Bitcoin and trading robots are a powerful combination for making profits, but both require a deep understanding of the market, risk management, and preparedness for volatility. Trading robots are not an “instant rich guarantee”, but rather an effective tool when used with a tested and disciplined strategy. Always do your research and start small!

BTC DEEP AI is a forex robot that is specifically used on BTC and has resistance to high movements and provides consistent profits. equipped with AI sophistication and a combination of technical analysis designed to always take profits at any time 24/7 NON STOP.

In 2021, Bitcoin once rose from $30,000 to $64,000 in 3 months, then dropped to $28,000 in the following 2 months. Daily movements of 5-10% are common.

It Controls risk, finding trends and Top/Low levels across multiple timeframes to High profit opportunities in the amazing cryptocurrency market.

Features:

Pair: BTCUSD

Timeframe: M5

Minimum lots: 0.01

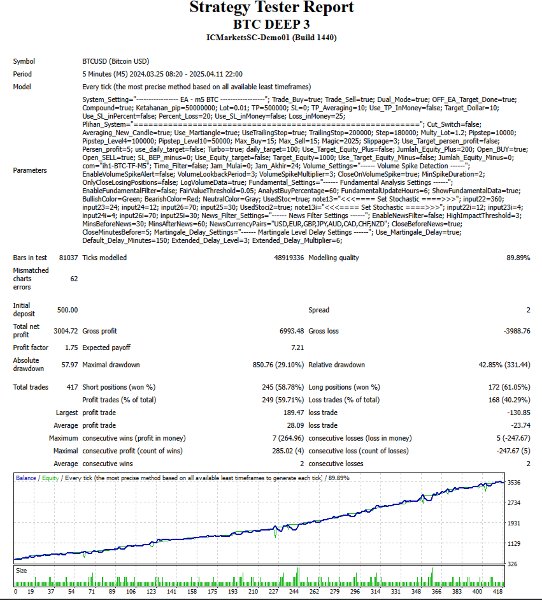

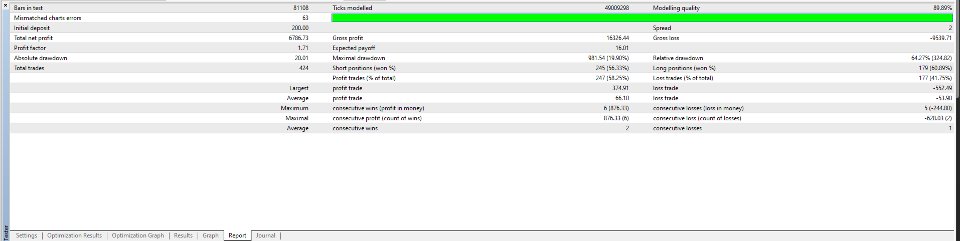

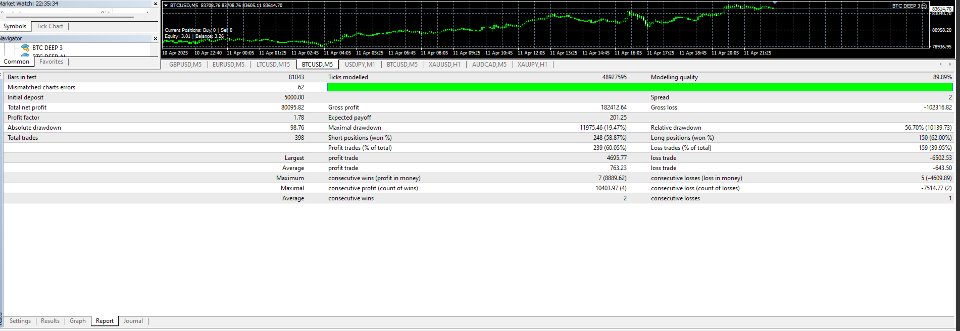

Minimum deposit: 500

Recommended Brokers: All account types in well-known brokers

Maintained all existing functionality while adding this new feature, including:

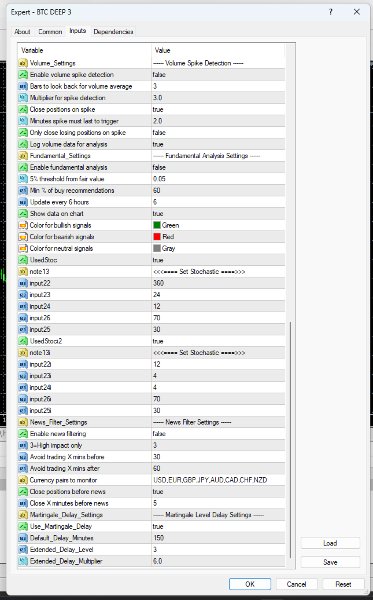

Volume spike protection

News filtering

Stochastic conditions

Pivot point analysis

Time-based trading restrictions

**Advantages for BTC/USD Trading:**

1. **BTC Volatility Adaptation**:

- Specifically engineered to handle Bitcoin's extreme price swings with:

* Pipstep_Level4 (150,000 points) for dynamic averaging distance in BTC's wild movements

* Smart volume spike detection that pauses trading during abnormal volatility

* Dynamic trailing stop (100,000 points) to secure profits in erratic markets

2. **24/5 Market Operation**:

- Continuous operation capability matching crypto market hours

- Optional time filter for restricted trading windows

3. **Compounding Engine**:

- Auto-scaling position sizes to capitalize on BTC's large price movements

- Intelligent lot sizing based on account balance

**Premium Features:**

1. **Adaptive Averaging System**:

- Multi-stage martingale with:

* Smart delay algorithm between levels based on:

- Real-time volatility (ATR-adjusted)

- Daily range formation time

- Current market trend

2. **Multi-Layer Protection**:

- Volume Shock Absorber:

* Detects abnormal trading volume (5x MA)

* Activates 4-hour trading cooldown

- News Filter:

* Integrated economic calendar

* Auto-disable during high-impact events

3. **Intelligent Entry System**:

- Dual-layer stochastic confirmation (fast & slow)

- New candle requirement for averaging entries

- Configurable trading session filter

4. **Advanced Risk Management**:

- Multiple SL protocols:

* Fixed stop-loss

* Equity percentage-based SL

* Dollar amount SL

* Break-even minus SL

- Equity guardrails:

* Auto-stop at profit targets

* Equity drawdown circuit breaker

5. **Flexible Strategy Options**:

- Dual mode (hedging) or single direction operation

- Choice between standard TP or averaging TP

- Configurable as pure martingale or indicator-confirmed strategy

2. M5 timeframe ideal for:

- Capturing BTC's rapid momentum

- Avoiding lower timeframe noise

3. Critical volume protection for BTC's:

- Frequent sudden volume spikes

- 4-hour cooldown for market stabilization

This EA excels in BTC trading by:

- Sustaining through prolonged trends

- Automatically locking in profits

- Preventing catastrophic losses during extreme volatility

- Capitalizing on BTC's characteristic pullback patterns

Key Improvements Implemented:

1. Enhanced Error Handling:

o Dynamic Pipstep

o Comprehensive checks before order modifications

o Retry logic with delays for temporary issues

2. Volume Spike Detection:

o Dynamic volume threshold calculation

o Multiple timeframes for volume analysis

o Price speed analysis to confirm spikes

o Trading pause functionality during extreme volatility

3. Order Management:

o Safe order closing with spread and slippage checks

o Position closing safety mechanisms

o Improved trailing stop logic

4. Risk Management:

o Money-based and percentage-based stop loss options

o Dynamic pip step calculation based on volatility

o Support/resistance level integration

5. Fundamental Analysis:

o Simulated fundamental data integration

o Trading bias based on fundamental conditions

o Regular updates of fundamental data

6. News Filter:

o Simulated news event detection

o Trading pause around high-impact news

o Position closing before news events

7. Support/Resistance:

o Automatic SR level detection

o Trading near SR levels only

o Visual display of SR levels

It is optimized for volatile pairs like BTC/USD but can be adapted for other instruments.

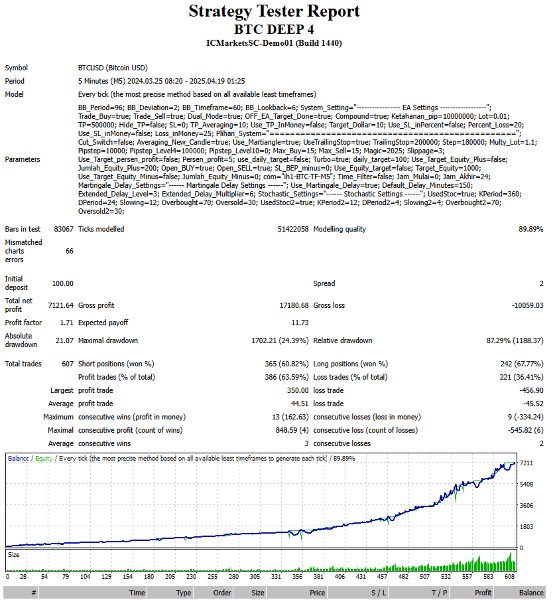

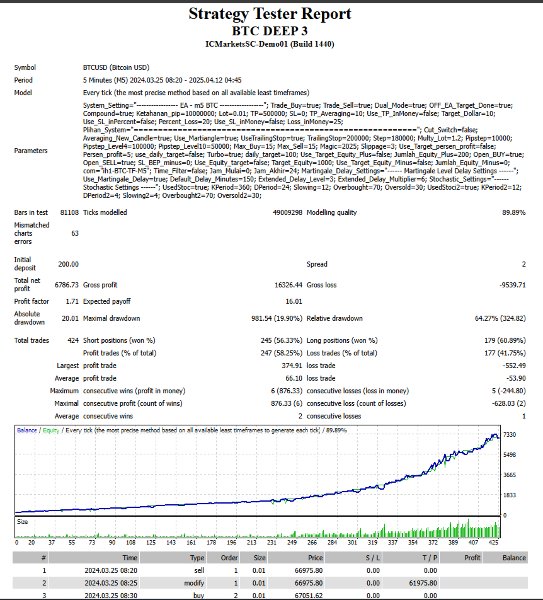

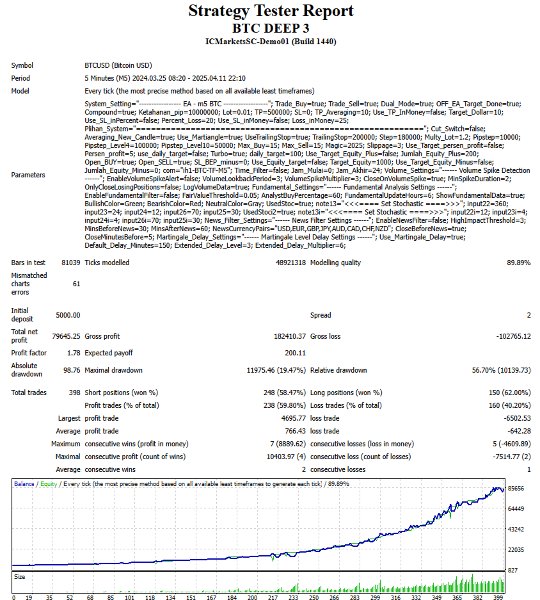

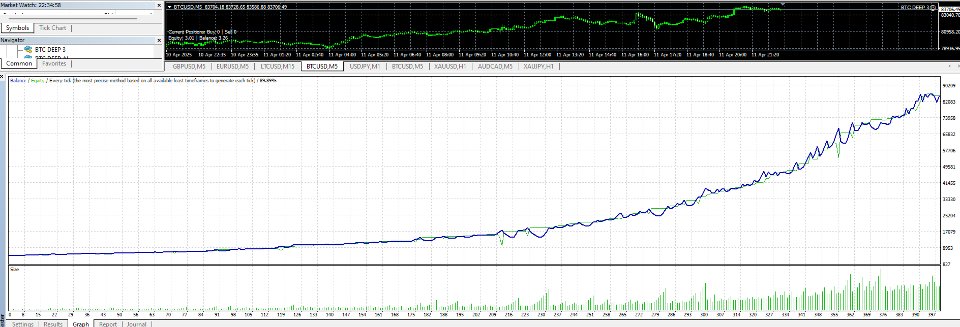

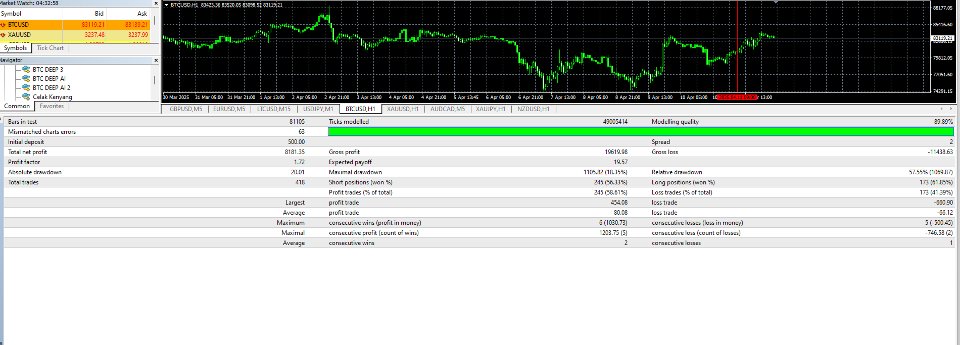

Backtesting the EA:

Choose a decent historical pricefeed, and make sure that it is one with low spreads, or set spread manually. Spreads should be lower than 1000 points on average.

If your backtesting results do not match mine, contact me in pm so I can help with the backtest-setup.