Clockwork Breakout EA

- Experten

- Romoi Kymani Meeks-steele

- Version: 1.0

- Aktivierungen: 10

You're busy, want to make money from trading, and are willing to buy into some tested & proven systems to speed up the process. The problem is that a lot of EAs on the marketplace look good on the surface, but causes you to lose all of your money in the end, as they’re built on risky principles.

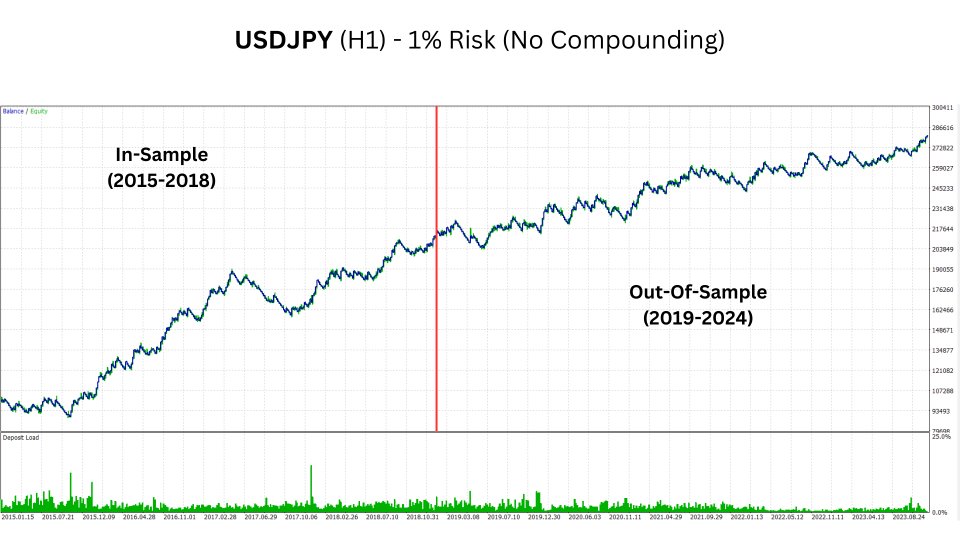

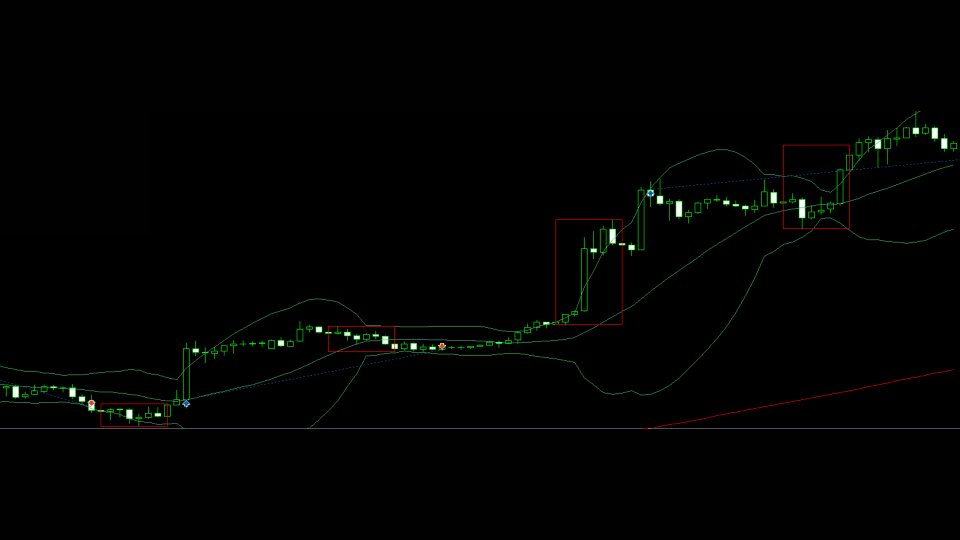

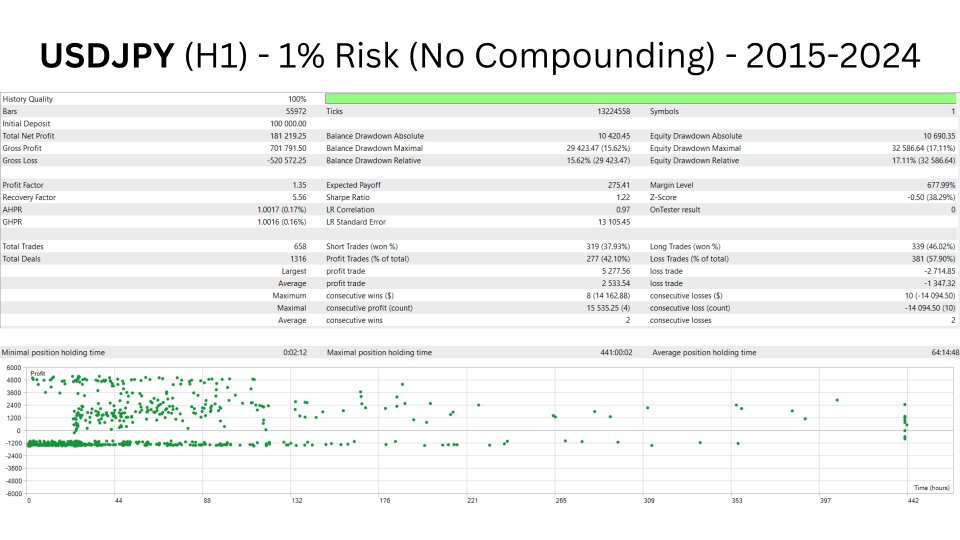

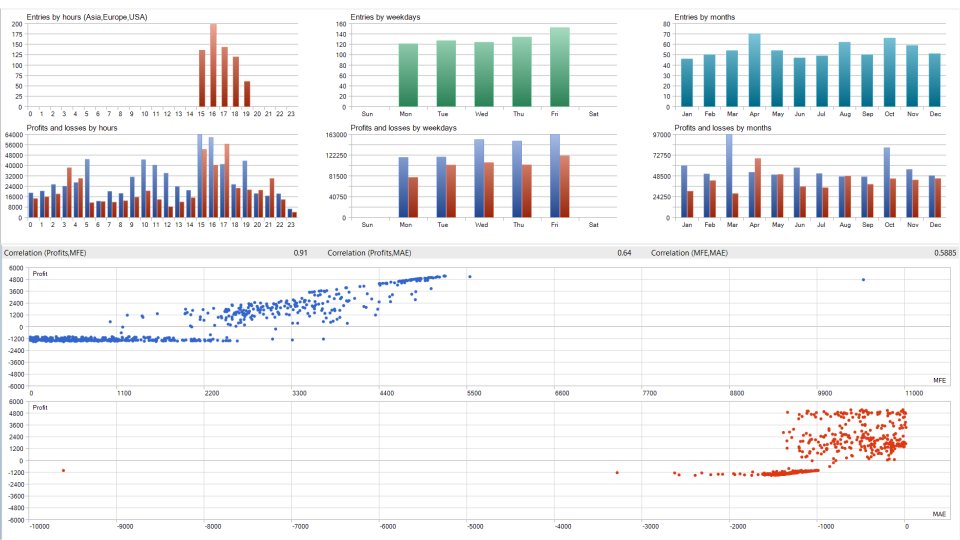

The Clockwork EA defines a range between x & y hours in the day, and then trades confirmed breakouts from that range. A simple & robust methodology, well-tested over decades, that I personally trade with my own capital. Extremely customisable (see settings below), rendering it useful to scalp intraday trends, or capture bigger market moves.

-

Reliable: No high-risk martingale or gridding maneuvers. Just sound trading.

-

Simple Setup: Minimal setup and fully automated execution.

-

Proven Logic: The strategy revolves around breakout trades from a clearly defined time window—no guesswork, just straightforward execution.

-

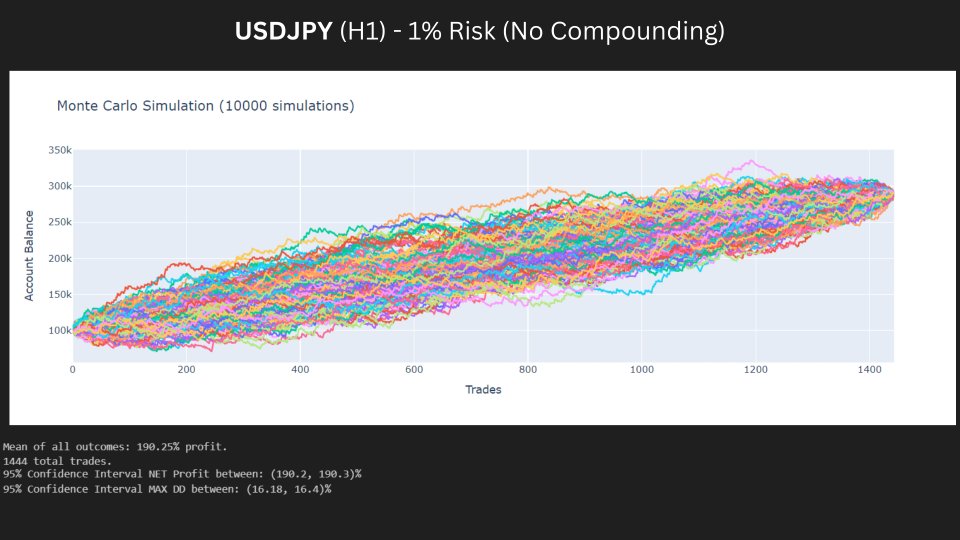

Extensively Tested: As a Python developer, I’ve stress-tested this strategy across 10,000 randomized scenarios, giving me a 95% confidence level in its metrics under varied market conditions.

Why I Built This EA

Like many traders, I once believed that success depended on finding the perfect strategy with a flawless equity curve. My current strategies, like the Clockwork EA, have taught me that generating consistent, reliable profits in the future doesn’t depend on one incredible equity curve, but a handful of decent equity curves.

What I was missing was trading the simple strategies that sound too basic, boring, and don't have “good” looking equity curves. I learned that these are the strategies that will continue to work into the future because they’re robust enough to survive varied market conditions and are realistic. And realistic isn’t as exciting as it’s hyped up to be.

If this sounds like the approach you’ve been looking for, try it out for free today. Take it for a spin, explore the settings, and see if it’s the missing piece in your portfolio. No empty promises here—just results you can test for yourself.

My settings:

-

Pair - USD/JPY

-

Timeframe - H1

-

Trigger timeframe - current

-

RangeStartHour - 6

-

RangeEndHour -13

-

ATR Period - 15

-

ATR Multiplier - 1

-

Reward-to-risk ratio - 3.5

-

OneTradePerDirection - true

-

IsLateExit - false

-

Bars to exit - 440

-

IsTimeWindow - true

-

TradeEndHour - 20

-

IsTSL - true

-

PipsBuffer - 5

-

CandleTrail - 20

-

StartTrailRR - 1.8

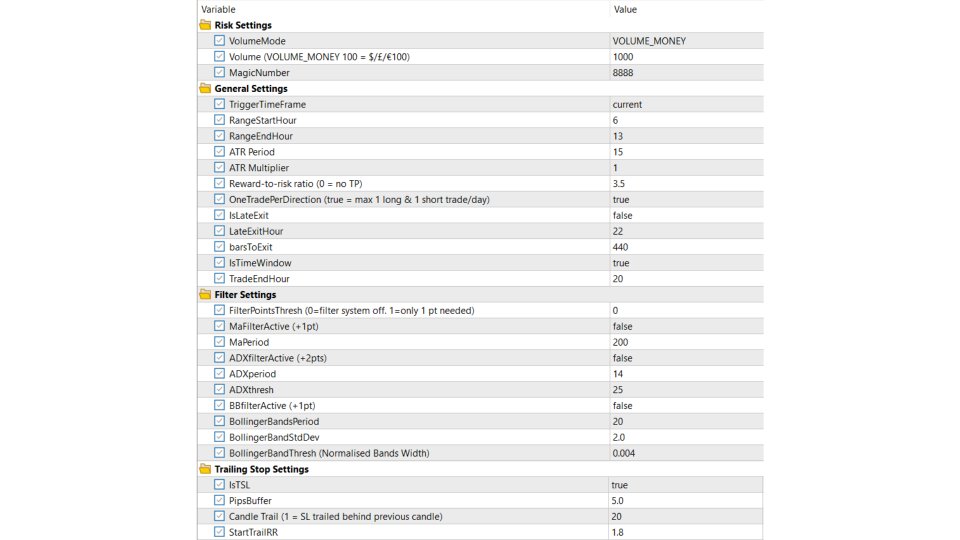

Other Settings:

- VolumeMode - VOLUME_LOTS or VOLUME_MONEY

- Volume

- FilterPointsThresh (0 = filter system off. 1 = only 1 point needed)

- MaFilterActive (+1 point)

- MaPeriod

- ADXfilterActive (+2 points)

- ADXperiod

- ADXthresh

- BBfilterActive (+1 point)

- BollingerBandsPeriod

- BollingerBandsStdDev

- BollingerBandsThreshold (Normalised Width)

Filter points system explained: Each active filter contributes a set number of points, and only trades meeting or exceeding the required threshold will be executed. Examples:

- FilterThresh = 2. ADXfilterActive (+2 pts) = true, MaFilterActive (+1 pt) = true. Only trades that pass the ADX filter will be taken. The MA filter is rendered useless, as it only contributes 1 point, and you require at least 2 points.

- FilterThresh = 4. ADXfilterActive (+2 pts) = true, MaFilterActive (+1 pt) = true, BBfilterActive (+1 pt) = true. Only trades that pass all filters will be taken, as that will gather all the points required to meet the threshold.

- FilterThresh = 1. ADXfilterActive (+2 pts) = true, MaFilterActive (+1 pt) = true, BBfilterActive (+1 pt) = true. A trade will be opened as long as it passes one of the filters, as it would have the required point to meet the threshold.