Open Market Breakout Pro

- Experten

- Lorenzo Mancuso

- Version: 1.2

- Aktualisiert: 19 April 2024

- Aktivierungen: 5

Expert Advisor: OpenMarketBreakout

Preferred Timeframe: H1. This is not hardcoded, try out your own strategy.

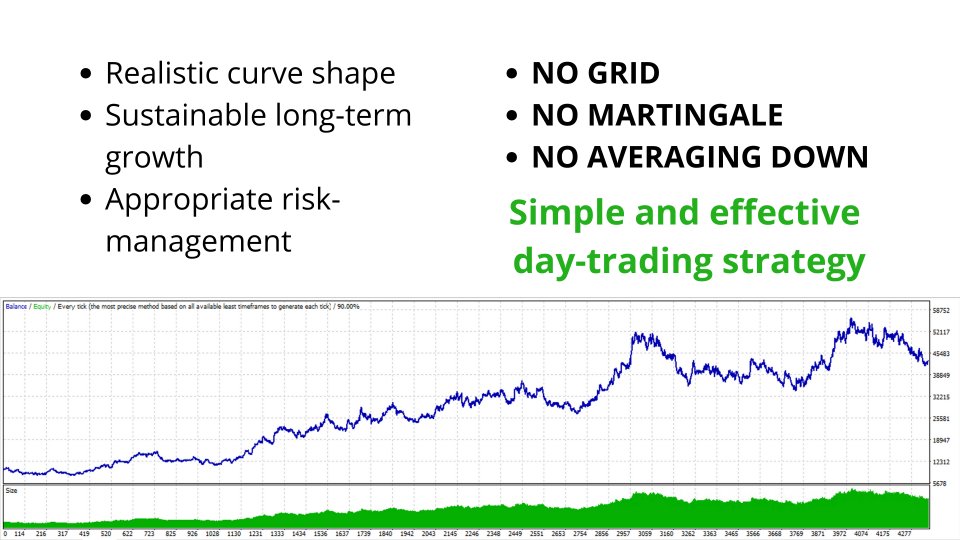

General Description: The OpenMarketBreakout Expert Advisor is a powerful tool designed to capitalize on market breakouts during specific timeframes. This EA employs a sophisticated algorithm to identify opportune moments for initiating trades, focusing on breakouts from local high and low points. By harnessing this strategy, traders can potentially capture significant market movements and optimize their trading performance.

Disclaimer: It's important for traders to use strategies that include both winning and losing trades, rather than chasing after unrealistic promises of huge profits. No strategy can guarantee constant success, so it's crucial to manage risks wisely. In essence, success in trading isn't about chasing mythical "holy grails" but about using robust strategies like OpenMarketBreakout that focus on sustainable growth and prudent risk management. With this expert advisor, traders can approach the markets with clarity, knowing that their trading decisions are grounded in a strategy designed for long-term success.

About the autor: Lorenzo Mancuso is a seasoned professional in computer science, specializing in artificial intelligence and engineering. With a master's degree in computer science and over a decade of experience, he has played pivotal roles in leading fintech companies in Europe. His expertise lies in designing and implementing robust and scalable software. Leveraging his skills, this EA offers traders a reliable tool backed by years of industry experience and innovation. Traders can trust in the reliability and effectiveness of this expert advisor for navigating the financial markets with confidence.

Key Features:

- Breakout Strategy: The EA specializes in identifying breakout opportunities, leveraging market dynamics to enter trades at optimal moments.

- Customizable Parameters: Users have the flexibility to tailor the EA to their preferences through adjustable parameters, including stop loss, take profit, trailing stop, and more.

- Automatic and Fixed Lot Sizing: Choose between automatic lot sizing based on account balance or fixed lot sizes for precise risk management.

- Intelligent Order Management: The EA intelligently manages orders, including the option to close opposite pending orders and apply trailing stop functionality.

- Time-Based Execution: Trades are executed at specific time intervals, allowing traders to align their strategies with market openings and closings.

Parameters:

-

Profit Settings:

- Stop Loss: Set the desired stop loss level for trades (in points. 30 pips = 300). If set to 0, the EA will automatically set the value to the local peak.

- Take Profit: Determine the take profit target for maximizing gains (in points. 30 pips = 300). If set to 0, the EA will automatically use the Profit Factor parameter.

- Trailing Stop: Enable trailing stop functionality to secure profits while allowing for potential further gains (in points. 30 pips = 300). If set to 0, the EA will automatically use the Profit Factor parameter.

- Profit Mode: Choose between fixed profit targets or dynamic trailing stop strategies.

- Profit Factor: Useful to setup automatically the profit settings.

- Price Mode: Select the reference price for pending order entry. Can be the current market price (Ask/Bid) or the Local Peak.

- Bars Buffer: Define the range of bars used to identify local high and low points (Local Peaks).

- Margin: Specify the additional distance from entry price to set orders. This could be useful to protect you from false signals

- Stop Loss: Set the desired stop loss level for trades (in points. 30 pips = 300). If set to 0, the EA will automatically set the value to the local peak.

-

Trade Settings:

- Max Trades: Limit the maximum number of concurrent trades for the given symbol (both pending and open).

- Expiration Hours: Set the duration (in hours) for pending orders before expiration.

- Lot Mode: Choose between automatic lot sizing or fixed lot sizes.

- Amount Per Lot: Determine the account balance multiplier for automatic lot sizing. Eg: amountPerLot=100, balance=1000, lotSize=1000/100*0,01 = 0,1

- Lot: Set fixed lot size if applicable.

- Close Opposite: Enable/disable the closure of opposite pending orders when one is triggered.

-

Algorithm Settings:

- Open UTC Hour: Define the hour for initiating trades.

- Order Close UTC Hour: Set the hour for closing orders.

- Magic Number: Assign a unique identifier for tracking EA transactions in MT4.

Setup: To utilize the OpenMarketBreakout EA, simply attach it to your MetaTrader 4 chart and configure the desired parameters according to your trading preferences. Once set up, the EA will automatically execute trades based on the specified parameters and market conditions.

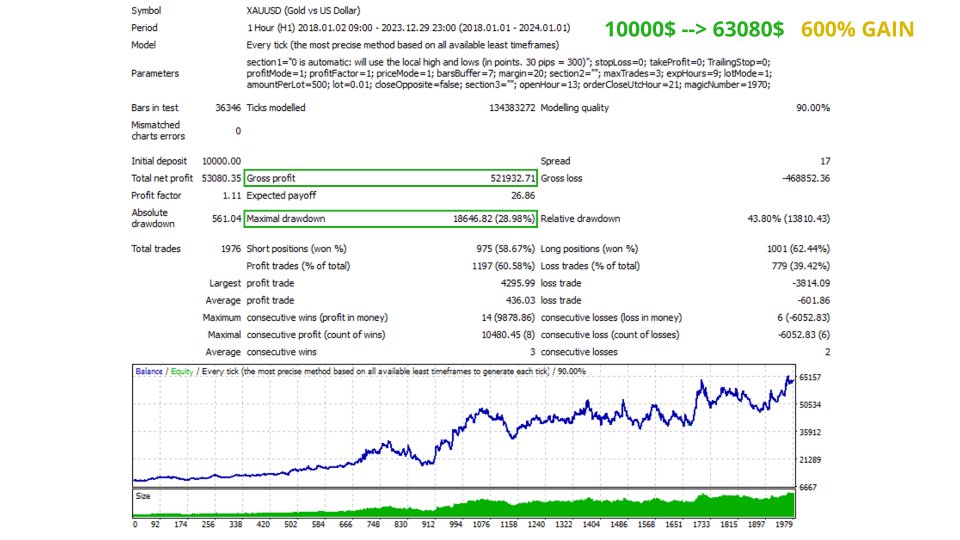

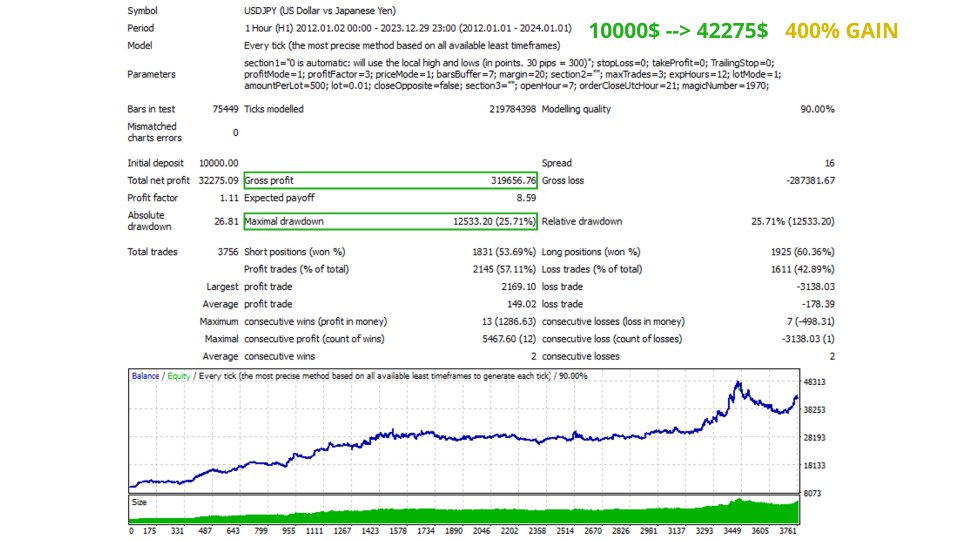

Backtesting: Prior to live trading, it is recommended to conduct thorough backtesting to evaluate the performance of the EA under various market conditions. Backtesting allows traders to assess the effectiveness of the strategy and fine-tune parameters for optimal results.

Experience the power of market breakouts with the OpenMarketBreakout Expert Advisor and unlock new opportunities for trading success.

For further inquiries or assistance, feel free to reach out to the developer.

Copyright 2024, Lorenzo Mancuso & Armerina Investment. All rights reserved.