ArbiMaster

- Experten

- Henruque Gomes

- Version: 1.4

- Aktivierungen: 5

ArbiMaster

The ArbiMaster is an advanced algorithm designed for executing arbitrage strategies between two correlated assets in the futures market. It automatically identifies price discrepancies between two instruments and performs simultaneous buy and sell operations to profit from these inefficiencies. The robot offers multiple arbitrage strategies, along with customizable risk management settings, making it ideal for traders seeking to explore market spreads in a secure and effective way.

Key Features:

Multiple Arbitrage Strategies: Choose from four arbitrage strategies:- ASK asset 1 - BID asset 2 >= X

- ASK asset 1 - BID asset 2 <= X

- ASK asset 1 > ASK asset 2

- BID asset 1 > BID asset 2

- Dynamic Risk Management: Set profit targets and maximum loss limits to ensure positions are automatically closed when your goals are reached.

- Custom Lot Sizes: Adjust the lot size of both assets to fit your risk strategy.

- Scheduled Trading: Define start and end times for trading to ensure operations happen within the desired period.

- Spread: Set maximum spread values to avoid trades in unfavorable market conditions.

- Price Verification Using Depth of Market: The robot automatically verifies if the user’s desired prices are available in the depth of market, ensuring that orders are executed according to the established conditions, offering an additional layer of security.

- Automatic Position Closure: Positions are closed automatically when profit targets or loss limits are reached, protecting the trader from additional risks.

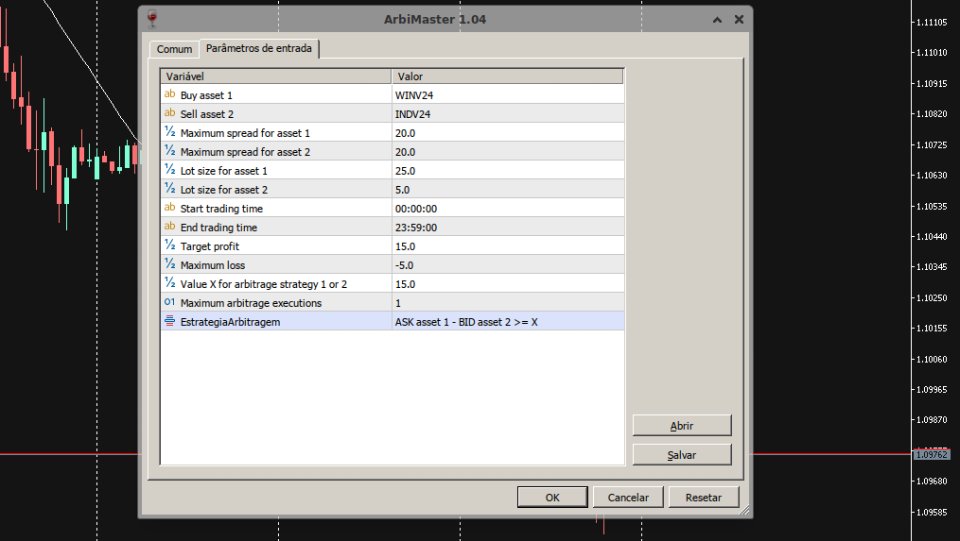

Input Options:

- Asset1 (Symbol 1): The symbol of the first asset to buy (e.g., "WINV24").

- Asset2 (Symbol 2): The symbol of the second asset to sell (e.g., "INDV24").

- Spread_1_Max: Maximum allowed spread for asset 1.

- Spread_2_Max: Maximum allowed spread for asset 2.

- LotesAtivo1: Lot size for asset 1.

- LotesAtivo2: Lot size for asset 2.

- StartTime: Trading start time (e.g., "09:00:00").

- EndTime: Trading end time (e.g., "18:00:00").

- TargetProfit: Total profit target value for closing positions.

- MaxLoss: Maximum allowed loss before all positions are closed.

- ValueX: Value controlling the arbitrage strategies based on price differences.

- MaxArbitrage: Maximum number of arbitrage operations allowed in one session.

- ArbitrageStrategy: Choose from one of the four available arbitrage strategies.

How It Works:

The robot continuously monitors the prices of both assets and executes simultaneous buy and sell orders according to the configured arbitrage strategy. Additionally, the built-in security mechanism checks the depth of market to ensure that the desired prices are available at the time of order execution. This protects the trader from unexpected executions and ensures trades are made according to the defined conditions. When profit targets are reached, or loss limits are triggered, the robot automatically closes all positions to protect capital.