Verdantreach Expert MT5

- Experten

- Ruengrit Loondecha

- Version: 1.2

- Aktivierungen: 10

- Verdantreach Expert

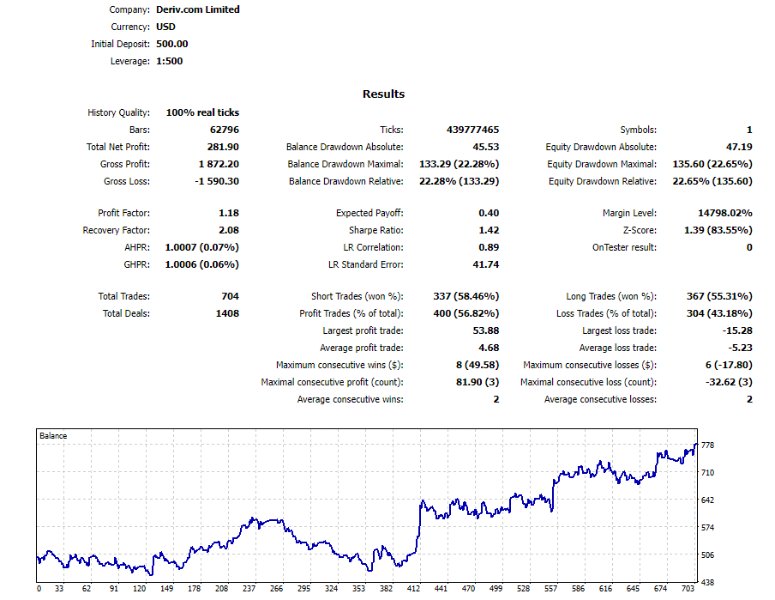

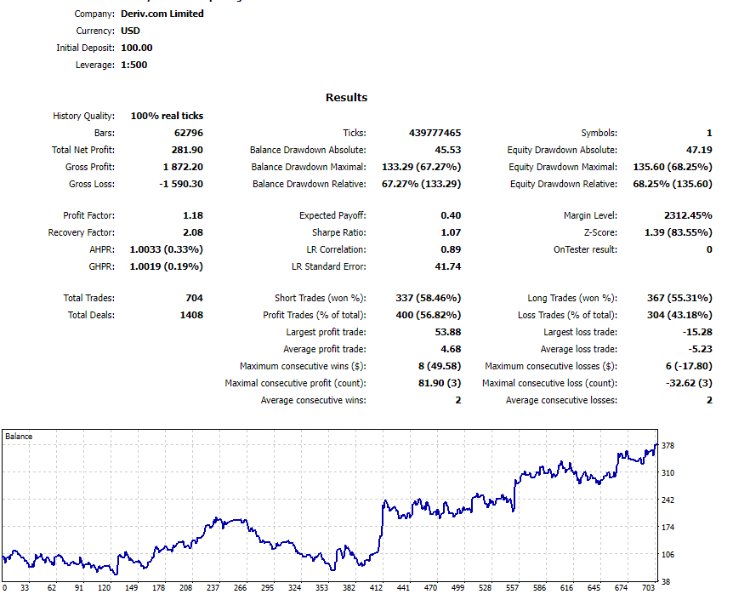

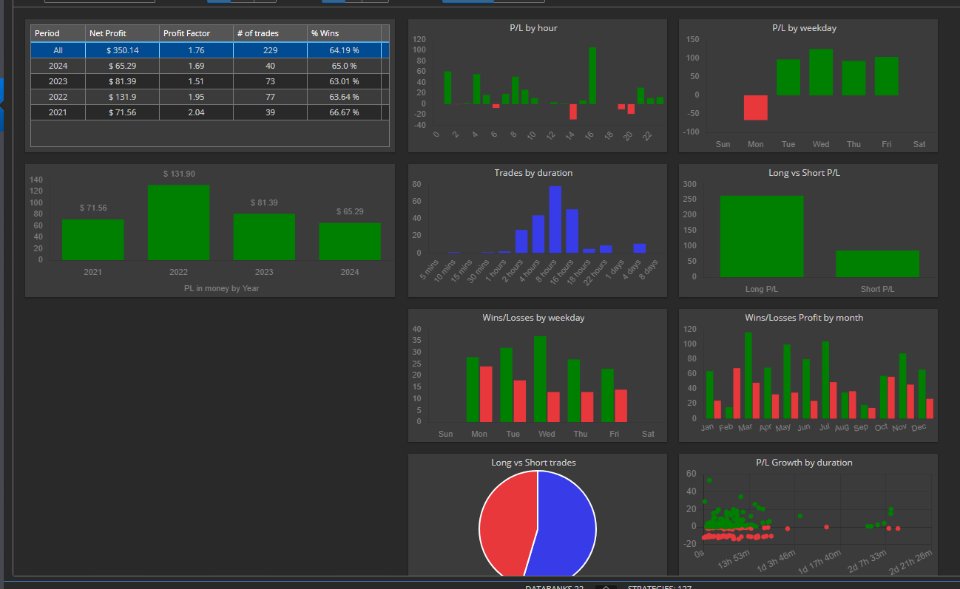

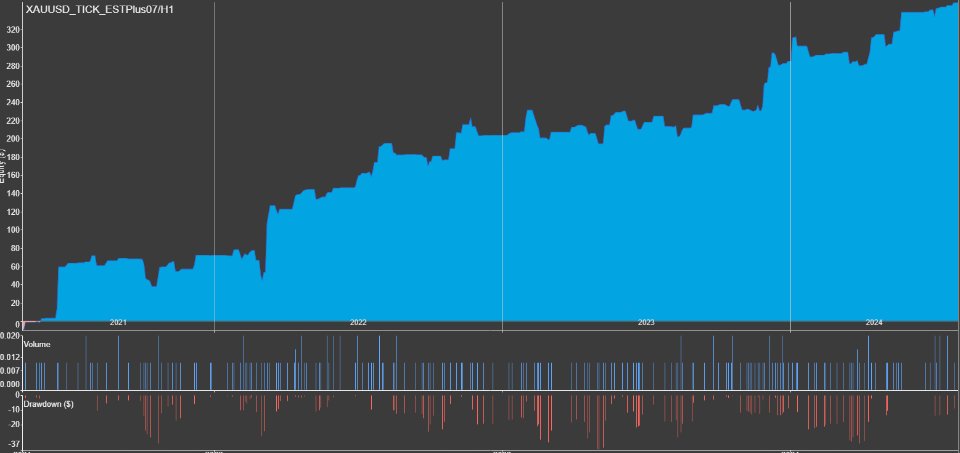

- Working best with GOLD - H1

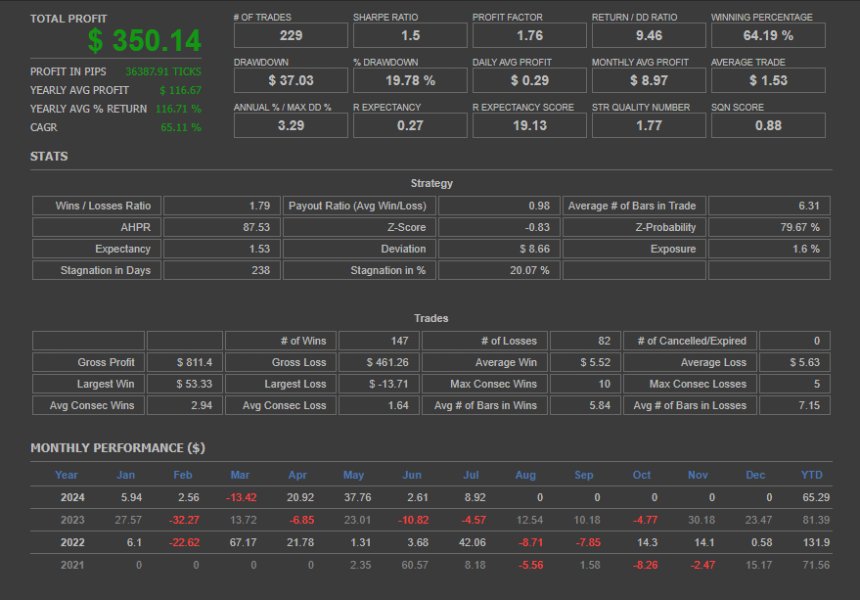

- Require minimal 300$ for 0.01 (AutoLot feature inside)

- Optimize update monthly. stay in Comment

- Live trade @ https://t.me/lullfrx

---------------------------------------------------------

Indicators and Concepts

-

Quantitative Qualitative Estimation (QQE):

- QQE is an enhanced version of the Relative Strength Index (RSI) that includes a smoothed RSI and volatility filters. It provides signals based on trend strength and potential reversals, offering a refined view of market momentum.

-

Average True Range (ATR):

- ATR measures market volatility by calculating the average range between the high and low prices over a specified period. It helps in setting stop-loss levels and take-profit targets based on market volatility.

-

Hull Moving Average (HMA):

- HMA is a smooth moving average that reduces lag and improves the responsiveness to price changes. It helps identify the current trend and potential reversal points more accurately than traditional moving averages.

-

Ichimoku Kinko Hyo:

- Ichimoku is a comprehensive indicator that provides information about support and resistance levels, trend direction, momentum, and potential future price points. It consists of multiple lines (Tenkan-sen, Kijun-sen, Senkou Span A & B, and Chikou Span) and a cloud (Kumo) to visualize market conditions.

-

Timer:

- In this context, a Timer might refer to time-based trading considerations, such as specific times to enter or exit trades or session-specific strategies.

Trade Style

-

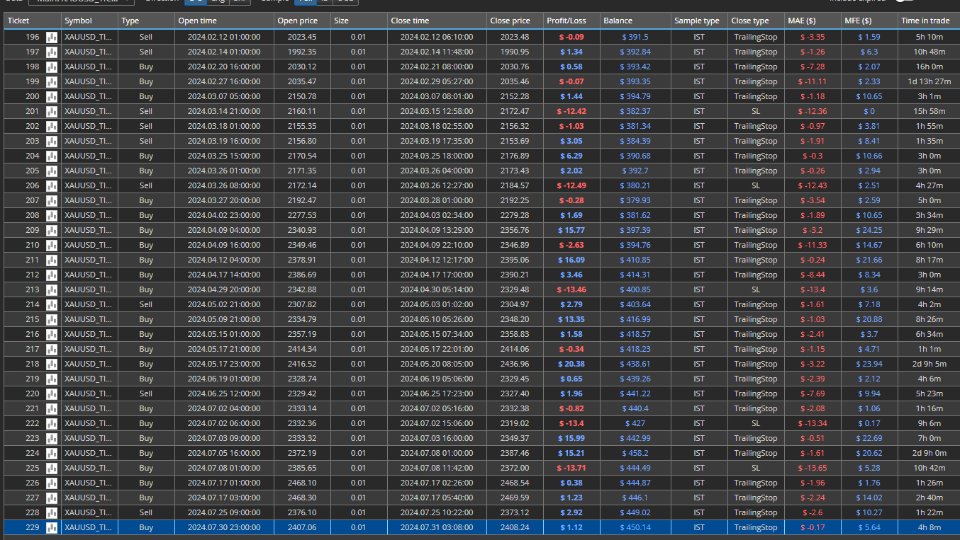

Trailing Stop with High:

- A trailing stop is set at the highest price reached after entering a trade. As the price increases, the trailing stop moves upward, locking in profits. This approach helps maximize gains while protecting against significant reversals.

-

Stop Loss (SL) by Percentage:

- The stop-loss level is determined by a fixed percentage from the entry price. This method sets a predefined risk limit for each trade, ensuring consistent risk management.

-

Take Profit (TP) by ATR Coefficient:

- The take-profit level is set based on a multiple (coefficient) of the ATR. This approach uses market volatility to determine a dynamic profit target, allowing for adaptation to changing market conditions. The ATR coefficient adjusts the TP distance based on the average range of price movements, providing a flexible and responsive profit-taking strategy.