SMT Divergence Indices ICT MT5

- Indikatoren

- Eda Kaya

- Version: 1.11

SMT Divergence Indices ICT Indicator MT5

The SMT Divergence Indices ICT Indicator MT5 is a specialized trading tool within the ICT methodology for MetaTrader 5. It assists traders in identifying three primary types of divergences across major stock indices. This indicator is particularly useful in spotting trendline divergences, higher-low divergences, and smart money divergences, providing traders with valuable insights into potential market reversals.

«Indicator Installation & User Guide»

MT5 Indicator Installation | SMT Divergence Indices ICT MT4 | ALL Products By TradingFinderLab | Best MT5 Indicator: Refined Order Block Indicator for MT5 | Best MT5 Utility: Trade Assistant Expert TF MT5 | TP & SL Tool: Risk Reward Ratio Calculator RRR MT5 | Money Management: Easy Trade Manager MT5

Key Indices Covered

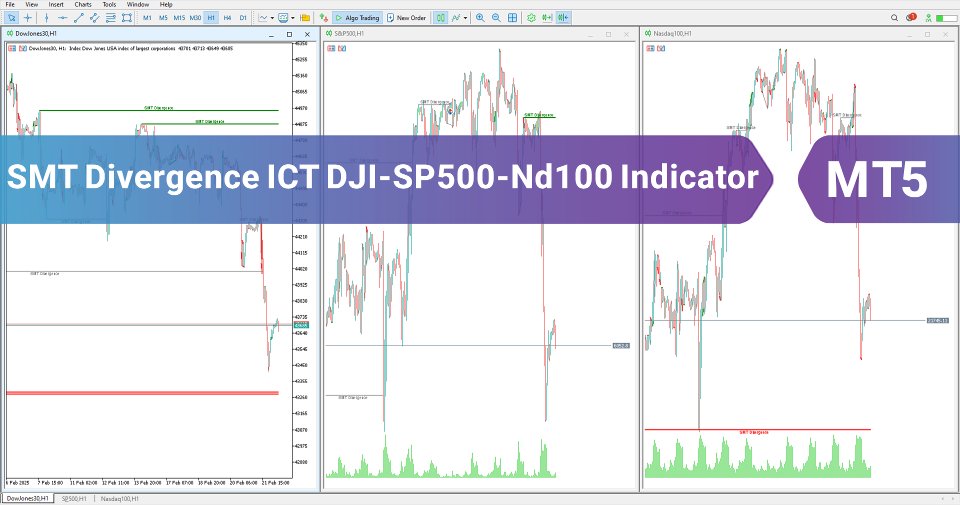

This indicator is designed to work with three major indices: Dow Jones (DJI), NASDAQ, and S&P 500. By analyzing divergence patterns across these indices, traders can identify critical turning points and improve their decision-making. The indicator is particularly helpful in recognizing market inefficiencies and detecting smart money movements, giving traders an edge in their analysis.

Overview of SMT Divergence Indices ICT Indicator

Below is a summary of the core specifications for the SMT Divergence Indices ICT Indicator in MetaTrader 5:

| Category | ICT - Smart Money - Trading Tool |

| Platform | MetaTrader 5 |

| Skill Level | Advanced |

| Indicator Type | Reversal - Breakout - Entry |

| Time Frame | Multi-Timeframe |

| Trading Style | Scalping - Day Trading - Intraday |

| Markets | Forex - Stocks - Indices |

Understanding SMT Divergence in Market Trends

The SMT Divergence Indices Indicator is an advanced analytical tool used to identify smart money divergences across multiple symbols. While it is specifically designed for Dow Jones, NASDAQ, and S&P 500, traders can adapt it for other instruments as well.

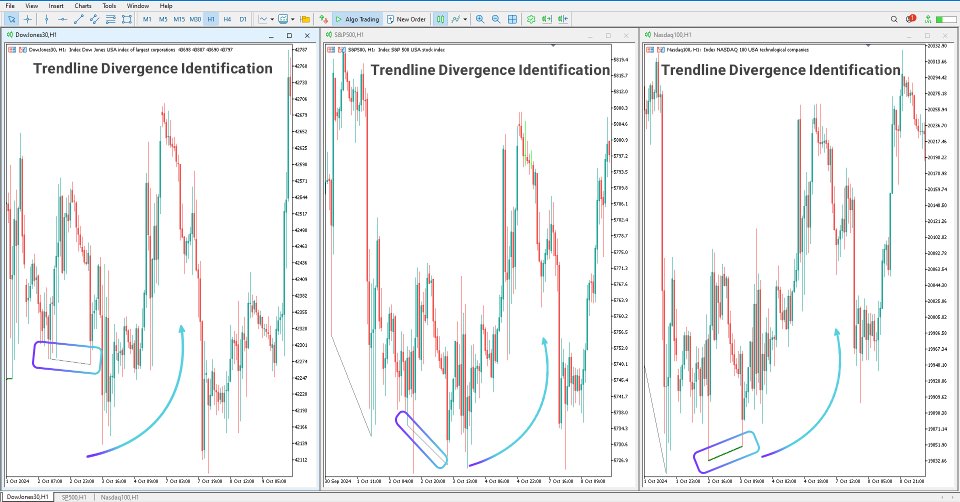

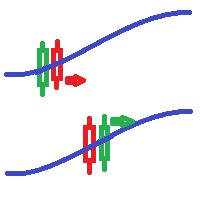

Trendline Divergence

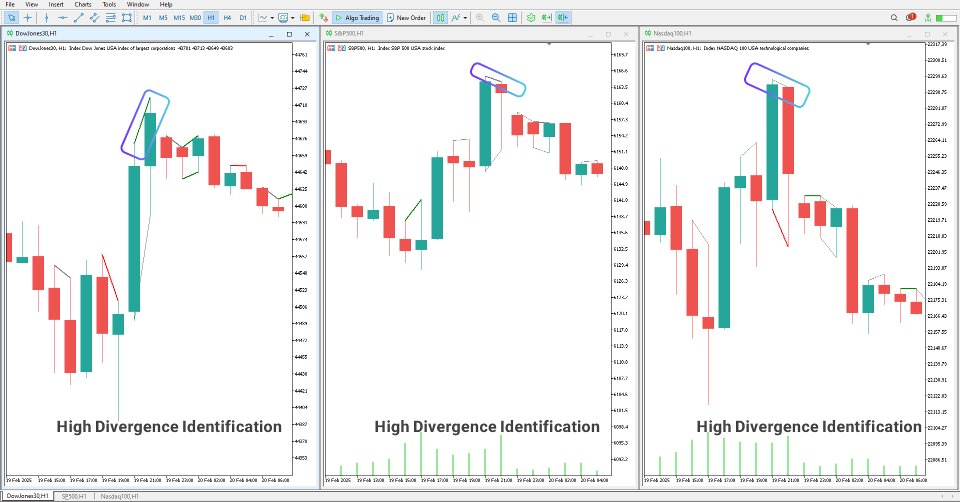

In the following examples, the SMT Divergence Indices ICT Indicator identifies trendline divergences across different indices. For instance, in Dow Jones and S&P 500, a downward trendline suggests a potential reversal, while in NASDAQ, an upward trendline signals a potential bullish breakout. These divergences help traders anticipate market shifts before they occur.

High-Low Divergence in Downtrends

By using the SMT Divergence Indices Indicator, traders can detect high-low divergences across different indices. This divergence often signals the potential exhaustion of a trend and helps traders refine their entry and exit points for better risk management.

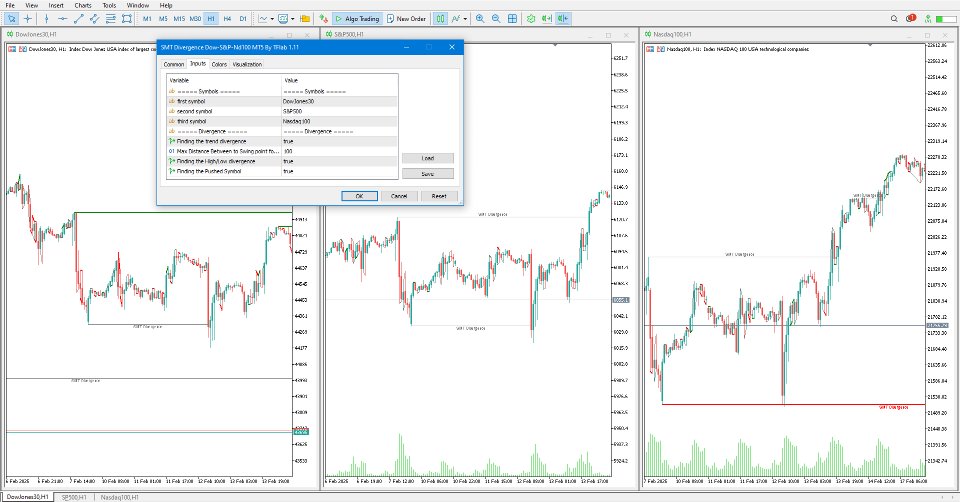

SMT Divergence Indices ICT Indicator Settings

Below are the primary settings for configuring the SMT Divergence Indices ICT Indicator in MT5:

Symbol Selection

- First symbol: Configure settings for the first index

- Second symbol: Configure settings for the second index

- Third symbol: Configure settings for the third index

Divergence Detection

- Enable/Disable trendline divergence detection

- Adjust maximum distance between two swing points

- Enable/Disable high-low divergence detection

- Enable/Disable SMT divergence visibility

Final Thoughts

The SMT Divergence Indices ICT Indicator for MT5 is a powerful analytical tool for ICT traders looking to refine their divergence-based trading strategies. By identifying smart money movements across three major indices, this indicator enhances precision in market analysis and improves traders' ability to anticipate shifts in market structure.