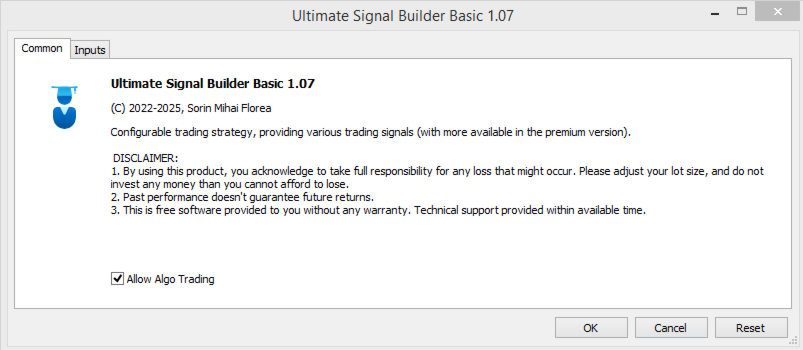

Ultimate Signal Builder Basic

- Experten

- Florea E. Sorin-Mihai Persoana Fizica Autorizata

- Version: 1.7

The Ultimate Signal Builder Basic combines the features of other 3 expert advisors, providing all their trading signals in one single place:

1. the Price Action Builder Basic;

2. the Bollinger Bands Builder Basic;

3. the Chart Patterns Builder Basic.

The Ultimate Signal Builder Basic expert advisor shares the same characteristics as the 3 underlying experts: usage of stop loss orders, maximum 1 managed open trade, automatic trade closure and configurable validation mechanism.

While being essentially a 3-in-1 product, the Ultimate Signal Builder Basic also provides some new, specific features:

- possibility to use a dynamic lot size per account available equity (instead of fixed lot);

- pre-defined risk profiles as shortcuts for some commonly-used value of the above-described (Dynamic Lot Size) setting;

- possibility to configure the signal validation mechanism separately per each of the 3 underlying experts (price action, Bollinger bands and chart patterns) signals.

Similarly with the other 3 experts, this EA does not use dangerous techniques such as grid trading or martingale nor does it require parameter optimization before being used.

Input parameters:

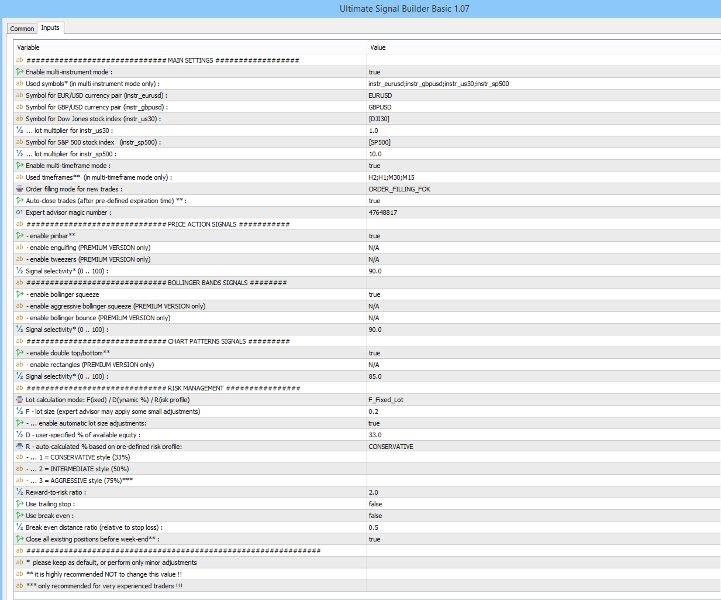

### MAIN SETTINGS

- Enable multi-instrument mode :

Specifies whether multiple instruments should be traded from the same chart (true - default setting) or only the current instrument (false).

- Used symbols (in multi-instrument mode only) :

List with symbols to be processed, separated by semi-colon (;). Due to differences in various brokers instrument naming, these are not be specified directly, but rather through their corresponding parameter name: instr_eurusd, instr_gbpusd, instr_us30, instr_sp500 (only these 4 are currently supported)

- Symbol for EUR/USD currency pair (instr_eurusd) :

This would be EURUSD in almost all situations, however some brokers may apply prefixes, suffixes or other custom naming schemes in some cases (e.g. EURUSD-Z)

- Symbol for GBP/USD currency pair (instr_gbpusd) :

This would be GBPUSD in almost all situations, however some brokers may apply prefixes, suffixes or other custom naming schemes in some cases (e.g. GBPUSD-Z)

- Symbol for Dow Jones stock index (instr_us30) :

The instrument name of the Dow Jones Industrial Average (DJIA) stock index. This is broker-specific, such as: [DJI30], US_30, #US30 etc.

- ... lot multiplier for instr_us30 :

The lot multiplier to be applied for the Dow Jones Industrial Average (DJIA) stock index. Used along with the "Lot size" parameter (e.g. if lot size is set to 2.0 and multiplier is 0.1, the effective lot size will be 0.2). The value for this parameter would be usually set to either 0.1 or 1.0, depending on your broker's instrument configuration.

- Symbol for S&P 500 stock index (instr_sp500) :

The instrument name of the Standard & Poor 500 stock index. This is broker-specific, such as: [SP500], US_500, #USSPX500 etc.

- ... lot multiplier for instr_sp500 :

The lot multiplier to be applied for the Standard & Poor 500 stock index. Used along with the "Lot size" parameter (e.g. if lot size is set to 2.0 and multiplier is 10.0, the effective lot size will be 20.0). The value for this parameter would be usually set to either 1.0 or 10.0, depending on your broker's instrument configuration.

- Enable multi-timeframe mode :

Specifies whether multiple timeframes should be traded from the same chart (true - default setting) or only the current timeframe (false).

- Used timeframes (in multi-timeframe mode only) :

List with timeframes to be processed, separated by semi-colon (;). It is recommended to keep the default value (H2;H1;M30;M15), although individual specific timeframes may be removed from the list.

- Order filling mode for new trades :

Specifies in which mode the new trade orders will be sent to the MetaTrader terminal. Different brokers might allow different filling modes. Most frequently, the ORDER_FILLING_FOK (Fill Or Kill) and ORDER_FILLING_IOC (Immediate Or Cancel) modes would be used.

- Auto-close trades (after pre-defined expiration time)

Specifies whether launched trades will be closed automatically (true), after fixed periods calculated by the system, or whether they will be allowed to continue until either Stop Loss or Take Profit levels are reached (false). It is recommended to keep the default value (true).

- Expert advisor magic number :

Used by this Expert Advisor in order to be able to identify its own trades between others launched by different EAs (or placed manually).

### PRICE ACTION SIGNALS

- enable pinbar: true/false, enables or disables the pinbar (hammer / shooting star) candlestick pattern in the trading strategy;

- enable engulfing: Not Available in the Basic version.

- enable tweezers: Not Available in the Basic version.

- Signal selectivity (0 .. 100) :Specifies the strength for the signal validation mechanism of the price action signals. When set to 0 it allows the maximum detected number of signals to be traded, but with a lower reliability. When set to 100, the minimum number of signals will be allowed to trade, but their reliability will be significantly higher. In principle, any in-between values can be set between 0 and 100, but for good results the recommendation is between 75 and 95. The default value is 90.

### BOLLINGER BANDS SIGNALS

- enable Bollinger squeeze: true/false, enables or disables the conservative entry Bollinger squeeze method in the trading strategy;

- enable aggressive Bollinger squeeze: Not Available in the Basic version.

- enable Bollinger Bounce: Not Available in the Basic version.

- Signal selectivity (0 .. 100) :

Specifies the strength of the signal validation mechanism of the Bollinger bands signals. When set to 0 it allows the maximum detected number of signals to be traded, but with a lower reliability. When set to 100, the minimum number of signals will be allowed to trade, but their reliability will be significantly higher. In principle, any in-between values can be set between 0 and 100, but for good results the recommendation is between 75 and 95. The default value is 90.

### CHART PATTERNS SIGNALS

- enable double top/bottom: true/false, enables or disables the double top and bottom pattern in the trading strategy;

- enable rectangles: Not Available in the Basic version.

- Signal selectivity (0 .. 100) :

Specifies the strength of the signal validation mechanism of the chart patterns signals. When set to 0 it allows the maximum detected number of signals to be traded, but with a lower reliability. When set to 100, the minimum number of signals will be allowed to trade, but their reliability will be significantly higher. In principle, any in-between values can be set between 0 and 100, but for good results the recommendation is over 70. The default value is 85.

### RISK MANAGEMENT

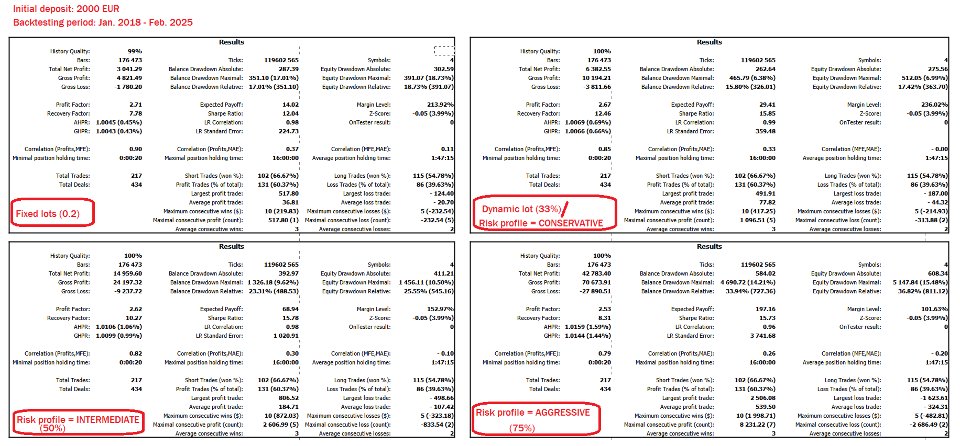

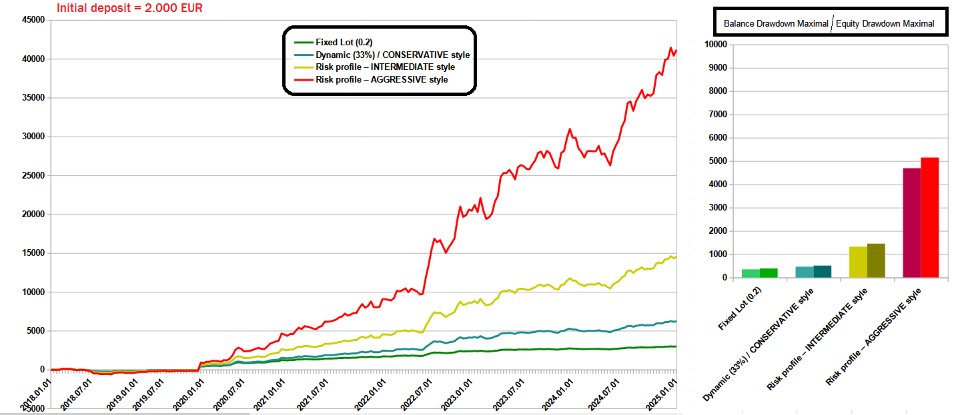

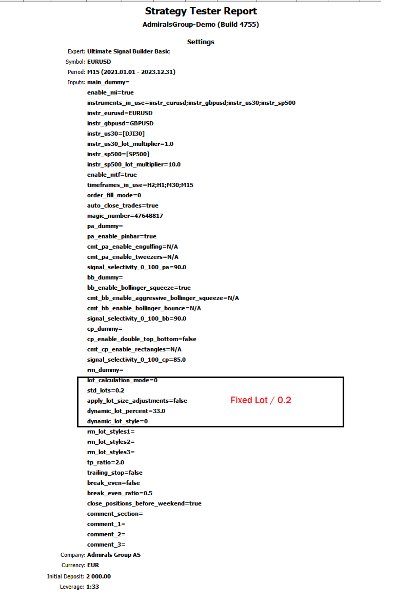

- Lot calculation mode: F(ixed) / D(ynamic %) / R(isk profile) :

Specifies the lot calculation mode, per below-described settings.

- F - lot size (expert advisor may apply some small adjustments) :

Fixed lot size for new trades. As stated above, some small adjustments may be applied by the system in some cases (e.g. instead of specified 1.0 lots value, the Expert may start e.g. a 0.96 or 0.64 lots trade). Default value is 0.20 lots.

- D - user-specified % of available equity :

Dynamic lot size according to available account equity. The lot size is not specified directly, but rather through the corresponding percent of available equity to be used as margin when launching new trades. Default value is 33%.

- R - auto-calculated % based on pre-defined risk profile:

These are 3 convenient shortcut, pre-defined values for for the dynamic lot size property:

1 = CONSERVATIVE style (33%)

2 = INTERMEDIATE style (50%)

3 = AGGRESSIVE style (75%) -> to be used with caution (and never exceeded).

- Use trailing stop:

Use a trailing stop order (when set to true) rather than a regular, fixed stop order (when set to false). Default value is false.

- Use break even:

When set to true, the trades will have their Stop Loss order advanced to the initial price, as soon as they become marginally profitable. Default value is false.

- Break even distance ratio (relative to stop loss) :

Determines the minimal profit that needs to be obtained in order for the break even mechanism to be triggered (when enabled, according to the above setting). This is calculated in pips and is multiplied by the distance to the Stop Loss order. Default value of this ratio is 0.50.

- Close all existing positions before week-end

When set to true, all managed positions will be automatically closed on Friday evening, 15 minutes before midnight. When set to false, the existing positions will be kept open over the week-end. Default (and recommended) value is true.

Important notes:

- before running this EA, you should first perform backtesting on your own account, making sure you have a profitable configuration in the long run;

- after backtesting, it is highly recommended to run it for at least 2-4 weeks on DEMO before moving it to a REAL account;

- please apply a careful money management policy, by adapting (and re-adjusting, if needed) the Lot Size to the funds available in your account.

Recommended settings:

- account type: either hedging or netting;

- symbol: EUR/USD;

- timeframe: M15;

- minimum deposit: 1000$ (preferably: at least 2000$);

- lot size:

- 0.10-0.15 per above-mentioned minimum amount (Fixed lot) -or-

- 33.0%-50.0% of available equity (Dynamic lot) -or-

- 1-CONSERVATIVE or 2-INTERMEDIATE (Risk profile).

Set files:

Development and primary testing was done under accounts opened at Admirals broker, and default parameter values generally follow their corresponding settings. Additional testing was done, with *.set files provided for AvaTrade and FxPro brokers. You may also send me a private message if you need additional *.set files corresponding to your broker.