Statistical Arbitrage with predictions

We will walk around statistical arbitrage, we will search with python for correlation and cointegration symbols, we will make an indicator for Pearson's coefficient and we will make an EA for trading statistical arbitrage with predictions done with python and ONNX models.

Neural networks made easy (Part 32): Distributed Q-Learning

We got acquainted with the Q-learning method in one of the earlier articles within this series. This method averages rewards for each action. Two works were presented in 2017, which show greater success when studying the reward distribution function. Let's consider the possibility of using such technology to solve our problems.

Timeseries in DoEasy library (part 54): Descendant classes of abstract base indicator

The article considers creation of classes of descendant objects of base abstract indicator. Such objects will provide access to features of creating indicator EAs, collecting and getting data value statistics of various indicators and prices. Also, create indicator object collection from which getting access to properties and data of each indicator created in the program will be possible.

How we developed the MetaTrader Signals service and Social Trading

We continue to enhance the Signals service, improve the mechanisms, add new functions and fix flaws. The MetaTrader Signals Service of 2012 and the current MetaTrader Signals Service are like two completely different services. Currently, we are implementing A Virtual Hosting Cloud service which consists of a network of servers to support specific versions of the MetaTrader client terminal.

Automating The Market Sentiment Indicator

In this article, we automate a custom market sentiment indicator that classifies market conditions into bullish, bearish, risk-on, risk-off, and neutral. The Expert Advisor delivers real-time insights into prevailing sentiment while streamlining the analysis process for current market trends or direction.

Understanding Programming Paradigms (Part 2): An Object-Oriented Approach to Developing a Price Action Expert Advisor

Learn about the object-oriented programming paradigm and its application in MQL5 code. This second article goes deeper into the specifics of object-oriented programming, offering hands-on experience through a practical example. You'll learn how to convert our earlier developed procedural price action expert advisor using the EMA indicator and candlestick price data to object-oriented code.

Reimagining Classic Strategies (Part 12): EURUSD Breakout Strategy

Join us today as we challenge ourselves to build a profitable break-out trading strategy in MQL5. We selected the EURUSD pair and attempted to trade price breakouts on the hourly timeframe. Our system had difficulty distinguishing between false breakouts and the beginning of true trends. We layered our system with filters intended to minimize our losses whilst increasing our gains. In the end, we successfully made our system profitable and less prone to false breakouts.

Automating Trading Strategies in MQL5 (Part 15): Price Action Harmonic Cypher Pattern with Visualization

In this article, we explore the automation of the Cypher harmonic pattern in MQL5, detailing its detection and visualization on MetaTrader 5 charts. We implement an Expert Advisor that identifies swing points, validates Fibonacci-based patterns, and executes trades with clear graphical annotations. The article concludes with guidance on backtesting and optimizing the program for effective trading.

How to create a simple Multi-Currency Expert Advisor using MQL5 (Part 3): Added symbols prefixes and/or suffixes and Trading Time Session

Several fellow traders sent emails or commented about how to use this Multi-Currency EA on brokers with symbol names that have prefixes and/or suffixes, and also how to implement trading time zones or trading time sessions on this Multi-Currency EA.

How to create a simple Multi-Currency Expert Advisor using MQL5 (Part 7): ZigZag with Awesome Oscillator Indicators Signal

The multi-currency expert advisor in this article is an expert advisor or automated trading that uses ZigZag indicator which are filtered with the Awesome Oscillator or filter each other's signals.

Neural Networks in Trading: A Multi-Agent System with Conceptual Reinforcement (FinCon)

We invite you to explore the FinCon framework, which is a a Large Language Model (LLM)-based multi-agent system. The framework uses conceptual verbal reinforcement to improve decision making and risk management, enabling effective performance on a variety of financial tasks.

Developing a trading Expert Advisor from scratch (Part 13): Time and Trade (II)

Today we will construct the second part of the Times & Trade system for market analysis. In the previous article "Times & Trade (I)" we discussed an alternative chart organization system, which would allow having an indicator for the quickest possible interpretation of deals executed in the market.

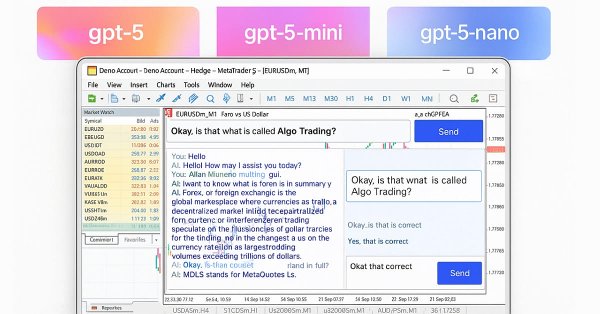

Building AI-Powered Trading Systems in MQL5 (Part 2): Developing a ChatGPT-Integrated Program with User Interface

In this article, we develop a ChatGPT-integrated program in MQL5 with a user interface, leveraging the JSON parsing framework from Part 1 to send prompts to OpenAI’s API and display responses on a MetaTrader 5 chart. We implement a dashboard with an input field, submit button, and response display, handling API communication and text wrapping for user interaction.

Price Action Analysis Toolkit Development (Part 42): Interactive Chart Testing with Button Logic and Statistical Levels

In a world where speed and precision matter, analysis tools need to be as smart as the markets we trade. This article presents an EA built on button logic—an interactive system that instantly transforms raw price data into meaningful statistical levels. With a single click, it calculates and displays mean, deviation, percentiles, and more, turning advanced analytics into clear on-chart signals. It highlights the zones where price is most likely to bounce, retrace, or break, making analysis both faster and more practical.

Neural Networks in Trading: Parameter-Efficient Transformer with Segmented Attention (Final Part)

In the previous work, we discussed the theoretical aspects of the PSformer framework, which includes two major innovations in the classical Transformer architecture: the Parameter Shared (PS) mechanism and attention to spatio-temporal segments (SegAtt). In this article, we continue the work we started on implementing the proposed approaches using MQL5.

Neural networks made easy (Part 76): Exploring diverse interaction patterns with Multi-future Transformer

This article continues the topic of predicting the upcoming price movement. I invite you to get acquainted with the Multi-future Transformer architecture. Its main idea is to decompose the multimodal distribution of the future into several unimodal distributions, which allows you to effectively simulate various models of interaction between agents on the scene.

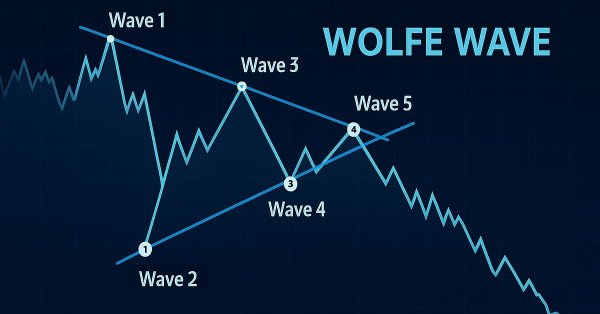

Introduction to MQL5 (Part 19): Automating Wolfe Wave Detection

This article shows how to programmatically identify bullish and bearish Wolfe Wave patterns and trade them using MQL5. We’ll explore how to identify Wolfe Wave structures programmatically and execute trades based on them using MQL5. This includes detecting key swing points, validating pattern rules, and preparing the EA to act on the signals it finds.

Reimagining Classic Strategies (Part 15): Daily Breakout Trading Strategy

Human traders had long participated in financial markets before the rise of computers, developing rules of thumb that guided their decisions. In this article, we revisit a well-known breakout strategy to test whether such market logic, learned through experience, can hold its own against systematic methods. Our findings show that while the original strategy produced high accuracy, it suffered from instability and poor risk control. By refining the approach, we demonstrate how discretionary insights can be adapted into more robust, algorithmic trading strategies.

Introduction to MQL5 (Part 15): A Beginner's Guide to Building Custom Indicators (IV)

In this article, you'll learn how to build a price action indicator in MQL5, focusing on key points like low (L), high (H), higher low (HL), higher high (HH), lower low (LL), and lower high (LH) for analyzing trends. You'll also explore how to identify the premium and discount zones, mark the 50% retracement level, and use the risk-reward ratio to calculate profit targets. The article also covers determining entry points, stop loss (SL), and take profit (TP) levels based on the trend structure.

How to build and optimize a volatility-based trading system (Chaikin Volatility - CHV)

In this article, we will provide another volatility-based indicator named Chaikin Volatility. We will understand how to build a custom indicator after identifying how it can be used and constructed. We will share some simple strategies that can be used and then test them to understand which one can be better.

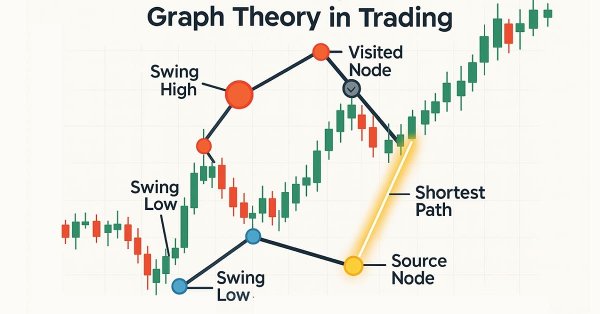

Graph Theory: Dijkstra's Algorithm Applied in Trading

Dijkstra's algorithm, a classic shortest-path solution in graph theory, can optimize trading strategies by modeling market networks. Traders can use it to find the most efficient routes in the candlestick chart data.

Build Self Optimizing Expert Advisors in MQL5 (Part 3): Dynamic Trend Following and Mean Reversion Strategies

Financial markets are typically classified as either in a range mode or a trending mode. This static view of the market may make it easier for us to trade in the short run. However, it is disconnected from the reality of the market. In this article, we look to better understand how exactly financial markets move between these 2 possible modes and how we can use our new understanding of market behavior to gain confidence in our algorithmic trading strategies.

MetaTrader 5 Machine Learning Blueprint (Part 1): Data Leakage and Timestamp Fixes

Before we can even begin to make use of ML in our trading on MetaTrader 5, it’s crucial to address one of the most overlooked pitfalls—data leakage. This article unpacks how data leakage, particularly the MetaTrader 5 timestamp trap, can distort our model's performance and lead to unreliable trading signals. By diving into the mechanics of this issue and presenting strategies to prevent it, we pave the way for building robust machine learning models that deliver trustworthy predictions in live trading environments.

Price Action Analysis Toolkit Development (Part 17): TrendLoom EA Tool

As a price action observer and trader, I've noticed that when a trend is confirmed by multiple timeframes, it usually continues in that direction. What may vary is how long the trend lasts, and this depends on the type of trader you are, whether you hold positions for the long term or engage in scalping. The timeframes you choose for confirmation play a crucial role. Check out this article for a quick, automated system that helps you analyze the overall trend across different timeframes with just a button click or regular updates.

Introduction to MQL5 (Part 14): A Beginner's Guide to Building Custom Indicators (III)

Learn to build a Harmonic Pattern indicator in MQL5 using chart objects. Discover how to detect swing points, apply Fibonacci retracements, and automate pattern recognition.

Revisiting Murray system

Graphical price analysis systems are deservedly popular among traders. In this article, I am going to describe the complete Murray system, including its famous levels, as well as some other useful techniques for assessing the current price position and making a trading decision.

Expert Advisors Based on Popular Trading Strategies and Alchemy of Trading Robot Optimization (Part VI)

In this article, the author proposes the way of improving trading systems presented in his previous articles. The article is of interest for traders already having experiences in writing Expert Advisors.

Neural networks made easy (Part 31): Evolutionary algorithms

In the previous article, we started exploring non-gradient optimization methods. We got acquainted with the genetic algorithm. Today, we will continue this topic and will consider another class of evolutionary algorithms.

Self Optimizing Expert Advisors in MQL5 (Part 9): Double Moving Average Crossover

This article outlines the design of a double moving average crossover strategy that uses signals from a higher timeframe (D1) to guide entries on a lower timeframe (M15), with stop-loss levels calculated from an intermediate risk timeframe (H4). It introduces system constants, custom enumerations, and logic for trend-following and mean-reverting modes, while emphasizing modularity and future optimization using a genetic algorithm. The approach allows for flexible entry and exit conditions, aiming to reduce signal lag and improve trade timing by aligning lower-timeframe entries with higher-timeframe trends.

Mastering Fair Value Gaps: Formation, Logic, and Automated Trading with Breakers and Market Structure Shifts

This is an article that I have written aimed to expound and explain Fair Value Gaps, their formation logic for occurring, and automated trading with breakers and market structure shifts.

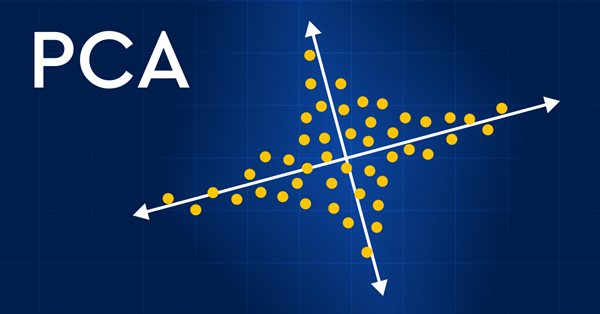

Data Science and Machine Learning (Part 13): Improve your financial market analysis with Principal Component Analysis (PCA)

Revolutionize your financial market analysis with Principal Component Analysis (PCA)! Discover how this powerful technique can unlock hidden patterns in your data, uncover latent market trends, and optimize your investment strategies. In this article, we explore how PCA can provide a new lens for analyzing complex financial data, revealing insights that would be missed by traditional approaches. Find out how applying PCA to financial market data can give you a competitive edge and help you stay ahead of the curve

Timeseries in DoEasy library (part 47): Multi-period multi-symbol standard indicators

In this article, I will start developing the methods of working with standard indicators, which will ultimately allow creating multi-symbol multi-period standard indicators based on library classes. Besides, I will add the "Skipped bars" event to the timeseries classes and eliminate excessive load from the main program code by moving the library preparation functions to CEngine class.

Creating an EA that works automatically (Part 10): Automation (II)

Automation means nothing if you cannot control its schedule. No worker can be efficient working 24 hours a day. However, many believe that an automated system should operate 24 hours a day. But it is always good to have means to set a working time range for the EA. In this article, we will consider how to properly set such a time range.

Cycles and trading

This article is about using cycles in trading. We will consider building a trading strategy based on cyclical models.

MQL5 Market Results for Q2 2013

Successfully operating for 1.5 years, MQL5 Market has become the largest traders' store of trading strategies and technical indicators. It offers around 800 trading applications provided by 350 developers from around the world. Over 100.000 trading programs have already been purchased and downloaded by traders to their MetaTrader 5 terminals.

Neural networks made easy (Part 49): Soft Actor-Critic

We continue our discussion of reinforcement learning algorithms for solving continuous action space problems. In this article, I will present the Soft Actor-Critic (SAC) algorithm. The main advantage of SAC is the ability to find optimal policies that not only maximize the expected reward, but also have maximum entropy (diversity) of actions.

Neural Networks in Trading: An Agent with Layered Memory

Layered memory approaches that mimic human cognitive processes enable the processing of complex financial data and adaptation to new signals, thereby improving the effectiveness of investment decisions in dynamic markets.

Developing a Replay System — Market simulation (Part 21): FOREX (II)

We will continue to build a system for working in the FOREX market. In order to solve this problem, we must first declare the loading of ticks before loading the previous bars. This solves the problem, but at the same time forces the user to follow some structure in the configuration file, which, personally, does not make much sense to me. The reason is that by designing a program that is responsible for analyzing and executing what is in the configuration file, we can allow the user to declare the elements he needs in any order.

Developing a trading Expert Advisor from scratch (Part 11): Cross order system

In this article we will create a system of cross orders. There is one type of assets that makes traders' life very difficult for traders — futures contracts. But why do they make life difficult?

MQL5 Wizard Techniques you should know (Part 09): Pairing K-Means Clustering with Fractal Waves

K-Means clustering takes the approach to grouping data points as a process that’s initially focused on the macro view of a data set that uses random generated cluster centroids before zooming in and adjusting these centroids to accurately represent the data set. We will look at this and exploit a few of its use cases.