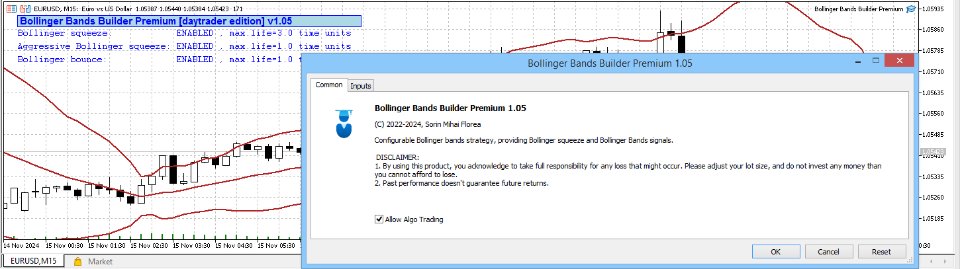

Bollinger Bands Builder Premium

- Experten

- Florea E. Sorin-Mihai Persoana Fizica Autorizata

- Version: 1.8

- Aktualisiert: 19 März 2025

- Aktivierungen: 15

- it provides 2 new trading techniques besides the standard Bollinger squeeze (already available in the basic edition);

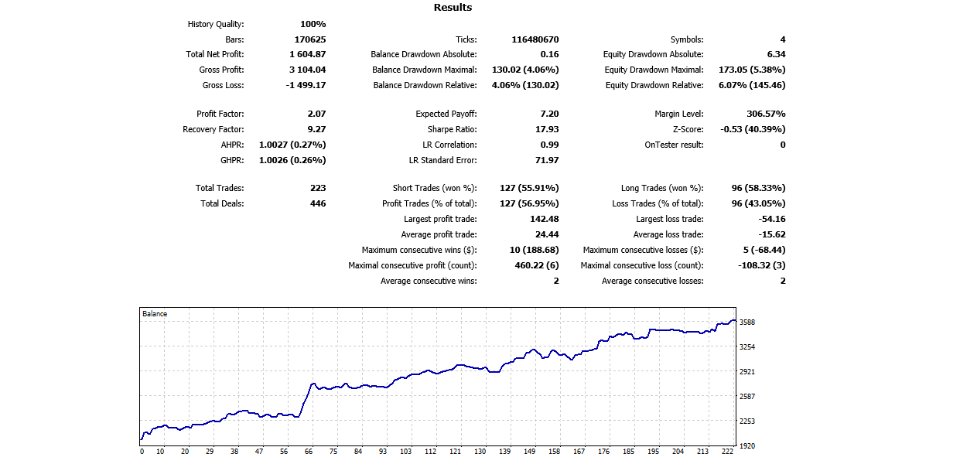

- in most configurations, backtesting usually shows more than double (2x) average yearly return rate;

- the account growth curve is also smoother, due to larger number of trades (about 3x) compared to the free version.

- usage of automatically placed stop loss orders for all launched trades;

- allowing maximum 1 managed open trade at a given time, avoiding pressure on margin/deposit load;

- minimization of positions holding time by automatic trade closure at pre-calculated intervals;

- avoiding the usage of exotic, highly volatile instruments.

Technical details:

Currently, 3 distinct strategy types are supported:

1. Bollinger squeeze, conservative entry;

2. Bollinger squeeze, aggressive entry;

3. Bollinger bounce.

Both the conservative-entry and aggressive-entry Bollinger squeeze methods start by verifying an increase in the Bollinger bands height following an existing contraction phase. Between these 2 there are a few important differences:

- the aggressive-entry method generates a signal as soon as a support or resistance level is broken, signaling the beggining of a new trend;

- the conservative-entry method waits for 1 more chart candle with the right direction (bullish or bearish) to confirm the viability of the newly detected trend;

- the aggressive-entry method uses more strict validations for the detection of the support or resistance level breakout, in order to compensate for the lack of trend extra-validation candle;

- the conservative-entry method has a shorter predefined lifetime, being theoretically prone to slighly shorter trends (due to delayed entry caused by extra-validation/confirmation candle).

The Bollinger bounce method enters an opposite direction trade when a chart candle hits one of the higher or lower bands levels.

For all 3 strategies, additional validations are performed by various methods, mostly related to the particularities of the last formation on the chart. This is usually either a trend-wise big body candle, or a counter-trendwise doji. Additional validations may be performed for detection of potential counter-pattern (leading to signal exclusion). The strength of this validation mechanism may be configured, allowing to deploy either fewer (but more reliable) or more (but less reliable) signals.

- instruments: EUR/USD and GBP/USD Forex pairs, along with DJIA and S&P 500 stock indices;

- timeframes: M15, M30, H1 and H2.

By default, the system uses a multi-instrument and multi-timeframe approach with the above-mentioned parameters. Thus, only a single instance of the Expert Advisor needs to be run. Specific instruments or timeframes may be removed, but not added to these lists. There are also available configuration options for running in a single-instrument and/or single-timeframe mode, according to the current chart _Symbol and _Period variables.

This EA does not use dangerous techniques such as grid trading or martingale nor does it require parameter optimization before being used.

Input parameters:

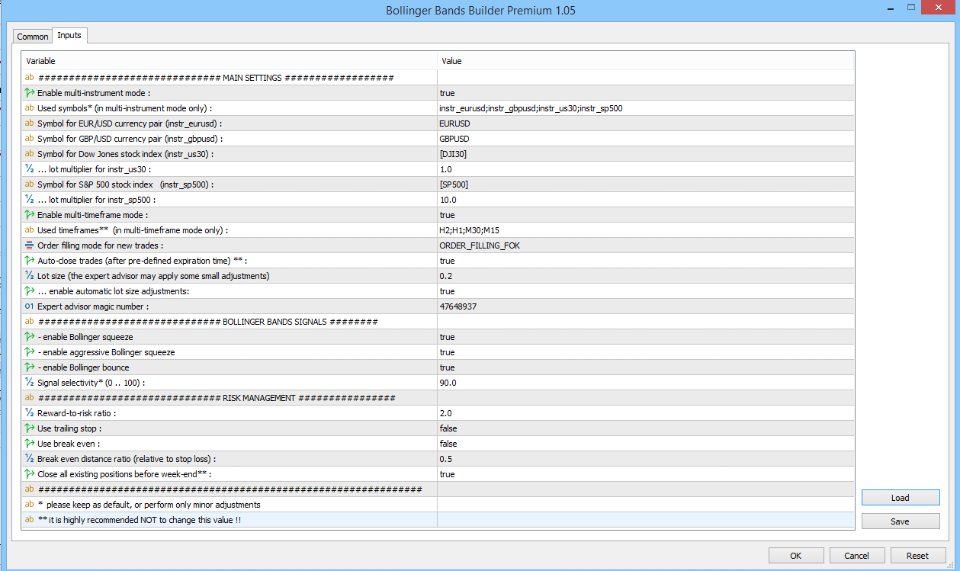

### MAIN SETTINGS

- Enable multi-instrument mode :

Specifies whether multiple instruments should be traded from the same chart (true - default setting) or only the current instrument (false).

- Used symbols (in multi-instrument mode only) :

List with symbols to be processed, separated by semi-colon (;). Due to differences in various brokers instrument naming, these are not be specified directly, but rather through their corresponding parameter name: instr_eurusd, instr_gbpusd, instr_us30, instr_sp500 (only these 4 are currently supported)

- Symbol for EUR/USD currency pair (instr_eurusd) :

This would be EURUSD in almost all situations, however some brokers may apply prefixes, suffixes or other custom naming schemes in some cases (e.g. EURUSD-Z)

- Symbol for GBP/USD currency pair (instr_gbpusd) :

This would be GBPUSD in almost all situations, however some brokers may apply prefixes, suffixes or other custom naming schemes in some cases (e.g. GBPUSD-Z)

- Symbol for Dow Jones stock index (instr_us30) :

The instrument name of the Dow Jones Industrial Average (DJIA) stock index. This is broker-specific, such as: [DJI30], US_30, #US30 etc.

- ... lot multiplier for instr_us30 :

The lot multiplier to be applied for the Dow Jones Industrial Average (DJIA) stock index. Used along with the "Lot size" parameter (e.g. if lot size is set to 2.0 and multiplier is 0.1, the effective lot size will be 0.2). The value for this parameter would be usually set to either 0.1 or 1.0, depending on your broker's instrument configuration.

- Symbol for S&P 500 stock index (instr_sp500) :

The instrument name of the Standard & Poor 500 stock index. This is broker-specific, such as: [SP500], US_500, #USSPX500 etc.

- ... lot multiplier for instr_sp500 :

The lot multiplier to be applied for the Standard & Poor 500 stock index. Used along with the "Lot size" parameter (e.g. if lot size is set to 2.0 and multiplier is 10.0, the effective lot size will be 20.0). The value for this parameter would be usually set to either 1.0 or 10.0, depending on your broker's instrument configuration.

- Enable multi-timeframe mode :

Specifies whether multiple timeframes should be traded from the same chart (true - default setting) or only the current timeframe (false).

- Used timeframes (in multi-timeframe mode only) :

List with timeframes to be processed, separated by semi-colon (;). It is recommended to keep the default value (H2;H1;M30;M15), although individual specific timeframes may be removed from the list.

- Order filling mode for new trades :

Specifies in which mode the new trade orders will be sent to the MetaTrader terminal. Different brokers might allow different filling modes. Most frequently, the ORDER_FILLING_FOK (Fill Or Kill) and ORDER_FILLING_IOC (Immediate Or Cancel) modes would be used.

- Auto-close trades (after pre-defined expiration time)

Specifies whether launched trades will be closed automatically (true), after fixed periods calculated by the system, or whether they will be allowed to continue until either Stop Loss or Take Profit levels are reached (false). It is recommended to keep the default value (true).

- Lot size (the expert advisor may apply some small adjustments)

Fixed lot size for new trades. As stated above, some small adjustments may be applied by the system in some cases (e.g. instead of specified 1.0 lots value, the Expert may start e.g. a 0.96 or 0.64 lots trade). Default value is 0.20 lots.

- Expert advisor magic number :

Used by this Expert Advisor in order to be able to identify its own trades between others launched by different EAs (or placed manually).

### BOLLINGER BANDS SIGNALS

- enable Bollinger squeeze: true/false, enables or disables the conservative entry Bollinger squeeze method in the trading strategy;

- enable aggressive Bollinger squeeze: true/false, enables or disables the aggressive entry Bollinger squeeze method in the trading strategy;

- enable Bollinger Bounce: true/false, enables or disables the Bollinger Bounce method in the trading strategy.

- Signal selectivity (0 .. 100) :

Specifies the strength for the signal validation mechanism of the price action signals. When set to 0 it allows the maximum detected number of signals to be traded, but with a lower reliability. When set to 100, the minimum number of signals will be allowed to trade, but their reliability will be significantly higher. In principle, any in-between values can be set between 0 and 100, but for good results the recommendation is between 75 and 95. The default value is 90.

### RISK MANAGEMENT

- Reward-to-risk ratio :

The ratio between potential profit (upto the Take Profit price) and potential loss (to the Stop Loss price) of a trade. This setting determines how far the Take Profit price will be set (since the Stop Loss is automatically calculated by the Expert Advisor). Default value is 2.0.

- Use trailing stop:

Use a trailing stop order (when set to true) rather than a regular, fixed stop order (when set to false). Default value is false.

- Use break even:

When set to true, the trades will have their Stop Loss order advanced to the initial price, as soon as they become marginally profitable. Default value is false.

- Break even distance ratio (relative to stop loss) :

Determines the minimal profit that needs to be obtained in order for the break even mechanism to be triggered (when enabled, according to the above setting). This is calculated in pips and is multiplied by the distance to the Stop Loss order. Default value of this ratio is 0.50.

- Close all existing positions before week-end

When set to true, all managed positions will be automatically closed on Friday evening, 15 minutes before midnight. When set to false, the existing positions will be kept open over the week-end. Default (and recommended) value is true.

Important notes:

- before running this EA, you should first perform backtesting on your own account, making sure you have a profitable configuration in the long run;

- after backtesting, it is highly recommended to run it for at least 2-4 weeks on DEMO before moving it to a REAL account;

- please apply a careful money management policy, by adapting (and re-adjusting, if needed) the Lot Size to the funds available in your account.

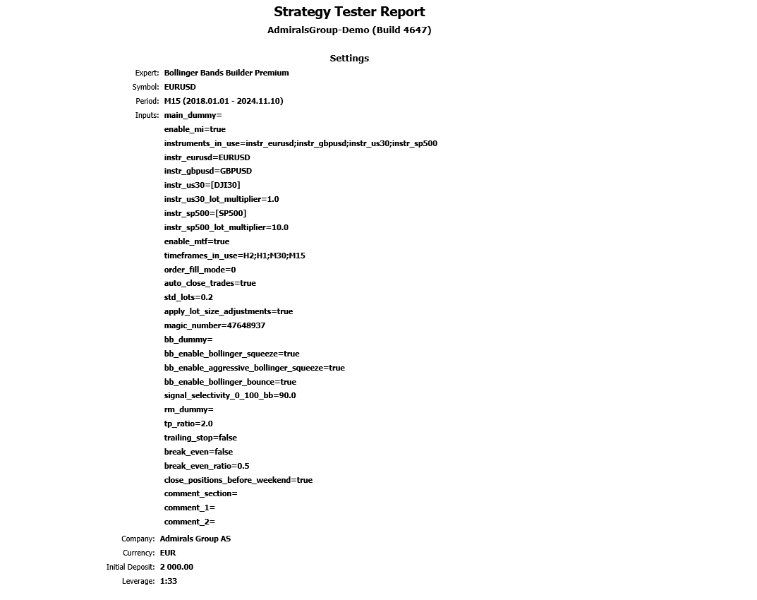

Recommended settings:

- account type: either hedging or netting;

- symbol: EUR/USD;

- timeframe: M15;

- minimum deposit: 1000$ (preferably: at least 2000$);

- lot size: 0.10 per above-mentioned minimum amount.

Set files:

Development and primary testing was done under accounts opened at Admirals broker, and default parameter values generally follow their corresponding settings. Additional testing was done, with *.set files provided for AvaTrade and FxPro brokers. You may also send me a private message if you need additional *.set files corresponding to your broker.