Secret Range EA

- Experten

- Hong Ling Mu

- Version: 1.1

- Aktualisiert: 13 Juni 2024

Summary of EA logic

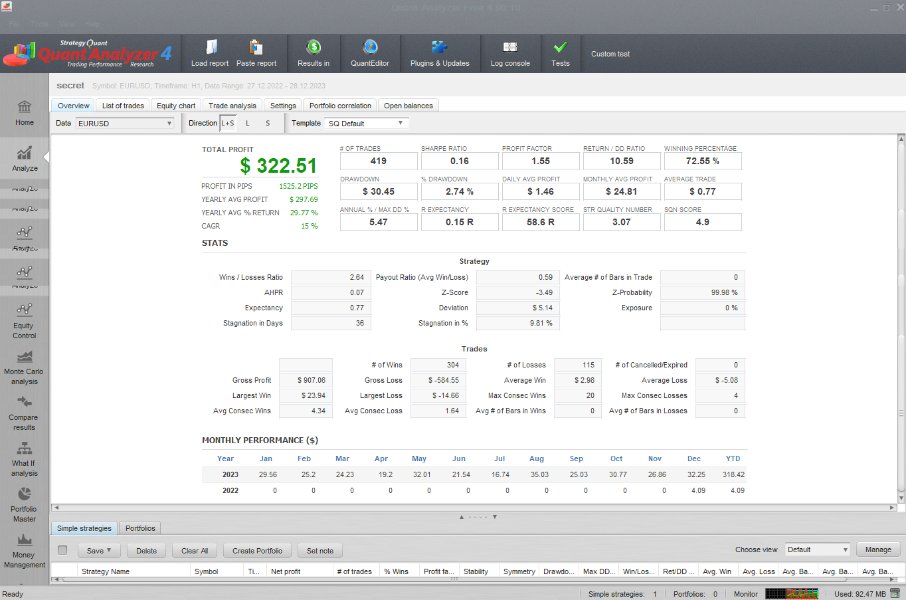

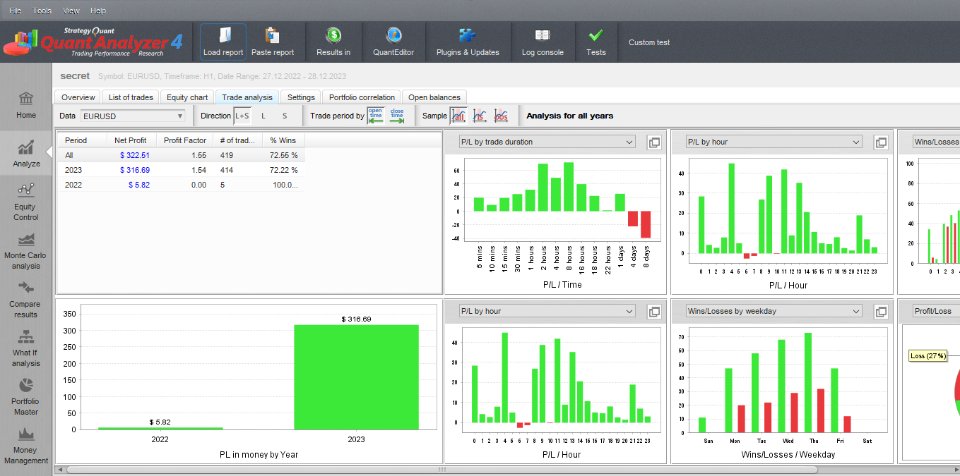

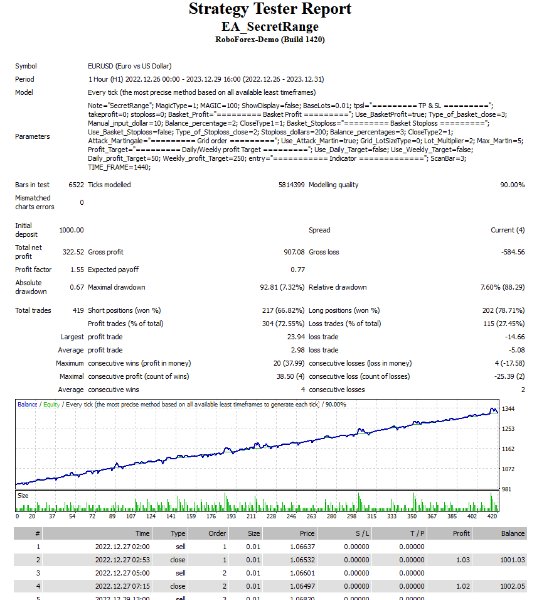

Secret Range EA, as the name suggests, enters trades based on market ranges.

Specifically, the EA will enter a trade when the highest or lowest price over a specified period, based on a long-term timeframe set in the EA settings, is broken. However, a price break does not necessarily mean the price will revert.

Therefore, the EA uses GRID orders in conjunction. While the market tends to revert to its original price after a certain period, predicting the exact timing is challenging. Hence, after a price break, the EA will use the range of the highest and lowest prices from the initial long-term timeframe to determine the grid levels.

Concretely, the value obtained by dividing this range by the maximum number of grids becomes the GRID interval. This logic helps in keeping the drawdown relatively low, eliminating the need for unnecessary GRID orders.

Additionally, the EA incorporates a unique strategy that places a single hedge order along with the GRID orders. None of the orders are closed individually; instead, the EA monitors the overall profit and automatically calculates the best moment to close all orders (both BUY and SELL) simultaneously.

Summary of how to use

No complicated settings are required. The EA is optimized by default and can be used with Forex major pairs. The recommended timeframe is H1.

Determine the maximum number of grids based on your initial capital. After selecting the timeframe from the settings, decide on the scan bars. By default, the range is determined by the highest and lowest prices from just three daily candles back.