CryptoSwing

- Experten

- Jason Smith

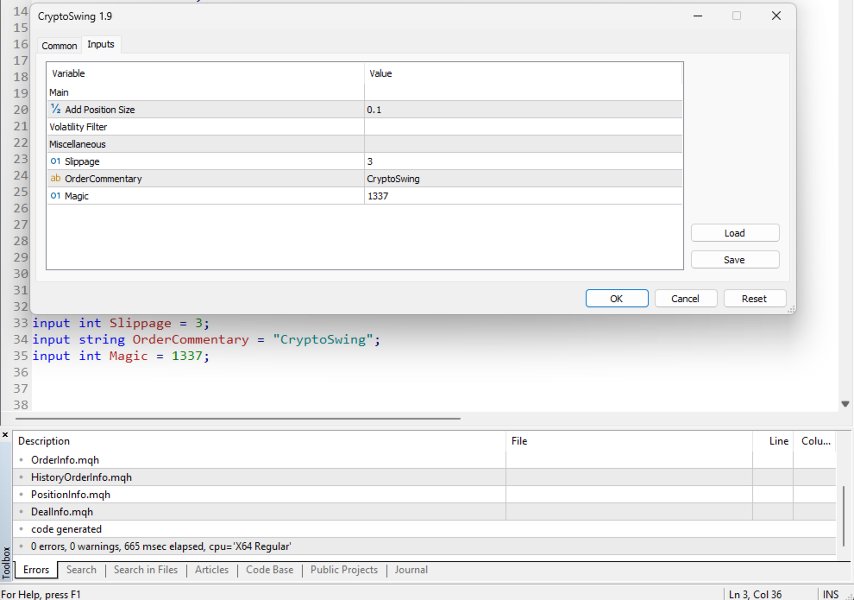

- Version: 1.9

- Aktivierungen: 20

It's recommended that you read through the entire document.

Are you ready to step into the world of crypto with a game-changing edge?

Introducing CryptoSwing: The Advanced Automated Bitcoin Swing Trading Bot.

CryptoSwing utilizes cutting-edge algorithms to analyze market trends, execute strategic trades and maximize profits — all without any manual intervention. Whether you're a seasoned investor or just starting, this bot works tirelessly to capitalize on market movements, giving you the freedom to sit back and relax while your portfolio grows.

🔑 Why CryptoSwing?Automated Trading 24/7:

No more watching charts or stress. The bot works around the clock, executing trades when conditions are perfect.

Swing Trading Expertise:

It doesn’t rush. CryptoSwing is built for the long game, capitalizing on mid-to-long-term price movements with precision.

Outstanding Results:

With a proven track record of success, CryptoSwing adapts to changing market conditions to maximize returns while minimizing risk.

Easy Setup:

Simply add the bot to Bitcoin H2 chart, set your risk tolerance, and let CryptoSwing handle the rest.

Patience Pays Off:

The bot works on well-researched strategies, allowing you to enjoy significant returns.

Efficient & Effective:

CryptoSwing removes the complexity from trading, allowing you to participate in the cryptocurrency market with ease, while the bot handles the technical analysis and execution.

Scalable Performance:

Whether you're new to trading or an experienced investor, it adapts to your needs and scales according to your investment goals, offering a flexible solution for every investor.

Patience-Driven Growth:

CryptoSwing’s strategy emphasizes steady, long-term growth. While other traders might chase short-term gains, CryptoSwing focuses on the bigger picture, ensuring that your patience is rewarded with sustainable results.

Swing Trading Strategy:

Designed specifically for swing trading, it capitalizes on medium-to-long-term market movements, optimizing your profit potential without the need for constant oversight.

🌟

CryptoSwing takes the guesswork out of Bitcoin trading, providing you with a sophisticated, fully automated solution that’s engineered for results.

Discpline is all you need —

The Bot will monitor and execute trade entries with flawless precision. Enabling you to ride trends like never before.

Start trading smarter today!

Do you want a dedicated partner in the world of Bitcoin trading, making sophisticated, data-driven decisions on your behalf to generate meaningful, long-term returns.

Experience the exciting world of trading — effortlessly.

Why Patience is the Key to Success

While many bots rush for short-term gains, CryptoSwing’s strategy takes the long view. By capitalizing on mid-to-long-term trends, CryptoSwing builds sustainable growth over time — letting your patience deliver consistent, meaningful returns.In today’s fast-paced cryptocurrency market, success requires precision, strategy, and constant monitoring. That’s where CryptoSwing comes in — an advanced, fully automated Bitcoin swing trading bot designed to deliver consistent, exceptional results with minimal effort on your part.

What CryptoSwing Offers:

Fully Automated Trading: CryptoSwing operates 24/7, executing trades on your behalf with no manual intervention required. With cutting-edge algorithms, it continually analyzes market data to make informed decisions, capturing opportunities in real-time.

To maximize your success with CryptoSwing, follow this structured approach:

-

Load the H2 Bitcoin Chart

This timeframe provides a balanced perspective of mid-term price action, smoothing out the noise from smaller timeframes while capturing significant market trends. By using the H2 chart, you'll get a clearer understanding of the market’s direction over a longer period, ideal for swing trading. -

Adjust Your Position Size

Before entering any trades, it's crucial to adjust your position size based on your predefined risk tolerance and trading objectives. Take a moment to review the amount of capital you are willing to risk per trade, and set your position size accordingly. CryptoSwing's adaptive risk management features allow you to fine-tune this easily, ensuring each trade aligns with your broader investment strategy. -

Wait for the Market Opening at the Start of the Week

Timing is key in swing trading. The beginning of the week often presents fresh opportunities as market conditions stabilize after the weekend volatility. Allow CryptoSwing to execute trades once the market shows clear signs of directionality, ensuring you capitalize on mid-to-long-term price movements rather than short-term fluctuations. By entering trades at the start of the week, you position yourself to capture potential gains over the coming days. - Example: Trading a $10,000 prop challenge (2-phase evaluation) with a Daily Drawdown limit of $500 and an Overall Drawdown limit of $1,000. Set your position size to 5 micro lots (0.05). Wait until the Asian session has settled, ideally at the beginning of the week or early Monday morning. Adhere to the strategy and maintain discipline throughout the process.

– CryptoSwing

Mind Care for Traders: Cultivating a Healthy Trading Mindset

Trading in the cryptocurrency market can be an exciting and profitable venture, but it also comes with its fair share of stress, uncertainty, and emotional challenges. To be successful, it’s not just about strategies, tools, or algorithms — it’s about managing your mindset. Here's how you can cultivate a healthy, focused, and resilient mindset for trading:

1. Embrace Patience Over Impulse

The allure of quick gains can be tempting, but successful trading requires patience. Avoid the urge to chase every price movement or make impulsive decisions based on fear of missing out (FOMO). In swing trading, the key is to let the market unfold over time. Trust your strategy and know that the best opportunities often come after waiting for the right conditions.

2. Accept Risk and Set Realistic Expectations

Every trade carries risk, and it’s crucial to accept that not every position will be a winner. Risk management is a core aspect of any successful trading strategy. Setting realistic expectations, understanding that losses are part of the process, and sticking to your risk tolerance will help you avoid emotional reactions to short-term setbacks.

3. Focus on the Process, Not the Outcome

When you're invested in a trade, it’s easy to become fixated on the potential profits or losses. However, focusing on the process — executing your strategy with discipline, following your risk management rules, and using your tools effectively — is what leads to long-term success. Trust the system, whether that’s CryptoSwing or your own methods, and avoid becoming overly concerned with daily fluctuations.

4. Control Your Emotions: Stay Calm and Collected

The psychological challenges of trading can be intense. Fear and greed can cloud judgment, leading to poor decisions. Emotional control is essential. Step away from your trades when emotions run high, take a break, and return with a clear mind. Meditation, deep breathing, or simply going for a walk can help clear your head. Remember, trading should be approached with a calm, rational mindset, not as a source of stress.

5. Learn from Every Experience

Both wins and losses provide valuable lessons. Reflecting on your trades — understanding why a trade was successful or why it failed — allows you to refine your strategy and improve. This continuous learning process helps you evolve as a trader and enhances your ability to make better decisions moving forward.

6. Create a Routine

Having a consistent daily routine helps foster mental clarity and focus. Start your day by reviewing your strategy, checking market conditions, and ensuring your mindset is prepared for the trading day ahead. Sticking to a routine will reduce stress and create a sense of control, helping you stay grounded even in volatile market conditions.

7. Take Care of Your Physical Health

Physical well-being directly impacts your mental clarity and decision-making. Exercise, proper nutrition, and adequate sleep are essential for maintaining sharp focus. Trading demands mental energy, so ensuring you're physically energized will help you stay alert, make better decisions, and manage stress effectively.

8. Know When to Step Away

If you’ve been trading for a long time or you’re feeling overwhelmed, take a step back. Sometimes the best decision is to pause and give yourself a break. Overtrading can lead to burnout and poor decision-making. A short break can refresh your mind, allowing you to return with renewed perspective and energy.

Final Thought: Mindset is Your Most Valuable Asset

In the world of trading, the most successful traders are those who understand that mental resilience and emotional discipline are just as important as technical knowledge and market analysis. By prioritizing mind care and maintaining a balanced, patient, and focused mindset, you’ll be better equipped to navigate the ups and downs of the market and achieve long-term success. Stay calm, stay disciplined, and trust the process.

Bug report

Given the complexity of this EA. Some bugs may not have been discovered yet.

If you think you've found a bug in CyptoSwing.

Do not rush the process.

- Write a precise description of the context.

- Write a description of the error as precise as possible.

- Attach the logs of the expert tab for the corresponding date.

- Attach the logs from the log tab for the corresponding date.

By growing your account slowly, you take advantage of compounding. When you reinvest your profits and grow your account in a measured way, even small, consistent gains will start to accumulate and snowball. Rather than aiming for huge, short-term wins, you're building a steady base that grows more over time, creating a sustainable path for long-term wealth.

2. Lowering the Risk of Large Losses

Trading with a slow and steady approach allows you to keep your risk under control. If you’re risking a small percentage of your account on each trade, even if you make mistakes or encounter unexpected market shifts, your losses will be manageable. This protects your capital and ensures that one bad trade won’t wipe out your account.

3. Developing Consistency and Discipline

The key to successful trading isn’t about making big, one-time gains; it’s about consistency. Growing your account slowly forces you to stick to a disciplined, systematic approach. It helps you refine your strategy, manage your emotions, and focus on steady profits rather than seeking instant gratification. Over time, your trading becomes more methodical and less driven by impulsive decisions.

4. Mastering Your Trading Strategy

When you build your account slowly, you give yourself the time and space to perfect your trading strategy. You can test different tactics, learn from each trade, and adjust your methods without the pressure of trying to grow your account quickly. This gradual approach allows you to evaluate what works and make improvements based on real market data.

5. Reducing the Impact of Market Volatility

The cryptocurrency market, especially Bitcoin, can be highly volatile. By growing your account slowly, you’re not forced to chase every price swing. Instead, you can focus on capturing steady, longer-term trends that don’t require you to react impulsively to every sudden move. A slow growth strategy ensures that you're not putting all your capital at risk with every market fluctuation.

6. Psychological Benefits

One of the biggest reasons why slow, steady growth works is because it’s easier to manage psychologically. Rapid account growth often leads to intense emotional highs and lows, which can cloud judgment and lead to bad decisions. By gradually growing your account, you avoid the emotional rollercoaster, making it easier to stay disciplined and objective. The mental clarity you gain through a steady approach is crucial for long-term success.

7. Long-Term Financial Stability

Building your trading account slowly sets you up for long-term financial stability. While quick gains might seem appealing, they often come with higher risk and the potential for significant losses. Growing your account in smaller, more controlled increments provides a safer, more reliable pathway to financial growth, making it easier to weather market downturns and unexpected events.

8. Avoiding the Dangers of Overleveraging

Trying to grow your account quickly often leads traders to use high leverage, which can amplify both gains and losses. The problem with this approach is that it increases the likelihood of blowing up your account when things don’t go as planned. By focusing on slow, incremental growth, you avoid overleveraging, keeping your risk manageable and protecting your capital in the long run.

In Conclusion:

Growing your trading account slowly might not provide the instant gratification of fast profits, but it sets the foundation for sustainable, long-term success. By focusing on steady, consistent gains, minimizing risk, and learning from each trade, you’re building a solid, growing portfolio that can weather market fluctuations and expand over time. Patience, discipline, and a gradual approach are the keys to transforming your trading into a reliable source of profit.

The Youtube video below is 2 years of CryptoSwing trading Bitcoin in a 5 minute video

If you would like to recreate for yourself the results from the below video.

icmarkets raw spread demo account

Start date used was 1.1.2023-17.1.2025 MT5 Strategy Tester