Indices Time Frame BreakOut EA

- Experten

- Rudolf Neustadt

- Version: 3.0

- Aktualisiert: 19 Februar 2024

- Aktivierungen: 10

Time Frame Breakout Indices MT5

Apart from many other programs in the MQL5 market this is a REAL and EXCELLENT tool for trading Indices using a breakout strategy. After opening the markets or at the time of announcing significant economic data, markets often try to find its direction and follow short or long trends. Time Frame Breakout Indices EA is designed to trade these trends using BreakOut strategy. It does not use any martingale or grid functionalities.

We use this strategy for many months and it brings good results. Let’s download the demo and try it yourself!

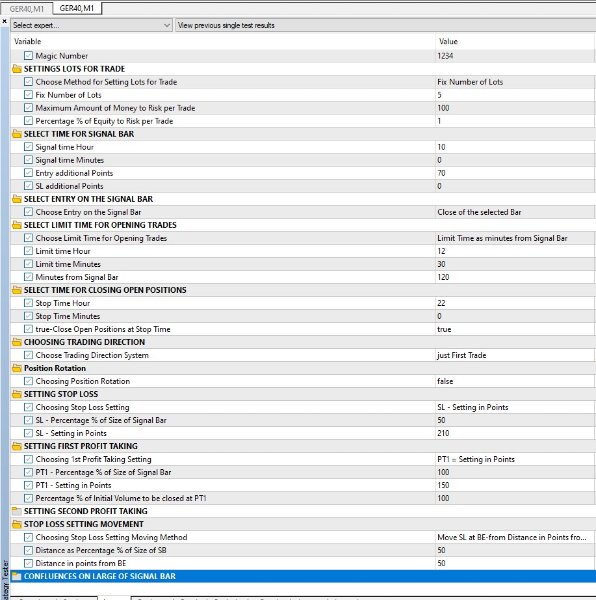

Main advantage of this program is the variability of menu settings. The settings can be adjusted for trend expectations as well as for small movement expectations. The user can adapt it to his/her preferences whether he prefers a conservative trading with lower risk (and of course, lower profit) or the trader is more progressive and his mind is set for longer trends and accepting a higher risk. As the program is variable the user can choose different time ranges to trade even with the function to close all trades to avoid trading during night, for example. The user can choose from many possible settings of Profit Taking, Stop Loss, Trading Method etc.

One of the most beneficial feature which is providing by this EA is partial closing of position. User can set different methods for setting profit taking both first level and second level. For example for setting second profit taking level, user can choose from 3 methods:

· fixed profit taking level

· trailing stop loss based on Points

· trailing stop loss based on Bars

Program offers user to choose from 4 trading direction options:

· just first trade

· only Long positions

· only Short positions

· both Short and Long positions

The another interesting option for this extraordinary EA is independent setting of stop loss movement from 4 possibilities including trailing or just one time shift at BE.

Version 2.0.

Version 2.0 has been enhanced with the requested feature of position rotation. If selected, when a high of the signal candle is broken out, a short position is opened instead of a long one, and vice versa. This strategy proves to be highly profitable in the case of having a ranging period rather than a trending period on the underlying asset – stock index.

Version 3.0.

Version 3.0. has been enhanced with the feature of entering trades not only after breaking the High and Low of the signal bar, plus points specified in the variable Entry Additional Points, but also with the option to enter a position at the Close level of the signal bar plus points specified in the Entry Additional Points variable.

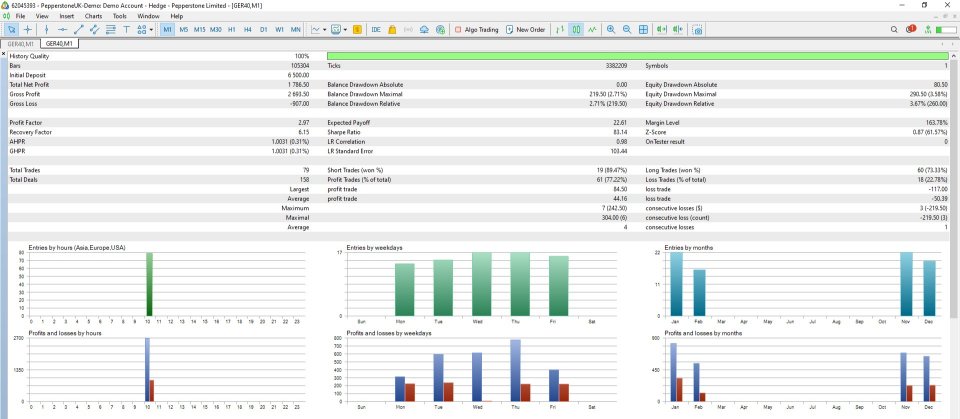

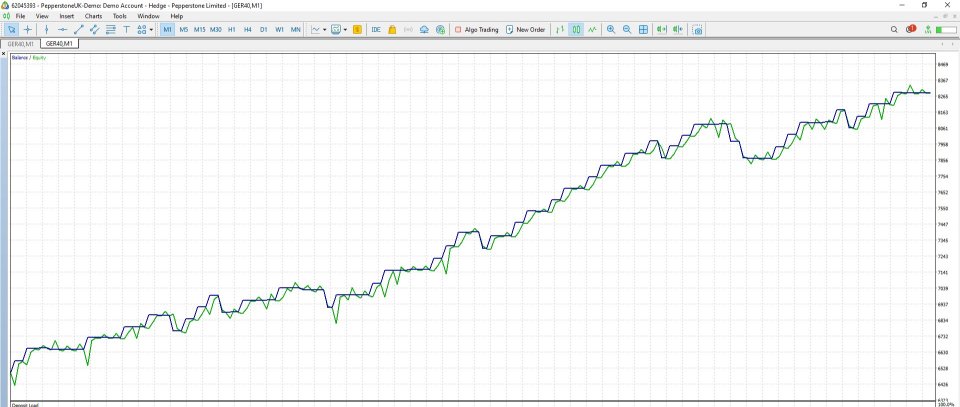

The author provides a settings file along with results for the DAX index, where entering trades at the Close level of the signal bar is employed. https://www.mql5.com/en/blogs/post/755354

Strategy

Let's clarify the basic description of the strategy implemented in the EA (Expert Advisor) using an example. We aim to trade breakouts of levels defined by the signal candle /bar/ from 9:15 to 9:30 on the DAX. This involves a 15-minute candle on the DAX asset. The program setup process is as follows:

1. Select a chart displaying the DAX asset with a 15-minute time frame.

2. Attach the EA to this chart.

3. SET in the menu – SELECT TIME FOR SIGNAL BAR with the following inputs:

· Signal Time Hour - 9

· Signal Time Minutes - 30

The program recognizes that it is connected to a chart with the DAX asset, a time frame of 15 minutes, and the values in the Signal Time Hour and Signal Time Minutes fields represent the closing time of the signal candle, which is a 15-minute candle ending at 9:30. If there is a breakout of the high value of the signal candle, the EA enters a long position; if there is a breakout of the low value of signal candle, the program enters a short position. The trade parameter settings are described in the user manual. Users are encouraged to study it as the main advantage of this program lies in the broad complexity of trade parameter settings.

Manual with all the settings can be found here: https://www.mql5.com/en/blogs/post/755302

Set file to use like example with results on attached screenshots can be downloaded here: https://www.mql5.com/en/blogs/post/755354

If a user wants to trade multiple assets on different signal candles, the process is as follows. For example, if a user wants to trade also a 30-minute candle on the FTSE index starting at 10:00 and ending at 10:30:

1. Select a chart displaying the FTSE asset with a 30-minute time frame.

2. Attach the EA to this chart.

3. SET in the menu – SELECT TIME FOR SIGNAL BAR with the following inputs:

· Signal Time Hour - 10

· Signal Time Minutes - 30

4. Set in the menu – Magic Number with the following input:

· Magic number – enter a number different from the program connected to the DAX, Time Range 15M.

Different Magic numbers allow independent trading of any number of assets with different signal candles and trade parameters. If different Magic numbers are used, the programs are independent of each other.

I wish users a lot of fun testing various strategies, whether it's choosing different underlying assets with different signal candles or different trade settings. The program allows for very complex customization of individual trades, which is detailed in the user manual.

Recommendations:

- Indices – Germany 40 Rolling cash (also known as DAX), US Tech 100 (Nasdaq), Wall Street 30 (Dow,...)

- Timeframe - M5, M15,..

- It is important to use accounts with low spreads and low slippages for best results

- Best results achieved during trend periods