Opening Gap and Void ICT Indicator MT5

- Indikatoren

- Eda Kaya

- Version: 1.11

Opening Gap and Void ICT Indicator MT5

The Opening Gap and Void ICT Indicator MT5 is a highly effective tool for MetaTrader 5, designed to assist traders in spotting price gaps that occur when a new candlestick forms.

This indicator automatically detects and marks these gaps on the chart, making market analysis more streamlined. When the price retraces and fills a gap, the indicator removes that level from the chart, ensuring only active gaps remain visible. These gaps often serve as crucial support and resistance levels, influencing price action. Recognizing these areas allows traders to refine their strategies and predict market trends more accurately.

Opening Gap Indicator Specifications

The table below outlines the key details of the Opening Gap and Void ICT Indicator MT5:

| Category | ICT - Liquidity - Smart Money |

| Platform | MetaTrader 5 |

| Skill Level | Intermediate |

| Indicator Type | Continuation - Reversal |

| Timeframe | Multi-Timeframe |

| Trading Style | Intraday Trading |

| Markets | Forex - Stocks - Crypto - Commodities |

Understanding the Opening Gap Indicator

When a price gap appears between two candlesticks, it typically indicates increased market volatility, major news events, or shifts in trader sentiment. The Opening Gap and Void ICT Indicator MT5 highlights these gaps, offering traders an opportunity to leverage them in their market approach.

Active gaps are displayed in green, and once they are filled or become invalid, they shift to red, providing a clear visual representation of market conditions.

Opening Gap Indicator in a Bullish Market

In the example below, the 30-minute USD/CHF chart illustrates a bullish scenario. A price gap emerges and establishes a support zone. When the price retraces to this level, it stabilizes, presenting an opportunity for a buy trade, which leads to an upward move.

Opening Gap Indicator in a Bearish Market

On the 15-minute Bitcoin (BTC) chart, a gap forms, acting as a resistance level. As the price revisits this zone, it struggles to push higher and instead reverses downward, signaling a sell opportunity.

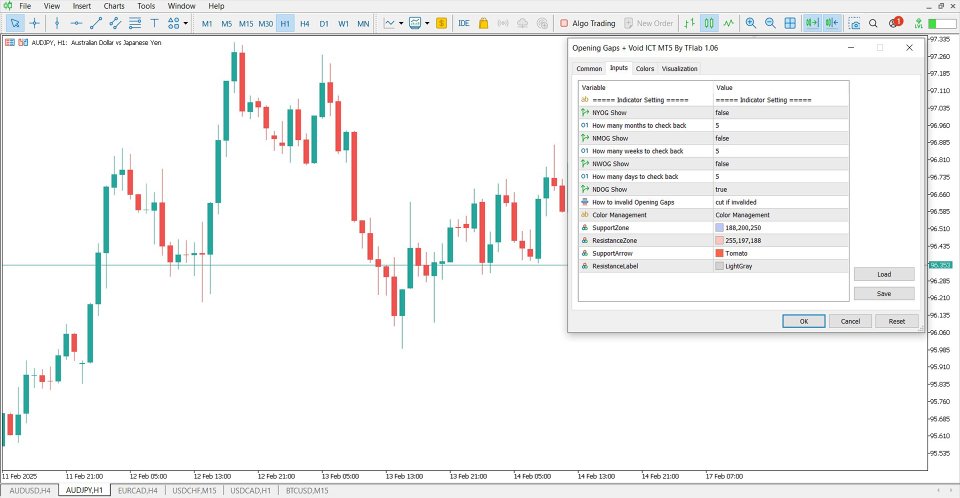

Indicator Settings

The Opening Gap and Void ICT Indicator MT5 includes a variety of customization options, allowing traders to align it with their specific trading approach. Below is a summary of its primary settings:

- HYOG Show – Enables the yearly gap display

- How Many Months to Check Back – Defines the range for reviewing monthly gaps

- NMOG Show – Activates the monthly gap feature

- How Many Weeks to Check Back – Determines how far back to check for weekly gaps

- NWOG Show – Displays weekly gaps

- How Many Days to Check Back – Sets the number of days for analyzing daily gaps

- NDOG Show – Turns on the daily gap display

- How to Invalidate Opening Gaps – Automatically removes invalidated gaps from the chart

- SupportZone – Customizes the color of support areas

- ResistanceZone – Adjusts the color of resistance levels

- SupportArrow – Defines the arrow color for support markers

- ResistanceLabel – Configures the label color for resistance points

Conclusion

The Opening Gap and Void ICT Indicator MT5 is a vital resource for identifying price gaps that function as dynamic support and resistance levels. These gaps provide key insights into potential reversals or continuations in price action.

Traders utilizing ICT methodologies or following Smart Money principles can integrate this indicator into their trading strategies to enhance their market analysis and optimize trade execution.