Cipher Hybrid HFT Gold Trader

- Experten

- Evren Caglar

- Version: 1.3

- Aktualisiert: 30 Juni 2024

- Aktivierungen: 5

The Cipher Hybrid-HFT Gold Trader: The Power of Probability Theory and Price Action Principles

The vast majority of technical indicators are the same age as dinosaurs. Also, many retail traders are not aware of this fact: most technical indicators are developed for the stock market - not for the forex and not for the metals market.

The apparent fact that you can not achieve consistent success in the metal market with old technical indicator theories and with the tools developed for stock markets.

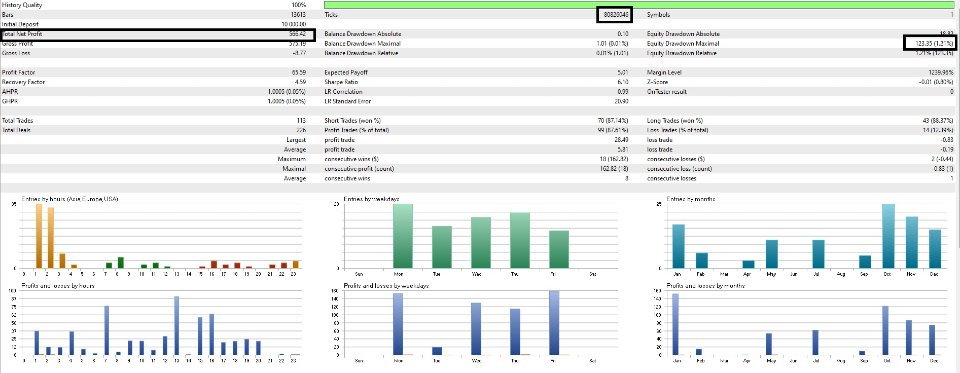

We follow the professional approach those institutions use in the development of the trading algorithm. Cipher is one of the newest generation of algo traders which relies on probability model and price action theories. It uses only ATR indicator to determine the initial take-profit and stop-loss levels.

The Cipher is equipped with an advanced trade management system in which every order managed separately from each other.

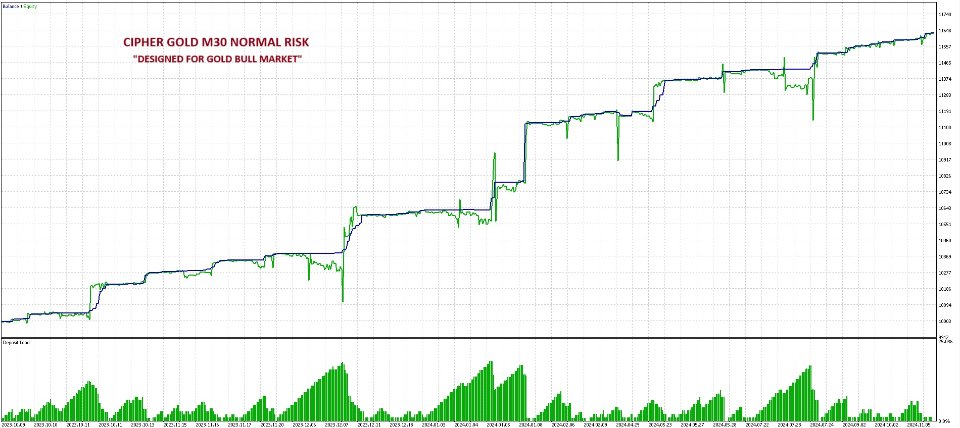

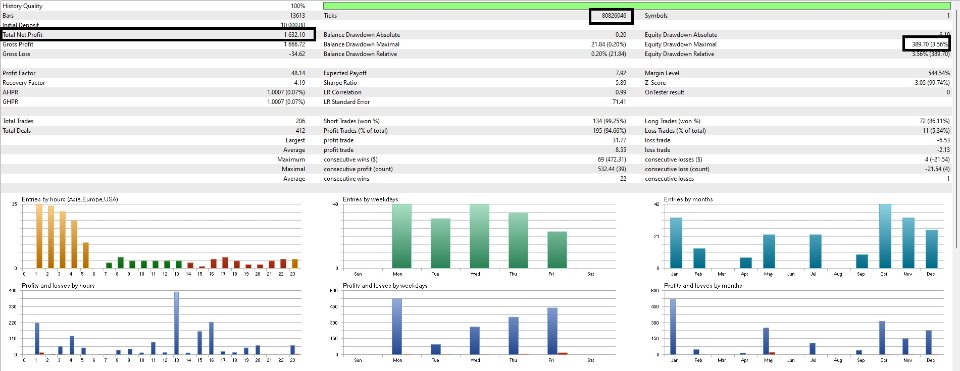

Easily Customizable and Optimizable Algo Trader, Particularly Tailored for Trading Gold Bull Market

Every market has its own characteristics. The key to success of any trading algorithm is that in the development process, the characteristics of the instrument need to be well studied and the cycle in which the instrument in should be considered.

After its historic all-time high in 2020, gold market consolidated nearly by 4 years and in the last August something happen very significant: 3 year-length consolidation range has been breakout. Price action analysis no 101: year long consolidation periods generate year long trends in prices. That breakout has initiated the new gold bull market that will last several years.

The Cipher Gold Trader has been developed considering the dynamics of the newest bull market in gold prices. The algorithm itself and the set files are designed considering the dynamics of this bull market. Hence, there is little to no sense to analyze these sets for pre 2019 period where gold prices is in consolidation range.

Cipher M30 Low Risk Set for Gold Bull Market: Download

Cipher M30 Normal Risk Set for Gold Bull Market: Download

Yet, the EA is very easy to customize and optimize, you can work for other trading instruments and/or timeframes.

Where Can The Cipher Be Used?

The Cipher can be used in your personal accounts, for passing the prop challenges and/or after you pass the prop challenges. It does not rely on grid and martingale strategies, every order comes with TP and SL. Many prop trading companies does not allow for hard core HFT but the Cipher is a Hybrid-HFT trader and therefore it is safe to be used with the most prop trading companies.

Below we have provided detailed information on the Hybrid-HFT approach.

Before First Time Use The Cipher

We aim for 100% customer satisfaction with our products. We want Cipher to provide maximum benefits to every user. Therefore, before you purchase, you can consult us on how to setup for your broker and with your risk limits.

1. Cipher operates on M30 or H1 timeframe and ready to go on Gold charts.

2. After you purchase, you can contact me for installation and remote help. No need for set file.

3. We recommend testing Cipher in your broker without purchase and make sure it satisfies your expectations.

4. We recommend using Cipher in a demo account for at least 2-3 weeks before you put it in a real account.

5. Please make sure you have a sufficient buffer in your account before you work

6. Always double check the magic number, lot size and the time frame.

7. We offer free trading algorithms: Cybele CFD MT5 and Secutor CFD MT5 . You can improve the portfolio return by adding them in your portfolio.

8. You can join the Institution Breaker's private community after purchasing the product. Only verified users can join. Just PM me after the purchase for the details.

Parameter Description

| Parameter | Description | Settings |

|---|---|---|

| TP and SL | Both are in the forms of coefficient of ATR. | Number |

| Move Stop Out Coefficient | After a certain point gain, Cipher locks the risk. It has no green to red policy. | Number |

| Trail Stop | Dynamic stop-loss order that adjusts as the market price moves in favor of the trade. | Pips |

| TS Activation | TS Activation Level determines when the trailing stop should become active. | Pips |

| Limit Time Range | You can limit the operations of Cipher within a certain time period. You need to match time with broker's time. | Time |

| Max Number of Trades | You can limit the daily number of trades. By default Cipher places orders as long as trade signal continues. | Number |

| Exit At The End Of Range | Closes all open orders at the end of the time range. It does not consider if it is in profit or not. | True-False |

| Normalization of Data | To stabilize the operations among different brokers, we normalize the data with some coefficient. The default value is 1. | Number |

| Delay Trades In Minutes | Cipher waits placing an order by the minutes defined here. | Number |

Final Words

I kindly underline that our risk is the only thing we can control in financial markets. Therefore, appropriate risk management is the beginning of everything in financial markets. The foundation of wealth stems from the aggregation of small gains over time. We advise you do not take aggressive risks with Cipher Hybrid-HFT Gold Trader.