StochAlligator

- Experten

- Sami Triki

- Version: 3.1

- Aktivierungen: 5

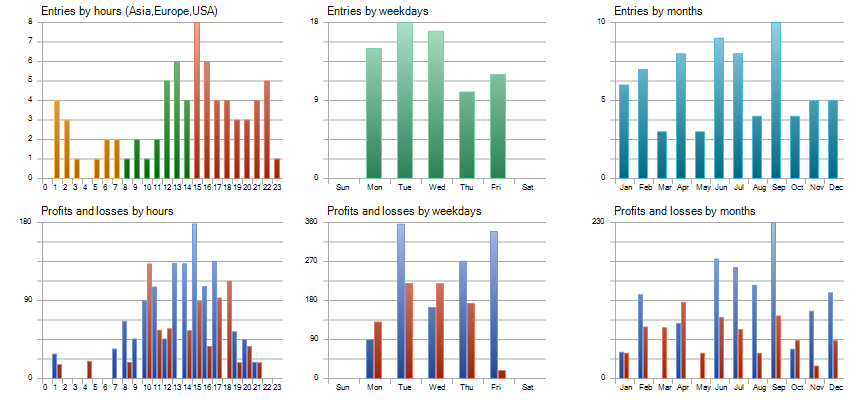

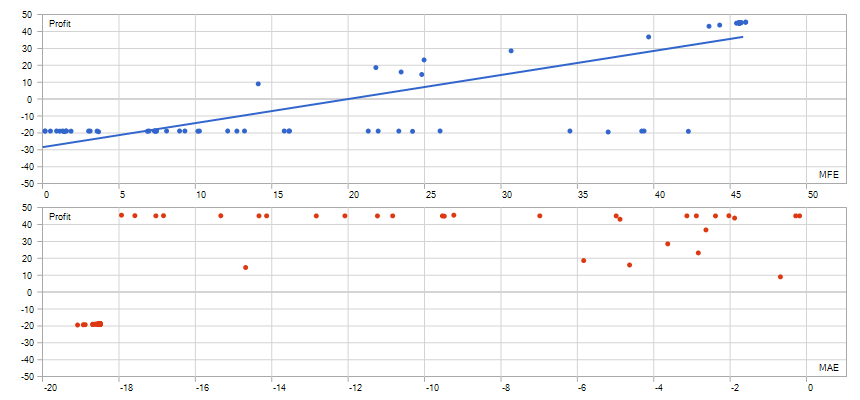

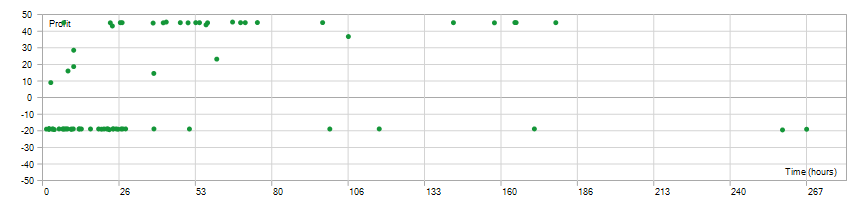

The StochAlligator trading strategy combines the strengths of the Stochastic Oscillator, Alligator, and Bollinger Bands indicators to identify high-probability trade setups. It works best with EUR/USD pair in H1 Timeframe.

-

Stochastic Oscillator: Used to gauge momentum and overbought or oversold conditions in the market. The Stochastic helps confirm potential entry and exit points, particularly at extremes when price may be due for a reversal.

-

Alligator Indicator: This trend-following tool, based on three smoothed moving averages, helps identify trend direction and market phases. When the "Alligator" (the lines) awakens, it signals a trending market; when it "sleeps," it indicates consolidation. The StochAlligator strategy uses the Alligator to determine if the market is trending or ranging, guiding decisions on trade direction.

-

Bollinger Bands: These bands help define price volatility, often marking potential reversals or continuation points at the outer bands. In StochAlligator, Bollinger Bands can confirm areas where price may be overextended within a trend or signal potential entry/exit points along with the Stochastic.

This strategy uses each indicator's unique strengths, filtering trades based on trend strength and reversal signals for optimal entries with favorable risk-reward ratios.

It has a Sharpe Ratio of 2.75, A profit Factor of 1.6 and maximum Equity Drawdown of 15%.