Asistente de traiding One

- Utilitys

- Uriel Alonso Camargo Bayona

- Version: 4.0

- Aktualisiert: 27 Februar 2024

- Aktivierungen: 5

Description: The forex risk management script is designed to assist traders in effectively managing the risk associated with their trades and maximizing profit potential. This script can be used on a trading platform to automate and simplify the risk management process.

Features:

-

Risk Configuration:

- Allows the user to set the percentage of capital they are willing to risk on a trade.

-

Position Size Calculation:

- Automatically calculates the position size based on the specified risk percentage and distance to the stop loss.

-

Setting Stop Loss and Take Profit:

- Enables the trader to set stop loss and take profit levels according to their strategy.

-

Information Display:

- Clearly and visually displays relevant information such as position size, risk in monetary terms, and profit potential.

-

Parameter Validation:

- Performs checks to ensure that the entered parameters are coherent and viable.

-

Adaptability to Different Currency Pairs:

- Can be used with different currency pairs, automatically adjusting for the volatility of each pair.

-

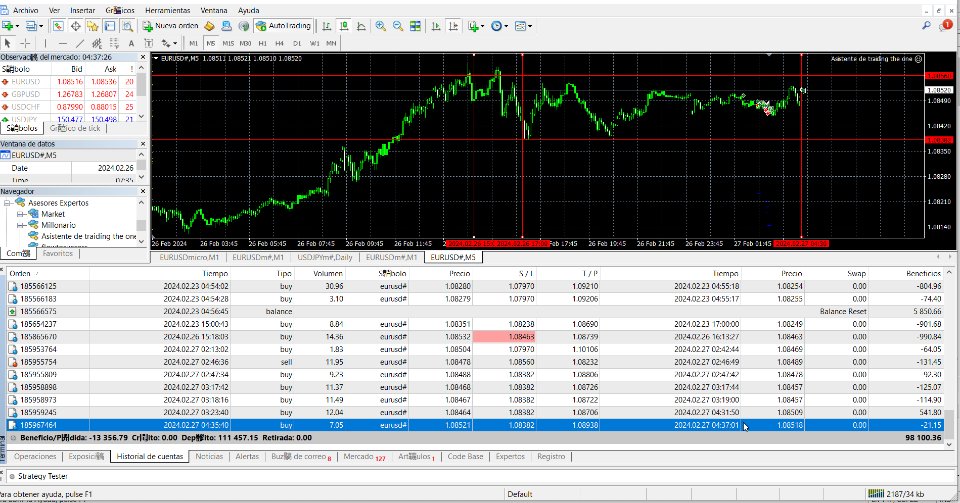

Trade Logging:

- Optionally, can maintain a log of executed trades, including details such as date, currency pair, position size, risk, and results.

Usage Instructions:

-

Load the Script:

- The user loads the script onto the trading platform.

-

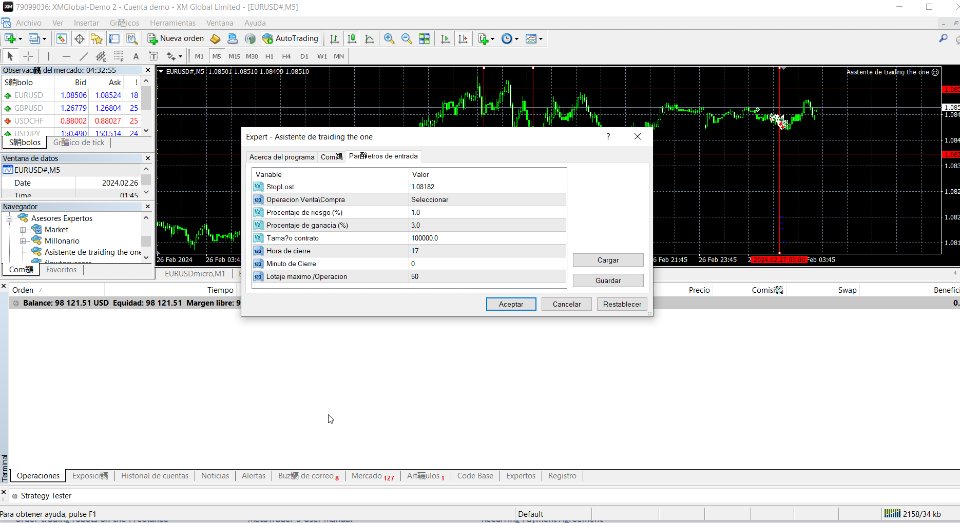

Configure Parameters:

- Enter the desired risk percentage, stop loss and take profit levels, and other parameters based on the trader's preference.

-

Execute the Script:

- When opening a new trade, the trader executes the script, which automatically calculates the position size and sets stop loss and take profit levels.

-

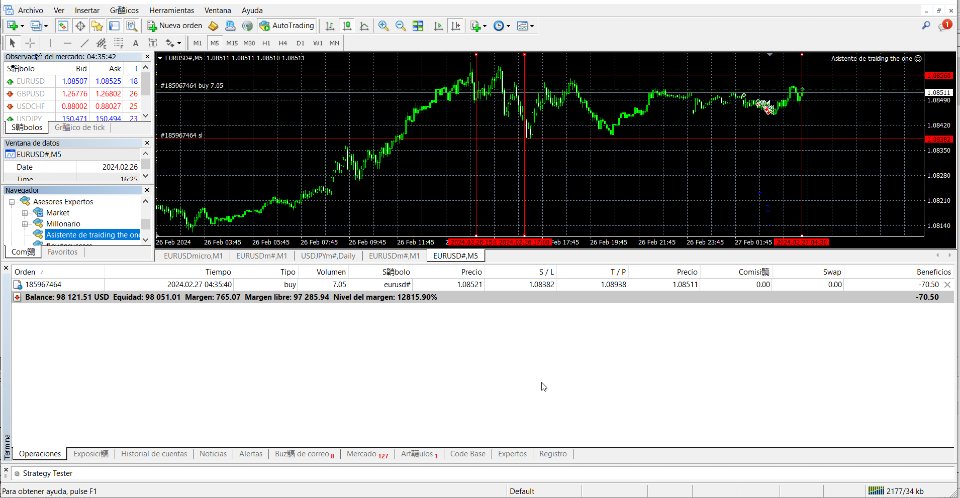

Real-Time Monitoring:

- The trader can monitor real-time information provided by the script and make adjustments as needed.

This script provides a valuable tool for forex traders by automating critical aspects of risk management, allowing for more informed and disciplined decision-making. It is crucial to fully understand its operation before implementing it in live trades.