CapitalMAGL

- Experten

- Mr Nisit Noijeam

- Version: 1.2

- Aktualisiert: 13 Februar 2024

- Aktivierungen: 10

GRID MA TRADING

Trading Strategy Overview

-

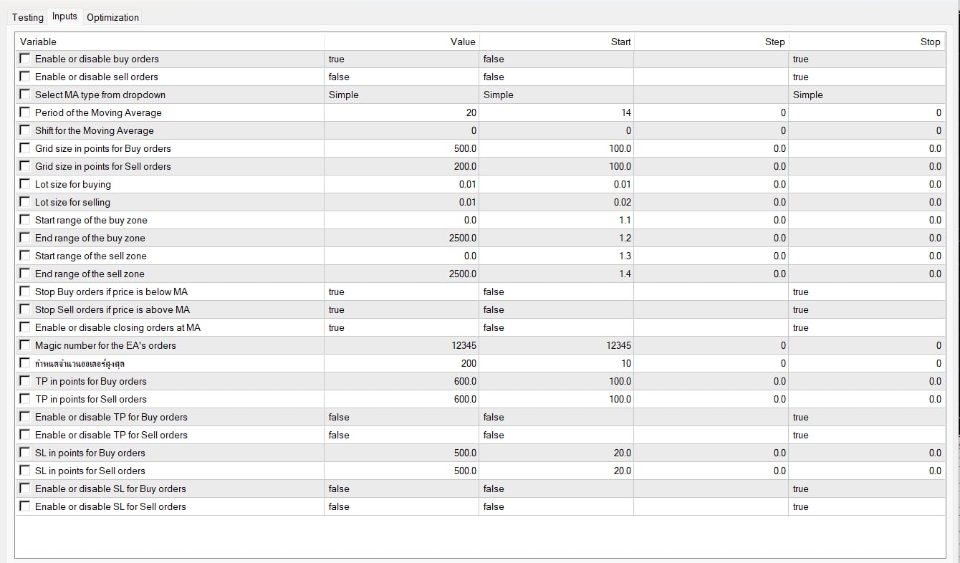

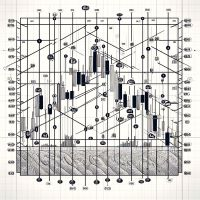

Moving Average (MA) Based Decisions:

- The EA uses a Moving Average (MA) as a key indicator for its trading decisions. The type (Simple, Exponential, Smooth, Linear Weighted), period, and shift of the MA are configurable.

- It decides whether to buy or sell based on the position of the price relative to the MA. For example, it may stop buying if the price is below the MA or stop selling if the price is above the MA.

-

Grid Trading System:

- The EA appears to implement a grid trading strategy, where orders are placed at regular intervals (determined by GridSizePoints ).

- Buy and sell orders are placed within specified zones ( BuyZoneStart to BuyZoneEnd , and SellZoneStart to SellZoneEnd ).

-

Order Management:

- The EA manages orders based on the grid strategy and MA criteria. It has the ability to close profitable orders when certain conditions are met.

- It uses a MagicNumber to identify and manage its own trades, which is a common practice to differentiate an EA's trades from others.

-

Normalization of Lot Size:

- The EA adjusts the lot size for each trade to comply with the broker's requirements, using the NormalizeLotSize function.

-

Take Profit (TP):

- It incorporates a take profit strategy where a trade is closed once it reaches a specified profit level.

-

Account Limits Check:

- The EA includes a check for account limits ( IsNewOrderAllowed function), ensuring it doesn't exceed the maximum number of allowed pending orders.