SMC setup 3 Minor OB and Trend Proof

- Indikatoren

- Minh Truong Pham

- Version: 1.3

- Aktualisiert: 15 Mai 2024

- Aktivierungen: 5

🔵Introduction

The "Smart Money Concept" transcends mere technical trading strategies; it embodies a comprehensive philosophy elucidating market dynamics. Central to this concept is the acknowledgment that influential market participants manipulate price actions, presenting challenges for retail traders.

As a "retail trader", aligning your strategy with the behavior of "Smart Money," primarily market makers, is paramount. Understanding their trading patterns, which revolve around supply, demand, and market structure, forms the cornerstone of your approach. Consequently, decisions to enter trades should be informed by these considerations.

🟣Important Note

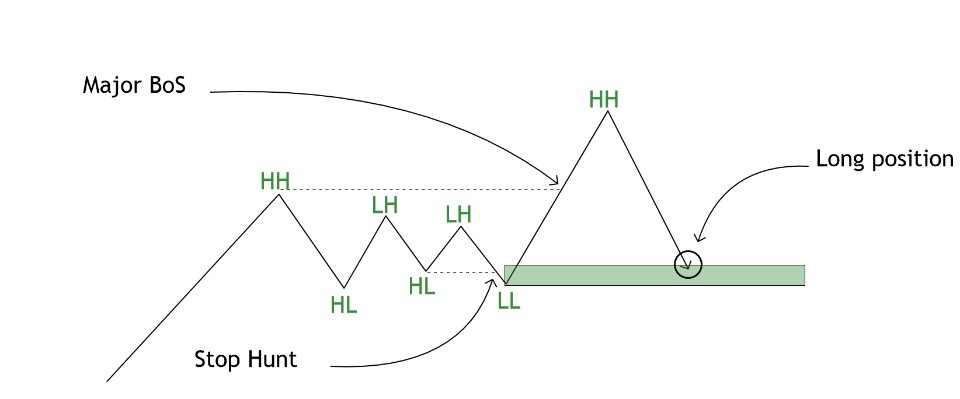

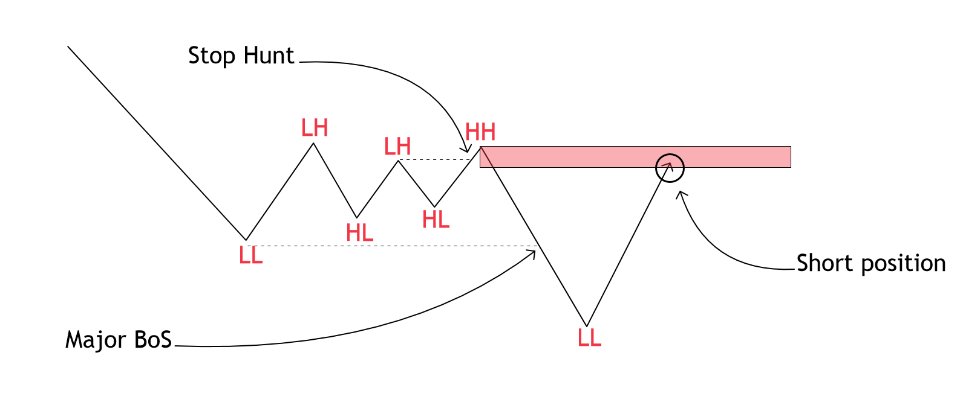

In this setup, pattern formation revolves around the robustness of the "Stop Hunt" targeting retail traders.

When this stop hunt occurs, if the price tests below the minor pivot or above the minor pivot, a "Minor Order Block" is formed.

Similarly, if the price tests below the major pivot or above the major pivot, a "Major Order Block" is formed.

Since the price hasn't successfully broken the major pivots before breaking the Top or Bottom, it can be inferred that the minor pivots formed within a leg of price movement exhibit a "Range" structure.

For a deeper comprehension of this setup, refer to the accompanying visual aids below.

Bullish Setup Details: Image 2

Bearish Setup Details: Image 3

🔵How to Use

Upon integrating the indicator into your chart, exercise patience as you await the evolution of the trading setup.

Experiment with different trading positions by adjusting both the "Time Frame" and "Pivot Period". Typically, setups materializing over longer "Time Frames" and "Pivot Periods" carry heightened validity.

Bullish Setup Details on Chart: Image 4

Bearish Setup Details on Chart: Image 5

🔵Settings

- Pivot Period: the most important setting that define pivot point length (left side and right side). Diffirent period will diffirent model detected.

- Lookback number: the history bar calculate at init time

- Show or high pivot point when have model

- Alert setting (when bullish setup detected and when price test OB - entry)

- Prefix: the prefix of object shown in chart.

The common weakness of indicators that automatically identify patterns according to the SMC strategy is that they need a fixed length to determine the pivot point. With different length values, "HH", "LL", "LH", "HL" will be diffirent, the structurally recognized model will be different.

To overcome the above weakness, I introduced the concept of prefix. With different prefixes, users can attach multiple indicators on the same chart, each indicator applies to a different pivot length such as 2, 5, 6, 7.... From there, it is possible to monitor models across all market structures.