Discussion of article "Data Science and Machine Learning (Part 11): Naïve Bayes, Probability theory in Trading"

everything is good and wonderful, but the only thing is that the taken indicators are not independent, they are mutual transposition of one and the same thing. You can deduce the others from the readings of one and the formulas are known.

Bayes won't do anything.

Just downloading it and running it in a tester is a bit of a drain. In the article I did not find instructions "to teach, press X"

Something for academics again.

everything is good and wonderful, but the only thing is that the taken indicators are not independent, they are mutual transposition of one and the same thing. The readings of one can be used to derive the others, and the formulas are known

Bayes won't do anything.

I did study probabilities at university when I was doing my financial planning degree.

I've never used probabilities in trading in their traditional "probability formula" sense of "Probability = Number of favorable outcomes / Total number of outcomes" for analysis, though I probably should!

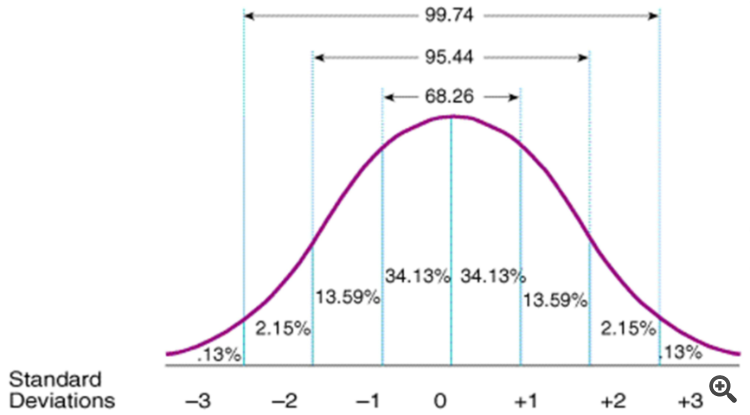

With that said, realistically that's what standard deviations are anyway, in that they provide the deviation (and therefore the probability of reversal or continuation) of trades from the mean over a given timespan. (i.e. if the price is approaching SD1 there's a 68% probability of returning back towards the mean, if it's reached SD2, a 95.5% probability, and SD3, a 99.7% probability), so Standard Deviations can be very handy when it comes to gauging when trade positions are likely to turn and head the opposite direction, especially if you use something like a Standard Deviation Channel.

I can certainly see the possible applications of probabilities when it comes to neural network analysis in ANN training and reflection, though!

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

New article Data Science and Machine Learning (Part 11): Naïve Bayes, Probability theory in Trading has been published:

Trading with probability is like walking on a tightrope - it requires precision, balance, and a keen understanding of risk. In the world of trading, the probability is everything. It's the difference between success and failure, profit and loss. By leveraging the power of probability, traders can make informed decisions, manage risk effectively, and achieve their financial goals. So, whether you're a seasoned investor or a novice trader, understanding probability is the key to unlocking your trading potential. In this article, we'll explore the exciting world of trading with probability and show you how to take your trading game to the next level.

Naïve Bayes classifier is a probabilistic algorithm used in machine learning for classification tasks. It is based on Bayes' theorem, which calculates the probability of a hypothesis given the available evidence. This probabilistic classifier is a simple yet effective algorithm in various situations. It assumes that the features used for classification are independent of each other. For example: If you want this model to classify humans(male and female) given height, foot size, weight, and shoulder length, this model treats all these variables as independent of each other, In this case, it doesn't even think that foot size and height are related for a human.

Since this model doesn't bother understanding the patterns between the independent variables, I think we should give it a shot by trying to use it to make informed trading decisions. I believe in the trading space nobody fully understands the patterns anyway so, let's see how the Naïve Bayes performs.

Author: Omega J Msigwa