InequationEurUsdChf4

- Experten

- Kai Wei Luo

- Version: 1.0

- Aktivierungen: 5

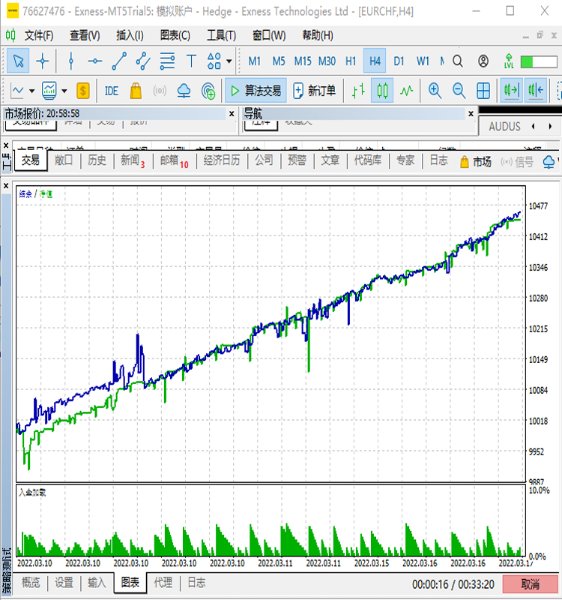

1. The principle of InequationEurUsdChf4 intelligent trading system:

The three currency hedge unbalanced arbitrage is the extension and continuation of the triangle arbitrage. As a common arbitrage method, triangle arbitrage has been used by many investors in foreign exchange trading. Triangle arbitrage is based on cross exchange rates, which is the basis of triangle arbitrage. The so-called cross exchange rate refers to the price of a non-US dollar currency expressed by another non-US dollar currency. For example, USDCHF =0.88366,EURCHF =0.95921,EURUSD =1.08575 in a certain foreign exchange market, whenUSDCHF×EURUSD≠EURCHF, this provides the possibility for triangular arbitrage.

However, strict triangular arbitrage is not profitable due to spreads, slip points, overnight interest, fees and other reasons. If you increase the imbalance coefficient on the above three currency pairs, breaking this symmetry, there is the possibility of profit.

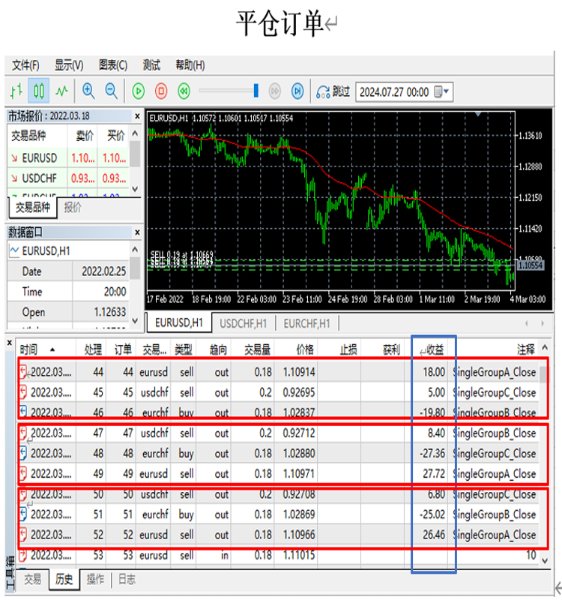

- For example: place orders 1, sellA lot eurusd,2, sellB lot usdchf,3, buy C lot eurchf, 4, A, B, C coefficients are calculated.

- If Ask_EURUSD * ASK_USDCHF-BID_EURCHF < -500, trade three orders Ask_EURUSD, Ask_USDCHF, Bid_EURCHF at the same time;

- If Bid _EURUSD * Bid _USDCHF-ask _EURCHF > +500, three orders Bid _EURUSD, Bid _USDCHF, Ask _EURCHF are traded simultaneously;

When the above three orders are profitable, close the position. To make a profit.

2. Risk control and Tips:

- The overall profit ratio is recommended to be 0.01, and the overall loss ratio is 0.6 or the value acceptable to the customer;

- With a principal of $10,000, it is recommended to set "basic position" as 0.2 lots, "BBS Order Total Control" as 12, and "SSB Order Total control" as 12.

- Any trading system has risks and should be invested with caution.

3. if the following problems, suggestions:

- If there is no trading order for a long time, it is recommended to modify "Set the maximum price difference of three currencies" and "set the minimum price difference of three currencies";

- If the three currency combinations cannot be closed for a long time, it is recommended to modify the "EURUSD order imbalance coefficient", "USDCHF order imbalance coefficient", "EURCHF order imbalance coefficient", and modify the "Parameter F platform trading fee per lot" and "Parameter N" to make them at a reasonable level;

- After modifying parameters, reload EA.

4.Troubleshooting Common problems

- If "Account error!! You should set up your own trading account in EA;

- If there is no data or no transaction, check the letter subscript of the currency pair in the EA Settings;

- If "Abnormal account is detected during program operation or software expires" occurs, please contact the seller in time.

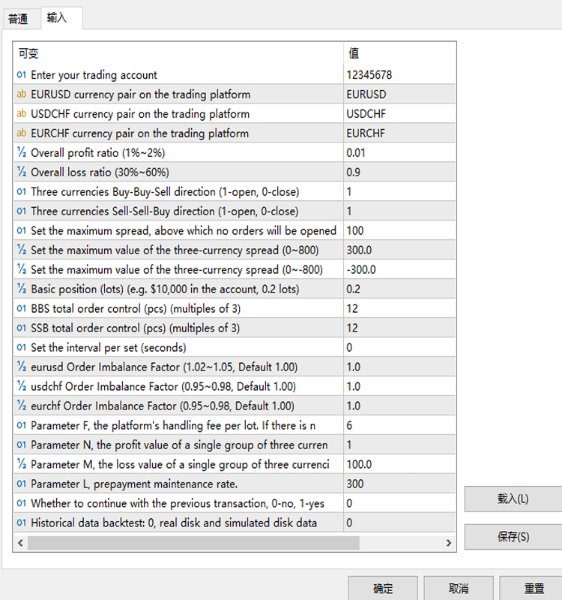

input long MyAccount= 12345678; //Enter your trading account //外部参数-货币对 input string symbol0= "EURUSD"; //EURUSD currency pair on the trading platform input string symbol1= "USDCHF"; //USDCHF currency pair on the trading platform input string symbol2= "EURCHF"; //EURCHF currency pair on the trading platform //外部参数-总体盈亏比例 input double p_profit = 0.01; //Overall profit ratio (1%~2%) input double p_lost = 0.9; //Overall loss ratio (30%~60%) //外部参数-单向下单选项 input int BBS_open = 1; //Three currencies Buy-Buy-Sell direction (1-open, 0-close) input int SSB_open = 1; //Three currencies Sell-Sell-Buy direction (1-open, 0-close) //外部参数-点差最大值 input long Spread_high = 100; //Set the maximum spread, above which no orders will be opened //外部参数-计算价-市价最大值 input double p_high = 300; //Set the maximum value of the three-currency spread (0~800) //外部参数-计算价-市价最小值 input double p_low = -300; //Set the maximum value of the three-currency spread (0~-800) //外部参数-下单量 input double p_lots= 0.2; //Basic position (lots) (e.g. $10,000 in the account, 0.2 lots) //外部参数-下单个数 input int BBS_number_lots= 12; //BBS total order control (pcs) (multiples of 3) //外部参数-下单个数 input int SSB_number_lots= 12; //SSB total order control (pcs) (multiples of 3) //外部参数-延迟时间(s) input int group_TimeInterval= 0; //Set the interval per set (seconds) //外部参数-偏心系数 input double px_big =1.00; //eurusd Order Imbalance Factor (1.02~1.05, Default 1.00) input double px_small=1.00; //usdchf Order Imbalance Factor (0.95~0.98, Default 1.00) input double px_middle=1.00; //eurchf Order Imbalance Factor (0.95~0.98, Default 1.00) //外部参数-倍数 input int fee_everyone=6; //Parameter F, the platform's handling fee per lot. If there is no fee, set it to 6 input int fee_times=1; //Parameter N, the profit value of a single group of three currencies = N×F input double loss_fee_times=100; //Parameter M, the loss value of a single group of three currencies = M×F input int margin_level=300; //Parameter L, prepayment maintenance rate. input int P_continue=0; //Whether to continue with the previous transaction, 0-no, 1-yes input int test=0; //Historical data backtest: 0, real disk and simulated disk data writing: 1