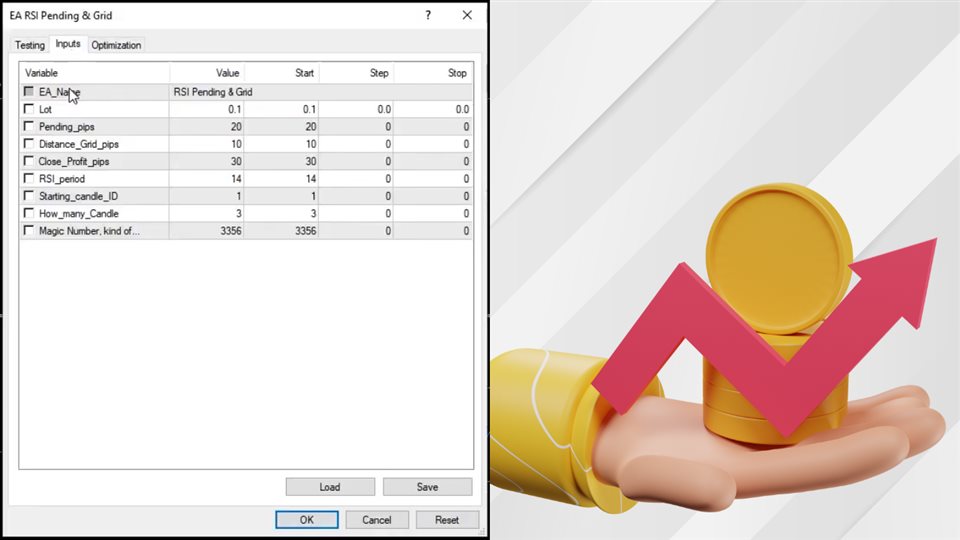

EA RSI Pending Grid

- Experten

- Zafar Iqbal Sheraslam

- Version: 1.0

- Aktivierungen: 10

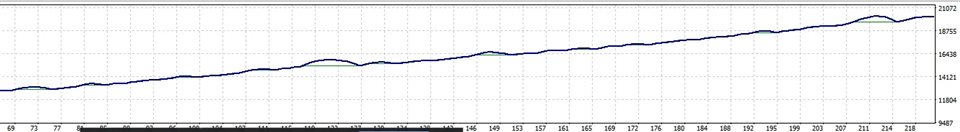

"RSI" usually refers to the Relative Strength Index, a technical indicator used in financial markets to analyze the strength or weakness of an asset's price. "Pending Grid" may suggest a specific trading strategy that combines pending orders with grid trading techniques.

-

RSI EA: RSI (Relative Strength Index) is a technical indicator used in trading to assess whether an asset is overbought or oversold. It measures the speed and change of price movements. RSI values range from 0 to 100. Typically, values above 70 suggest an asset is overbought (potentially due for a price drop), while values below 30 indicate oversold conditions (possibly due for a price increase).

-

Pending Orders: Pending orders are a type of order in trading where you specify a price level at which you want to enter or exit a trade in the future. These orders become active only when the market reaches the specified price.

-

Grid Trading: Grid trading is a strategy where you place multiple pending orders above and below the current market price at regular intervals or grid levels. These orders are usually set to capture price fluctuations within a specific range.

So, an "RSI Pending Grid" strategy likely involves using the RSI indicator to determine when an asset is overbought or oversold. When RSI conditions are met, traders may place pending buy orders below the market price if the asset is oversold or pending sell orders above the market price if the asset is overbought. These orders are placed at predefined grid levels, aiming to profit from price reversals or fluctuations.

Please note that the specifics of this strategy can vary, and it's essential to have a clear plan, risk management strategy, and a good understanding of how RSI and pending orders work before implementing such a strategy in real trading.