Three Linear Regression Indicator CCH

- Indikatoren

- Chi Hai Cao

- Version: 1.0

The TLR indicator is a market trend identification indicator. The idea behind this indicator is to use 3 linear regression lines, one short-term, one medium-term, and one long-term.

The UPTREND will be determined when:

- The long-term linear regression line and the medium-term linear regression line have an uptrend.

- The long-term linear regression line has an uptrend, the medium-term linear regression line has a sideway, and the short-term linear regression line has an uptrend.

The DOWNTREND will be determined when:

- The long-term linear regression line and the medium-term linear regression line have an downtrend.

- The long-term linear regression line has an downtrend, the medium-term linear regression line has a sideway, and the short-term linear regression line has an downtrend.

The remaining cases are determined to have no clear trend.

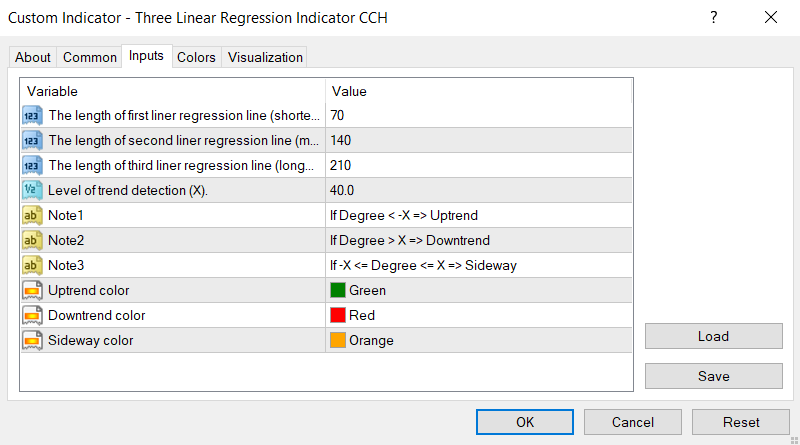

Indicator Inputs:

- The length of first line: This is the length of the short-term linear regression line. Its must be 1-500.

- The length of second line: This is the length of the medium-term linear regression line. Its must be 1-500.

- The length of third line: This is the length of the long-term linear regression line. Its must be 1-500.

- Level of trend detection: Call it is “X”. X is the degree using to detect trend.

- If the degree of the linear regression line is > X. It’s mean “Downtrend”.

- If the degree of the linear regression line is < -X. It’s mean “Uptrend”.

- If the degree of the linear regression line is ≥ -X and ≤ X. It’s mean “Sideway”.