Structure Blocks

- Indikatoren

- Haidar, Lionel Haj Ali

- Version: 1.3

- Aktualisiert: 24 Juli 2024

Structure Blocks: a structured way to analyze market structure

This indicator is for you if you are a price action or smart money concept trader. It identifies market trends' ultimate highs and lows and intermediaries' swing lows and highs. It adjusts based on candles' body where most of the volume is, disregarding wicks.

Need help or have questions? I am Lio, don't hesitate to reach out! I am always available to respond, help, and improve.

How it works:

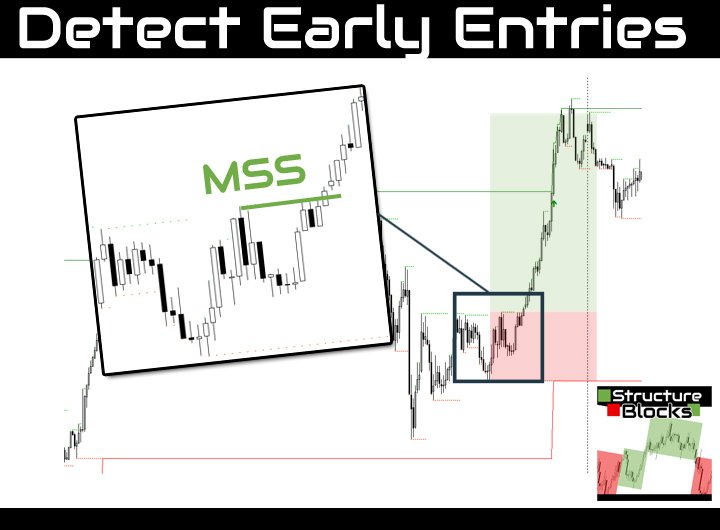

Each block consists of a move with the trend and correction until a breakout is up or down. The criteria for establishing a breakout depends on the current trend's direction. In bullish trends, any breaks above previous highs start a new block, and the same is true in bearish trends for breaks below previous lows. A new breakout occurs if the body of a candle falls below the low or above the high. Price wicks are ignored. The indicator will continuously check the intermediate swing high and swing low. A swing high is identified by having lower highs on both sides, whereas a swing low has higher lows.

How you can use it:

- Multi-timeframe breakdown analysis

- Identify market structure if trending down or up

- Plan your trades by trading breakouts and retracements

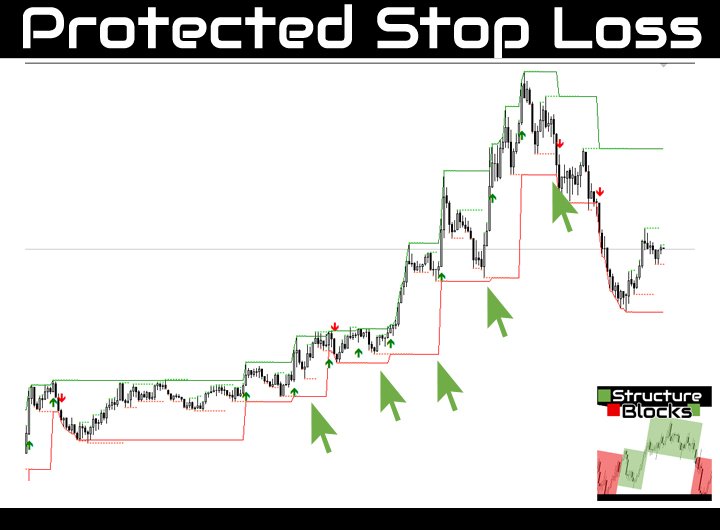

- Identify where to put stop loss and take profit

- Trail your stop loss with new swing forming

- Get informed by alert and mobile notifications on new breaks

Love the simplicity and use of this indicator. Please make a pdf with some more examples, inlcuding best timeframes and assets to trade. Great work guys!!