Automatic Support and Resistance MT4

- Indikatoren

- Eda Kaya

- Version: 1.2

Automatic Support & Resistance Indicator for MT4

The Automatic Support & Resistance Indicator for MT4 is a specialized tool within the MetaTrader 4 platform, developed to autonomously detect significant support and resistance levels across multiple timeframes. Utilizing historical price interactions, it marks support regions with green and resistance zones with brown, simplifying visual analysis for traders.

This indicator is widely used by market professionals to forecast potential price turning points and outline trade-worthy regions. Its algorithmic precision improves strategic decision-making and facilitates better execution of trading plans.

Its core strength lies in recognizing price zones with a high probability of reaction, helping improve the accuracy of market entries and exits.

«Indicator Installation & User Guide»

MT4 Indicator Installation | Automatic Support and Resistance Indicator MT4 | ALL Products By TradingFinderLab | Best MT4 Indicator: Refined Order Block Indicator for MT4 | Best MT4 Utility: Trade Assistant Expert TF MT4 | TP & SL Tool: Risk Reward Ratio Calculator RRR MT4 | Money Management: Easy Trade Manager MT4

Automatic Support & Resistance Indicator Table

Outlined below are the standard parameters of the Automatic Support & Resistance Indicator for MT4:

| Category | Support & Resistance – Supply & Demand – Price Structure |

| Platform | MetaTrader 4 |

| Skill Level | Beginner |

| Indicator Type | Entry – Reversal – Ranging |

| Timeframe | Multi-Timeframe |

| Trading Style | Scalping – Day Trading – Intraday |

| Markets | Forex – Stocks – Indices |

Indicator at a Glance

The Automatic Support & Resistance Indicator for MT4 offers a smart framework for interpreting the market structure by outlining vital zones. Green signifies support areas, while resistance regions are displayed in red.

Bold colors indicate fresh zones, while faded tones represent retested regions, allowing traders to distinguish zone strength at a glance.

By accurately mapping these zones, it enhances one’s ability to identify probable reversal areas. These areas serve as reliable references for planning market entries, stop loss levels, and profit targets.

Additionally, the dynamic shading based on zone interaction provides clarity on the relative reliability of each level, guiding better risk-reward setups.

Support Zone in an Uptrend

On a 1-hour GBP/USD chart, the Automatic Support & Resistance Indicator for MT4 marks a clear support level, illustrated by a green rectangle.

As price pulls back to this zone, the green shade shifts from dark to light, signaling that the level has been retested.

This change helps traders recognize areas where price momentum may resume, making it easier to detect buy setups within bullish trends.

Resistance Zone in a Downtrend

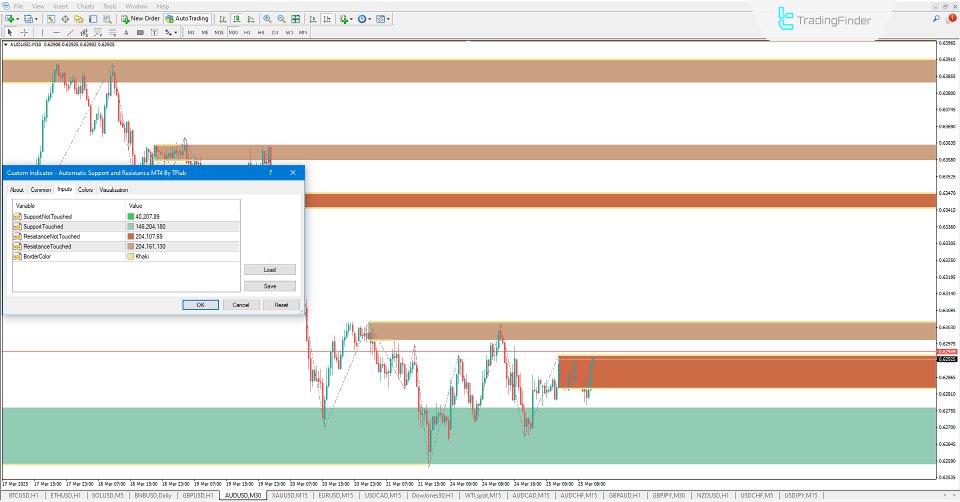

On a 15-minute timeframe of the AUD/CAD pair, the indicator identifies a critical resistance level, represented in brown.

Once price revisits this level post-breakout, the zone's color transitions from dark brown to a lighter tone, confirming a successful test.

This signal often aligns with bearish momentum and can be used with candlestick patterns or market structure to increase the accuracy of short entries.

Automatic Support & Resistance Indicator Settings

The following are the adjustable settings available within the Automatic Support & Resistance Indicator for MT4 interface:

- Support Not Touched: Set the color for fresh support levels.

- Support Touched: Define the color for previously tested support zones.

- Resistance Not Touched: Choose a color for untouched resistance zones.

- Resistance Touched: Set the appearance for tested resistance areas.

- Border Color: Customize the outline color of all support/resistance boxes.

Conclusion

The Automatic Support & Resistance Indicator for MT4 is an intelligent market analysis tool capable of identifying high-impact price zones. Its visual precision and automated detection of key levels make it highly effective for traders who depend on support and resistance dynamics.

This indicator is especially valuable for those applying price action strategies, as it assists in locating strategic trade entries and exits based on historically tested zones.