The Golden Rule of Traders

Introduction

The main task of a trader is not only to find the right time to enter the market. It is also necessary to find the right moment to exit it. The golden rule of trading says: "Always cut your losses short and let your profits run".

To make profit based on a high mathematical expectation, we must understand three basic principles of good trading.

- Know your risk when entering the market (that is an initial Stop Loss value);

- Cut your profits short and allow your profits to run (do not close your position before it is required by your system);

- Know the mathematical expectation of your system – test and adjust it regularly.

Step-by-Step Positions Trailing Method Allowing Profits to Run

Many think that it is impossible to make profit, as we do not know where the market will go. But do we really need to know that to trade successfully? Successful trading is mostly based on a properly designed system considering suitable moments for entering the market. Such considerations are made using the power of expectation and the rules of step-by-step positions trailing that allow profit to run for the highest possible level.

The market entry moment can be found in many ways, for example, using candlesticks models, wave models, etc. At the same time, the profit factor must be considered (profit/loss ratio).

This method is based on the following requirement: a trader selects the lowest possible Stop Loss value when opening a position. That value can be determined using various methods, for

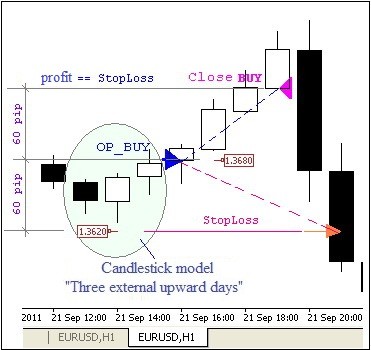

example, it may be equal to 1.5% of the deposit. When the market reaches a profit equal to Stop Loss value, the half of the lot is closed but Stop Loss is not changed!

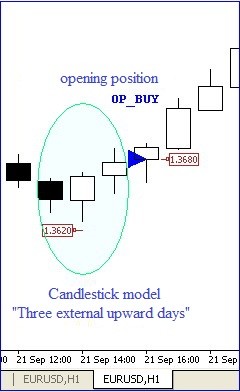

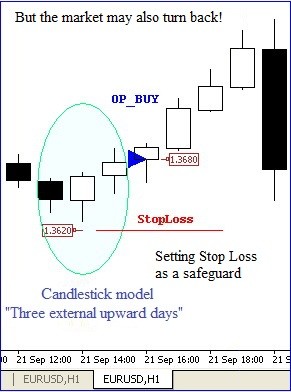

Therefore, we create a sort of a safety net, in case the market goes the opposite way. I.e., we reduce our risk by fixing the minimum losses. If the market moved in favorable direction just to turn back some time later, Stop Loss is triggered (Fig. 1-3).

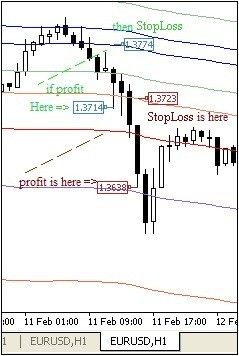

Fig. 1. Opening a position

Fig. 2. Setting Stop Loss

if the market has turned back:

Fig. 3. If the market has turned back, you are at break-even level

Position Trailing Program Code

We offer a program code trailing open positions and actualizing the second golden principle, as it allows profit to run for the highest possible level.

If the market still moves in favorable direction and reaches some predetermined value, for example, 100 pips, Stop Loss is reset to a break-even level. Further resets are made when reaching the profit in predetermined intervals, for example, 50 pips. We can move Stop Loss at each next bar but brokers do not like frequent resets, especially when the trade is performed on the lower timeframes. The error file (stdlib.mq4) from the libraries folder even has the error # 8 error="too frequent requests" exactly for that case.

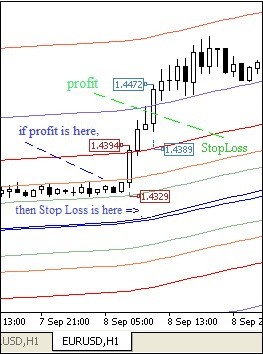

The method for determining each next Stop Loss level is selected by a price position at the time of gaining a profit depending on the Fibonacci levels. Applied Fibonacci levels are built according to Vegas Tunnel method here.

Fibonacci levels calculation is performed by LevelFibo() levels generation function:

//+------------------------------------------------------------------+ void LevelFibo() { double Fb1,Fb2,Fb3,Fb4,Fb5,Fb6,Fb7,Fb8,Fb9,Fb10,Fb11,Fb12,Fb13; // "Vegas" channel double Ma144_1 = iMA(NULL,0,144,0,MODE_EMA,PRICE_CLOSE,1); double Ma169_1 = iMA(NULL,0,169,0,MODE_EMA,PRICE_CLOSE,1); // "Vegas" channel median double MedVegas=NormalizeDouble((Ma144_1+Ma169_1)/2,Digits); // calculate Fibo levels values using "Vegas" method Fb1=MedVegas-377*Point; Fb12=MedVegas+377*Point; Fb2=MedVegas-233*Point; Fb11=MedVegas+233*Point; Fb3=MedVegas-144*Point; Fb10=MedVegas+144*Point; Fb4=MedVegas-89*Point; Fb9=MedVegas+89*Point; Fb5=MedVegas-55*Point; Fb8=MedVegas+55*Point; Fb6=MedVegas-34*Point; Fb7=MedVegas+34*Point; } //+------------------------------------------------------------------+

When calculating Stop Loss for BUY positions, the profit is the difference between Max price of the first bar High[1] and position opening level OrderOpenPrice(). Stop Loss level is defined as the "closest" Fibonacci level relative to the Min value of the first bar Low[1] (Fig. 4).

Fig. 4. Stop Loss calculation for BUY position

When calculating Stop Loss for SELL positions, the profit is the difference between position opening level OrderOpenPrice() and Max price of the first bar High[1] (Fig. 5).

Fig. 5. Stop Loss calculation for SELL position

For Buy positions, Stop Loss values are based on Fibo levels. Depending on the lowest value of the first candlestick, it is presented as a separate function.

The function code is shown below:

//+---------------------------------------------------------------------+ //| Function (table) for specifying Stop Loss values for BUY position | //| by Fibo levels according to the lowest value of the first candle | //+---------------------------------------------------------------------+ void StopLevelFiboBuy() { if(Low[1]>Fb12) newSL_B=Fb12-100*Point; if(Low[1]<=Fb12 && Low[1]>(Fb12+Fb11)/2) newSL_B=(Fb12+Fb11)/2; if(Low[1]<=(Fb12+Fb11)/2 && Low[1]>Fb11) newSL_B=Fb11; if(Low[1]<=Fb11 && Low[1]>(Fb11+Fb10)/2) newSL_B=(Fb11+Fb10)/2; if(Low[1]<=(Fb10+Fb11)/2 && Low[1]>Fb10) newSL_B=Fb10; if(Low[1]<=Fb10 && Low[1]>(Fb10+Fb9)/2) newSL_B=Fb9; if(Low[1]<=(Fb10+Fb9)/2 && Low[1]>Fb9) newSL_B=Fb8; if(Low[1]<=Fb9 && Low[1]>Fb8) newSL_B=Fb7; if(Low[1]<=Fb8 && Low[1]>Fb7) newSL_B=(Fb7+MedVegas)/2; if(Low[1]<=Fb7 && Low[1]>MedVegas) newSL_B=Fb6; if(Low[1]<=MedVegas && Low[1]>(MedVegas+Fb6)/2)newSL_B=Fb6; if(Low[1]<=(MedVegas+Fb6)/2 && Low[1]>Fb6) newSL_B=Fb5; if(Low[1]<=Fb6 && Low[1]>Fb5) newSL_B=Fb4; if(Low[1]<=Fb5 && Low[1]>Fb4) newSL_B=(Fb3+Fb4)/2; if(Low[1]<=Fb4 && Low[1]>Fb3) newSL_B=Fb3; if(Low[1]<=Fb3 && Low[1]>(Fb3+Fb2)/2) newSL_B=(Fb3+Fb2)/2; if(Low[1]<=(Fb3+Fb2)/2 && Low[1]>Fb2) newSL_B=Fb2; if(Low[1]<=Fb2 && Low[1]>(Fb2+Fb1)/2) newSL_B=(Fb1+Fb2)/2; if(Low[1]<=(Fb2+Fb1)/2 && Low[1]>Fb1) newSL_B=Fb1; if(Low[1]<=Fb1) newSL_B=Fb1-100*Point; } //+------------------------------------------------------------------+

The table of Stop Loss values by Fibo levels depending on the maximum value of the first StopLevelFiboSell() function candlestick for Sell positions is represented by the following code:

//+----------------------------------------------------------------------+ //| Function (table) for specifying Stop Loss values for SELL position | //| by Fibo levels according to the highest value of the first candle | //+----------------------------------------------------------------------+ void StopLevelFiboSell() { if(High[1]<=Fb12 && High[1]>(Fb12+Fb11)/2) newSL_S=Fb12+100*Point; if(High[1]<=Fb12 && High[1]>Fb11) newSL_S=Fb12; if(High[1]<=Fb11 && High[1]>Fb11+Fb10) newSL_S=Fb11; if(High[1]<=Fb10 && High[1]>(Fb10+Fb9)/2) newSL_S=(Fb11+Fb10)/2; if(High[1]<=Fb9 && High[1]>Fb8) newSL_S=(Fb10+Fb9)/2; if(High[1]<=Fb8 && High[1]>Fb7) newSL_S=Fb9; if(High[1]<=Fb7 && High[1]>MedVegas) newSL_S=Fb8; if(High[1]<=MedVegas && High[1]>MedVegas) newSL_S=Fb7; if(High[1]<=(MedVegas+Fb6)/2 && High[1]>Fb6) newSL_S=MedVegas; if(High[1]<=Fb6 && High[1]>Fb5) newSL_S=MedVegas; if(High[1]<=Fb5 && High[1]>Fb4) newSL_S=Fb6; if(High[1]<=Fb4 && High[1]>Fb3) newSL_S=Fb5; if(High[1]<=Fb3 && High[1]>Fb2) newSL_S=Fb4; if(High[1]<=Fb2 && High[1]>(Fb2+Fb1)/2) newSL_S=(Fb2+Fb3)/2; if(High[1]<(Fb2+Fb1)/2 && High[1]>Fb1) newSL_S=Fb2; if(High[1]<Fb1) newSL_S=(Fb2+Fb1)/2; } //+------------------------------------------------------------------+

It would be appropriate to add LevelFibo Fibonacci levels calculation function to each of the two mentioned dependency functions. That has been done in the attached demo files.

Now, regarding the combination of two functions or rather enabling LevelFibo() levels calculation function in the identification function of Stop Loss levels focused on these levels. This combination makes sense, as the functions work together. Therefore, the number of functions calls during the trailing will be reduced - only one will remain instead of two.

After combining, they will look as follows:

//+----------------------------------------------------------------------+ //| Function (table) for specifying Stop Loss values for BUY position | //| by Fibo levels according to the lowest value of the first candle | //+----------------------------------------------------------------------+ void StoplevelFiboBuy() { double Fb1,Fb2,Fb3,Fb4,Fb5,Fb6,Fb7,Fb8,Fb9,Fb10,Fb11,Fb12,Fb13; double Ma144_1 = iMA(NULL,0,144,0,MODE_EMA,PRICE_CLOSE,1); double Ma169_1 = iMA(NULL,0,169,0,MODE_EMA,PRICE_CLOSE,1); double MedVegas=NormalizeDouble((Ma144_1+Ma169_1)/2,Digits); Fb1=MedVegas-377*Point; Fb12=MedVegas+377*Point; Fb2=MedVegas-233*Point; Fb11=MedVegas+233*Point; Fb3=MedVegas-144*Point; Fb10=MedVegas+144*Point; Fb4=MedVegas-89*Point; Fb9=MedVegas+89*Point; Fb5=MedVegas-55*Point; Fb8=MedVegas+55*Point; Fb6=MedVegas-34*Point; Fb7=MedVegas+34*Point; if(Low[1]>Fb12) newSL_B=Fb12-100*Point; if(Low[1]<=Fb12 && Low[1]>(Fb12+Fb11)/2) newSL_B=(Fb12+Fb11)/2; if(Low[1]<=(Fb12+Fb11)/2 && Low[1]>Fb11) newSL_B=Fb11; if(Low[1]<=Fb11 && Low[1]>(Fb11+Fb10)/2) newSL_B=(Fb11+Fb10)/2; if(Low[1]<=(Fb10+Fb11)/2 && Low[1]>Fb10) newSL_B=Fb10; if(Low[1]<=Fb10 && Low[1]>(Fb10+Fb9)/2) newSL_B=Fb9; if(Low[1]<=(Fb10+Fb9)/2 && Low[1]>Fb9) newSL_B=Fb8; if(Low[1]<=Fb9 && Low[1]>Fb8) newSL_B=Fb7; if(Low[1]<=Fb8 && Low[1]>Fb7) newSL_B=(Fb7+MedVegas)/2; if(Low[1]<=Fb7 && Low[1]>MedVegas) newSL_B=Fb6; if(Low[1]<=MedVegas && Low[1]>(MedVegas+Fb6)/2)newSL_B=Fb6; if(Low[1]<=(MedVegas+Fb6)/2 && Low[1]>Fb6) newSL_B=Fb5; if(Low[1]<=Fb6 && Low[1]>Fb5) newSL_B=Fb4; if(Low[1]<=Fb5 && Low[1]>Fb4) newSL_B=(Fb3+Fb4)/2; if(Low[1]<=Fb4 && Low[1]>Fb3) newSL_B=Fb3; if(Low[1]<=Fb3 && Low[1]>(Fb3+Fb2)/2) newSL_B=(Fb3+Fb2)/2; if(Low[1]<=(Fb3+Fb2)/2 && Low[1]>Fb2) newSL_B=Fb2; if(Low[1]<=Fb2 && Low[1]>(Fb2+Fb1)/2) newSL_B=(Fb1+Fb2)/2; if(Low[1]<=(Fb2+Fb1)/2 && Low[1]>Fb1) newSL_B=Fb1; if(Low[1]<=Fb1) newSL_B=Fb1-100*Point; } // ----------------------------------------------------------------------+

Main command code of positions trailing is represented as an Expert Advisor fragment with the sequence of actions for execution of the functions mentioned above according to the price values of the current bars. Step-by-step trailing starts after an appropriate open order has been selected.

A small fragment of trailing code is shown below:

//+------------------------------------------------------------------+ //| TRAILING OPEN POSITIONS | //+------------------------------------------------------------------+ for(int i=OrdersTotal()-1; i>=0; i--) { if(!OrderSelect(i,SELECT_BY_POS,MODE_TRADES)) {Print("Order selection error = ",GetLastError());} if(OrderSymbol()==Symbol()) { if(OrderType()==OP_BUY) { if(OrderMagicNumber()==Magic) { // ----------------------------------------------------------------------+ if((High[1]-OrderOpenPrice())>=SL_B*Point && OrderLots()==0.2)Close_B_lot(); // ----------------------------------------------------------------------+ if((High[1]-OrderOpenPrice())/Point>=100 && OrderLots()==0.1 && OrderStopLoss()<OrderOpenPrice()) { Print(" 1 - StopLoss shift"); if(!OrderModify(OrderTicket(),OrderOpenPrice(),OrderOpenPrice()+2*Point,OrderTakeProfit(),0,Aqua)) { Print(" at Modif.ord.# ",OrderTicket()," Error # ",GetLastError()); } return; } // ----------------------------------------------------------------------+ if((High[1]-OrderOpenPrice())>=120*Point && OrderOpenPrice()>Ma144_1-144*Point) { StoplevelFiboBuy(); newSL_B=newSL_B+21*Point; if((Bid-newSL_B)/Point<StopLevel)newSL_B=Bid-StopLevel*Point; if(newSL_B>OrderStopLoss() && (Bid-newSL_B)/Point>StopLevel) { Print("2nd shift of StopLoss "); Modyf_B_lot(); } } // ----------------------------------------------------------------------+ if((High[1]-OrderOpenPrice())>=200*Point && (High[1]-OrderOpenPrice())<=250*Point) { StoplevelFiboBuy(); if((Bid-newSL_B)/Point<StopLevel)newSL_B=Bid-StopLevel*Point; if(newSL_B>OrderStopLoss() && (Bid-newSL_B)/Point>StopLevel) { Print(" 3rd shift by level order # ",OrderTicket()); Modyf_B_lot(); } } // ----------------------------------------------------------------------+ if((High[1]-OrderOpenPrice())>=250*Point && OrderOpenPrice()>Ma144_1-144*Point) { StoplevelFiboBuy(); newSL_B=newSL_B+10*Point; if((Bid-newSL_B)/Point<StopLevel) newSL_B=Bid-StopLevel*Point; if(newSL_B>OrderStopLoss() && (Bid-newSL_B)/Point>StopLevel) { Print(" 4th shift by level order # ",OrderTicket()); Modyf_B_lot(); } } // ----------------------------------------------------------------------+ if((High[1]-OrderOpenPrice())>=300*Point && (High[1]-OrderOpenPrice())<=350*Point) { StoplevelFiboBuy(); newSL_B=newSL_B+20*Point; if((Bid-newSL_B)/Point<StopLevel) newSL_B=Bid-StopLevel*Point; if(newSL_B>OrderStopLoss() && (Bid-newSL_B)/Point>StopLevel) { Print(" 5th shift by level order # ",OrderTicket()); Modyf_B_lot(); } } // ----------------------------------------------------------------------+ ... } } } }

The sequence of step-by-step trailing consists of 8 steps in the attached version of the demo Expert Advisor.

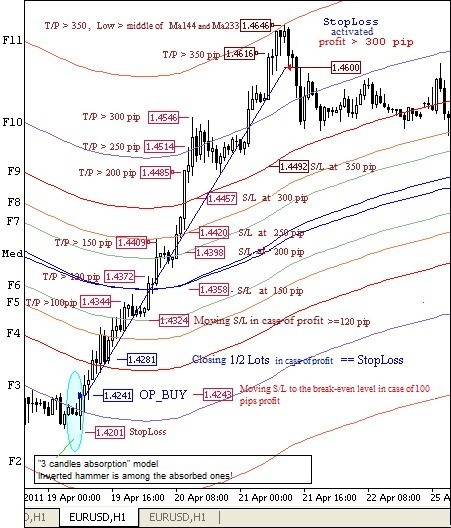

Below is the screenshot displaying the steps of operation of the demo Expert Advisor for Buy position trailing. The position was opened due to the fact that the "absorption of three candles" model has been formed. Besides, the "inverted hammer" is among the absorbed candles. That fact reinforces the signal's strength to open a buy position.

Fig. 6. Example of Buy position trailing

"Vegas" indicator should be used to see Fibo lines like on a light screenshot. It can be seen on MQL4 website: https://www.mql5.com/en/code/7148

The same little stretched screenshot from the "dark" screen:

Fig. 7. Screenshot from the monitor screen (demo version for Buy)

Fig. 8. Example of Sell position trailing

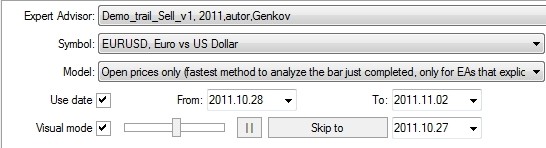

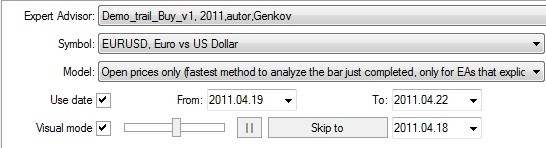

Temporary testing parameters should be installed to display the work of demo Expert Advisors, as shown in Fig. 9-10 below:

Fig. 9. Demo_trail_Buy.mql Expert Advisor testing parameters

Fig. 10. Demo_trail_Sell.mql Expert Advisor testing parameters

Note: Files with demo Expert Advisors are attached to the article, as mini-robots for trailing buy and sell positions. Positions are opened in a double lot here. But when Stop Loss is moved to a break-even level, there is confidence in the future price movement in the right direction and it is possible to add another position.

Conclusion

Presented examples of orders trailing show that Stop Loss orders moving method focused on Fibo dynamic levels may yield positive results. The described method can be recommended for practical use in trading.

Dynamic Fibo levels identifying functions:

- LevelFiboKgd.mq4

- StopLevelFiboBuy.mq4

- StopLevelFiboSell.mq4

- Demo files:

- Demo_trail_Buy_v1.mq4 – Demo file for Buy

- Demo_trail_Sell_v1.mq4 - Demo file for Sell

Translated from Russian by MetaQuotes Ltd.

Original article: https://www.mql5.com/ru/articles/1349

Limitless Opportunities with MetaTrader 5 and MQL5

Limitless Opportunities with MetaTrader 5 and MQL5

Visualize a Strategy in the MetaTrader 5 Tester

Visualize a Strategy in the MetaTrader 5 Tester

OpenCL: From Naive Towards More Insightful Programming

OpenCL: From Naive Towards More Insightful Programming

Get 200 usd for your algorithmic trading article!

Get 200 usd for your algorithmic trading article!

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

hey how to apply this things..I can't understnad