Shadow Breakout Titan

- Experten

- Elias Abu Al-zulf

- Version: 2.0

- Aktualisiert: 1 April 2025

- Aktivierungen: 10

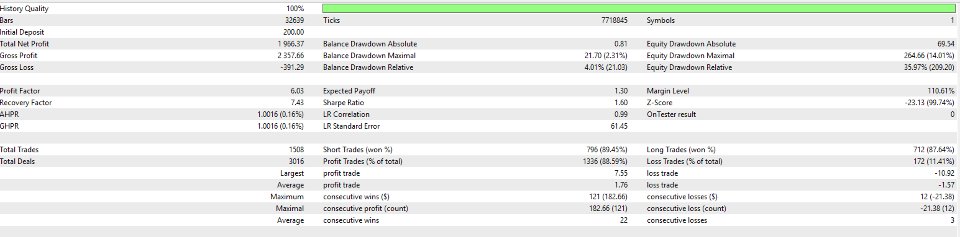

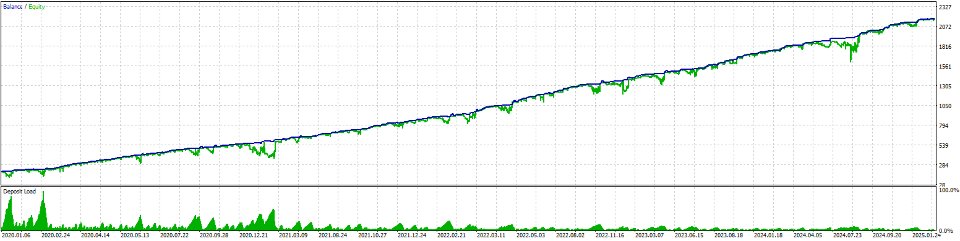

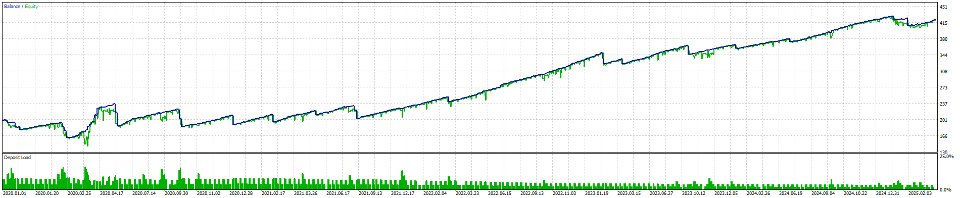

| Only First 10 Copies are 30$ then Price will be 100$ AUDCAD 200$ to 2000$ - Screenshots + Set File |

|---|

Important: Download the Demo EA and backtest it thoroughly before purchasing.

Important: Message me after Purchase to invite you to private discord for set files/strategies and support.

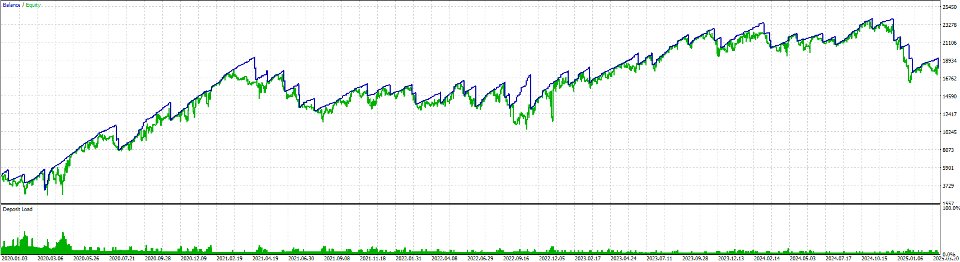

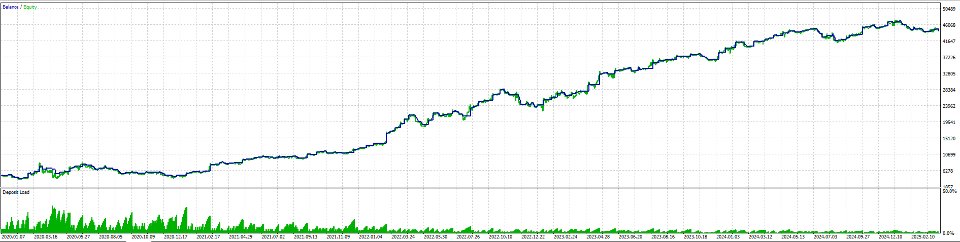

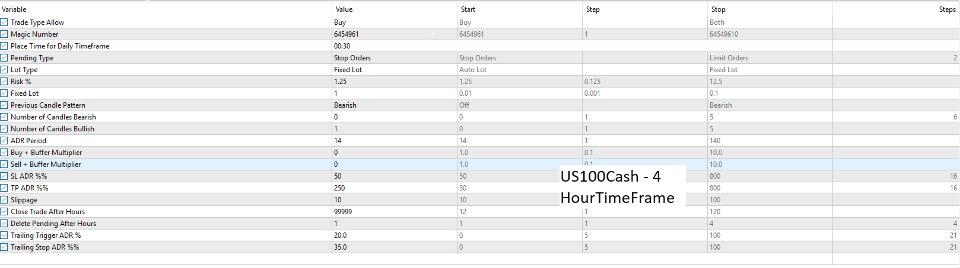

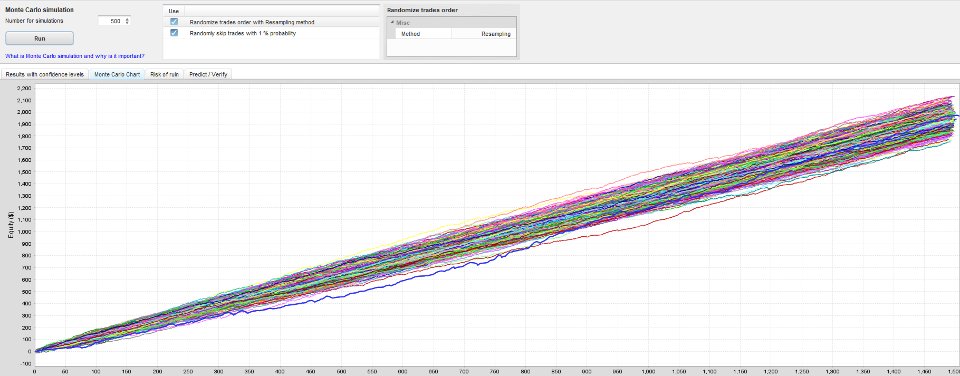

Example Set File for us100Cash in the Images 4h Timeframe From 5000 USD to 20,318$ in 4 Years

While the EA can be used in a simple set-and-run mode, you'll get much better results if you understand what you're doing.

For example, if fundamentals and technical analysis both suggest that EUR/USD is bullish, you can run two instances of the EA:

-

One version can target breakouts above the daily highs—buying into strength.

-

The other can focus on buying dips at the previous day’s lows, where liquidity often sits and price is likely to reverse and continue its intended direction.

This approach aligns with concepts taught in ICT’s core content—after a market structure shift on the daily chart, you can apply those insights to guide your intraday trades.

and it can be a powerful tool in your trading arsenal

Another effective strategy is using EA on the US500 (S&P 500) — especially if you're a fan of buy-and-hold investing. Instead of simply holding through all the market noise, you can use the EA to either:

-

Buy the dips at key liquidity zones

-

Catch breakouts in the direction of the prevailing trend

By using very small lot sizes and letting the EA manage entries, this approach can potentially outperform traditional US500 buy-and-hold strategies by 2 to 5 times over time.

It’s a smarter way to compound gains while still keeping risk under control.

Daily ADR Breakout Reversal EA

A Powerful Expert Advisor for Breakout and Reversal Trading

Daily ADR Breakout Reversal EA is designed for traders who want to capitalize on daily market movements using a fully automated strategy. Whether you trade breakouts or reversals, this EA provides precise entry and exit points based on the Average Daily Range (ADR) and Average True Range (ATR).

This Expert Advisor is built for Forex, indices, and metals, allowing traders to configure risk management, trade execution, and trailing stop strategies efficiently. It offers flexibility with multiple trading options, ensuring adaptability across different market conditions.

Key Features

-

Breakout and Reversal Modes – Choose whether the EA trades breakouts or reversals at the daily high/low.

-

Customizable Order Types – Supports stop orders and limit orders, placed at the previous day’s high or low.

-

ADR and ATR-Based Calculations – Stop loss, take profit, and trailing stop are automatically calculated as a percentage of the ADR.

-

Smart Risk Management – Adjust trade size and risk based on daily market conditions.

-

Automated Trade Management – Option to close trades after a set number of hours or delete pending orders automatically.

-

Dynamic Trailing Stop – The EA starts trailing at a specified percentage of ADR, ensuring optimal risk-reward management.

-

Multi-Pair Compatibility – Works on all Forex pairs, indices, and metals.

-

No Manual Calculations Required – The EA dynamically adapts to market conditions without the need to adjust pips manually.

How It Works

-

Select Breakout Mode to trade in the direction of market momentum or Reversal Mode to trade against it.

-

The EA identifies the previous day’s high and low.

-

Pending orders are placed based on the selected strategy (limit orders or stop orders).

-

Once price reaches the entry level, the trade executes with a predefined stop loss and take profit.

-

Trailing stop can be activated at a certain ADR percentage to secure profits.

Who Should Use This EA?

-

Traders who use ADR and ATR strategies for market entries.

-

Those looking for a set-and-forget solution for trading breakouts and reversals.

-

Scalpers, day traders, and swing traders who want to trade based on daily market movement.

-

Traders who want a fully automated system without manually setting stop losses and take profits.

Why Choose This EA?

Unlike many generic breakout strategies, Daily ADR Breakout Reversal EA is designed to adapt to market volatility. It automatically adjusts risk management settings using ADR-based calculations, ensuring that stop loss and take profit levels are relevant to the current market conditions.

This EA eliminates guesswork, allowing traders to focus on execution rather than manually calculating trade levels. Whether the market is trending or ranging, the strategy ensures a structured approach to entering and exiting trades efficiently.

Example Strategies to use with this Expert Advisor

🔹 1. Daily Breakout Strategy (Momentum Based)

Goal: Capture strong moves as price breaks out of the previous day's range.

Setup:

- Order Type: Stop Orders

- Trade Direction: Buy & Sell

- Entry Buffer: 5-15% of ADR

- Stop Loss: 25-40% of ADR

- Take Profit: 70-100% of ADR or use Trailing

- Delete Pending Orders After: 6-8 hours

Best For: Trending markets or post-news volatility.

🔹 2. Daily Reversal Strategy (Mean Reversion)

Goal: Fade moves near the previous day's high/low.

Setup:

- Order Type: Limit Orders

- Trade Direction: Buy & Sell

- Entry Buffer: 0-10% of ADR

- Stop Loss: 30-50% of ADR

- Take Profit: 40-80% of ADR

- Delete Pending Orders After: 4-6 hours

Best For: Ranging or exhausted trend markets.

🔹 3. Directional Bias Strategy

Goal: Trade only in one direction based on your fundamental or technical bias.

Setup:

- Trade Direction: Buy Only or Sell Only

- Order Type: Stop or Limit (based on breakout or reversal idea)

- Combine with HTF RSI/Trend Filter (optional, outside EA)

Best For: When you expect a directional move (e.g., strong news or macro bias).

🔹 4. Volatility Trap Strategy (Fakeout Catcher)

Goal: Take advantage of false breakouts and trade back into the range.

Setup:

- Order Type: Limit Orders

- Place orders beyond the daily high/low with small buffers

- Close trades quickly with small TP (20–30% ADR)

- Best with reversal settings.

Best For: Sideways or low-volume conditions.

🔹 5. Time-Based Exit Strategy

Goal: Use ADR setup, but let time manage the trade.

Setup:

- Use either order type

- SL optional, no TP, just Close After X Hours

- Works best if you want “set and forget” logic for daily entries.

🔹 6. Daily Scalper with Tight Range

Goal: Use the EA in low ADR environments to scalp quick moves.

Setup:

- Tight entry buffer (e.g. 2-5% ADR)

- Small SL & TP (20-30% ADR)

- Close trades within 2-3 hours

Best For: Calm markets or sideways conditions with occasional spikes.