MarketMagnet

- Indikatoren

- Kelly Adediran Raymond

- Version: 2.20

- Aktualisiert: 1 Juli 2023

- Aktivierungen: 10

Are you ready to take your trading journey to new heights? Look no further than MarketMagnet, this groundbreaking indicator designed to propel your trading success with excitement and accuracy. Powered by the convergence of Momentum and CCI (Commodity Channel Index), MarketMagnet equips traders with the ultimate tool to determine direction and entry prices for a wide range of recommended currency pairs and instruments. It is designed for traders seeking to scalp for a few pips on lower timeframes to hundreds of pips on higher timeframes. If you are a beginner, an intermediate level trader who is having issues with consistency and strategy hunting or a professional who seeks to discover another trading edge then this indicator is for you.

Advantages:

-

Early Entries: MarketMagnet stands out by providing traders with early entry opportunities. By leveraging the combined power of Momentum and CCI, this indicator allows you to spot potential trades at the inception of a trend, continuation of a trends, entry into pull-backs and enabling you to seize opportunities before the crowd.

-

Precision and Accuracy: MarketMagnet's methodology incorporates rigorous analysis and complex algorithms, providing traders with reliable signals that yield precise entry position. With its robust design, this indicator helps eliminate guesswork and enhances trading decisions with a scientific edge.

-

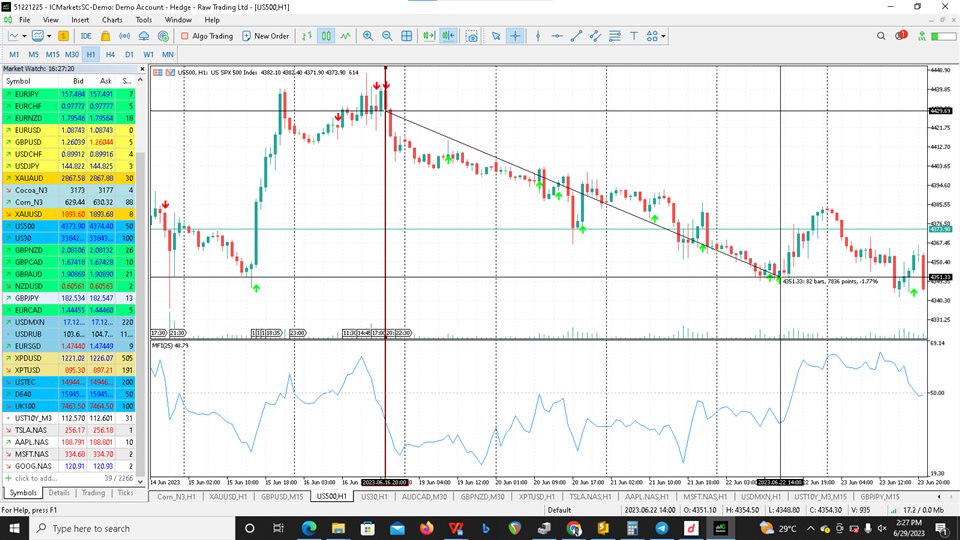

Diversified Opportunities: MarketMagnet is not limited to a single currency pair or market segment. It caters to the needs of both forex and stock traders, offering recommended pairs such as GBPUSD, XAUUSD, Dow Jones, S&P500, and even popular stocks like TSLA. This versatility allows you to explore various markets and maximize your profit potential.

-

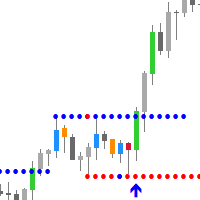

Streamlined Decision-Making: With MarketMagnet, traders can make informed decisions efficiently. The indicator's user-friendly interface simplifies complex data into clear and actionable signals, empowering you to navigate the market with confidence and agility. It is as simple as placing a buy when there is an arrow up and placing a sell order when the arrow down appears on your chart.

-

Tailored Time Frames: MarketMagnet adapts to your trading style and preferences by offering flexibility in time frames. Whether you prefer shorter time frames for quick trades or longer time frames for comprehensive analysis, this indicator has you covered, allowing you to optimize your strategies based on your preferred trading horizon.

Disadvantages:

-

Early Entry Fake-Outs: While MarketMagnet excels at identifying early entry points, it is important to acknowledge the possibility of fake-outs. Due to the volatile nature of the market, early entries may sometimes result in false signals. Traders must exercise caution and employ appropriate risk management strategies to mitigate potential losses. In order to reduce fake-outs and false signals please read till last paragraph (It is crucial).

-

Learning Curve: MarketMagnet is a sophisticated indicator that requires traders to familiarize themselves with its methodology and interpretation. As with any powerful tool, it may take some time to grasp the intricacies and harness its full potential. However, with discipline, you will have a solid understanding of the indicator and its filter then the rewards can be substantial.

To better understand the capabilities and intricacies of MarketMagnet, let's explore some frequently asked questions (FAQs):

- How does MarketMagnet identify the convergence of Momentum and CCI? This indicator weighs the momentum of the price in either direction and confirms the influence the price has in relation to the timeframe to determine the direction of the price and whether or not the perceived momentum has the required volume to reverse or continue a trend.

- What specific parameters does the indicator utilize to generate signals? Velocity/Price, Momentume/Volume.

- Can I customize the indicator's settings based on my trading preferences? Certainly, however, we advice the user to consider changing timeframes of the instrument rather than modifying the settings or overfitting it to a particular trading conditions.

- How often does MarketMagnet generate signals? Are they time-sensitive? It all depends on the chosen timeframe. M5 will produce more signals for shorter trends while higher timeframes would produce less signals. NB: Not all signals generated by the indicator is tradeable without consulting the filter as indicated below.

- Can I use MarketMagnet as a standalone tool, or should I combine it with other indicators? We have recommended a filter to enable users enjoy the most benefit of the indicator. More updates may help reduce its dependency on other filters.

- Does MarketMagnet provide any exit signals or guidance for trade management? No. That decision is solely the responsibility of the end user. However, we may make suggestions on and exit strategies especially for traders who prefer to trade on lower timeframes.

- Are there any specific trade management strategies or recommendations associated with MarketMagnet? No. MarketMagnet only gives entry signals. The confirmation of those entries is the responsibility of the trader, the management and exit of those trades are essentially the responsibility of the trader.

- How can I effectively use MarketMagnet in different market conditions, such as trending or ranging markets? MarketMagnet works in both trending and ranging market conditions. It shines during a trend especially when used with its recommended filter.

- Can I backtest MarketMagnet's performance to assess its historical accuracy? Yes.

- Does MarketMagnet offer any additional features or support, such as user forums or educational resources? Yes, we usually respond to private messages in a few minutes. Except of weekends and public holidays.

In order to make the most of MarketMagnet, you need to use a filter and the only indicator we recommend is a Money Flow Index which is a volume indicator. The following is the settings for the Money Flow Indicator (MFA).

Parameters Tab:

Period: 25

Volume: Tick

Levels Tab:

Level: 50

For a BUY Signal wait for the MarketMagnet to display an arrow up. Now, you will have to confirm that the Money Flow Index indicator is above 50. If the conditions are true, place a BUY trade.

For a SELL Signal wait for the MarketMagnet to display an arrow down. You will also have to confirm that the Money Flow Index Indicator is below 50. If the conditions are true, place a SELL Trade.

With MarketMagnet, you have the opportunity to unlock a world of profit potential. Even though this indicator was designed for scalping the trend, it could also lead to longer trends. This groundbreaking indicator combines the power of Momentum and CCI, providing you with early entries, precision, and versatility across multiple currency pairs and instruments. Harnessing the power of MarketMagnet, you can navigate the dynamic world of trading with confidence, excitement, and the potential for exceptional returns. Are you ready to embark on this thrilling journey and revolutionize your trading experience? The choice is yours – seize the power of MarketMagnet today!