Proximity to the series is not necessary. The curve can be anything, as long as it gives signals on the transition of the derivative through 0.

Smoothing will not eliminate false signals - due to the lag, new ones that were good before will appear.

One can simply limit the number of entries(open positions) and enter only on the [more] global trend.

Not enough arrows drawn :)

And if you take into account all the signals with their triggering prices, the loss is greater than the profit.

To filter out false signals is a super task, imho.

The only solution is a lag price (longer МА period), but it is not the best option.

I would like to understand the signs by which you can tell whether an indicator is a waving machine or not.

Pp. 2 and 3 are questionable, of course.

2. there will still be false signals (the picture may show a much tighter flat with its inherent thick tails on returns). Accordingly requirement of smoothness at least means some delay - for example entrance only by formed bars. These thick tails are an ambush, which forex often creates: the pattern on completed bars gives us an entry signal, but too late, because the last bar has already gone too far during its formation. This is actually a double lost profit - both on entry and exit. In case of a small amplitude of the mouve segment itself, we may well lose on the position - despite the fact that the mouve curve was located "correctly" and should seem to lead to a profit. Well, we all pretty much know what a flat is.

3. our chopped curve will not look monotonous due to the deadly delay, as it will not be "glued" together from the muve sections. Very likely it will appear as a curve with rare and strong upslope sections (on trends) and much more frequent shallow downslope sections (on flattens) - with m.o.s. of the order of zero.

Maybe smoothness should be abandoned? Or maybe it is better to retain smoothness, but allow overcorrection? No, no, not a peek into the future, but exactly and only a redrawing.

And lastly, already on point 1. I'm not sure that proximity to the BP curve should be a requirement. For example, introducing differentiation makes the phase delay smaller, but leads to small spikes near chart extrema (like LRMA). And it's a nice, smooth mashup, after all!

P.S. This just occurred to me about the redrawing indikators. Systems based on redrawing indicators that don't look into the future can be tested. Instead of calculating all historical indicators in advance, let's do the calculations "on the fly", at the moment of a trade operation in the Expert Advisor. Let them redraw later, to hell with them. The testing results will still correspond to reality.

Proximity to the series is not necessary. The curve can be anything, as long as it gives signals on the transition of the derivative through 0.

It is not a matter of principle. If you can ensure the closeness, it seems better to do it - the picture will be clearer.

Smoothness cannot exclude false signals - due to lag new ones will appear that were good before.

But, smoothness will allow us in the future to use standard mapper to solve the problem. In case of non-smooth function it becomes so complicated, that I don't know how to solve such problems. Therefore, there is no choice - only smooth!

We can simply limit the number of entries (open positions) and enter only on the [more] global trend.

It's not principal - if you want you can go to a stronger smoothing that solves the problem you mentioned.

goldtrader 19.01.2009 13:31.

It is a super task to filter out false signals, imho.

This task is a top priority for our EA. Let it be solved! Otherwise we may not need all this fuss.

2) False signals will be present anyway (the picture may show a much firmer flat with thick tails inherent in it). Accordingly the requirement of smoothness at least means some delay - for example, entrance only by formed bars.

Maybe smoothness should be rejected? Or maybe it's better to keep smoothness but allow overdrawing? No, no, not a peek into the future, but exactly and only a redrawing.

Mathemat, I can strictly show, that from the point of view of concrete TS there is no difference, if it will work by re-rating indicator or by lagging one (all other conditions being equal). Therefore, we can talk about re-risings/lagging only if we suppose their close connection. Let's talk about "overrift/lag" in terms of FZ, i.e. lagging, it is more academic and correct from the common sense point of view. Further on your post are variations on the same topic.

Let us formulate the basic requirements that such a smooth curve must satisfy:

1. proximity to the original BP. This is understandable - we should not draw the MA on the moon.

2. Smoothness. It must not produce "false signals".

About the authorship of the idea, I'm willing to argue. Most likely this idea is as old as the MA. :))

And in general the subject is interesting for me - I am engaged in it. Naturally, not everything is as beautiful as in your drawing. It clearly lacks a lot of arrows.

Now in order:

- The signal for opening/reversal should in practice be an inflection of the MA. Equality of the derivative to zero will give a "shelf" after which the MA may move in the same direction.

- The main requirement of point 1 will always be in conflict with point 2.

- To make МА close to the ideal, it should be adaptive.

So far I believe that such a system will not give profit without an aggressive MM.

This is the task that is being prioritised for our Masha. Let her decide! Or else we don't need all this fuss.

Is the target function based on the reference to the outline?

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

We all know the disadvantages of moving averages - lagging and/or overdrawing on the right side of the quotient. The essence of this phenomenon is a fundamental inability to see into the future, and nature will do anything to stop us from breaking its fundamental laws. This is not to say that we cannot predict the future, but a time series analysis (TSA) can reveal hidden patterns and exploit them successfully in one way or another. Unfortunately, the use of common algorithms for creating moving average prices does not lead to profitable TS on their basis. Now let us assume that there is a natural algorithm for МА, which is the best (profitable) one for a trader. Let us try to construct it from general considerations.

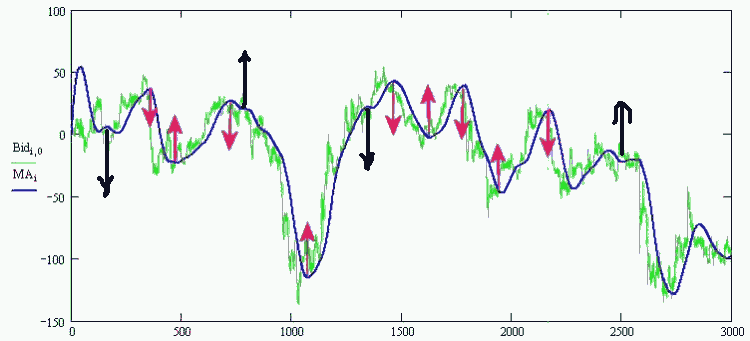

Suppose we have initial BP (series Open H1, the figure shows green) and a muving that smoothes this kotir (blue) and by the signals from which our EA opens/closes positions (arrows). We will enter the market immediately after the exit and always in the opposite direction (see fig.), the signal to open a position will be equal to zero derivative of our "ideal" MA (the place of its breaks).

Let us formulate the basic requirements that such a smooth curve should meet:

1. closeness to the initial BP. It is clear - we should not draw the MA on the moon.

2. Smoothness. It must not produce "false signals".

3. The Equity curve, which will be made up of chopped from the initial BP (arrow to arrow), should be increasing.

If this is all, we can begin to construct a functional, which minimization will allow to get a recursive digital low pass filter that is optimal in terms of speed of growth of balance on the account, for TS working on its signals.

Suggestions/additions are accepted!

P.S. The idea belongs to me and Korey. The outline here.