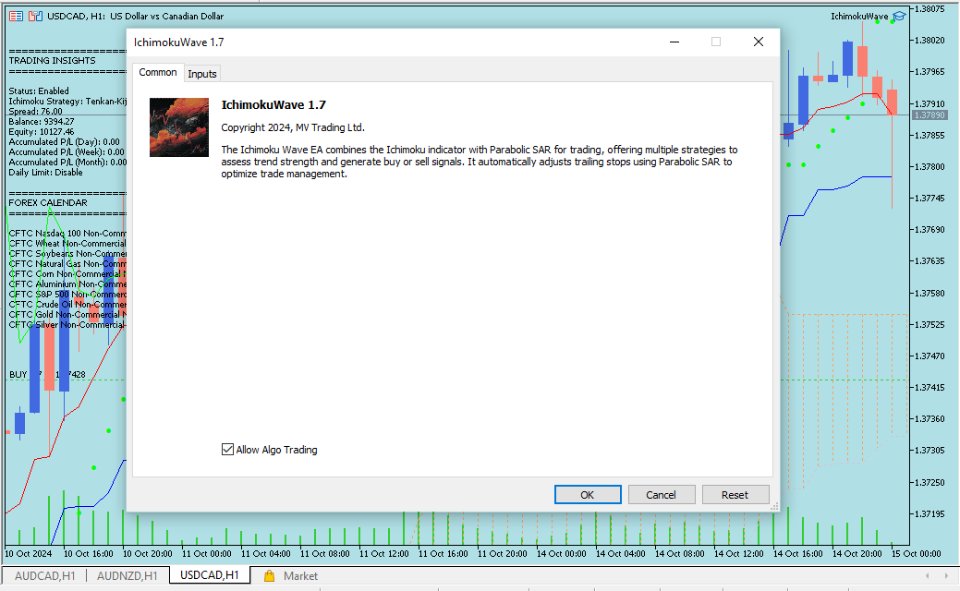

IChimoku Wave EA

- Experten

- Marcus Vinicius

- Version: 1.7

- Aktualisiert: 14 Oktober 2024

- Aktivierungen: 10

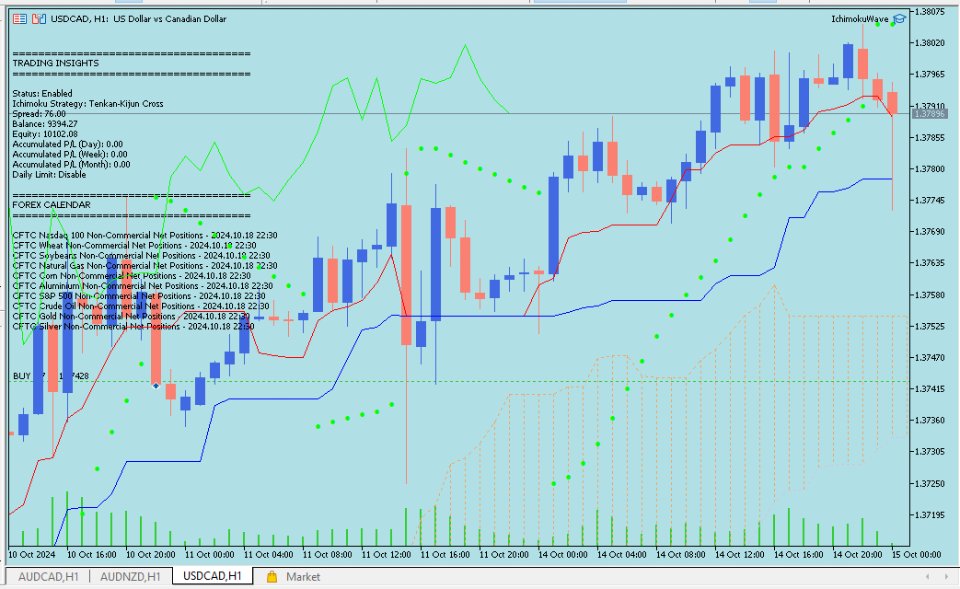

The Ichimoku Wave EA is one of the most comprehensive free Expert Advisors, ideal for traders seeking a high-performance automated solution based on the Ichimoku Cloud indicator. With multiple strategies available, it provides a robust approach to identifying buy and sell opportunities, utilizing either fixed or dynamic lot sizes that automatically adjust based on account balance and desired risk. Its architecture is designed to protect the trader's capital, featuring a daily P/L limit that halts operations once targets are reached, ensuring risk control.

Additionally, the Ichimoku Wave EA incorporates a smart trailing stop based on the Parabolic SAR, which automatically adjusts positions according to market movement, maximizing profits while minimizing losses. With an integrated weekly Forex calendar and dynamic data on the selected currency, this EA offers valuable insights for more efficient decision-making.

This combination of advanced tools and capital-preserving design makes the Ichimoku Wave EA a strategic choice for traders looking to maximize results while mitigating risks.

* The EA is fully optimized and ready for Propfirms like FTMO and others. It is performance-adjusted to meet evaluation requirements, with efficient risk management and strategies tailored to pass challenges confidently.

Recommendations and General Information

| Minimum Recommended Balance | Leverage | Assets | Account Type |

|---|---|---|---|

| $500 | 1:100 | Indices, Currencies and Commodities | Netting |

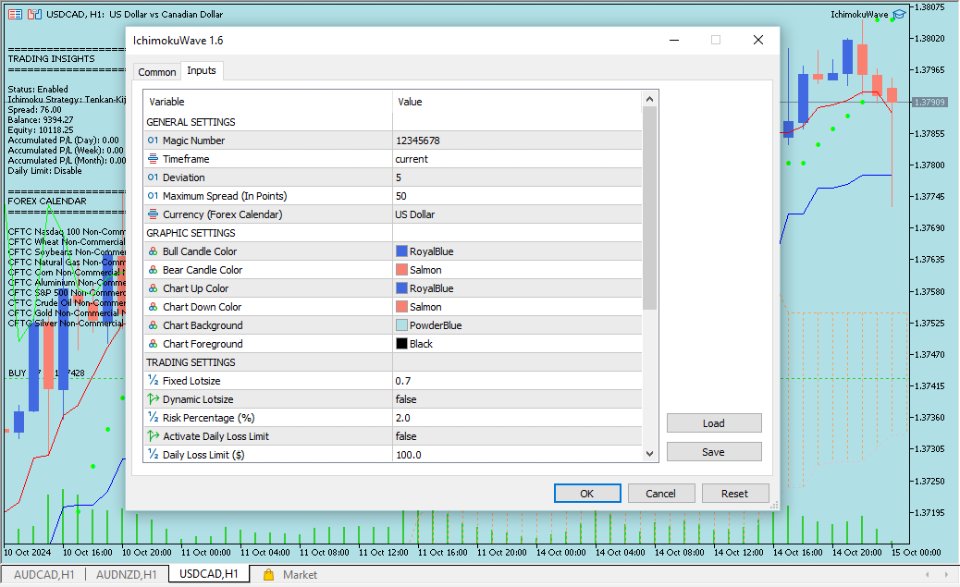

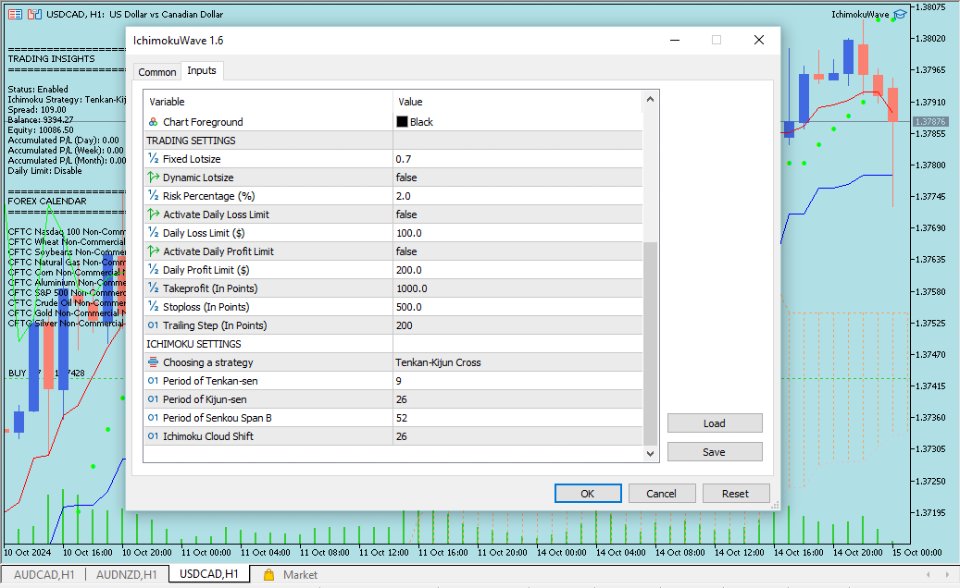

| PARAMETER | DESCRIPTION | DEFAULT |

|---|---|---|

| Magic Number | Unique number to identify orders generated by the EA | 12345678 |

| Timeframe | Time period used for analysis (default is the current chart) | PERIOD_CURRENT |

| Deviation | Deviation tolerance in points for pending orders | 5 |

| Max Spread | Maximum spread allowed for opening orders (in points) | 50 |

| Currency (Forex Calendar) | Currency to synchronize the news of the week | USD |

| Bull Candle Color | Bullish Candle Color | White |

| Bear Candle Color | Bearish Candle Color | Red |

| Chart Up Color | Bullish Candle Border | White |

| Chart Down Color | Bearish Candle Border | Red |

| Takeprofit | Target profit level, in points | 1000 |

| Stoploss | Maximum loss level, in points | 500 |

| Trailing Step | Trigger to activate Trailing Stop | 200 |

| Lotsize | Fixed lot size | 0.7 |

| Dynamic Lot | True = lot size based on risk percentage, False = fixed lot size | false |

| Risk Percentage | Risk percentage (%) | 2% |

| Activate Daily Loss Limit | Enable/disable daily loss limit | false |

| Daily Loss Limit ($) | Maximum daily loss allowed ($) | 100.0 |

| Activate Daily Profit Limit | Enable/disable daily profit limit | false |

| Daily Profit Limit ($) | Maximum daily profit allowed ($) | 200.0 |

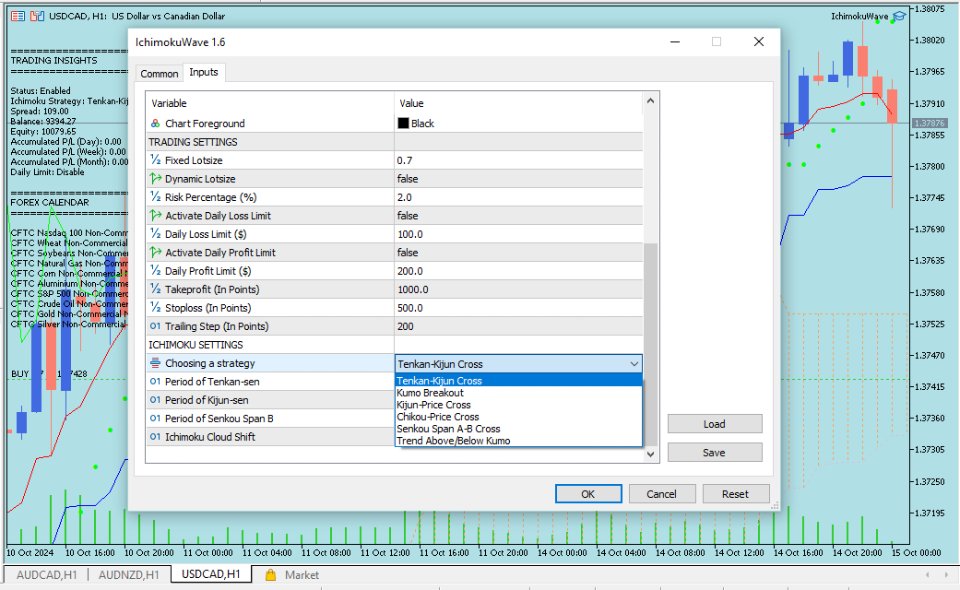

| Chosen Strategy | Choosing a strategy | Tenkan-Kijun Cross |

| Tenkan-sen | Tenkan-sen period | 9 |

| Kijun-sen | Kijun-sen period | 26 |

| Senkou Span B | Senkou Span B period | 52 |

| Shift | Detour to Senkou Span A and Senkou Span B | 26 |

Parameter Rules

| PARAMETER | PARAMETER RULES |

|---|---|

| Magic Number | Must have 8 digits |

| Deviation | Must be greater than or equal to 3 |

| Maximum Spread | Must be greater than 0 |

| Takeprofit | Must be greater than or equal to 200 points |

| Stoploss | Must be greater than or equal to 100 points |

| Trailing Step | Must be greater than or equal to 50 |

| Risk Percentage | Must be greater than 2% and less than or equal to 10% |

| Daily Loss Limit ($) | If enabled, the daily loss limit cannot exceed 10% of the account balance |