Gold Indicator

- Indikatoren

- Ahmed Alaaeldin Abdulrahman Ahmed Elherzawi

- Version: 1.0

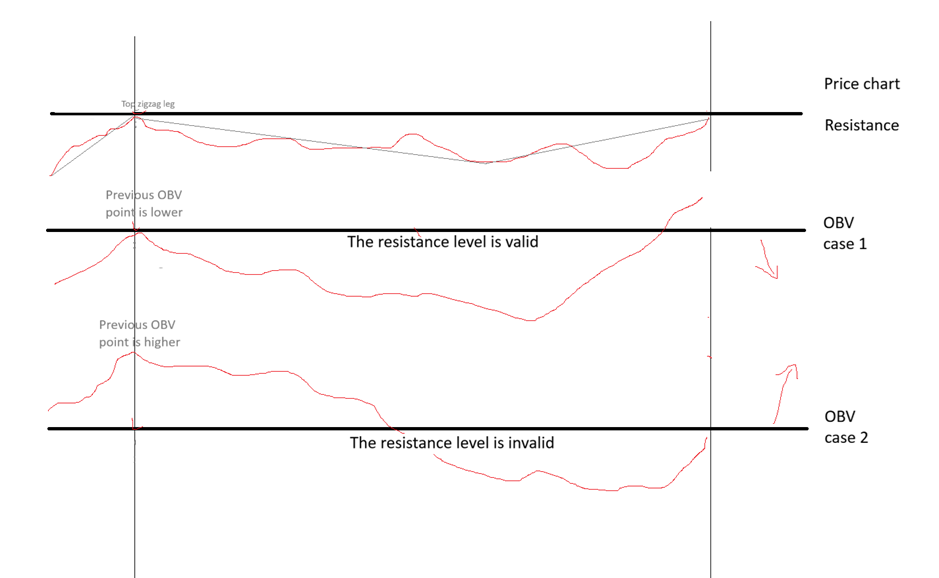

This indicator uses horizontal lines to identify support and resistance levels based on Zigzag legs and On-Balance Volume (OBV) analysis. Here is a summary of how the indicator works:

-

Resistance and Support Lines:

- A horizontal line above the current price level indicates resistance.

- A horizontal line below the current price level indicates support.

-

Drawing Horizontal Lines:

- Draw horizontal lines on every Zigzag leg within the last X legs, where X is a specified number (e.g., 10).

- Only the most recent top and bottom legs are considered.

-

Price Movements and OBV Validation:

-

When the price rises:

- Identify a previous Zigzag upper leg above the current price level.

- Draw a horizontal line at the Zigzag leg and a vertical line connecting to the OBV window.

- Draw a horizontal line on the OBV window where the vertical line crosses.

- The horizontal line is solid if the current OBV is higher than the previous OBV, and dotted if lower.

-

When the price falls:

- Identify a previous Zigzag lower leg below the current price level.

- Follow similar steps to draw horizontal and vertical lines as above.

- The horizontal line is solid if the current OBV is higher than the previous OBV, and dotted if lower.

-

-

Valid and Invalid Support/Resistance:

- A valid support/resistance line is shown as a solid red line.

- An invalid support/resistance line is shown as a dark dotted line, indicating it is easy to break.

-

Chart Timeframe:

- The indicator operates on the current chart timeframe.

- If no Zigzag leg is found within the history limit, the indicator looks back in history until the most recent Zigzag leg is found.

It seems to place the zigzag indicator into a subwindow which doesn't seem like much but it does seem vital. It bring detection of trends in price and would be personally be best to have another indicator join its activity. Good.