AdvancedDualThrust

- Experten

- Yan Xiong Xue

- Version: 1.0

- Aktivierungen: 5

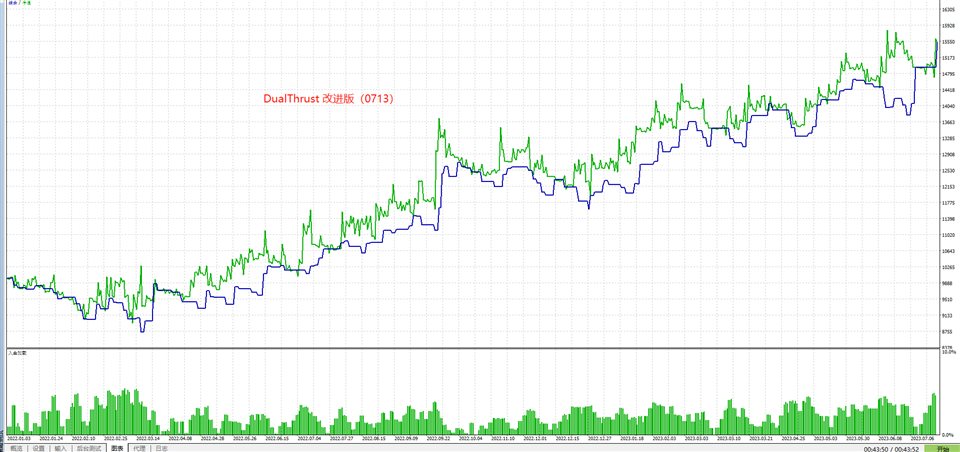

AdvancedDualThrust Introduces the policy

HH: the highest price of the N-day high, and LC: the lowest price of the N-day close

HC: the highest price of the N-day closing price, LL: the lowest price of the N-day low

The formula for calculating the oscillation Range is range =Max(HH-LC,HC-LL).

- UpLine=Open+k1 * Range;

DownLine=Open-k2 * Range;

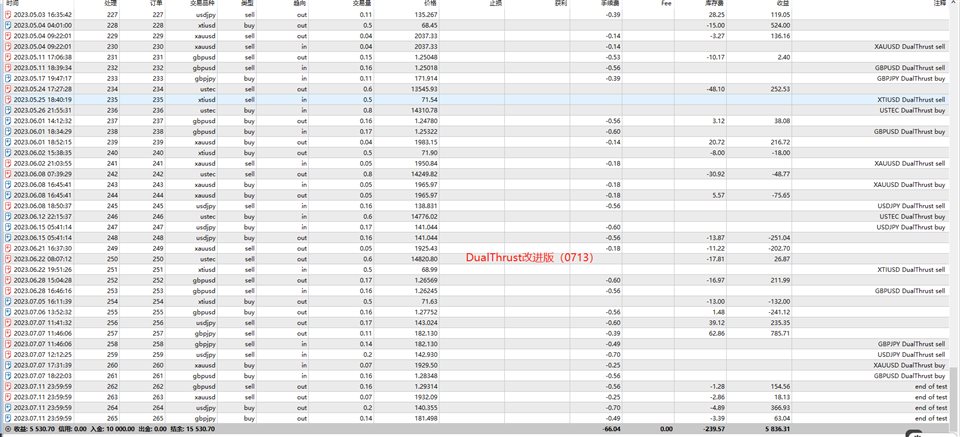

Trading rules: 1, the price breaks through the upper and lower rail to open positions; 2, only trade once a day; 3, reverse break through the upper and lower rail to close the position

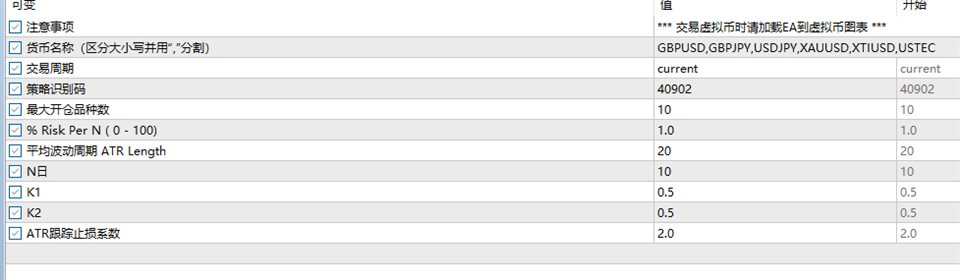

Parameter description:

-- Pairs List (comma separated) = "GBPUSD,GBPJPY,USDJPY,XAUUSD,XTIUSD,USTEC"; // List of symbols, divided by ","

- TimeFrame = PERIOD_D1; -// Trading cycle, default daily level

- MagicNumber = 40902; // Policy identifier, change to different values when multiple strategies trade the same variety

- RiskRatio = 0.5; // Opening capital ratio risk calculation coefficient

- ATR Periods = 20; // ATR calculation period

- BarsShift = 10; // High and low points calculate the number of K-lines

- Long Multiplier = 0.5; // Interval orbital calculation coefficient

- Short Multiplier = 0.5; // Interval lower rail calculation coefficient

- TrailingStop ATR Multiplier = 2; //ATR tracking stop loss coefficient, after entering the highest price or lowest price back N times ATR tracking stop loss