Price Action Day Trader

- Experten

- Vladimir Buchta

- Version: 1.1

- Aktivierungen: 5

Special time limited offer: BUY for 70 USD. |

Be a market analyst, not just a trader! Stop wasting time by round-the-clock market mionitoring. Do your market analysis, set trading range and market sentiment for a day session and let this EA trade for you! |

It was created to help all day traders using price action to distance themselves from the emotional influence caused by instant market monitoring and routine decisions to open and close trades which is the source of most trading mistakes.

Price Action Day Trader enables focusing exclusively on daily high-level market analysis, while the ongoing tactical decision-making is taken care of automatically.

EA works with trading range and market sentiment which must be set by user for every day session. This enables to adjust EA to current market conditions on daily basis.

Trading range is an area you plan to trade within in a daily session. Market sentiment then determines which trading direction is preffered for particular trading session (Buy, Sell or both).

EA identifies bullish price rejections in lower half of trading range and buys towards top of range. In upper half of trading range it identifies bearish price rejections and sells towards bottom of trading range.

Top of trading range or range maximum is a maximal sell price for day session (highest price below which it is still worthwhile to sell), range minimum is a minimal buy price (lowest price above which it is still worthwhile to buy).

EA buys in lower half of trading range and sells in higher half trading range, depending on market sentiment. Line marking center of trading range and separanting "buy and sell areas" is called balance point.

Market sentiment determines what types of trades are allowed during trading session. Buy sentiment means that buyers control the market and therefor EA is focused only on buy trading signals. Similarly in Sell market sentiment sellers are expected to control the market and EA picks only sell signals. Consolidation then means that there is no signifficant sentiment in the market and EA accepts both buy and sell trading signals. It is assumed that buyer and sellers are more or less in balance.

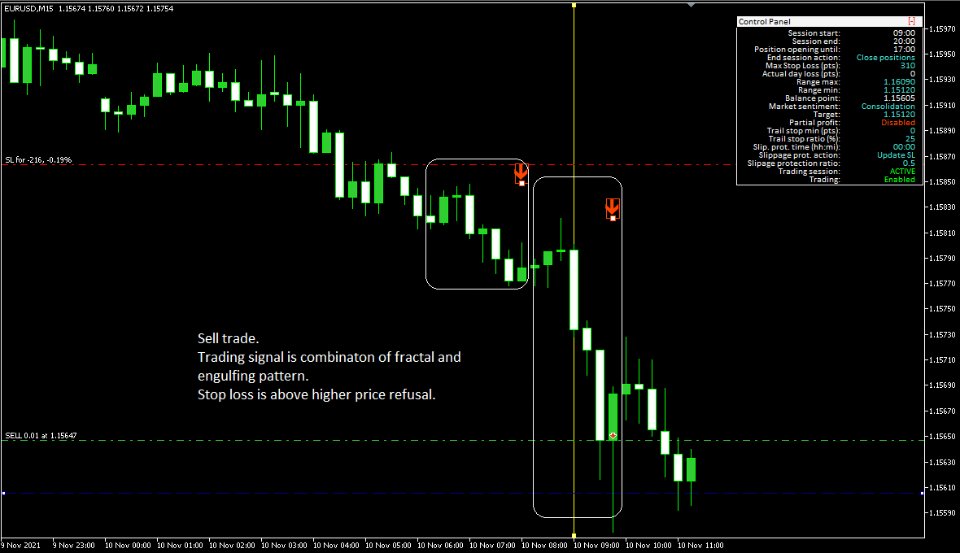

Trading signal

Trading signal consists of market sentiment, correct position of market price within trading range and confirmation by price rejection. Rejection is combination of fractal with price action pattern engulfing or pinbar.- BUY:

- Market sentiment is BUY or Consolidation.

- Price is below balance point.

- One of two following situations occurs

- Price rejection is formed near (within stop loss limit) range minimum. Range minimum is then a stop loss for potential buy trade.

- For newly formed price rejection EA is able to find previous, lower price rejection. If previous price rejection is within stop loss limit from market price, it is then a stop loss for new buy trade.

- SELL:

- Market sentiment is SELL or Consolidation.

- Price is above balance point.

- One of two following situations occurs

- Price rejection occurs near (within stop loss limit) range maximum. Range maximum is then a stop loss for potential sell trade.

- For newly formed price rejection EA is able to find previous, higher price rejection. If previous price rejection is within stop loss limit from market price, it is then a stop loss for potential buy trade.

Stop loss

Stop loss is either boundary of trading range (range minimum for buy, range maximum for sell) or in case of double rejection it is previous price rejection.

Another alternative for managing risk and protect profits is to use trailing stop.

Target

Target of a trade is by default opposite boundary of trading range. If target is not set, trade lasts until end of trading session (see input parameter Target in Trading session section).

User manual

This is only high level description. Detailed manual including list of input parameters is here.

Demo

Before installing demo and testing this EA, please read section Backtesting in very end of user manual linked above. There is attached csv file with bulk market data as well as description how to use it with EA in Strategy tester to get best possible understanding of how EA works.