Cybele CFD MT5

- Experten

- Evren Caglar

- Version: 1.4

- Aktualisiert: 21 Mai 2024

Cybele: The Less is More

Do you ever think, if you really need to open many positions to make money? Or have you ever thought that it could be better to open one position to make $80 instead of opening 80 positions to make $80. Which is better for you? In the first trading approach you take the risk only one time in a good quality trade setup. In the second approach, you take the risk 80 times in low quality trade setups. The most professional traders prefer the first approach and they patiently wait for an excellent trade setup to come in live trading environment.

Cybele EA is built on this principle and it mimics the behavioral characteristics of professional traders. In the end, this approach not only saves the account from the periods of financial turmoil and distress but also more success in profitability is achieved with at least 50% less position.

You can read my article for how to obtain x13x return with portfolio diversification.

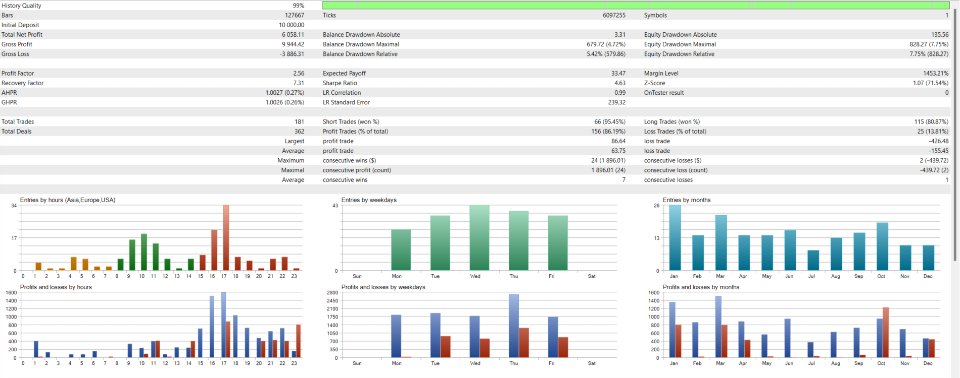

Robustness and Consistency Tests

Do you ever think, why retail customers in the forex market almost always lose money or why it is extremely difficult to generate consistent profits with the most expert advisors in the marketplace?

The answer is apparent:

1- Very few qualified traders or market specialists become developers,

2 -MetaTrader strategy tester is not a good tool for testing expert advisors because broker companies do not provide adequate data to their customers.

The truth is that data anomalies across brokers makes it difficult to develop a consistent trading algorithm.

Cybele is born in this environment by a team of qualified traders. It is a comprehensive free trading algorithm provided to you to reverse the money flow from institutions to your pocket. It can be used with prop trading challenges and without optimization for these specific periods, Cybele survives 2020 Covid 19 collapse and 2022 financial meltdown periods.

- Cybele utilizes a complex trading algorithm but all these complexity put under the hood. Even first time expert users can easily run without hassle.

- As we stated earlier, for developing a successful trading algorithm, you must use different testing tools. Cybele is developed completely outside of the MQL5 platform.

- During the development process, significant time and effort has been carried out for the robustness checks with 'what if scenarios', 'Monte Carlo simulations', 'out of sample tests' and 'sequential optimization'.

- Cybele is also tested in many brokers and the consistency and robustness of test results are compared under different tick-data environments.

Cybele EA and Secutor EA Are Better Together

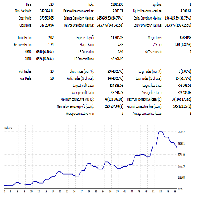

Cybele EA is the second free trading algorithm from Institution Breaker. With Secutor EA, we have completed the set of two free trading algorithms. We advise using Secutor EA and Cybele EA together. Our simulations have shown better risk-return ratios when Secutor EA and Cybele EA are used in conjunction. Portfolio results are provided in the screenshots section. You can access the Secutor EA on my MQL5 page.

Cybele is designed to work with NASDAQ index trading. Just to remind you, for some brokers M12 and for other brokers M30 can perform better. You can always PM me or comment if you are not sure.

M30 set with PF 3.74 is here

M12 set with PF 2.58 is here.

How Does Cybele Operates?

- In its core, Cybele is designed to take advantage of price action anomalies in NASDAQ. Confirmation of trades conducted through another complex algorithm.

- All complexity is put under the hood and users only need to control a few parameters.

- It is also ready to go for NASDAQ and no need to conduct any optimization.

Before First Time Use Cybele :

- To start with, we provide Cybele 'free of charge'. You should never think it is not a qualified trading algorithm. It does quite a good job with NASDAQ and can beat many expensive trading algorithms with its safeness and robustness.

- Always be kind and do not hesitate to ask questions. If you are happy with it, please leave a comment. The support is important for us to present more developed trading algorithms.

- Remember, Cybele is designed only for NASDAQ and only M12 or M30 timeframes.

- Recommended minimum balance is $1k for 0.1 lot standard accounts and $100 with 0.01 lot for the cent accounts.

- We strongly recommend you use Cybele in a demo account for at least 2-3 weeks before you put it in the real or prop company accounts. This rule should be applied to every EA you use.)

- We strongly recommend you test Cybele with at least 2 strategy testers from different brokers. Return and risk should be more or less the same. If you have more than 20% difference in results across brokers, you may need to re-calibrate some parameters. This rule should be applied to every EA you use.

- Grid and martingale strategies are not used. When EA places an order, it places TP and SL points straightaway.

- The starting lot is 0.1 lot for standard accounts.

Note: After you install and share a review on the page of the Cybele, you can join the 'Institution Breaker Trading Group' where I share key knowledge about trading, markets, how to correctly setup an EA and more. Just message me for the link. You can control the following parameters:

Parameters

| Parameter | Description |

|---|---|

| Bollinger Bar Period | The period of the Bollinger Bands. |

| Move Stop Loss Coefficient | Moving stop loss to a break even point after a certain gain in position. |

| Adjust Tick Size: | This parameter normalizes the tick values to a standard value. The default value is 1. |

Can and How Cybele Be Used In Prop Trading Challenges?

- Yes, it can be used.

- Cybele does not use grid and martingale strategies.

- It is also not programmed for high frequency trading.

- Cybele is a position trader and has a complex algorithm to decide trade entry points.

- Cybele presents many time and day adjustment parameters which some prop companies require.

- Every position comes with TP and SL points as soon as an order is placed.

- Cybele provides a perfect risk-return ratio and is safe up to the 5% daily DD limit .

- Cybele is one of the safer algorithms on marketplace for 'Black Swan events in financial markets.

Therefore, Cybele can be used in prop company challenges as long as you use it with correct settings. In my this article I explain how to setup a meta trader expert advisor to be used with prop trading accounts.

Final Words

We have tried to explain everything as transparently as possible. There is no magic or holy grail in the financial markets and Cybele is neither of them. Our only focus was to generate some AI trading algorithm that can consistently generate profits under many different market conditions.

Remember, the only thing you can control in financial markets is your risk. Therefore, please use Cybele responsively and always tightly control your risk limits.

The backtest is promising. I am going to use the EA on live account.