TrendSync Strategy Expert Advisor

- Experten

- Claas Ahlrichs

- Version: 1.21

- Aktivierungen: 5

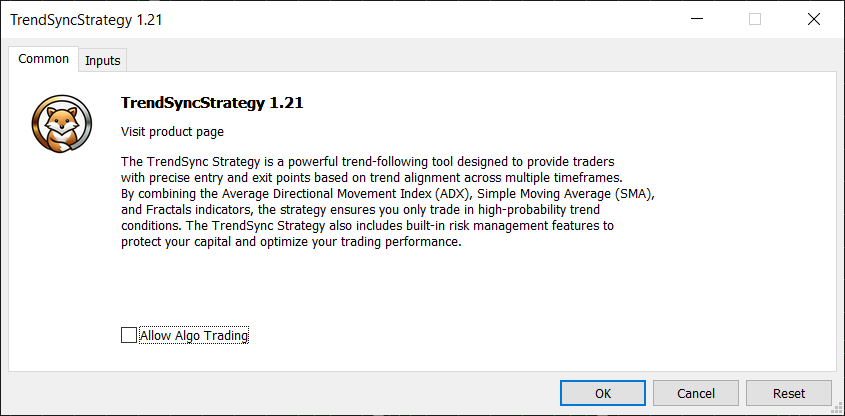

The TrendSync Strategy is a comprehensive trend-following tool designed to help traders capture high-probability trades by aligning trends across multiple timeframes. The strategy leverages the Average Directional Movement Index (ADX), Simple Moving Average (SMA), and Fractals indicators to provide precise entry and exit points. The strategy includes robust risk management features, making it suitable for both novice and experienced traders looking for a reliable and systematic approach.

This strategy is not a scalping or intraday trading tool. With the default settings, positions are typically held for several days, aligning with a longer-term trading approach. It’s not a get-rich-quick strategy, but it delivers consistent results when allowed to run without constant intervention.

For optimal results, the GBPJPY and USDJPY currency pairs are recommended, as they tend to exhibit strong, sustained trends that align well with the strategy's logic. The strategy works best on the D1, H4, and H1 timeframes, which are set as defaults.

Key Features

- Multi-Timeframe Trend Alignment: Ensures trends are aligned on the large (D1), mid (H4), and small (H1) timeframes before entering a position, increasing trade accuracy.

- ADX-Based Trade Filtering: The strategy considers trades only when the ADX confirms a strong trend, filtering out weaker signals and reducing false entries.

- Fractals for Precise Entry Points: Identifies the best entry points by using the Fractals indicator to detect significant price levels.

- Customizable Stop Loss and Take Profit: Uses the Simple Moving Average (SMA) to determine stop loss levels, with a fixed risk-to-reward ratio for setting take profit targets.

- Position Splitting for Flexible Risk Management: Allows for splitting positions, with the option to apply a trailing stop for the auxiliary portion of the trade.

- Dynamic Trailing Stop: Can be enabled across all trades to lock in profits as the price moves favorably.

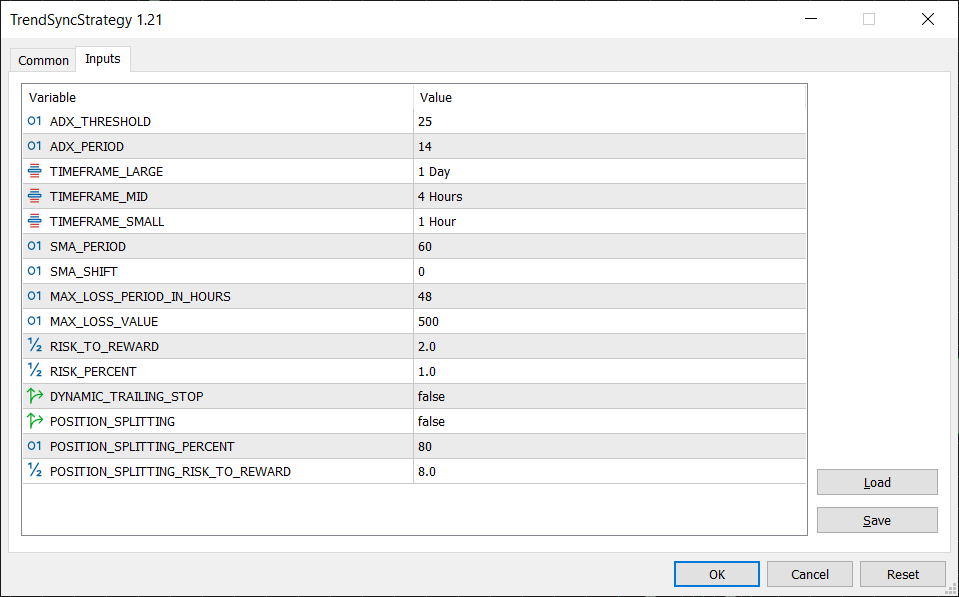

Inputs (Parameters)

- ADX Threshold: (Default: 25) - The minimum ADX value required to consider a trade. This ensures only strong trends are acted upon.

- ADX Period: (Default: 14) - The period for the ADX indicator, which affects how the trend strength is measured.

- Timeframe Large (D1): (Default: D1) - The largest timeframe used for trend alignment. This is typically set to the daily chart.

- Timeframe Mid (H4): (Default: H4) - The mid-level timeframe used for trend alignment.

- Timeframe Small (H1): (Default: H1) - The smallest timeframe used for trend alignment.

- SMA Period: (Default: 60) - The period for the Simple Moving Average, used to determine trend direction and stop loss levels.

- SMA Shift: (Default: 0) - Shifts the Simple Moving Average forward or backward, influencing when crossover signals occur.

- Maximum Loss Period: (Default: 48 hours) - The maximum period in hours over which losses are tracked to prevent opening new trades when the threshold is exceeded.

- Maximum Loss Value: (Default: 500) - The maximum amount of loss allowed during the specified period before trades are restricted.

- Risk-to-Reward Ratio: (Default: 2.0) - Determines the take-profit level relative to the stop loss, ensuring balanced risk management.

- Risk Percent: (Default: 1.0%) - The percentage of account balance to risk per trade, automatically calculating the trade size.

- Dynamic Trailing Stop: (Default: False) - Enables or disables the trailing stop feature for all positions.

- Position Splitting: (Default: False) - Enables or disables splitting trades into two parts, one with a fixed size and another with a trailing stop.

- Position Splitting Percent: (Default: 80%) - Sets the percentage of the trade size for the fixed portion when position splitting is enabled.

- Position Splitting Risk-to-Reward: (Default: 8.0) - The risk-to-reward ratio applied to the auxiliary position when position splitting is enabled.

Advantages

- Consistent, Long-Term Strategy: The TrendSync Strategy is ideal for traders looking for steady, long-term gains rather than fast profits. It requires patience, as trades are often kept open for several days.

- Built-in Risk Management: The strategy automatically calculates position size, stop loss, and take profit levels based on your account balance and risk tolerance, providing a systematic approach to risk management.

- Strong Trend Filtering: The ADX filter ensures that trades are only considered in strong trending markets, reducing the likelihood of being caught in sideways or weak trend conditions.

- Customizable for Your Needs: The inputs are fully adjustable, allowing traders to tweak the strategy according to their preferences and trading style.

Limitations

- The strategy is designed for long-term trend trading, meaning it may not perform well in sideways markets or highly volatile conditions where trends are less defined.

- Since this is not a scalping or intraday strategy, results may take longer to materialize, requiring traders to be patient and trust the system to deliver over time.

Risk Warning

Trading financial markets involves significant risk and is not suitable for every investor. The TrendSync Strategy is designed to help identify trading opportunities based on market trends, but past performance does not guarantee future results. Losses can exceed deposits, and traders should be aware of the possibility of losing a substantial amount of their investment. This strategy may require long holding periods, and its success depends on market conditions, which can change unexpectedly.

Before using this strategy, it is important to fully understand the risks involved, including market volatility, potential drawdowns, and the need for disciplined risk management. Always trade with capital you can afford to lose, and consider consulting with a financial advisor to ensure this strategy aligns with your trading objectives and risk tolerance.