Pivot Points High Low

- Indikatoren

- Mudit Agarwal

- Version: 1.0

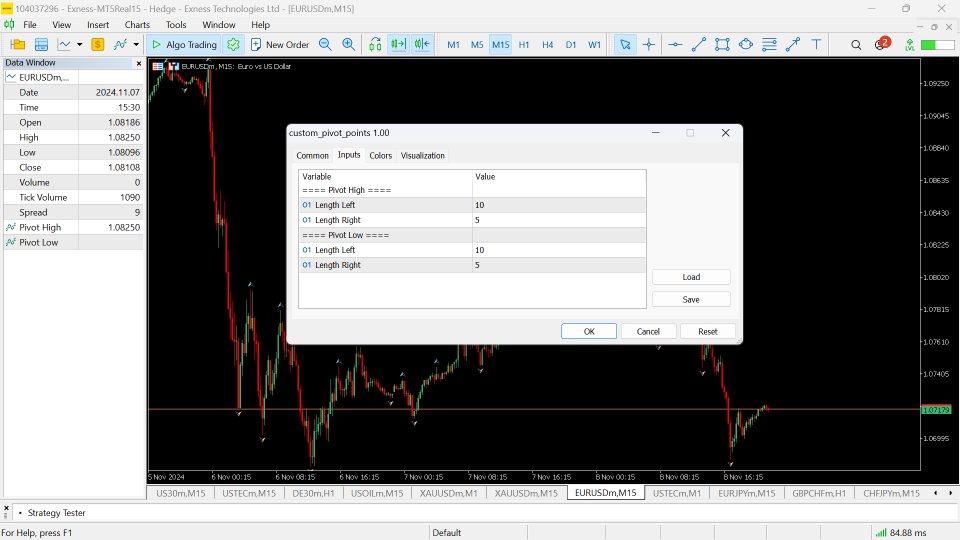

The Pivot Points High Low indicator is used to determine and anticipate potential changes in market price and reversals.

Get supertrend indicator based on this indicator and more: All-In-One Supertrend Indicator

Pivot Point Highs are determined by the number of bars with lower highs on either side of a Pivot Point High. Pivot Point Lows are determined by the number of bars with higher lows on either side of a Pivot Point Low.

For example, a Pivot Point High, with a period of 5 (left) and 5 (right), requires a minimum of 11 bars to be considered a valid Pivot Point. A minimum of 5 bars before and after the Pivot Point High all have to have lower highs.

Happy trading!