EA Bollinger Bands Hedge Strategy

- Experten

- Zafar Iqbal Sheraslam

- Version: 1.0

- Aktivierungen: 10

A Bollinger Bands hedge strategy is a trading strategy that utilizes Bollinger Bands to make trading decisions and manage risk. Bollinger Bands are a technical analysis tool that consists of a middle band (usually a simple moving average) and two outer bands that are typically set at a certain number of standard deviations away from the middle band. These bands expand and contract based on market volatility.

Here's a basic outline of a Bollinger Bands hedge strategy:

Objective: The primary goal of this strategy is to profit from price volatility while also managing risk through hedging.

Components:

-

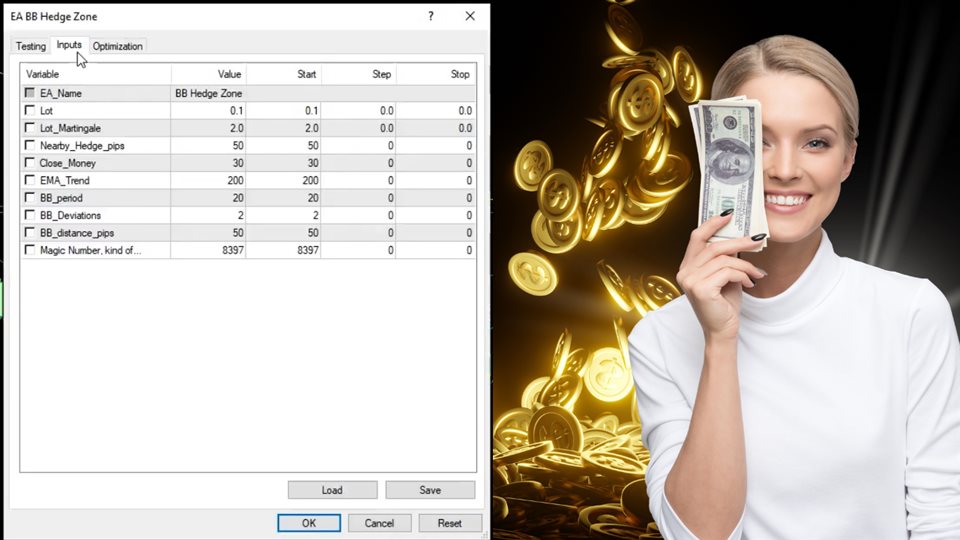

Bollinger Bands: Use Bollinger Bands with appropriate settings (commonly 20-period simple moving average and 2 standard deviations).

-

Long Position: When the price touches or crosses the lower Bollinger Band, consider taking a long position (buy) as this may indicate an oversold condition.

-

Short Position: When the price touches or crosses the upper Bollinger Band, consider taking a short position (sell) as this may indicate an overbought condition.

-

Stop-Loss Orders: Place stop-loss orders to limit potential losses. The level of the stop-loss can be set based on your risk tolerance and market conditions.

-

Hedging: To hedge your position and reduce risk, consider using options or other derivatives. For example, if you're long on a stock, you can buy put options to protect against potential downside moves. If you're short on a stock, you can buy call options for protection.

-

Risk Management: Determine your risk tolerance and position sizes based on your account size and risk management rules. Don't risk more than you can afford to lose.

-

Profit Targets: Set profit targets based on your trading strategy. These targets could be based on technical analysis, support/resistance levels, or other factors.

Considerations:

-

Volatility: Bollinger Bands work well in volatile markets. Ensure that the asset you're trading has enough volatility for this strategy to be effective.

-

Confirmation: It's essential to use other technical or fundamental analysis tools to confirm signals generated by Bollinger Bands. Relying solely on Bollinger Bands can lead to false signals.

-

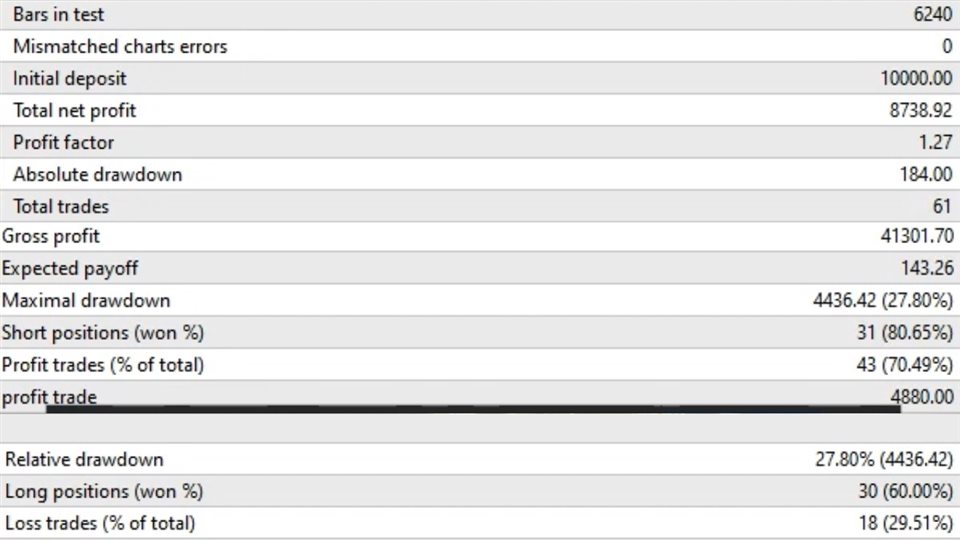

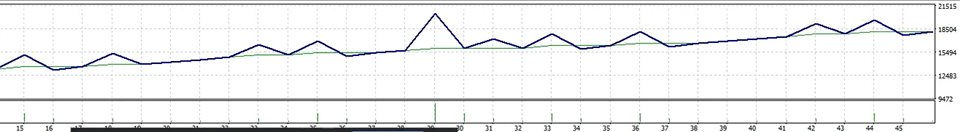

Backtesting: Before implementing this strategy with real money, consider backtesting it on historical data to see how it would have performed in the past.

-

Continuous Monitoring: Markets change, and so should your strategy. Continuously monitor your positions and adjust your strategy as needed.

-

Costs: Be mindful of transaction costs, including commissions and spreads, as they can impact the profitability of your hedge strategy.

Remember that trading in financial markets carries risks, and it's possible to incur losses. It's crucial to have a well-defined strategy, risk management plan, and discipline when implementing any trading strategy, including a Bollinger Bands hedge strategy. Additionally, seek advice from a financial advisor or professional before engaging in trading or investing activities.