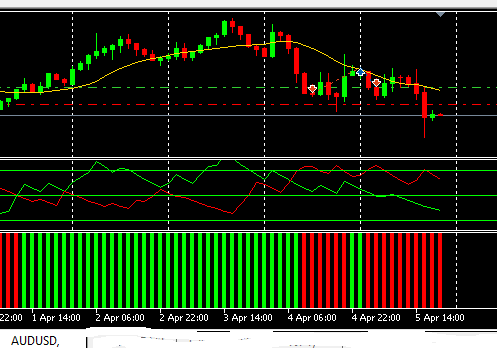

Quite ironic, after posting my points just take a look below

EUR/USD, oh boy!!!

The normal correlations were way off today and I got bit.

But coding in something like that with EUR/USD and GBP/USD would be

ideal. I have noticed that the AUD/USD is less correlated overall than

those two are with each other.

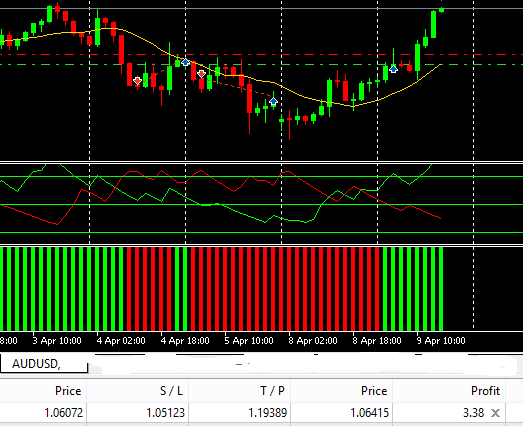

If there were an easy way to get the Dollar index (DX) futures chart data or the data found on this page

into an indicator (only USD vs many other pairs), then I think you

would have the best deal of all. "How is the USD fairing vs all the

other majors?" That is what I want to know. Then I can take the

weakest or strongest of the USD based majors and head off to FX nirvana

(for a few pips anyway). (see below)

The normal correlations were way off today and I got bit.

But coding in something like that with EUR/USD and GBP/USD would be

ideal. I have noticed that the AUD/USD is less correlated overall than

those two are with each other.

If there were an easy way to get the Dollar index (DX) futures chart data or the data found on this page

into an indicator (only USD vs many other pairs), then I think you

would have the best deal of all. "How is the USD fairing vs all the

other majors?" That is what I want to know. Then I can take the

weakest or strongest of the USD based majors and head off to FX nirvana

(for a few pips anyway). (see below)

There is one other method describe in dailyfx website

If trading eur/usd, your look for all eur pair and usd pair

If eur is up, you give one point, if usd is up, you give one point

then you compare the points and trade

There is one other method describe in dailyfx website

If trading eur/usd, your look for all eur pair and usd pair

If eur is up, you give one point, if usd is up, you give one point

then you compare the points and trade

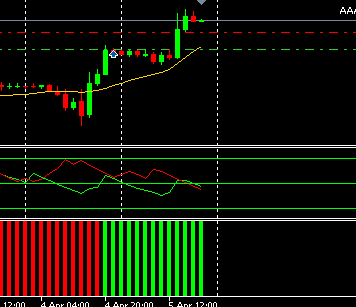

TT, wasn't to far from my prediction about the AUD/USD, since posting the rise has been stellar.

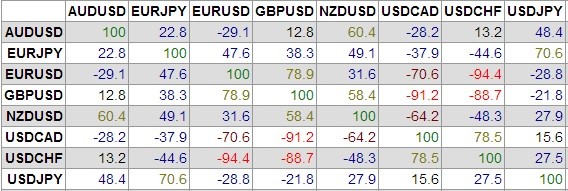

I was some time ago looking at correlations between currencies and found the following on forexticket.us on the daily :

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Watching for "market moves" where many instruments move in unison is a great way to stay on the right side of the market. Equities and Oil and EUR/USD often move together and when they are all going up, you should not be shorting the market. Similarly, two FX pairs can be correlated positively or negatively, and by watching one, you can have a good idea what the other one might be doing.

EUR/USD, GBP/USD, and AUD/USD are often correlated well because they all share the USD as the base currency. Same thing with the EUR/JPY, GBP/JPY, and the AUD/JPY because of JPY.

But what about other FX pairs? I just found a great free Currency Correlation tool from Oanda. (Click on the link and then click on different pairs and click across the top.) (Red is + and Blue is -)

So what to do with it? You can quickly see what to watch and what not to watch if you want to be the master EUR/USD trader. Of course you would NOT watch a chart of the USD/CHF, but would probably choose the GBP/USD (1 hr and 1 day) or the EUR/AUD (1 hr and 1-12 months)

If you were programming an EA, you could check to make sure that the pair you were trading was "in sync" with another pair that has a consistent correlation.

Please post how YOU have used any types of correlation in your FX trading.