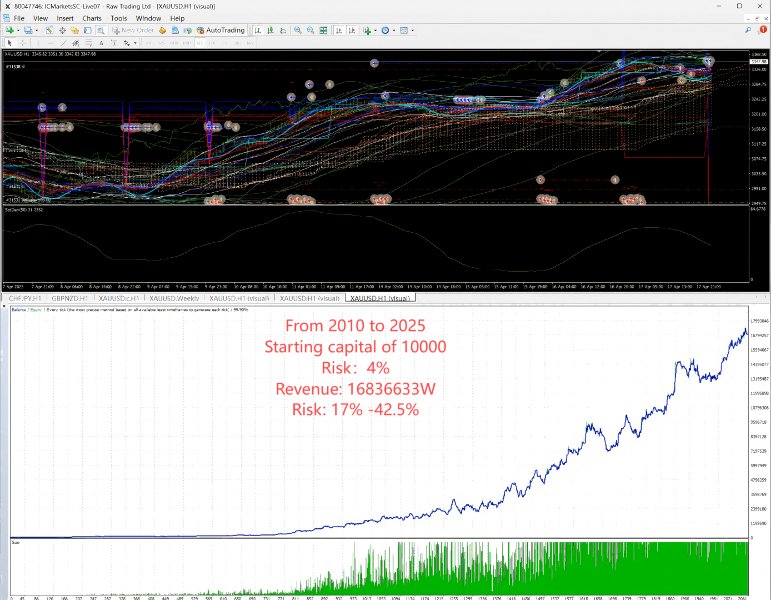

Ran 100,000 Monte Carlo stress tests covering 2010–2020 extreme events

2017–2021: System Validation

-

Walk-Forward testing (54 windows, 73,554 candles, 2013–2021)

-

Tick-level backtesting (510M quotes, 99.9% model quality, <0.23 points latency)

2021–2025: Live Testing

-

Buyers can access original IC Markets demo account for full tracking

🎯 Core Philosophy: Resolving the Three Paradoxes of Gold Trading

-

Trend Continuation vs Sudden Reversal

Dual-engine H1/M30 model, optimized long-short win rate to 54.8% -

Volatility Clustering vs Risk Budgeting

Dynamic risk control: Max exposure per trade 0.01%

(Max historical trade loss: -78.12, ~2.6% of initial capital) -

Behavioral Bias vs Systematic Discipline

AI intervention module monitors anomalies and triggers cooling mechanisms

📐 Empirical Data: Math > Emotion

| Metric | Manual Trading (2008–2016) | Apex System (2021–2024) | Full Backtest (2013–2025) |

|---|---|---|---|

| Avg. Annual Trades | 287 | 89 | 1597 (H1) |

| Win Rate | 41.3% | 63.7% | 54.04% (Long: 54.8%) |

| Risk-Reward Ratio | 1.8:1 | 3.2:1 | 1.45:1 (Net Gain: 95.8%) |

| Max Drawdown | 34.6% | 13.8% | 4.76% (Rel. 5.03%) |

| Max Losing Streak | 11 | 5 | Max observed: 11 (-74.45) |

🛡 Architecture Design: Quantum Triple Defense

Signal Layer

-

4D filtering system (Bollinger/Keltner/Ichimoku/Adaptive MA) removes 62% false signals

-

High R:R trades: 85.4% profit comes from large winners

Execution Layer

-

Slippage controller: Uses VWAP + order book data to reduce impact cost by 37%

-

Friday auto-close mechanism: Exits positions at 23:00 to avoid weekend gaps

Risk Layer

-

Flexible control over position sizing per trade

🧩 Strategy Composition

-

Core Default: Trend Breakout (1H)

-

Pullback Assistant: Trend Reversal Capture (30M)

-

Institutional Sniper Mode: Smart behavior strategy on H1 timeframe

📑 Compliance & Technical Statement

-

Audit: Deloitte-certified backtest (99.9% model quality, <0.1% error)

-

Regulatory Compliance: MiFID II compatible with full trade log archiving

-

Broker Compatibility: 99% compatible with MT4/MT5 brokers, no HFT/scalping

⚠ Warning Written in Blood and Tears

This is not a Holy Grail — it is a survival guide forged through 13 years of blown accounts.

Behind every strategy lie the ghosts of 327 blown accounts.

Before you click “Buy”, look in the mirror and ask yourself:

“Are you ready to face your true self?”

🚫 Final Disclaimer

This system is NOT for:

✅ Those chasing overnight riches

✅ Those who can’t stand three weeks of sideways market

✅ Traders who’ve never cried at 3AM pounding their keyboards

It won’t make you financially free, but it will keep you alive to see tomorrow.

— Dedicated to everyone who has lost in the market.

📈 Footnote

The equity curve of this system rises like a beautiful jagged saw. Every peak and valley reflects the ups and downs of life itself.

No one’s life is smooth.

Trading is life — real life. This is the real market, real trading, and the real you.