Setup IFR2

- Indikatoren

- Luigi Nunes Labigalini

- Version: 1.0

- Aktivierungen: 5

| Entry and exit signals from the IFR2 Strategy by Larry Connors in his book "Short Term Trading Strategies That Work". |

|---|

Larry claims this strategy correctly predicted the shortterm direction of the S&P 500 83.6% of the time from 1995 to 2007.

How does it work?

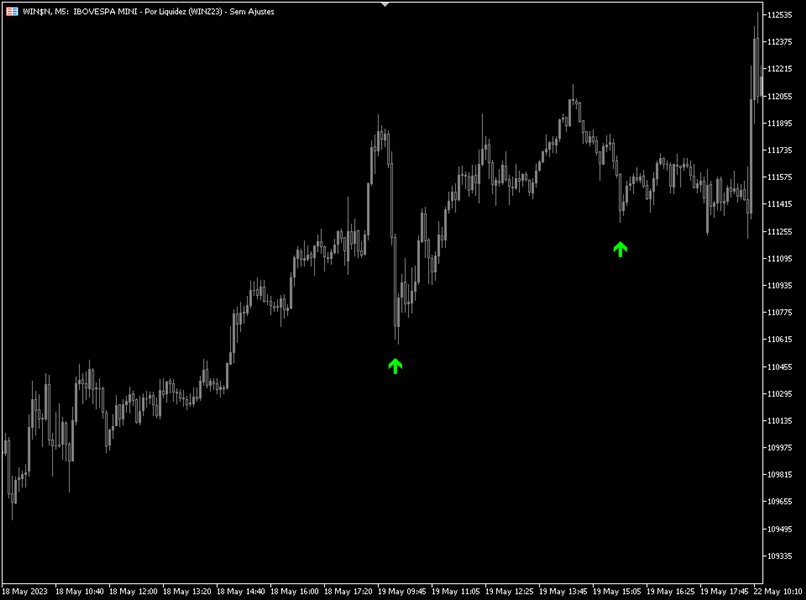

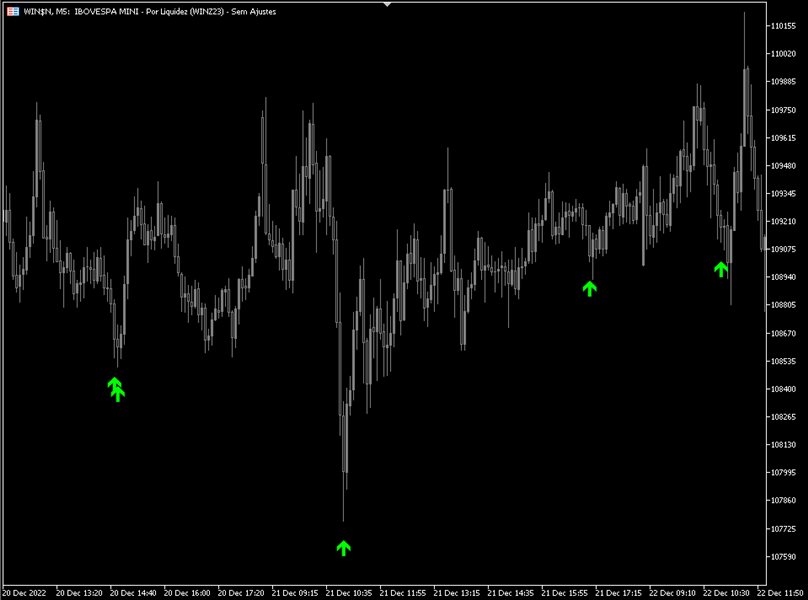

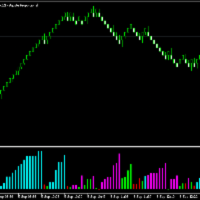

The indicator activates the buy signal when the price closes above the 200-day moving average and the 2-period IFR closes below 5.

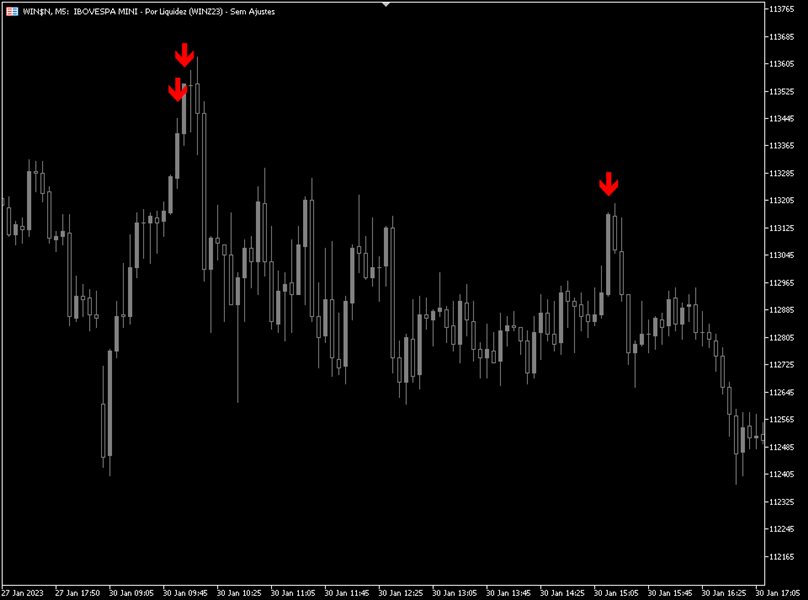

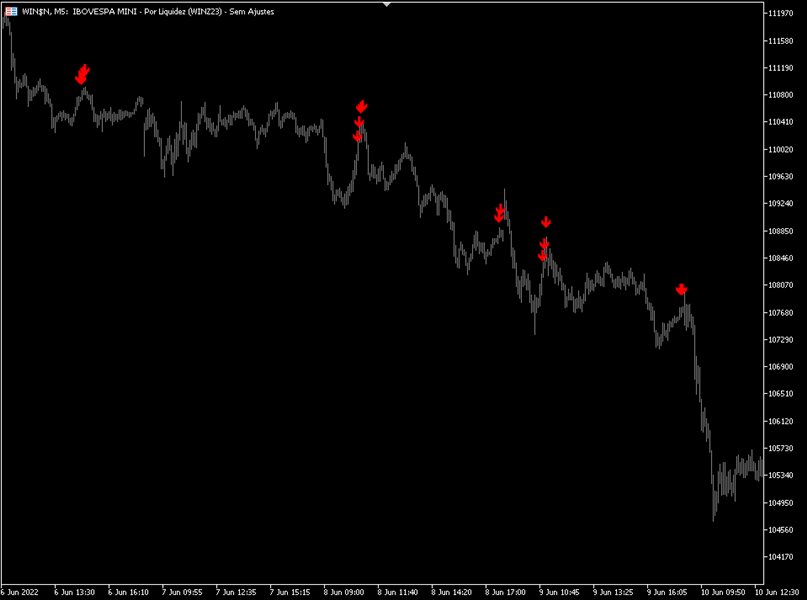

The sell signal is the opposite.

How to use it?

Enter the trade with a market order as soon as the candle closes with the buy signal.

There is no stop loss order neither take profit order.

The recommended exit is when the price closes above it's 5-period moving average.

Tip:

- Despite the author not recommending the use of a stop loss order, you can place one at the 200-period moving average just to be safe against unexpected sudden crashes and protect your capital.

Advantages:

- Let's you change the type of entry and exit arrows so you don't confuse with other indicators already in use.

- Can ring an alarm to draw your attention when there's an entry signal.

- Can pop an alert on the platform to inform you when there's an entry signal.

- Can send a push notification on your smartphone when there's an entry signal.

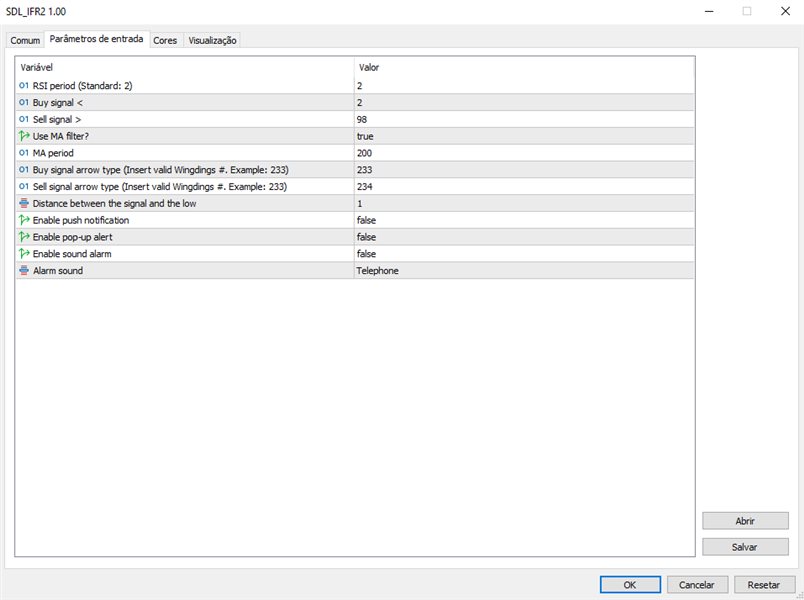

Features you can edit to your preference:

- Period of IFR

- Level of buy signal

- Level of sell signal

- Enable/disable trend filter

- Period of trend filter

- Distance between the arrow signals and the candle's high/low

- Type of the signal arrows, based on the Wingdings font

- Color and size of the signal arrows

- Enable push notifications

- Enable pop-up alerts

- Enable sound alarms

- Sound of the alarm

Who is the creator?

Larry Connors has over 30 years in the financial markets industry. His opinions have been featured at the Wall Street Journal, Bloomberg, Dow Jones, & many others. For over 15 years, Larry Connors and now Connors Research has provided the highest-quality, data-driven research on trading for individual investors, hedge funds, proprietary trading firms, and bank trading desks around the world.

Larry has been published extensively, with titles like "How Markets Really Work", "Short Term Trading Strategies That Work", "High Probability ETF Trading", and "The Connors Research Trading Strategy Series" including his latest Guidebook "High Probability Trading with Multiple Up & Down Days".