Ichimoku Strategies EA MT4

- Experten

- Biswarup Banerjee

- Version: 7.0

- Aktualisiert: 22 Januar 2025

- Aktivierungen: 20

Ichimoku Cloud Strategy EA MT4

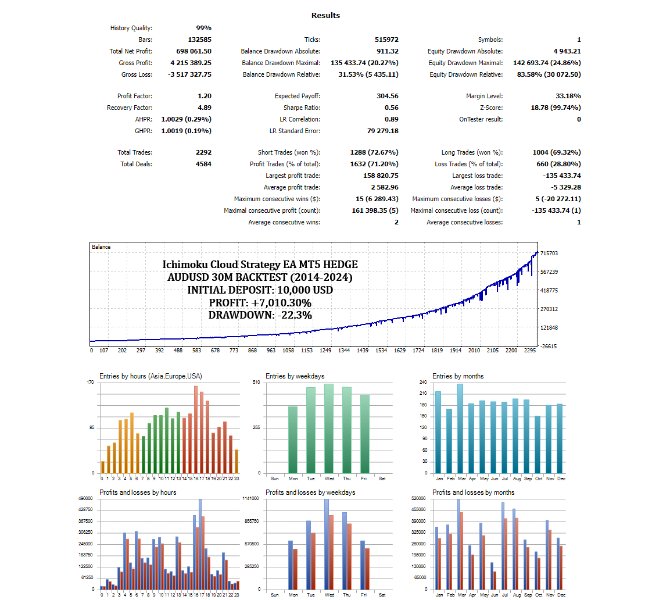

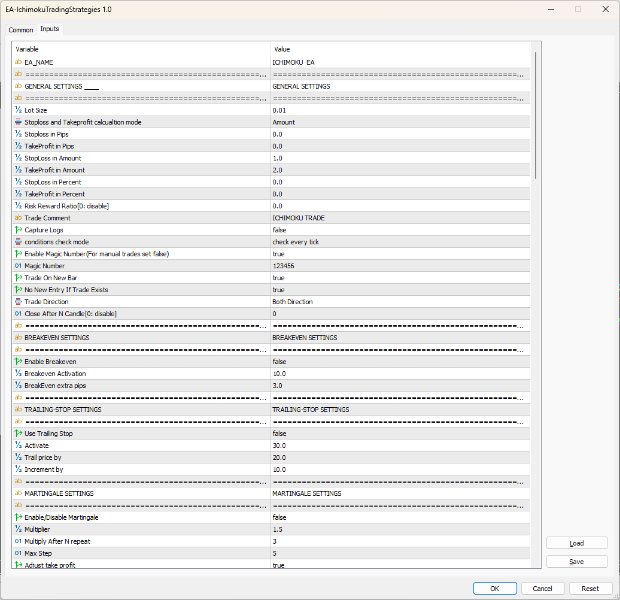

Welcome to the Ichimoku Strategies EA, an advanced tool designed exclusively for MetaTrader 4. This expert advisor streamlines trading activities by harnessing the power of the Ichimoku indicator, automating trade entries and exits based on 6 different strategies. The EA also facilitates reverse trading setups within these zones, offering a versatile approach to managing trades.

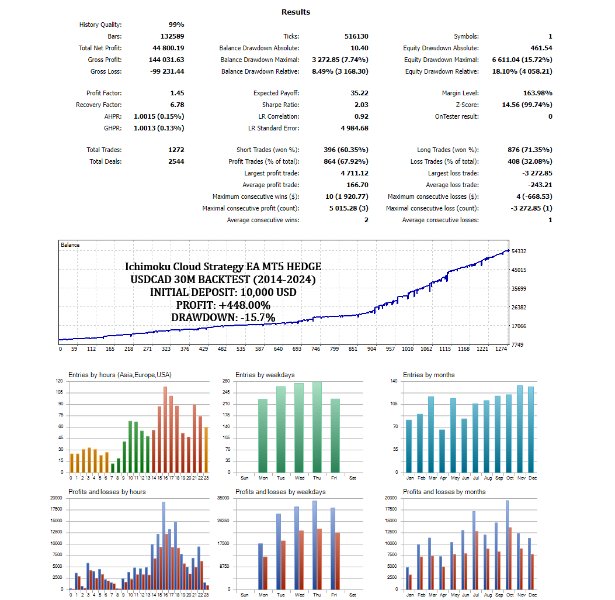

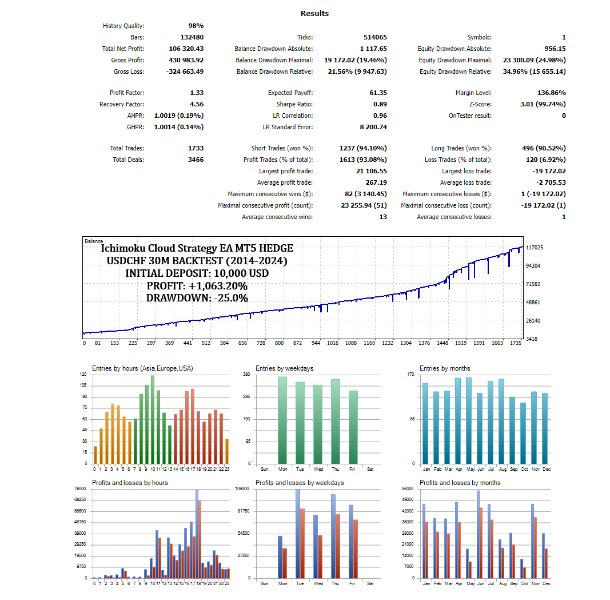

For detailed documentation General Settings/Input Guide | Indicator Settings/Input Guide | Backtests and Set files

MT5 version available here

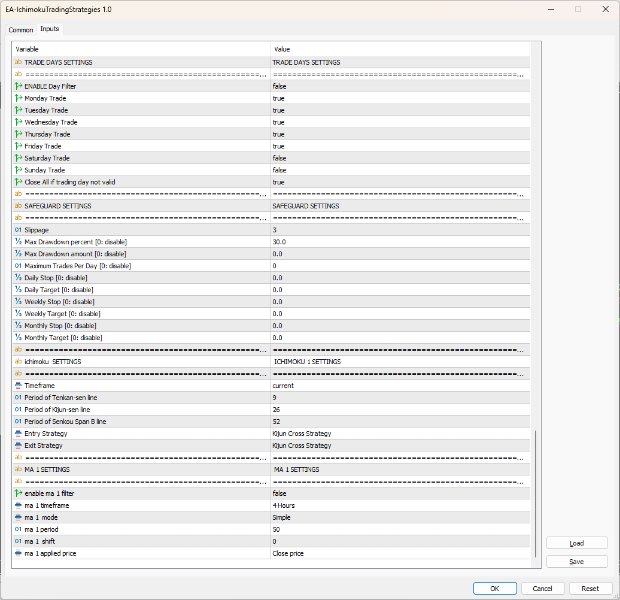

Kijun Cross Strategy: For a buy signal, the price crosses above the Kijun-sen line, with Tenkan-sen positioned above Kijun-sen, and the price is above the Kumo. For a sell signal, the price crosses below the Kijun-sen, with Tenkan-sen below Kijun-sen, and the price is below the Kumo.

Kumo Breakout Strategy: For a buy signal, the price breaks above the Kumo with Senkou Span A above Senkou Span B, indicating a bullish Kumo. For a sell signal, the price breaks below the Kumo with Senkou Span B above Senkou Span A, indicating a bearish Kumo.

Chikou Span Confirmation Strategy: For a buy signal, Chikou Span crosses above the price and Kumo, with Tenkan-sen above Kijun-sen for further confirmation. For a sell signal, Chikou Span crosses below the price and Kumo, with Tenkan-sen below Kijun-sen.

Tenkan-Kijun Cross Strategy (Short-Term): A buy signal occurs when Tenkan-sen crosses above Kijun-sen, with the price above the Kumo for confirmation. A sell signal occurs when Tenkan-sen crosses below Kijun-sen, with the price below the Kumo for confirmation.

Kumo Twist Strategy: For a buy signal, the Kumo twists from bearish to bullish, meaning Senkou Span A crosses above Senkou Span B. For a sell signal, the Kumo twists from bullish to bearish, meaning Senkou Span B crosses above Senkou Span A.

High Level Overview of Features

Implements a robust, backtested trading strategy.

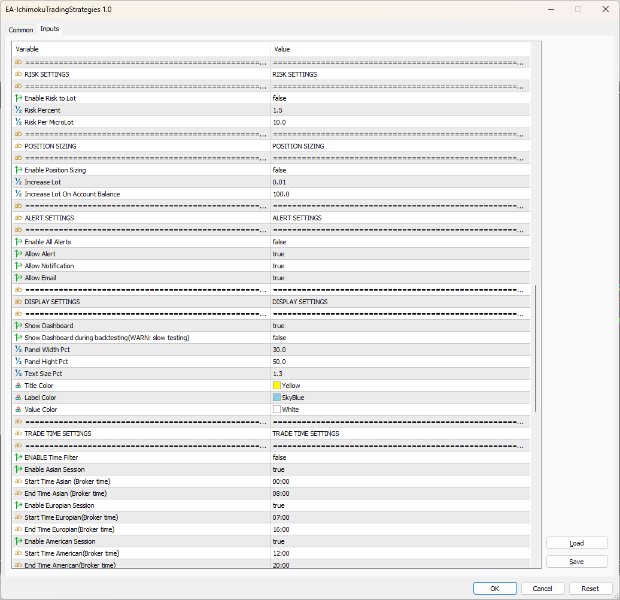

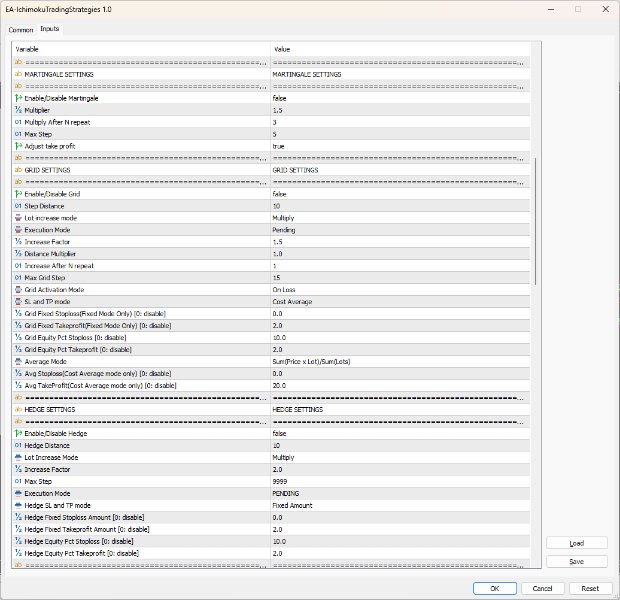

Allows for customizable parameters like lot sizes, indicators, and entry/exit criteria.

Offers clear Stop-Loss and Take-Profit settings.

Includes trailing stops to secure profits.

Uses position sizing to manage overall risk.

Has drawdown protection and spread/slippage filters.

Provides multiple entry methods (breakouts, reversals, trend-following).

Offers flexible exit rules (indicator-based, time-based, or profit-based).

Executes trades quickly with minimal delay.

Uses efficient, non-lagging indicators.

Consumes low system resources.

Delivers on-screen pop-ups and audio alerts.

Sends email or push notifications.

Adjustable input parameters and filters (time of day, sessions, day-of-week).

Modifiable indicator thresholds and conditions.

Adapts to various market conditions.

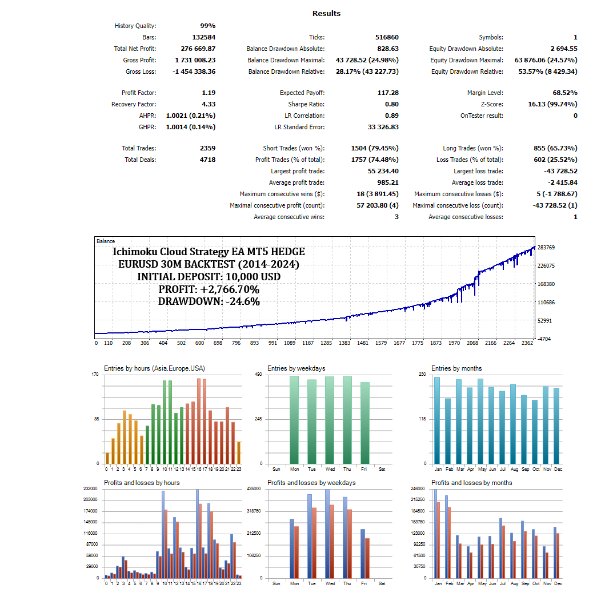

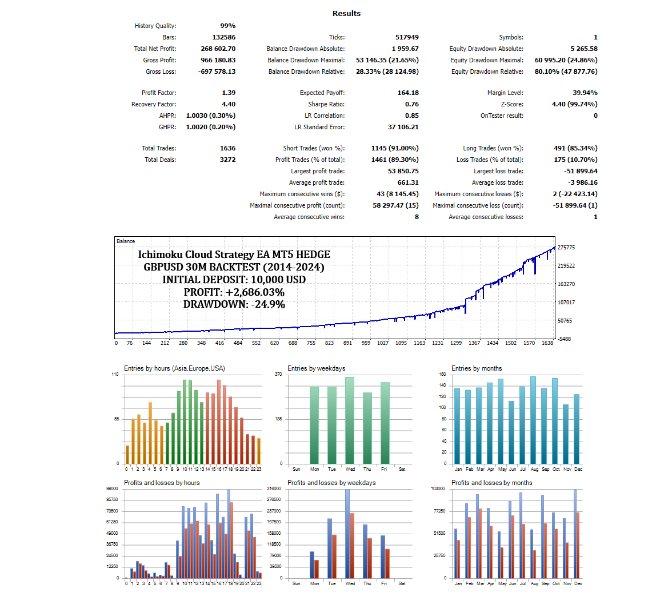

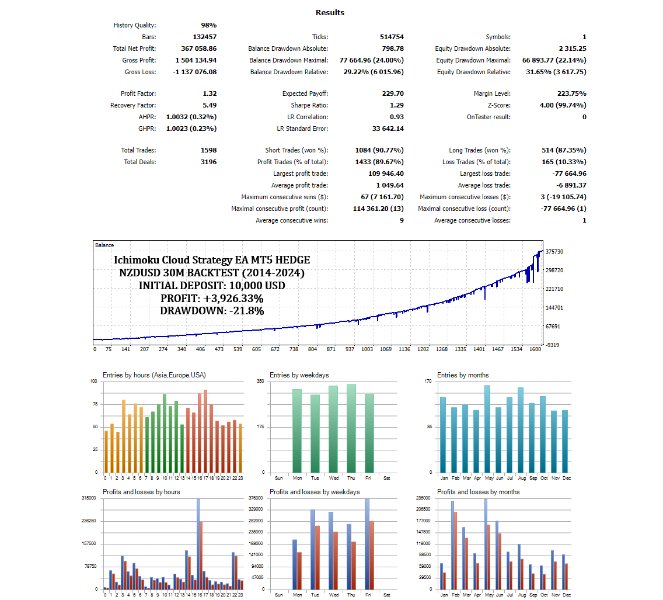

Supports historical data testing for performance validation.

Allows parameter optimization to find the best settings.

Displays a real-time dashboard of open trades, account equity, and system metrics.

Presents intuitive and well-organized input menus.

Offers clear documentation and user guides.

Incorporates slippage and spread controls.

Implements error-handling and logging.

Provides daily, weekly, and monthly trade summaries.

Tracks metrics like maximum drawdown, win rate, and profit factor.

Works seamlessly on MT4/MT5 platforms.

Receives regular updates and improvements.

Maintains reliable performance and stable operations over time.

Usage Recommendations:

Prior to deploying in live markets, thorough testing in a demo account is strongly advised. This ensures a comprehensive evaluation of the EA's performance, its alignment with your trading strategy, and an assessment of risk tolerance levels.

If you want to try the free trial version for 7 days, feel free to reach out to me via the profile section.