Nexus Pivot Points

- Indikatoren

- Mohammed Kaddour

- Version: 1.0

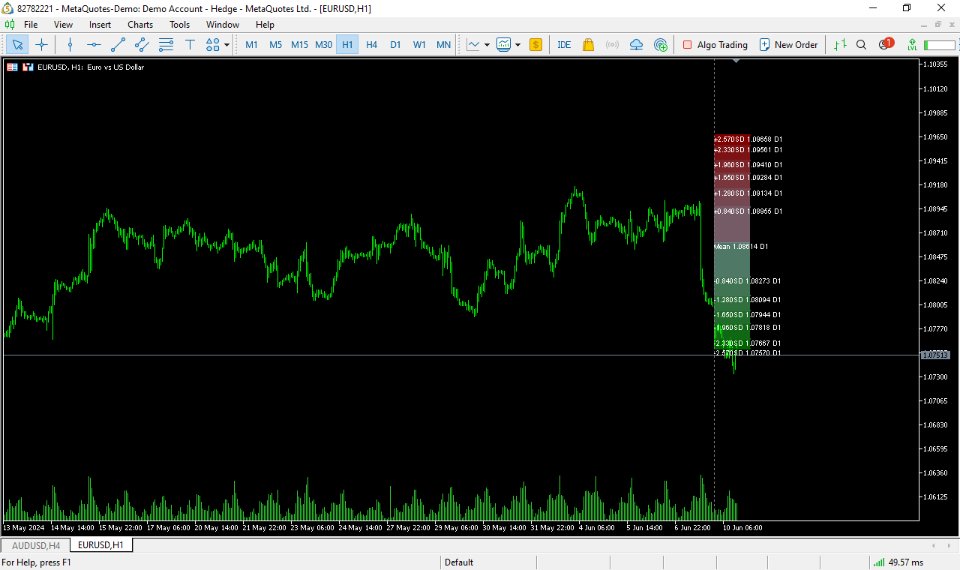

Pivot Points are used by Forex traders to find support and resistance levels based on the previous day's price action. There are various ways to calculate pivot points, including averaging the open, high, low, and close of the previous day's chart price.

Forex Traders use a combination of pivot points with moving averages to find trading opportunities in the currency markets.

Pivot points are very useful tools that use the previous bars' highs, lows and closings to project support and resistance levels for future bars.

Longer term pivot points provide an idea of where key support and resistance levels should be. Place the pivot points on your forex charts and price will bounce off one of these levels. These levels are used by traders trading market tops, market bottoms or trend reversals. The Pivot points are accurate since they provide the high and low of price for a particular day.

Forex Traders use a combination of pivot points with moving averages to find trading opportunities in the currency markets.

Pivot points are very useful tools that use the previous bars' highs, lows and closings to project support and resistance levels for future bars.

Longer term pivot points provide an idea of where key support and resistance levels should be. Place the pivot points on your forex charts and price will bounce off one of these levels. These levels are used by traders trading market tops, market bottoms or trend reversals. The Pivot points are accurate since they provide the high and low of price for a particular day.