MoMo Trader

- Experten

- Svetoslav Ognyano Chilingirov

- Version: 1.0

- Aktivierungen: 10

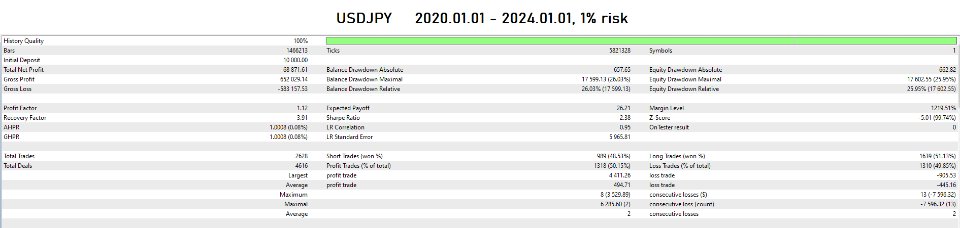

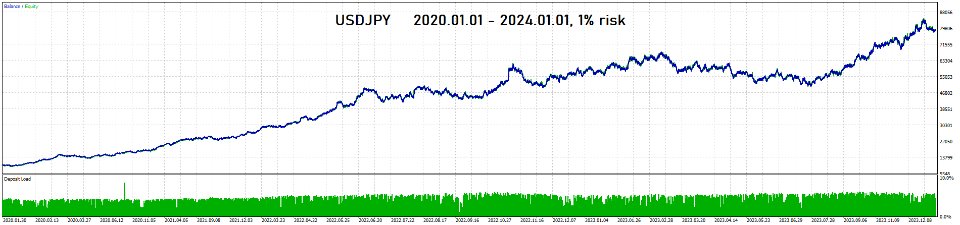

The MoMo Trader is an AI generated trend following strategy that is loosely based on a 5-minute trading system from Boris Schlossberg. It takes advantage of momentum bursts on short-term 5-minute charts and then quickly exits as soon as the momentum starts to wane. It uses a couple entry confirmations based on price action, MA and MACD.

The EA employs a strict no-grid, no-martingale policy, ensuring that equity drawdown remains stable and predictable.

You can explore my full suite of EAs here: https://www.mql5.com/en/users/s_moksa/seller

Originally the AI waits for a combo of MA and MACD entry signal and a momentum confirmation of a quick 100 points price spike. It is simple and it works surprisingly well (to my amazement). Nevertheless I decided to code a couple optional filters:

- Time filter

- Different SL placements

- Trend filter

- Number of trade positions

Inputs:

- Master Timeframe and IndicatorTF Synch-> Allows you to easily backtest many timeframes with one test*.

- Lots and Risk Percentage -> Define the sizing. 0 Risk Percentage leaves the user with fixed lot size.

- SL and TP -> Define SL in points and TP in Risk:Reward.

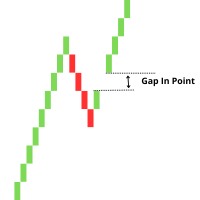

- Entry signals max gap -> bigger number = more entries.

- Distance confirmation -> define the momentum confirmation.

- Partial options -> how much and when to close a partial.

- Aggressive entry -> define the lookback period for the swing low/high SL placement.

- Break entry

- TSL -> SL will be trailed under the signal MA after a partial is closed.

- Max Positions -> The EA can open a series of positions, when it meets the criteria (use with fixed lots!). Or if set to 1 for example - hold no more than 1 long and 1 short positions (good for backtesting).

- Filters 1 and 2 -> MA and MACD settings for the entry signal.

- Filter 3 -> MA trend filter.

- Filter 4 -> Trading window.

- Others -> Magic number and dashboard.

Reach out after purchase so I can provide instructions on how to set up the EA. Share input sets and some general advice and experience about the EA.

Keep in mind that every legit strategy has losing periods. It is recommended to use every EA at least a few months to decide whether it suits you.

DISCLAIMER: I am not a financial advisor and this is not financial advice. Past results can't guarantee future profits. I cannot and won't be responsible for any losses you incur. Use this EA with proper risk management.

P.S. The EA comes with inputs slightly optimized for USDJPY, which I run on the 1M timeframe. Many more products in the pipeline. Stay tuned. Also - this product is, as far as I can gather, an AI innovative interpretation of a classic strategy, I'm opened to tweaking it in any way possible. Will be happy to discuss any variations and suggestions and potentially improving it.

Some thoughts: To be honest I'm quite shocked that such a simple idea works so good. Yes - as every strategy it has it's flaws (as for example trade ranges), but it looks like it performs very stable when it finds the trend. I don't have the time to test extensively at the moment, and I feel like I'm underselling it, but I'm content with the result and I see potential in it. It might be reused as a main entry signal for one of my next projects - The Griddy System.

* For faster optimization process -> When optimizing set isIndicatorTFSynch to true, and masterTimeframe input start to 5M and input stop to 4H (for example). Set timeframe in the settings window to 1M or the timeframe you just set as an input start for masterTimeframe parameter (5M). If you don't want indicators to be in synch with the EA bars and overall mechanics, set isIndicatorTFSynch to false, and optimize the indicators timeframe parameters together with the masterTimeframe parameter.