Laguerre RSI Indicator in MT5

- Indikatoren

- Eda Kaya

- Version: 1.5

Download the Laguerre RSI Indicator for MT5

The Laguerre RSI indicator is a powerful trend-following oscillator designed for MetaTrader 5. It can function independently as a trading tool or serve as a supporting confirmation indicator within broader strategies. Unlike the traditional RSI, it significantly reduces signal lag, particularly in extended time frames. Additionally, it employs a gamma (Γ) filter that minimizes price fluctuations, leading to fewer misleading signals.

«Indicator Installation & User Guide»

MT5 Indicator Installation | Laguerre RSI Indicator in MT4 | ALL Products By TradingFinderLab | Best MT5 Indicator: Refined Order Block Indicator for MT5 | Best MT5 Utility: Trade Assistant Expert TF MT5 | TP & SL Tool: Risk Reward Ratio Calculator RRR MT5 | Money Management: Easy Trade Manager MT5

Indicator Specifications

| Category | Smart Money - ICT - Oscillator |

| Platform | MetaTrader 5 |

| Skill Level | Intermediate |

| Indicator Type | Lagging - Trend Continuation |

| Time Frame | Multi-time frame |

| Trading Style | Day Trading |

| Markets | Forex - Crypto - Stocks |

Indicator Overview

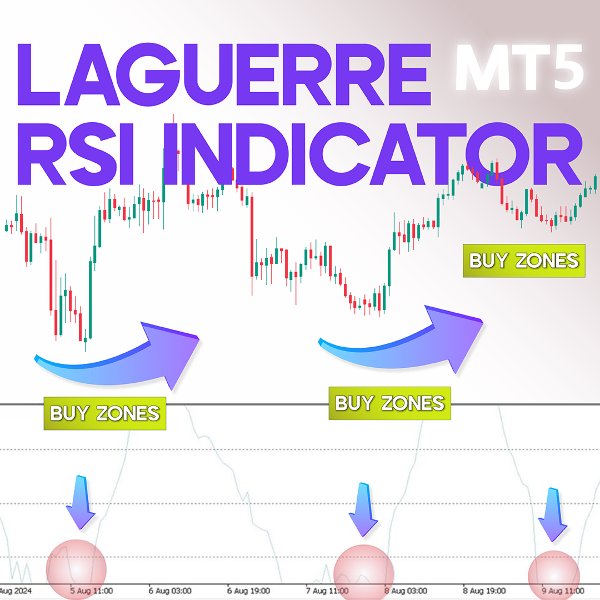

Similar to the standard RSI, the Laguerre RSI generates signals based on overbought and oversold levels. The default setting for its coefficient is 0.7, but traders can modify this to align with their specific strategies. A move below the 0.15 mark suggests a potential buying opportunity, while a rise above 0.75 signals an ideal selling condition. These levels help traders pinpoint market exhaustion and reversals effectively.

Indicator in Bullish Trends

When the indicator line bottoms out and stabilizes, it often signals the onset of a strong bullish move. For instance, in the AUD/NZD price chart, a drop below the 0.15 threshold presents an optimal buying setup.

Indicator in Bearish Trends

On an AUD/CAD chart, if the indicator line exceeds 0.75, it often indicates a favorable selling condition. Additionally, prolonged movement near zero suggests ongoing bearish momentum, making it a useful tool for identifying trend continuation.

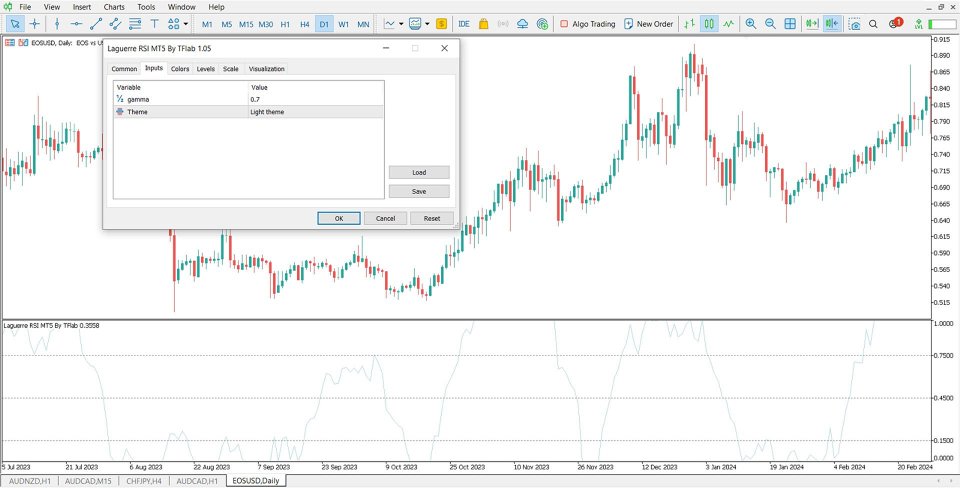

Indicator Customization

- RSI Multiplier: Adjusts the coefficient for personalized settings.

- Chart Theme: Modifies the background color for better visibility.

Conclusion

The Laguerre RSI indicator is a versatile tool suitable for both novice and experienced traders. Beginners can utilize it for clearer trade signals compared to traditional RSI, while seasoned traders can integrate it into complex analytical strategies. Its efficiency spans across various time frames, including daily, weekly, and monthly charts, as well as short-term intraday trading setups.

Good to catch the trend!