RandomWalk

- Indikatoren

- Stanislav Korotky

- Version: 1.1

- Aktualisiert: 24 November 2021

- Aktivierungen: 5

This indicator builds so called "random walk" bands: on every bar it finds maximal or average distance between current price and multiple expanding parabolic curves starting at predefined number of bars in the past. If you like Bollinger bands or Envelopes you may find this indicator useful as well.

As you may know, price movements are very similar to random walk time series (specifically, Gaussian random walk), yet they do effectively break the hypothesis of randomness. One of the features of the Gaussian random walk time series is that its translation distance after n steps (bars) is proportional to square root of n within a factor of some constant (deviation). Visually this can be represented as a parabolic curve originating at a specific bar and widening in direction of the future. As price fluctuates inside the parabola, it confirms the random walk hypothesis, thus such situation may be considered as random process without preferred direction, that is "flat". Once price breaks out the parabola, some deterministic process ("trend") comes into play.

The indicator calculates positions for upper and lower parabolic lines starting at each of Depth past bars, and then selects either most distant or average value (depending from Average setting) for drawing the bands.

Parameters

- Range - range of points to use as deviation; by default - 0, which means automatic calculation on one day-length number of bars for current timeframe; if calculation produces 1 or less bars (for D1 and higher), then Range is determined on last Depth bars;

- Depth - number of past bars to construct parabolas; by default - 11;

- PriceType - price type to use in calculations; by default - PRICE_CLOSE;

- Average - an option to choose one of two modes; false means to find maximal value among Depth results, true means average of Depth results; by default - false;

According to parameters used, one may trade the bands using break through or rebound strategies.

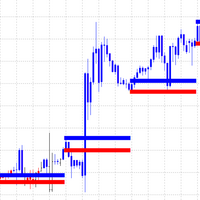

The indicator shows two thick lines as the bands (upper is blue and lower is red), and two thin lines. In the average mode the thin lines denote standard deviation from bands, and otherwise they show minimal maximums and maximal minimums of parabolic values.

While trading break through strategy the thin lines are stoploss positions, and while trading rebound they are first (partial) takeprofit position (mostly in the average mode).