ICT Unicorn Model

- Indikatoren

- Minh Truong Pham

- Version: 1.7

- Aktualisiert: 11 Oktober 2024

- Aktivierungen: 5

The ICT Unicorn Model indicator highlights the presence of "unicorn" patterns on the user's chart which is derived from the lectures of "The Inner Circle Trader" (ICT).

Detected patterns are followed by targets with a distance controlled by the user.

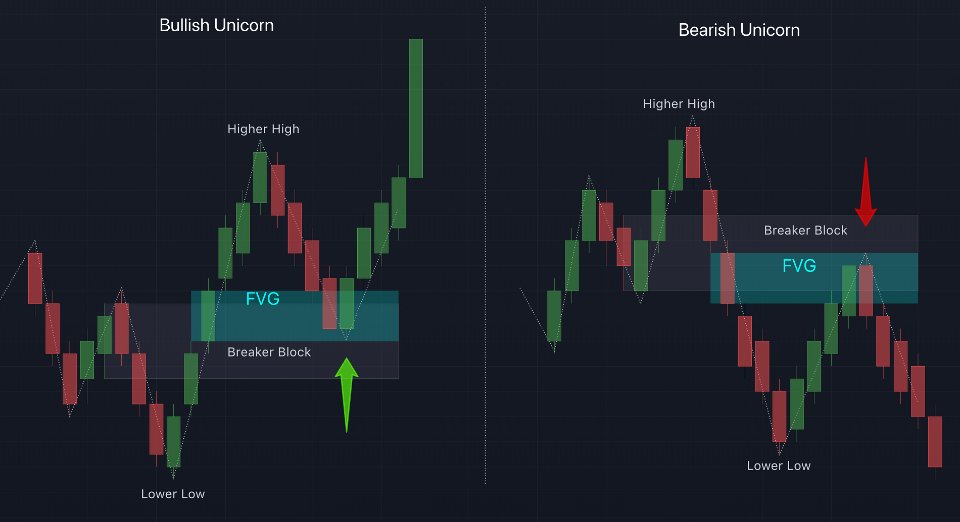

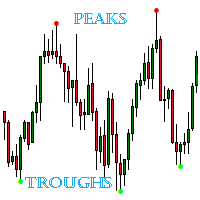

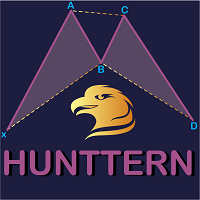

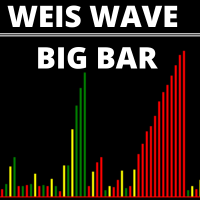

🔶 USAGE (image 2)

A Bullish Unicorn Pattern consists out of:

- A Lower Low (LL), followed by a Higher High (HH)

- A Fair Value Gap (FVG), overlapping the established Breaker Block

- A successful re-test of the FVG which confirms the pattern.

- A Higher High (HH), followed by a Lower Low (LL)

- A Fair Value Gap (FVG), overlapping the established Breaker Block

- A successful re-test of the FVG which confirms the pattern

The pattern detection depends on detected swings, which can be controlled by the Swing setting. Using higher values of this setting will return longer-term breaker blocks.

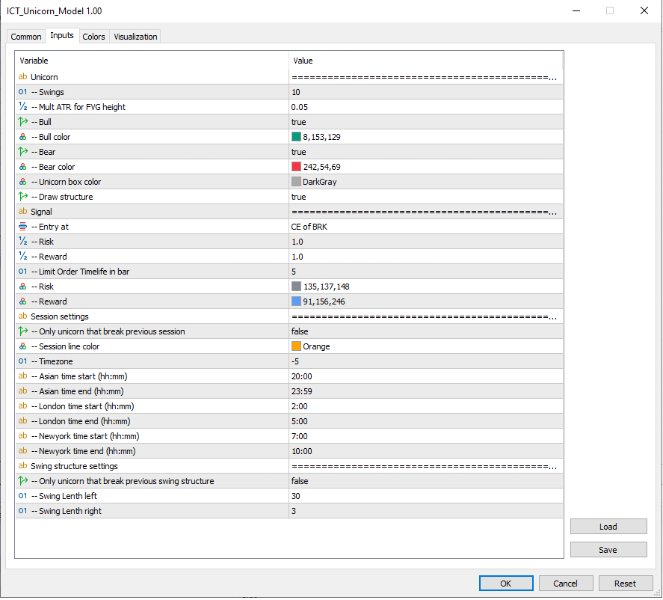

🔶 SETTINGS🔹 Unicorn

- Swings: This sets the length of swings, used for the underlying ZigZag and Unicorn Patterns detection.

- Mult ATR for FVG height: FVG is considered valid when its height is greater than the ATR multiplied by this value. Default is 0.05.

- Bull: Enable/disable Bullish patterns, and set the color of FVG box.

- Bear: Enable/disable Bearish patterns, and set the color of FVG box.

- Draw structure: This option allow mark pivot point inside model as a,b,c,d: With bullish model, c is LL and d is HH; With bearish model, c is HH and d is LL

🔹 Signal

- Entry at: Choose how entry include:

- CE of BRK: 50% of breaker block

- Edge of BRK: entry at top of breaker block with bullish model and vice versal

- CE of FVG: 50% of fair value gap

- Edge of FVG: entry at top of fair value gap with bullish model and vice versal

- Rish/Reward and its color settings.

- Limit order timelife (in bar): set how many bar that risk and reward box keep drawing

🔹 Session settings

- Only model that break previous session: When true, we just care about bullish model have C lower than low of previous session and vice versal. For example, we wait until close asian and just care about bullish model that break lowest of Asian.

- Other settings include: Timezone, sessions time and color

🔹 Swing Structure settings

- Only model that break previous swing structure: When true, we just care about bullish model have C lower than previous swing low and vice versal.

- Length of swing: include left-hand and right-hand length.

🔶 ALERTs

- When unicorn model detected

- When model was invalided by time (Depend on Limit order timelife setting)

- When buy/sell signal (price cross entry)

🔶 BUFFER

For easy to create EA base on this indicator, we add buffer as following:

0: buff_buy_entry

1: buff_buy_stoploss

2: buff_buy_take profit

//---

3: buff_sell_ent

4: buff_sell_sl

5: buff_sell_tp

Default value =0. When have unicorn signal, the candle will have buffer value as price.

Notes:

Remember that the above pattern does not occur often, so it is normal that the first time you run it, you do not see any change on the chart in the current view. That means that there is no pattern in the current view, not that the indicator is not working.

+ You can check the previous patterns by opening the "Object List" tool of MT terminator (use the shortcut Ctl+B), click on "List all" to display all objects. Click on an object with the prefix you set or the default is "un". Finally, click the "Show" button, you will see the pattern displayed on the chart.

+ Another way is that you can run a backtest to see how effectively the indicator works.

HOW TO BUILD A SIGNAL SCANNING SYSTEM:

To use this indicator effectively, build a signal scanning system as follows:

+ With 1 symbol, open each timeframe you are interested in on each different chart.

+ With each opened chart, attach multiple indicators, each of them for a different setting (usually different pivot period settings will give both short-term and long-term models)

+ Set a prefix that is easy to remember. For example, "m1_p3" means that the indicator is responsible for scanning on the M1 chart with pivot period = 3.

Thus, you have built a scanning system. Whenever there is a signal, the indicator will alert you via the notifications system. You have many different notification options such as via MT Alert, via email, or MT5 mobile app

Frequently Asked Questions

Why nothing show on chart when i load inidicator?

https://www.youtube.com/watch?v=hW-KHHvUCWI

How i build signal scan system with this indicator?