alextrader79 / Profil

alextrader79

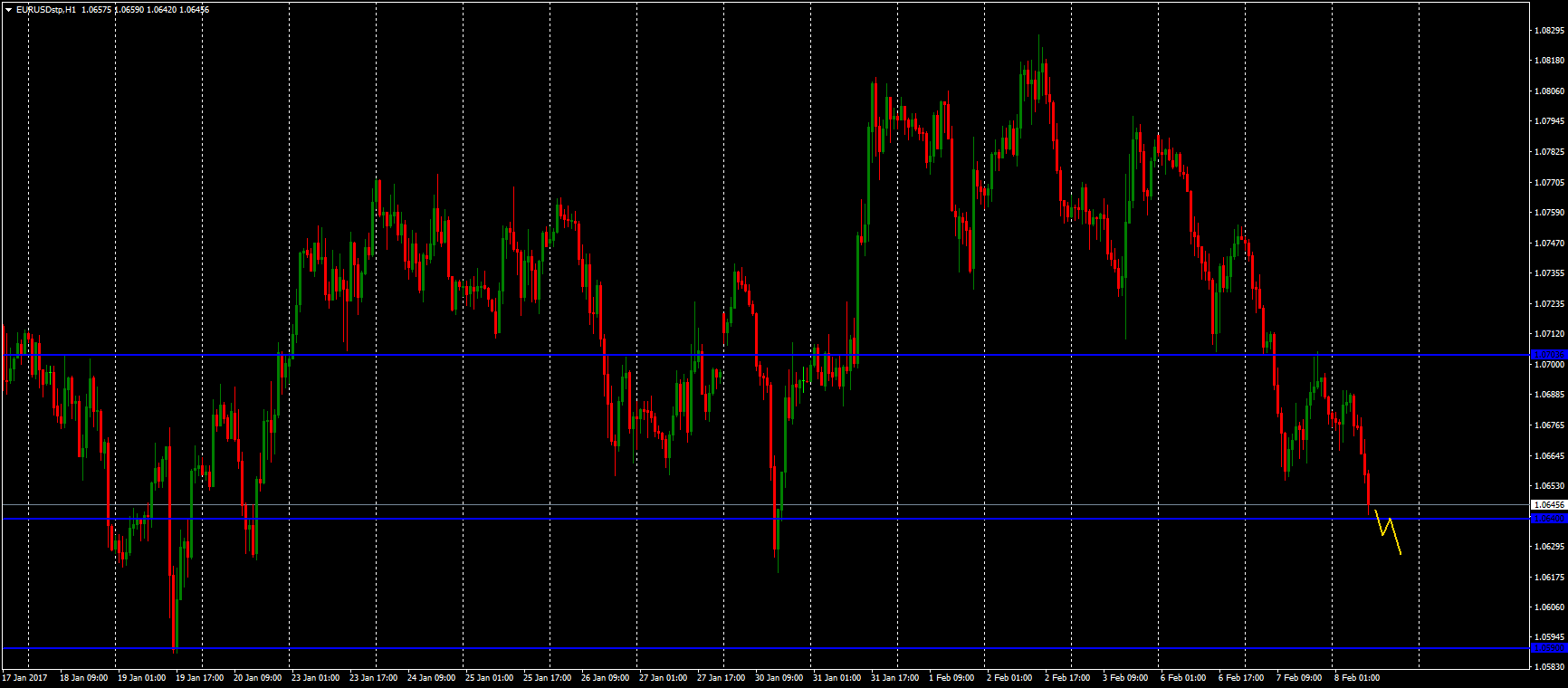

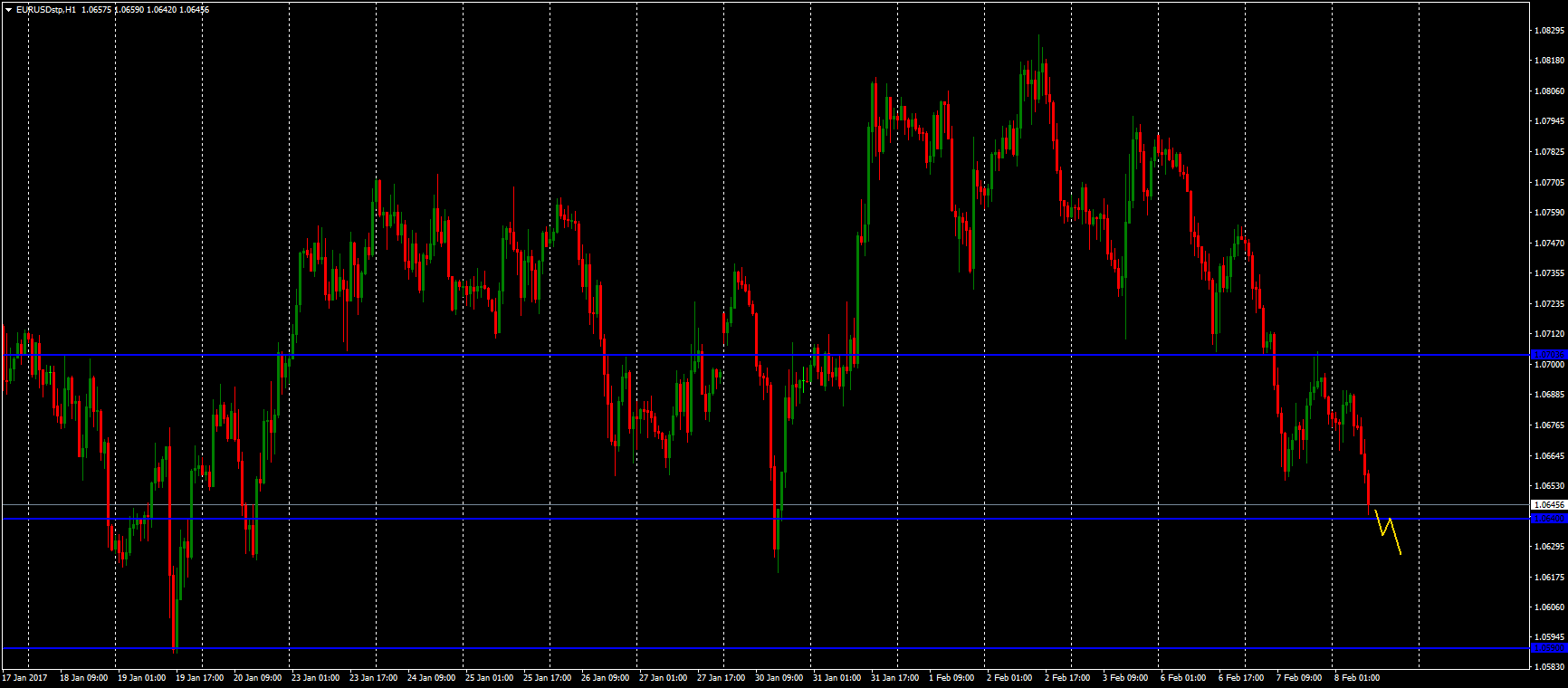

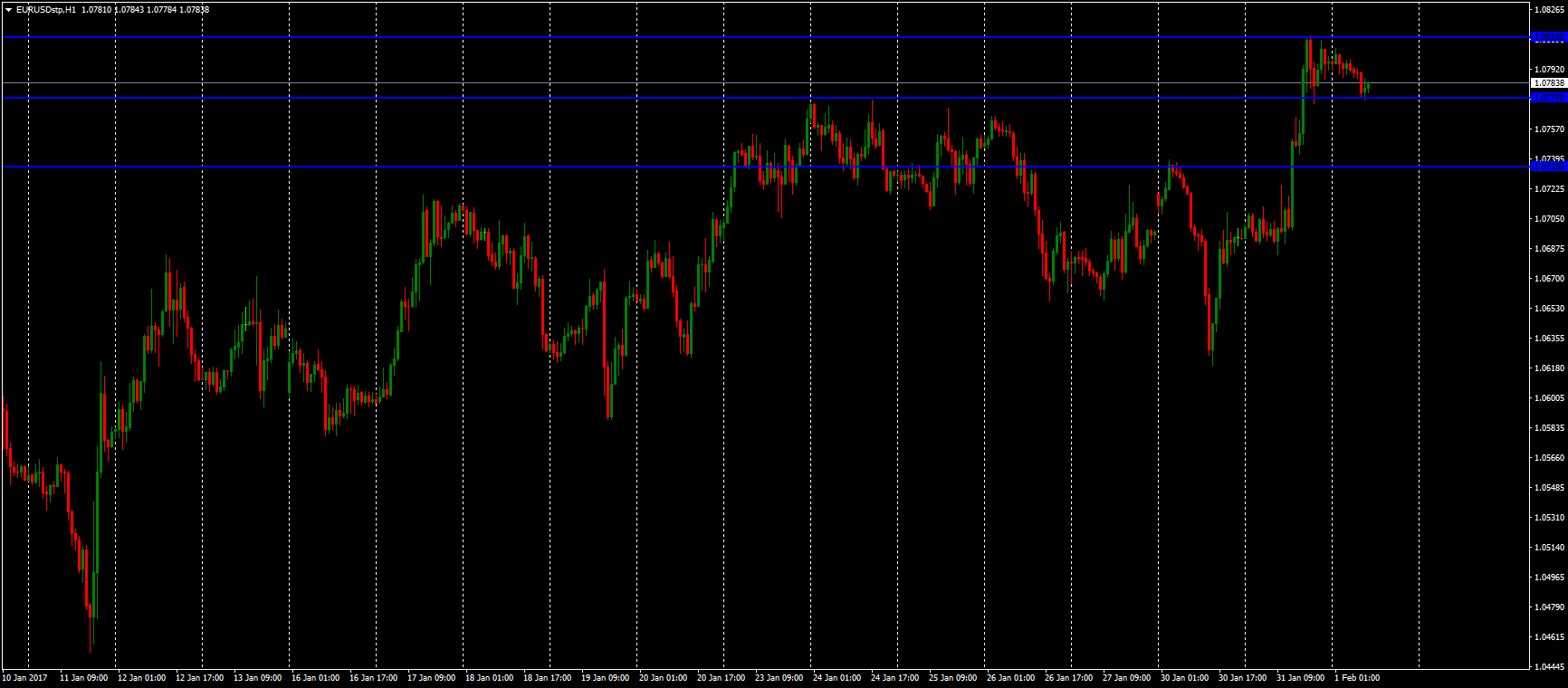

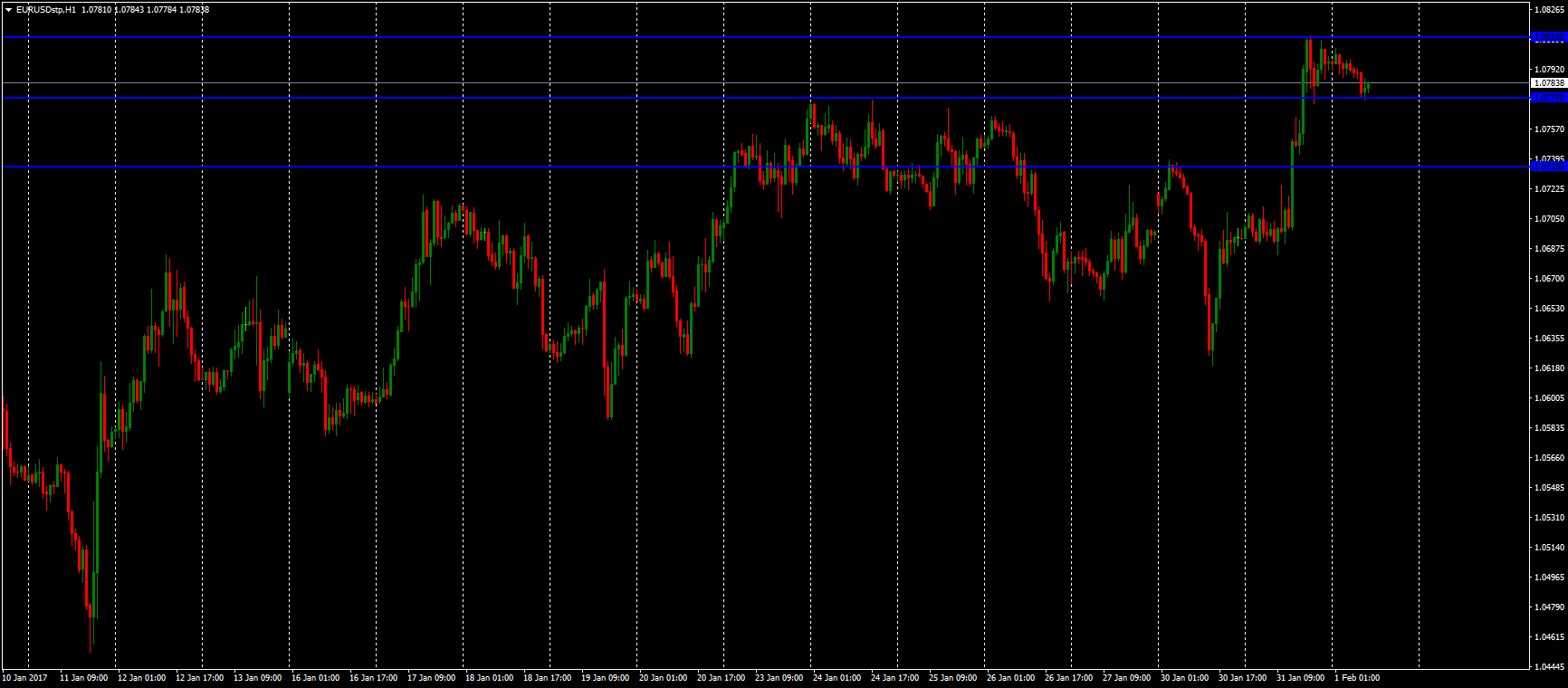

The euro continues to fall against the US dollar today. I plan to open a deal towards the current trend. I’m going to sell EUR/USD after the price fixes below 1.0640. Potential movement - to 1.0590. I recommend to use trailing stop to accompany this position.

alextrader79

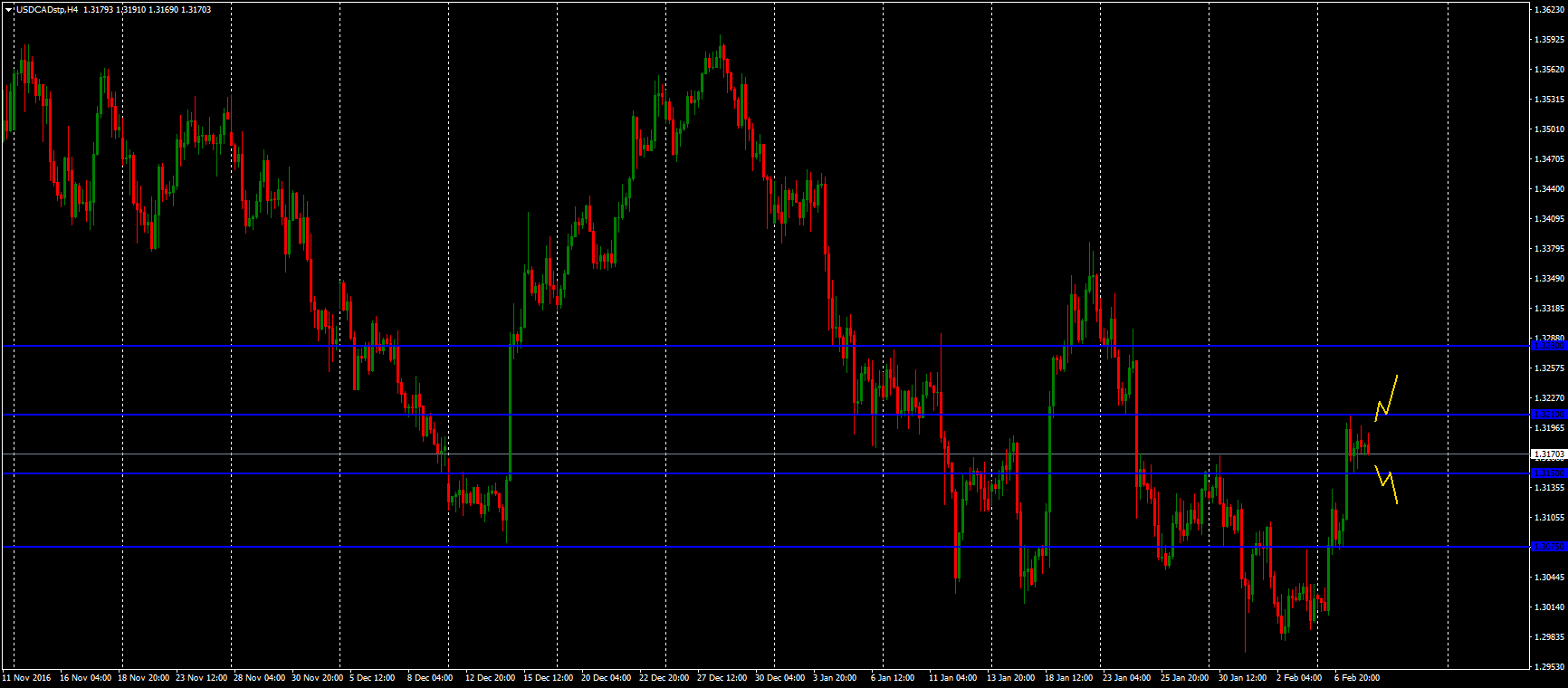

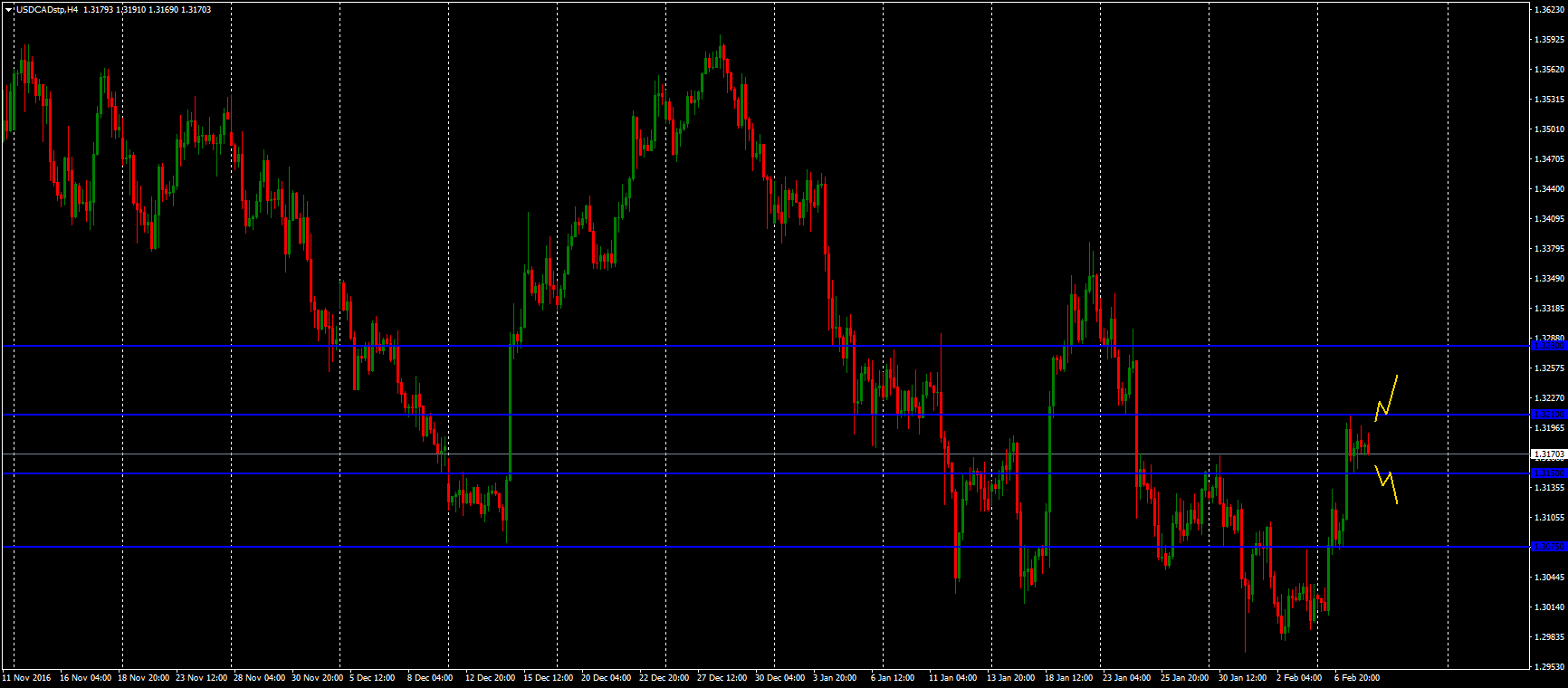

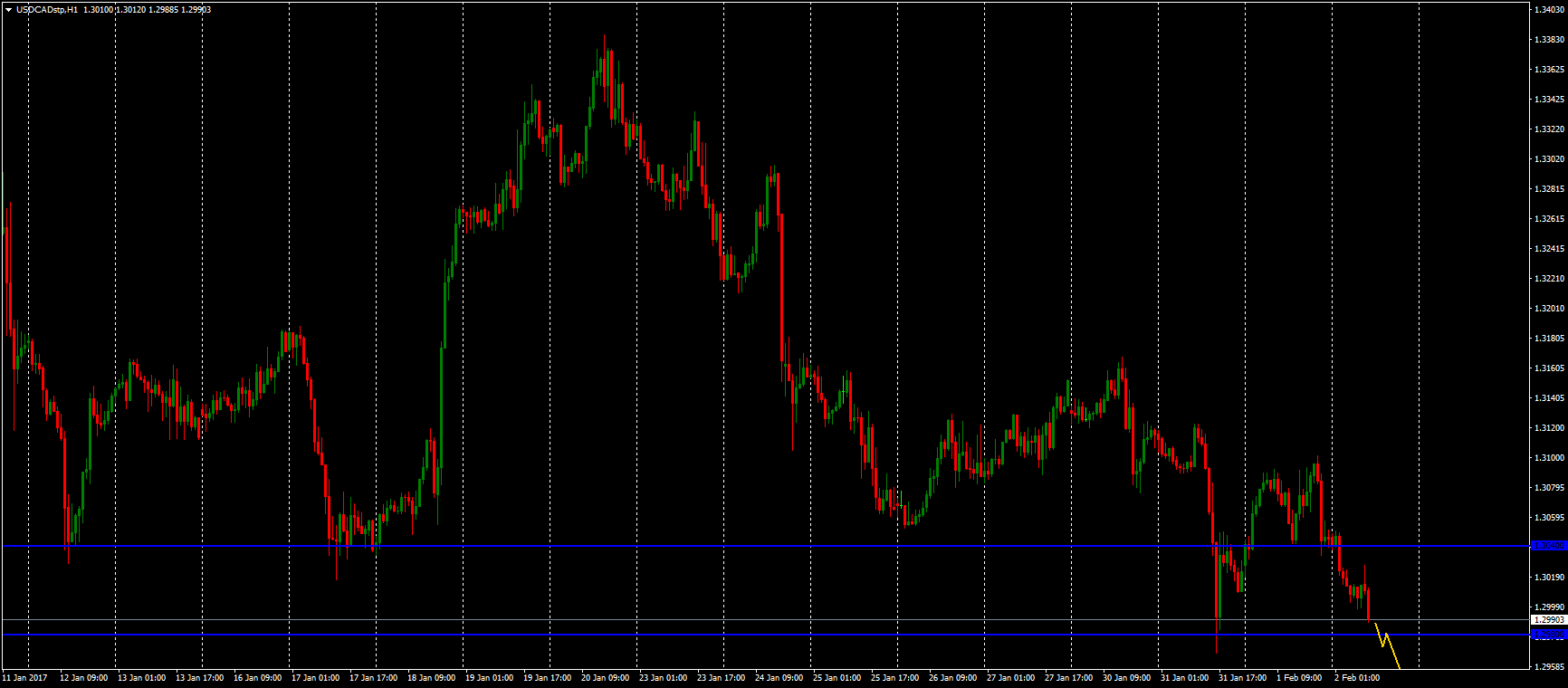

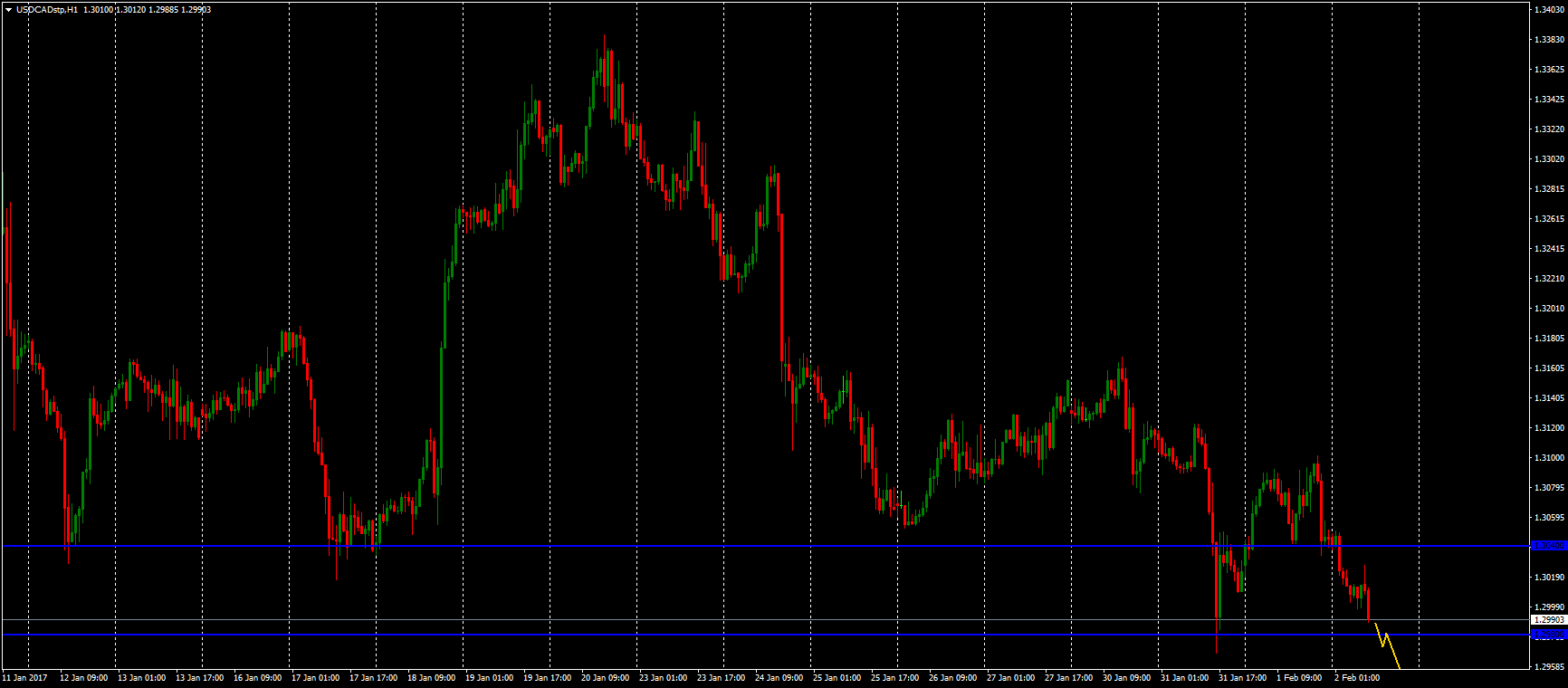

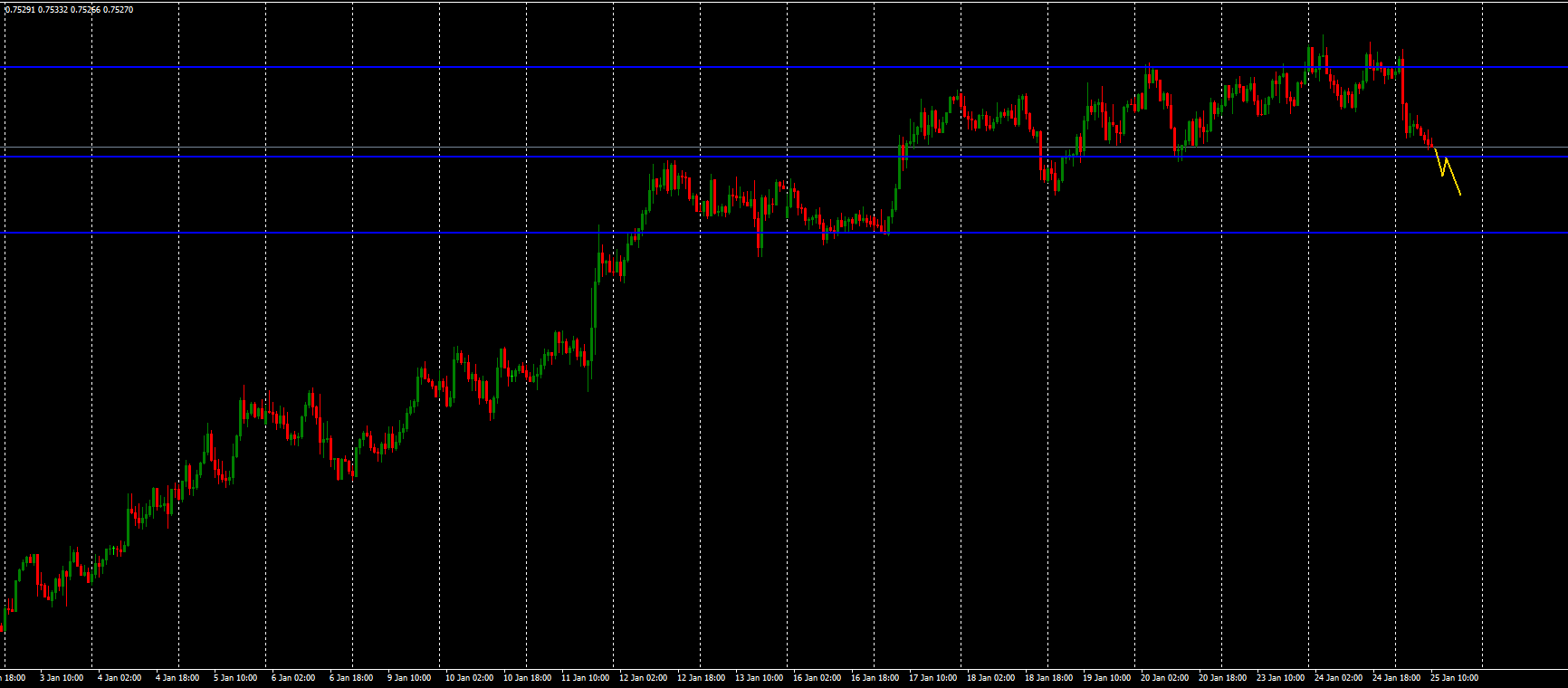

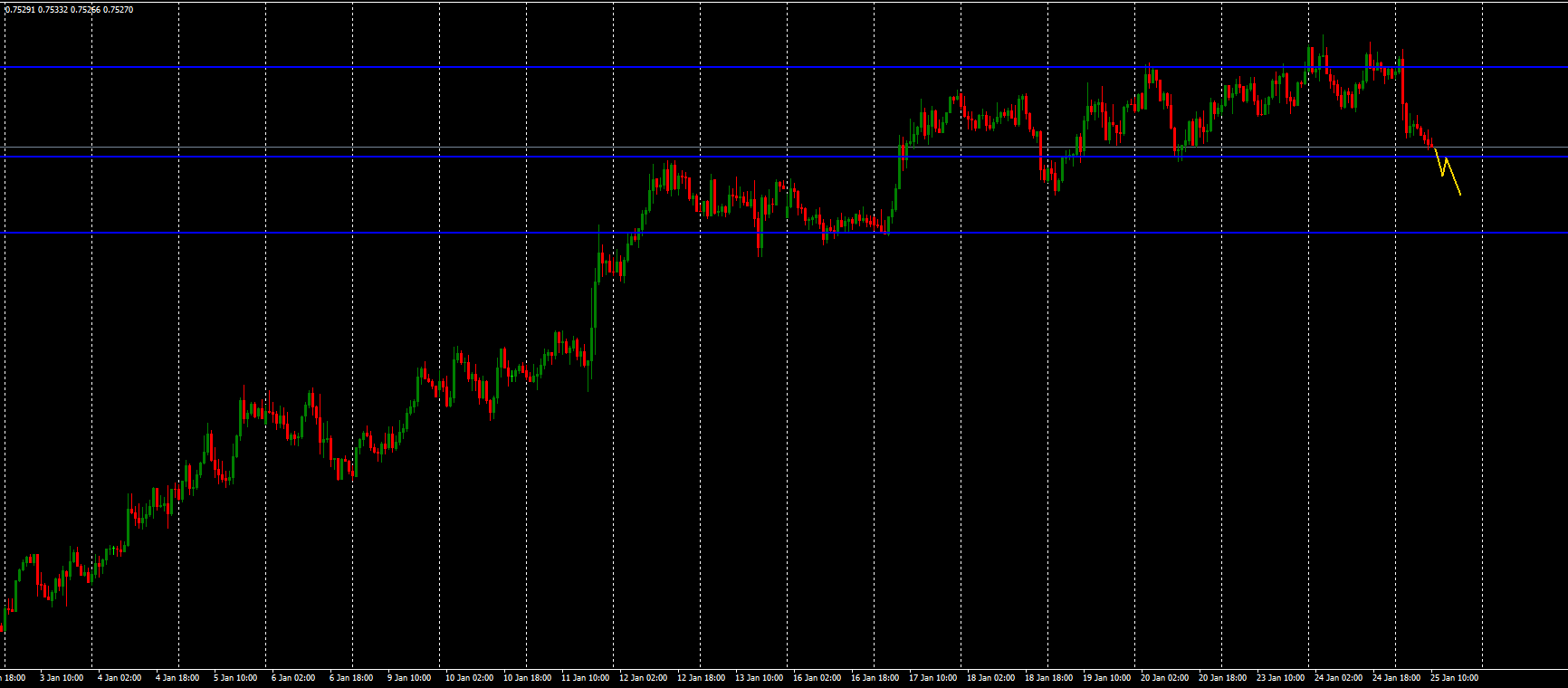

There was a fairly sharp rise of the USD/CAD currency pair this week. The technical pattern is mixed at the moment. The currency has reached the 1.3210 key resistance level. The nearest support level is 1.3150. I will open positions after the breakout and retest of these levels.

If the price fixes above the 1.3210 level, I will buy USD/CAD. Potential movement - to 1.3280.

If the price fixes below 1.3150, I’ll sell it. Potential movement - to 1.3075.

If the price fixes above the 1.3210 level, I will buy USD/CAD. Potential movement - to 1.3280.

If the price fixes below 1.3150, I’ll sell it. Potential movement - to 1.3075.

alextrader79

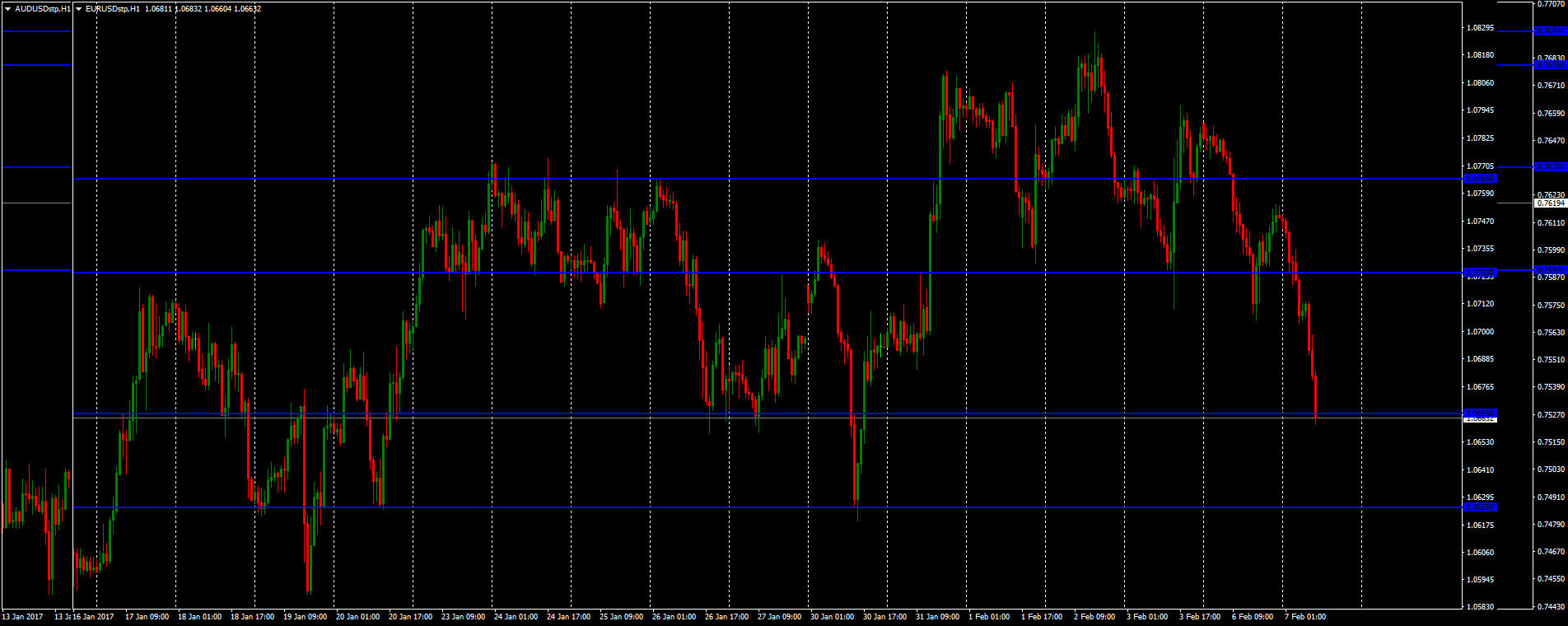

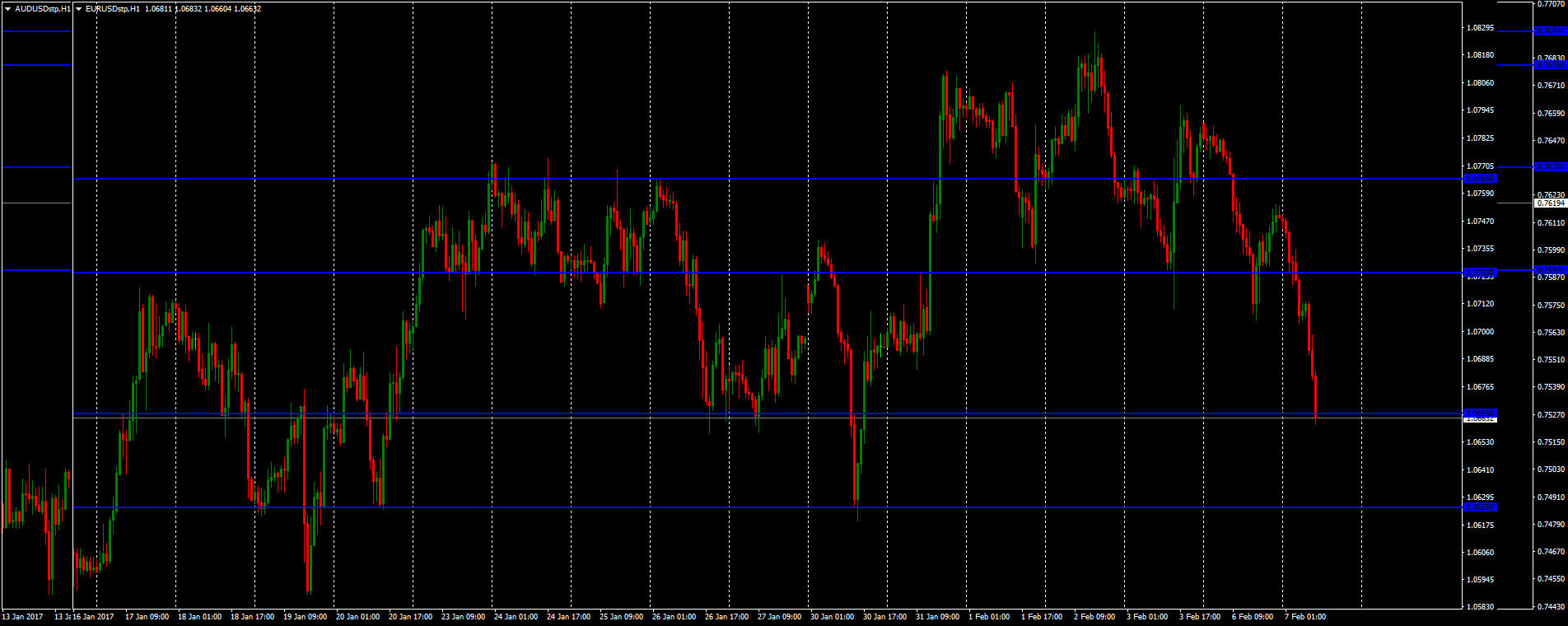

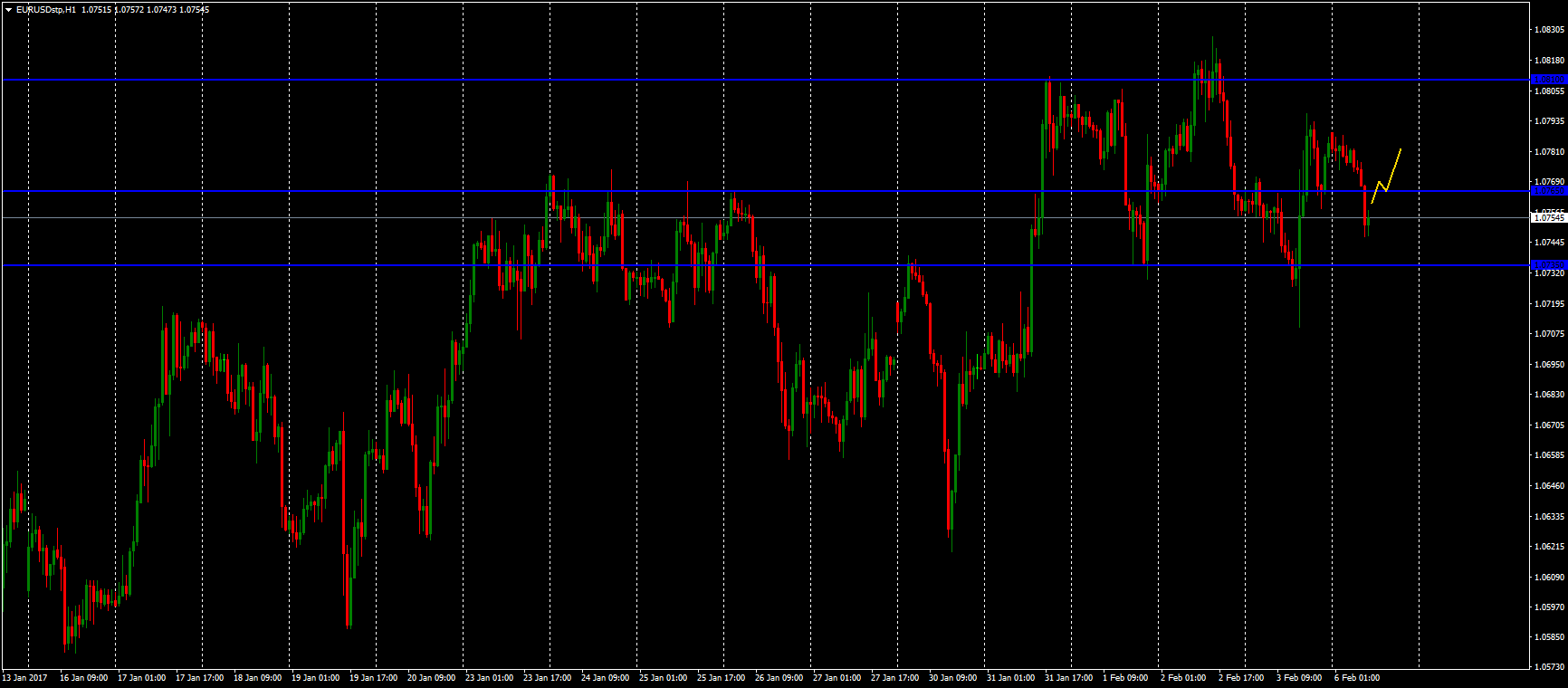

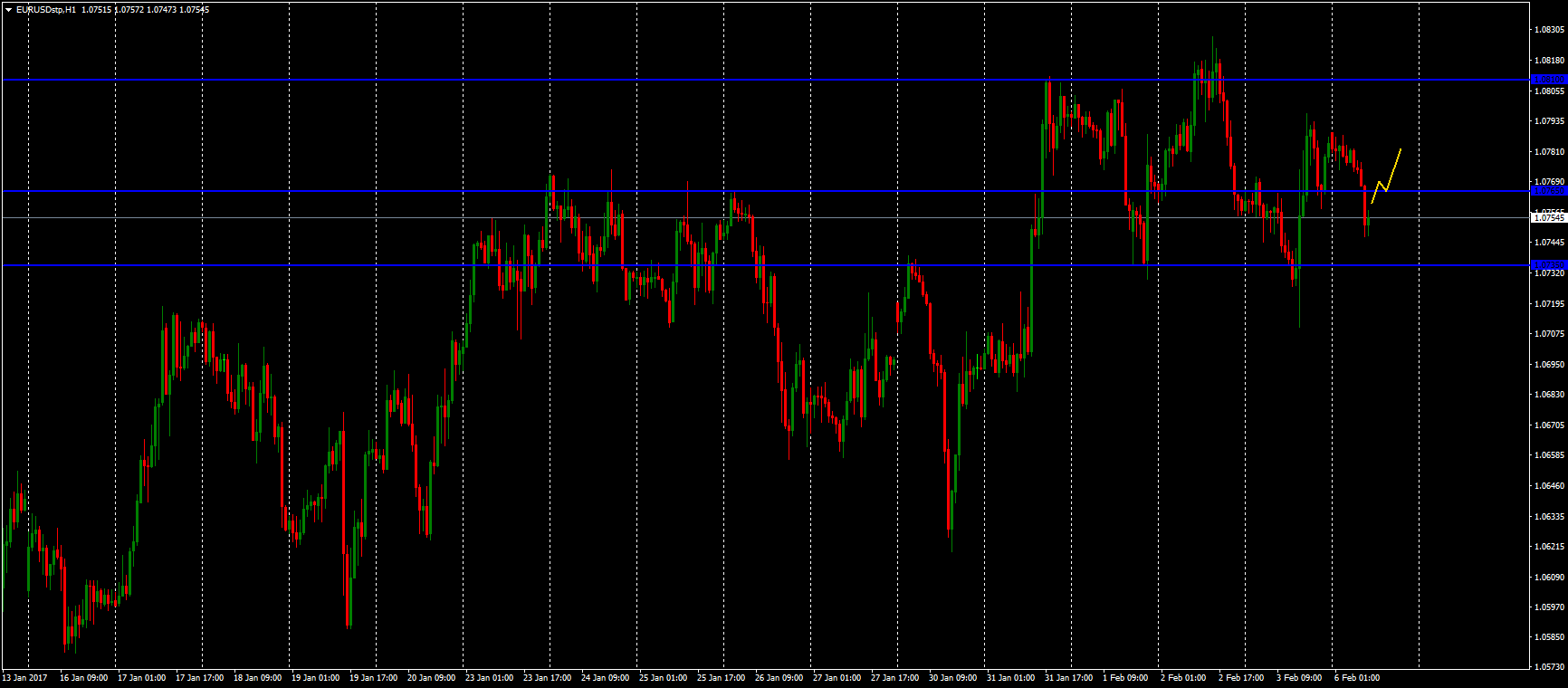

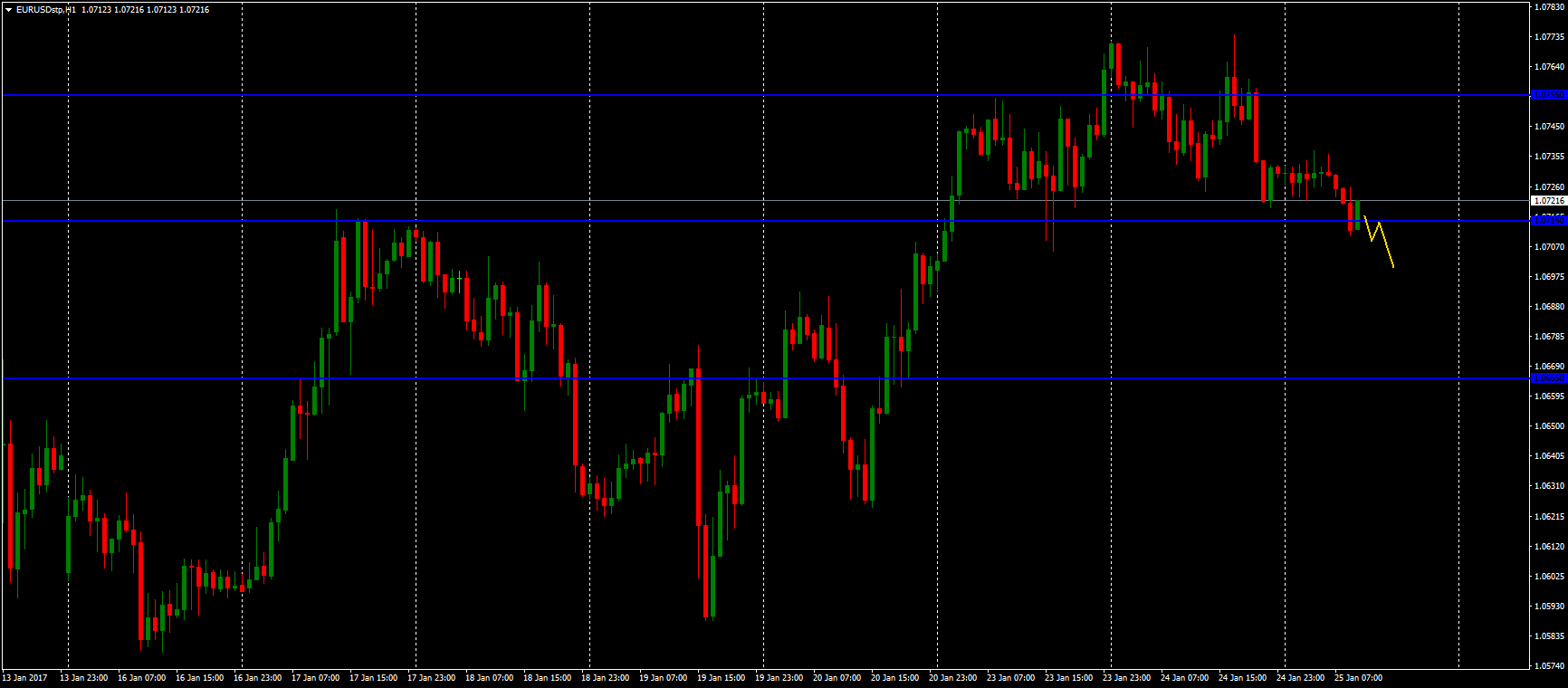

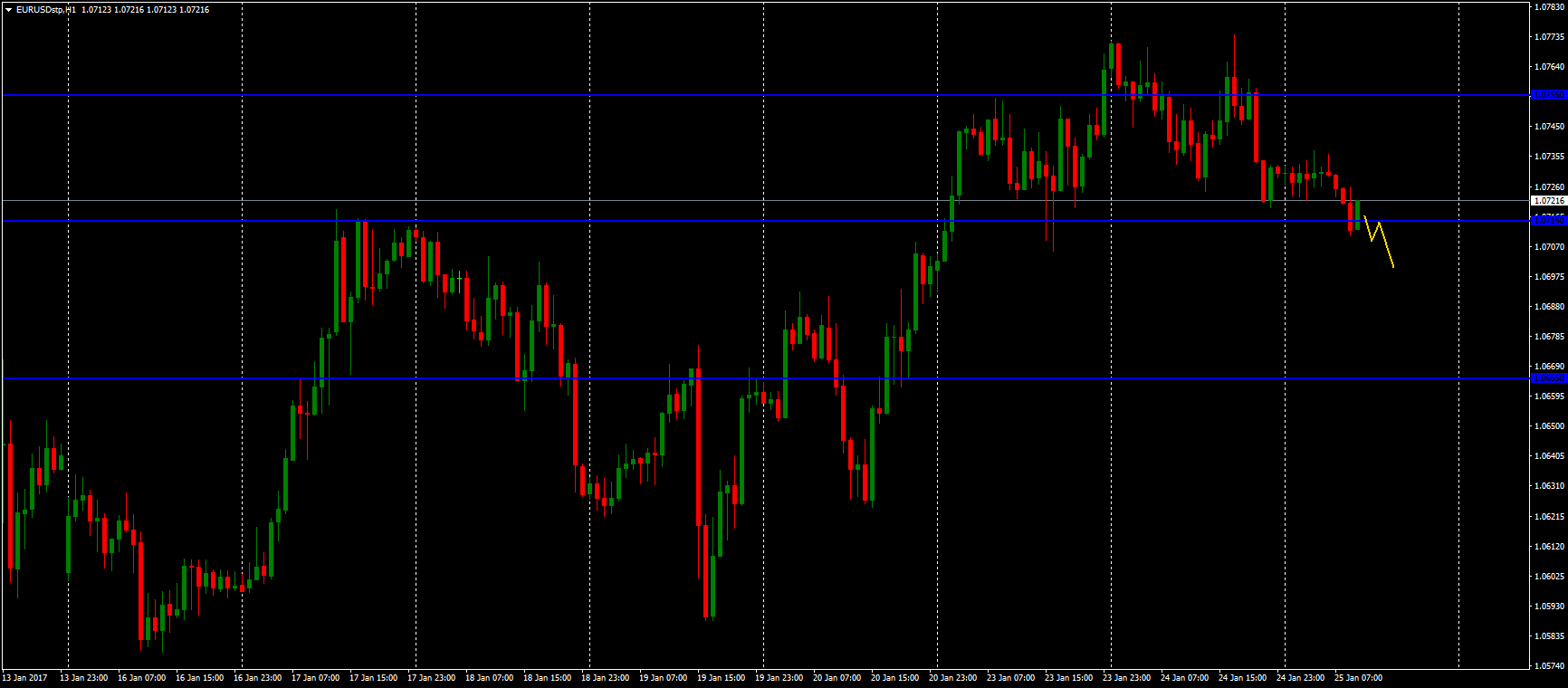

The euro weakened significantly against the US dollar today. I haven’t got any trading ideas currently. I’ve identified the following key levels:

Support: 1.0665, 1.0625

Resistance: 1.0725, 1.0765

So, I’ll watch how the price reacts to them. Maybe I’ll open short-time speculative orders from these levels with the reduced risk.

Wish you all good profit!

Support: 1.0665, 1.0625

Resistance: 1.0725, 1.0765

So, I’ll watch how the price reacts to them. Maybe I’ll open short-time speculative orders from these levels with the reduced risk.

Wish you all good profit!

alextrader79

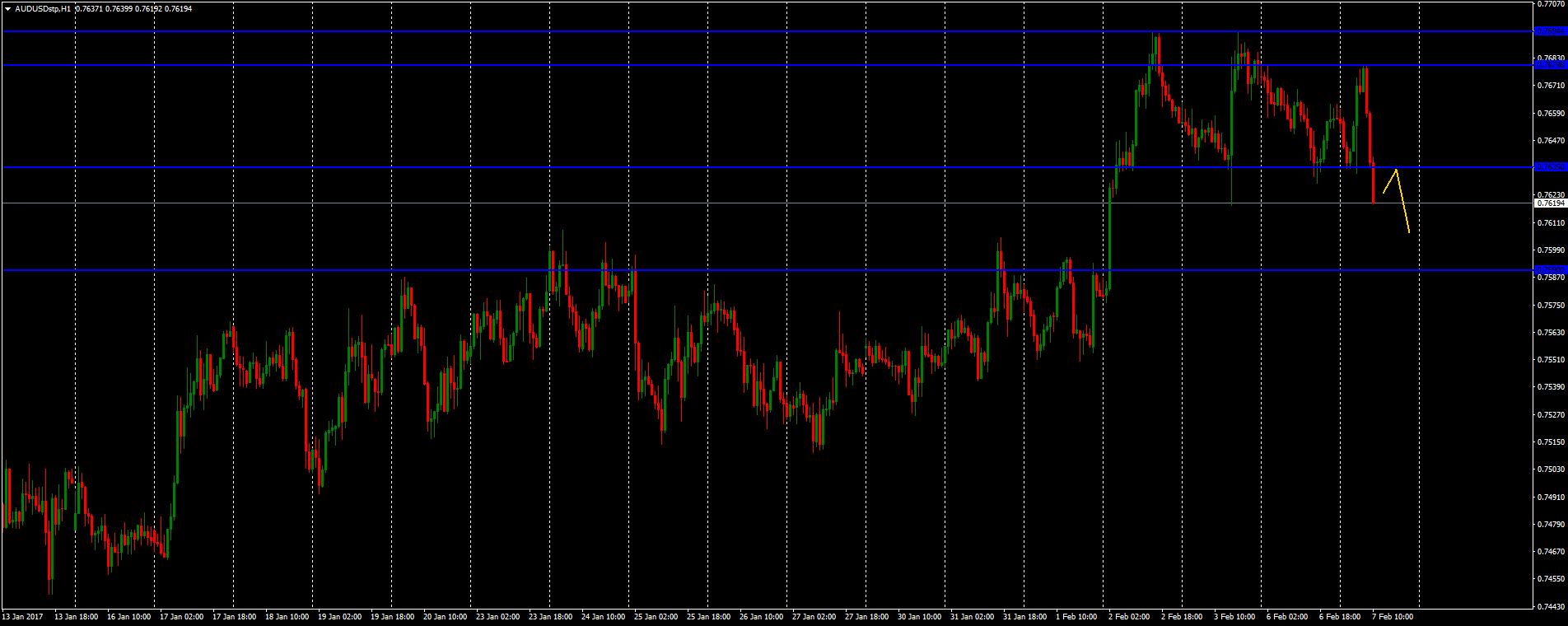

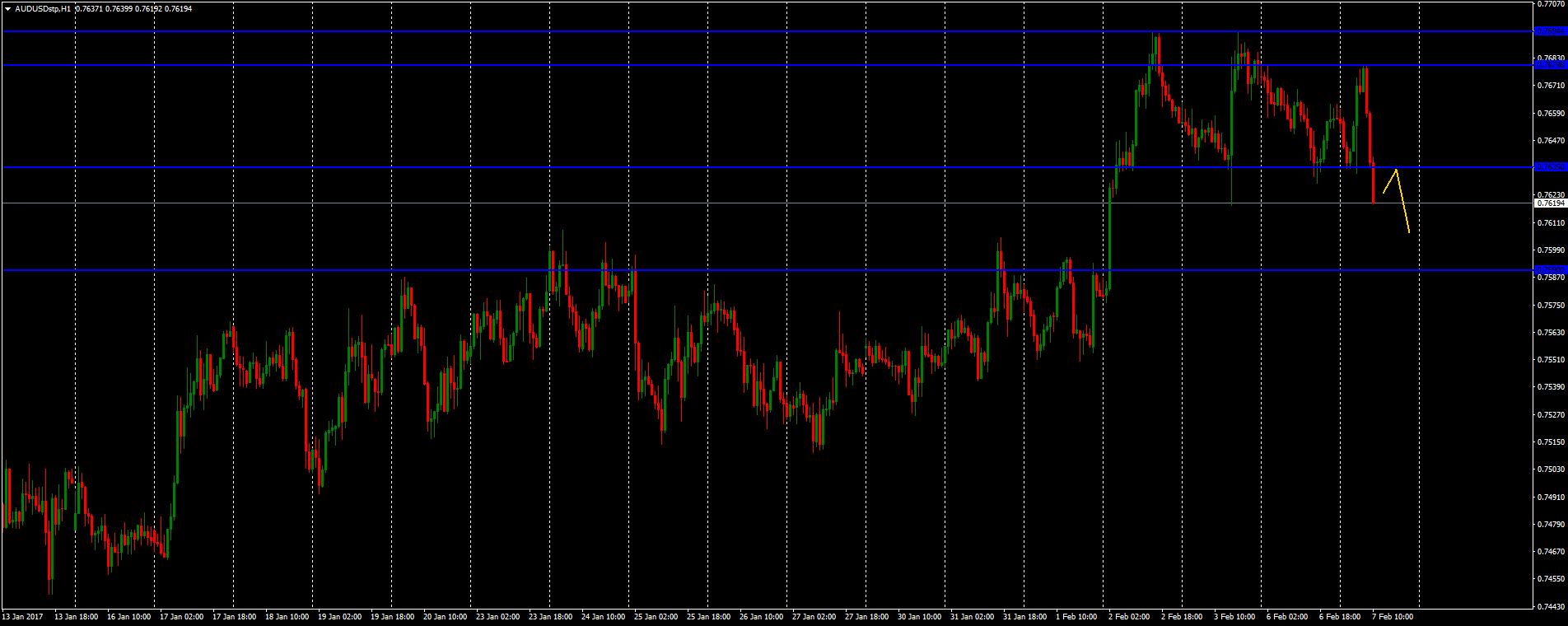

The RBA kept its monetary policy unchanged today. The regulator also noted the growth of China's economy, which is a key partner for Australia. I saw an increase in demand for the Australian dollar during the Asian session. Sales dominate on the market currently. The currency has broke the 0.7635 support level. I plan to open deals towards the current trend. I’m going to sell AUD/USD after the retest of the 0.7635 "mirror" the resistance level. Potential movement - to 0.7590.

alextrader79

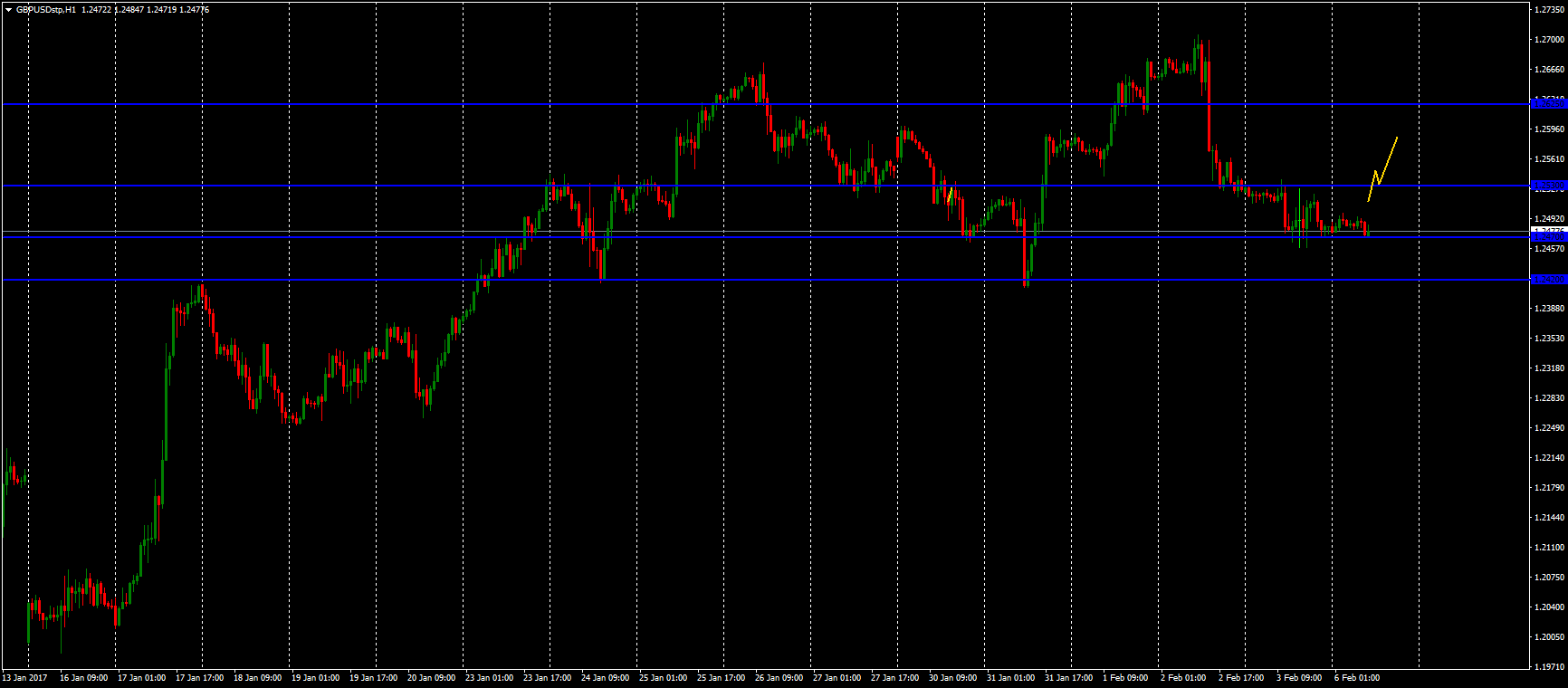

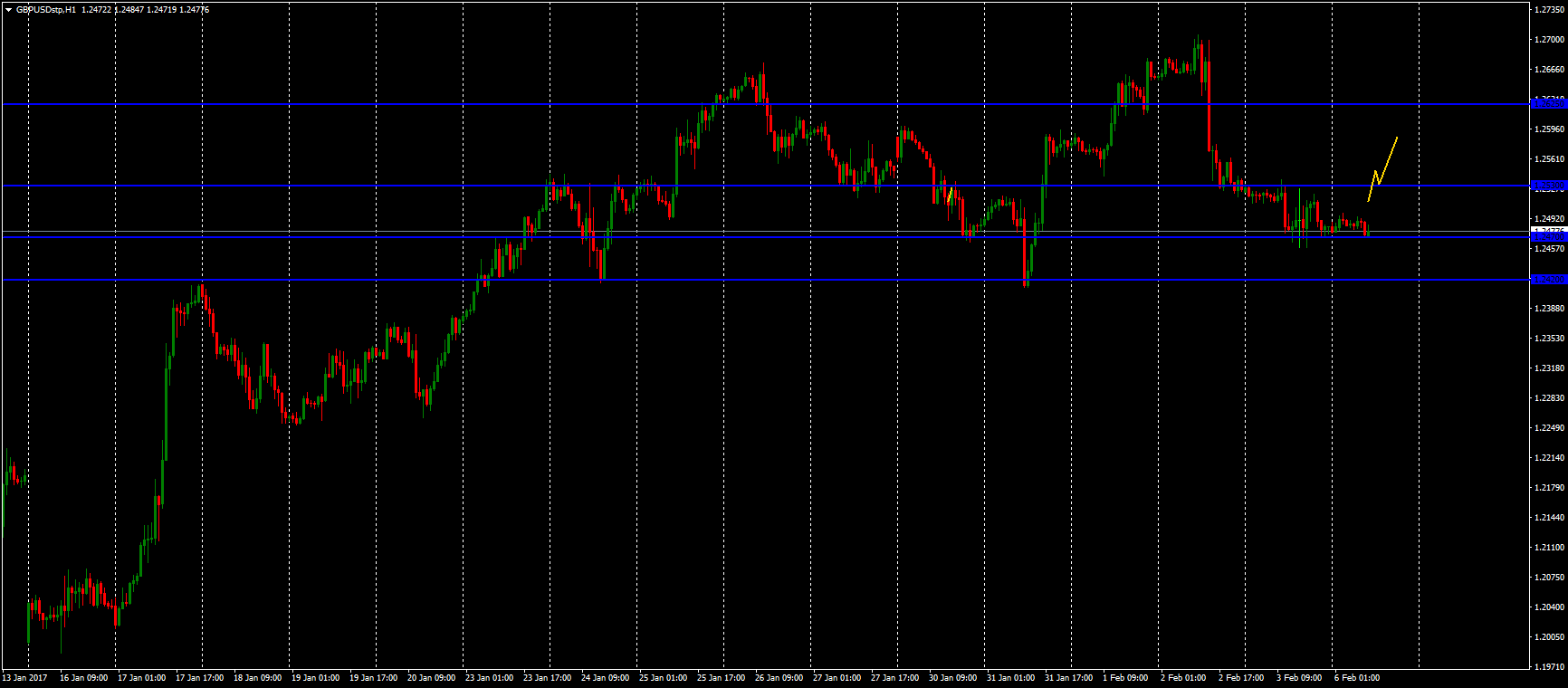

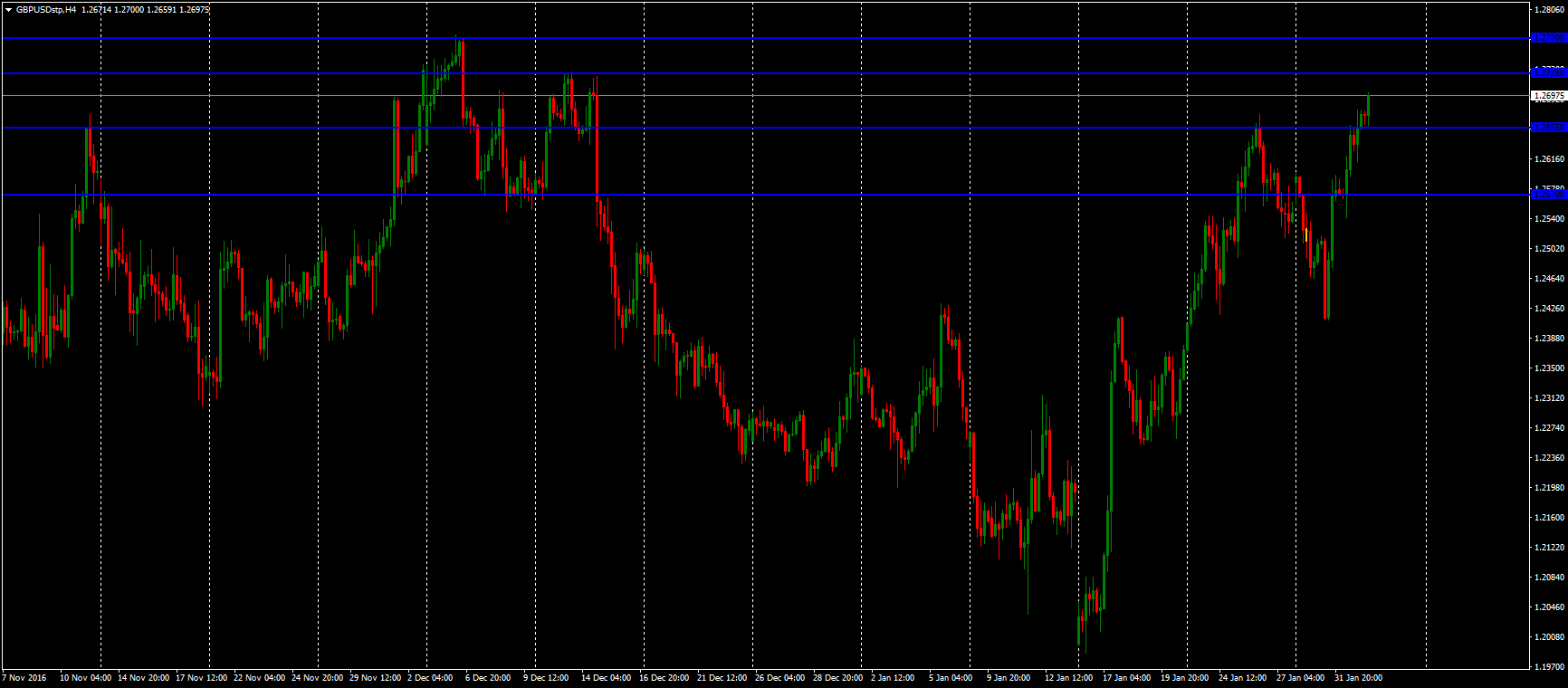

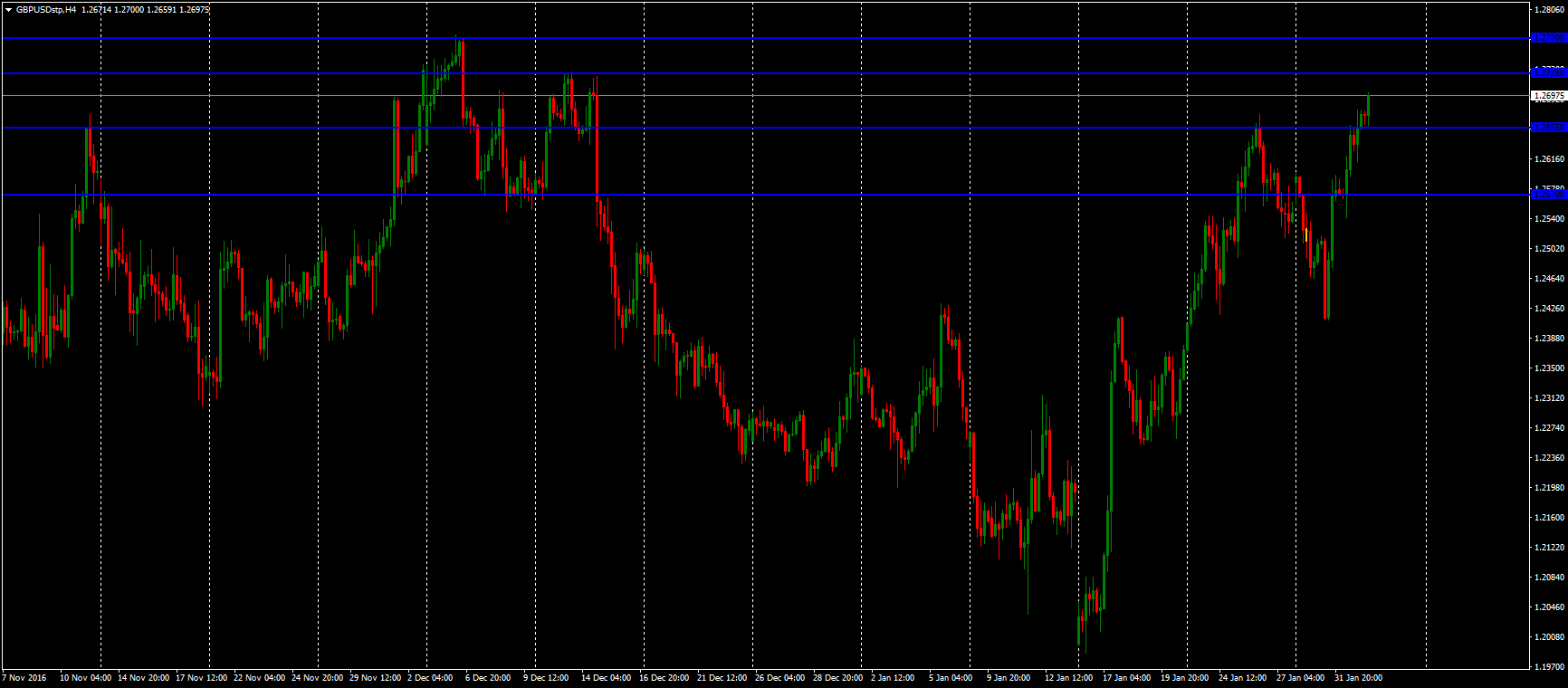

The pound weakened significantly against the US dollar on Thursday, February 02. GBP/USD is trading near the 1.2420-1.2470 key demand zone. I think that the correction is possible in the near future. I will monitor this instrument closely. I will buy if the price exceeds the 1.2530 level. Potential movement - to 1.2625.

alextrader79

The US dollar weakened against other major currencies on Friday, February 03. This happened due to the release of controversial statistics on the labor market.

EUR/USD

I’m going long today. The price kept the 1.0735 key support level. I’ll buy EUR/USD in case of breakout and retest the 1.0765 local resistance. Potential movement - to 1.0810.

EUR/USD

I’m going long today. The price kept the 1.0735 key support level. I’ll buy EUR/USD in case of breakout and retest the 1.0765 local resistance. Potential movement - to 1.0810.

alextrader79

GBP/USD

The important statistics on the UK economy will be published today. The Bank of England will make a decision on the key interest rate. I won’t open transactions on GBP/USD before the Central Bank meeting. I identified the following key levels and will watch how the price reacts to them.

Support: 1.2655, 1.2570

Resistance: 1.2725, 1.2770

The important statistics on the UK economy will be published today. The Bank of England will make a decision on the key interest rate. I won’t open transactions on GBP/USD before the Central Bank meeting. I identified the following key levels and will watch how the price reacts to them.

Support: 1.2655, 1.2570

Resistance: 1.2725, 1.2770

alextrader79

Yesterday's Federal Reserve meeting pressed the US currency. The central bank left its monetary policy unchanged. The regulator pointed to a gradual tightening of the monetary policy.

USD / CAD

The technical pattern on USD/CAD indicates the development of a downward trend. I plan to sell after the breakout and retest of the 1.2980 mark. Potential movement - to 1.2950-1.2925. The transaction will be short-term speculative.

USD / CAD

The technical pattern on USD/CAD indicates the development of a downward trend. I plan to sell after the breakout and retest of the 1.2980 mark. Potential movement - to 1.2950-1.2925. The transaction will be short-term speculative.

alextrader79

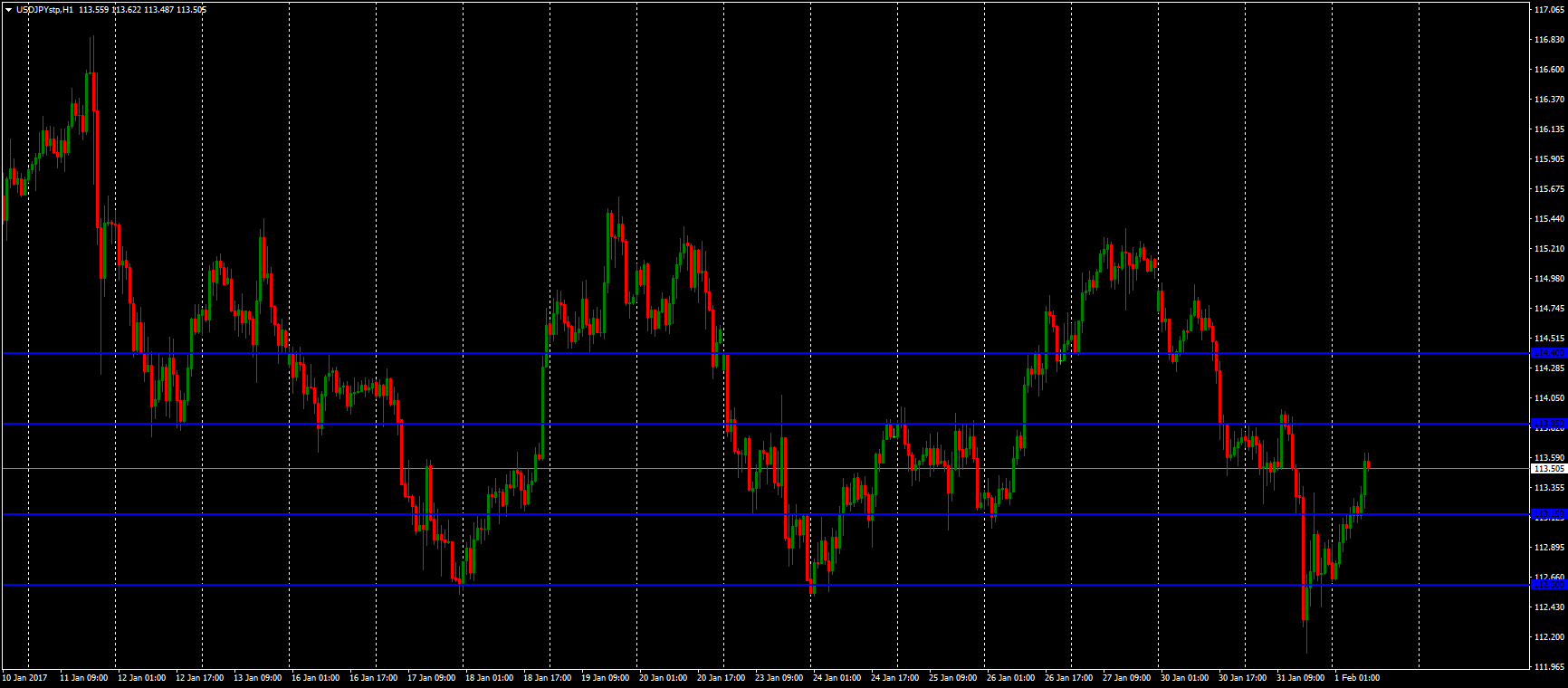

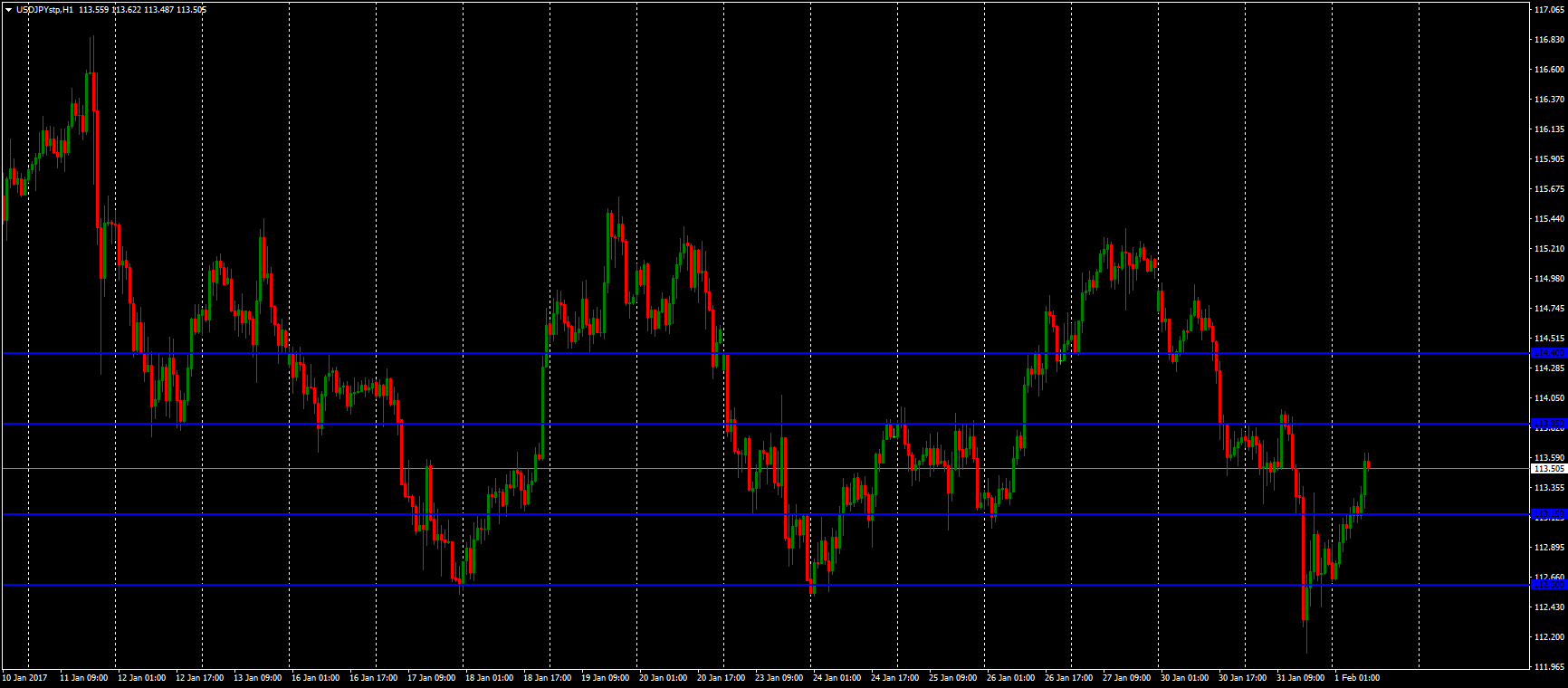

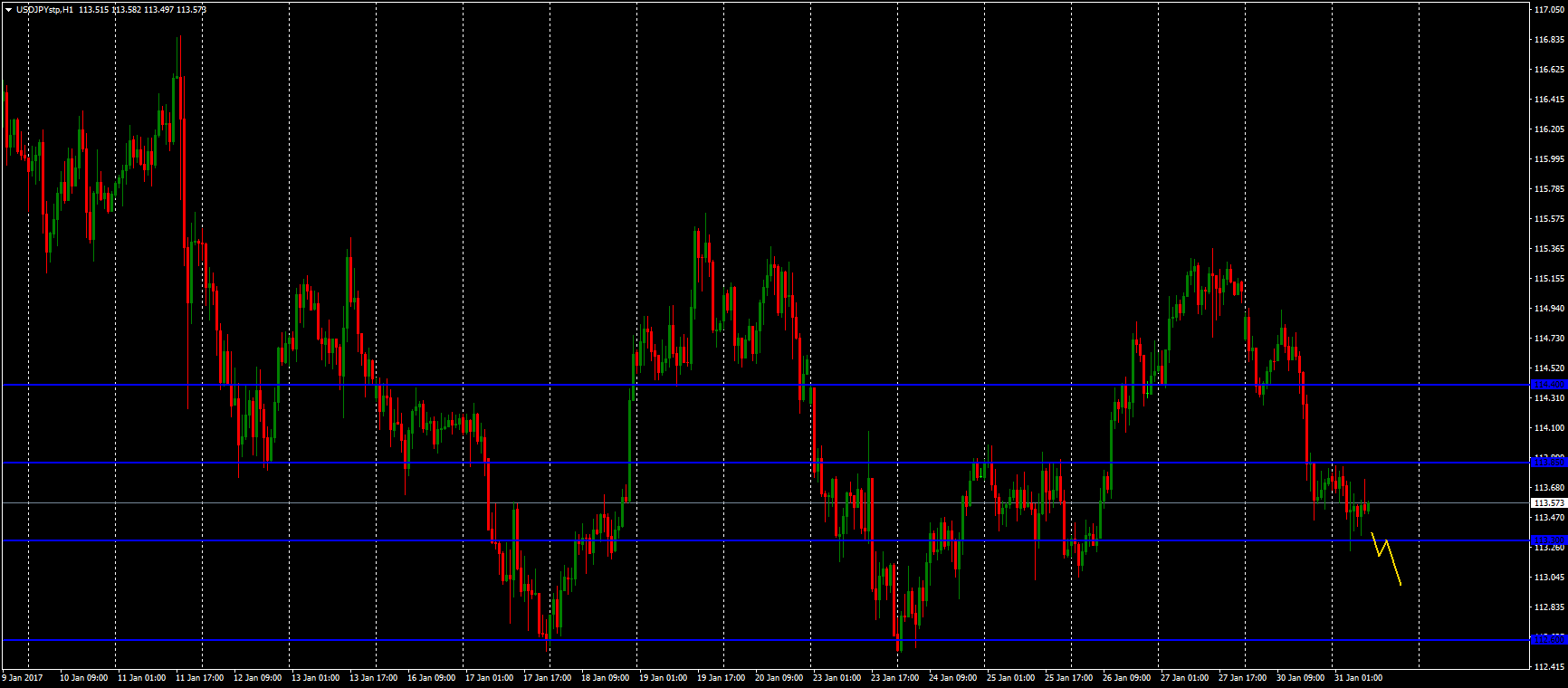

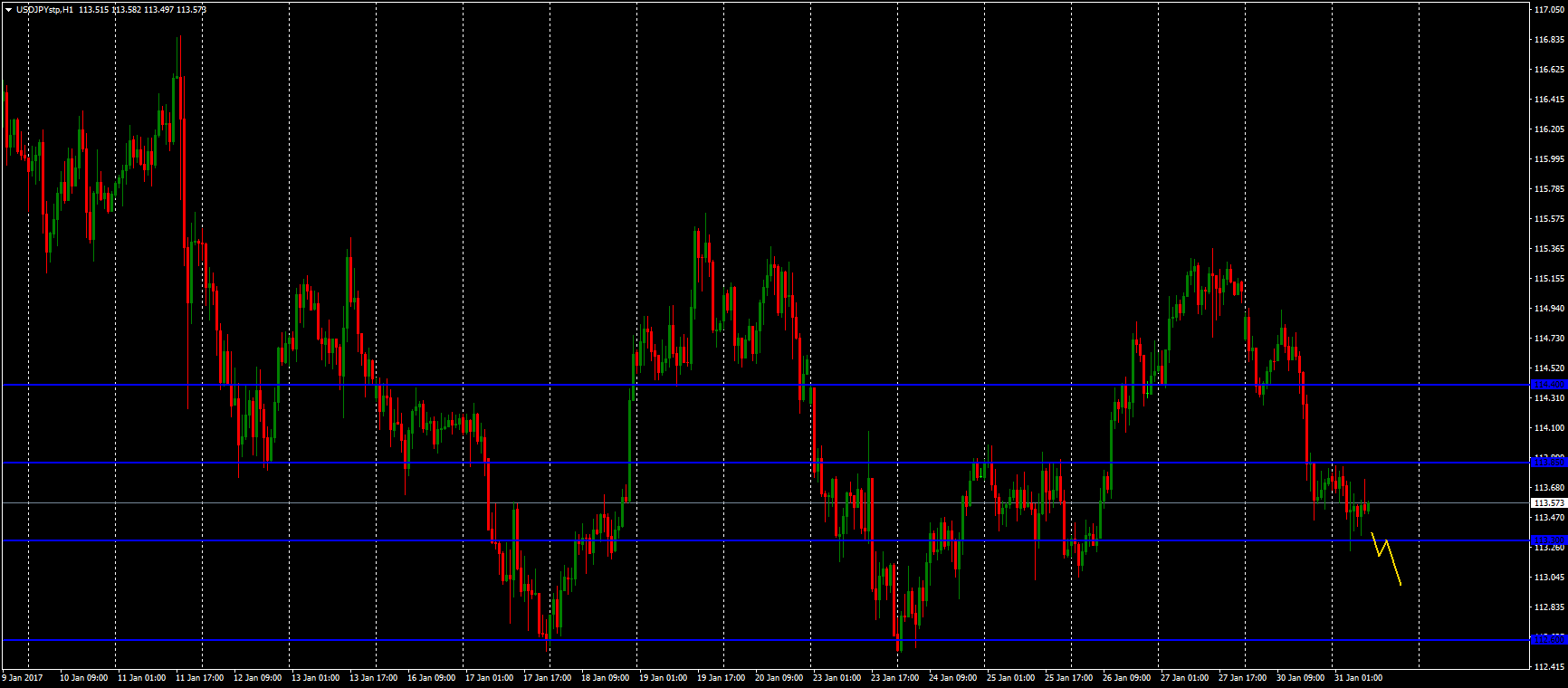

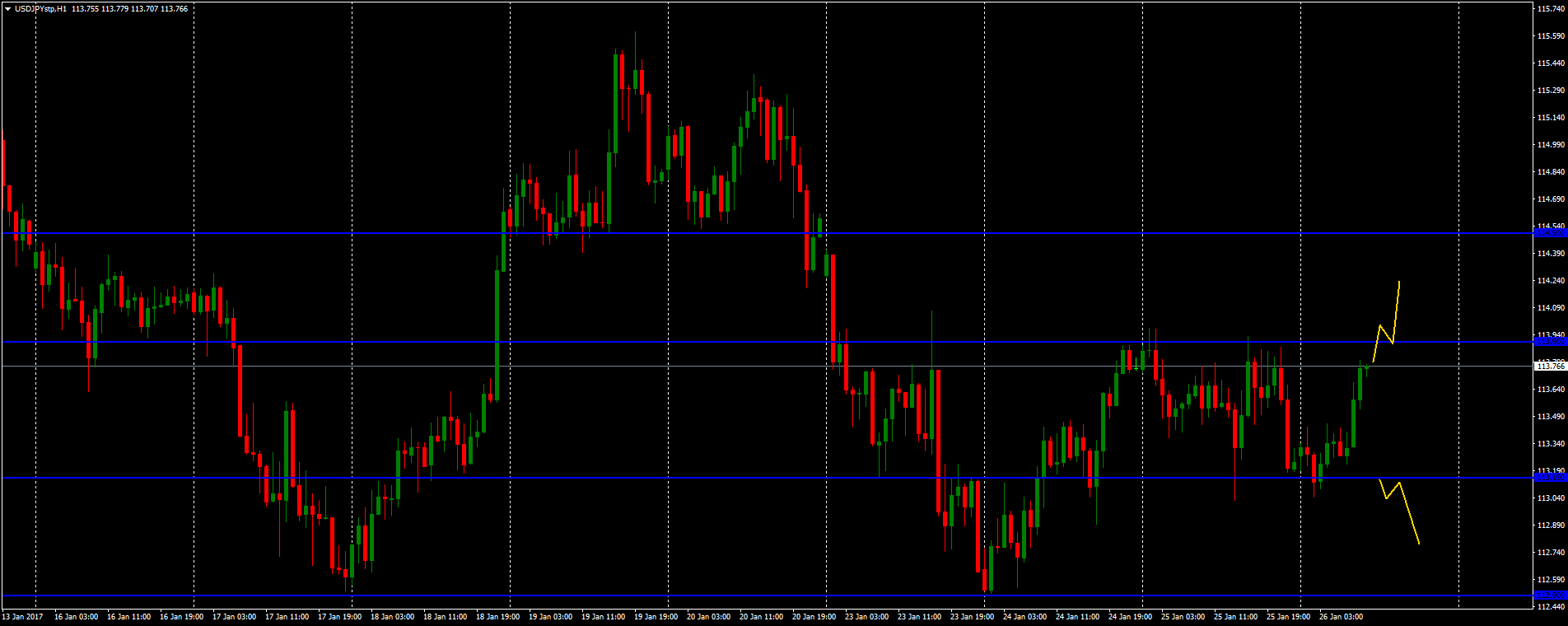

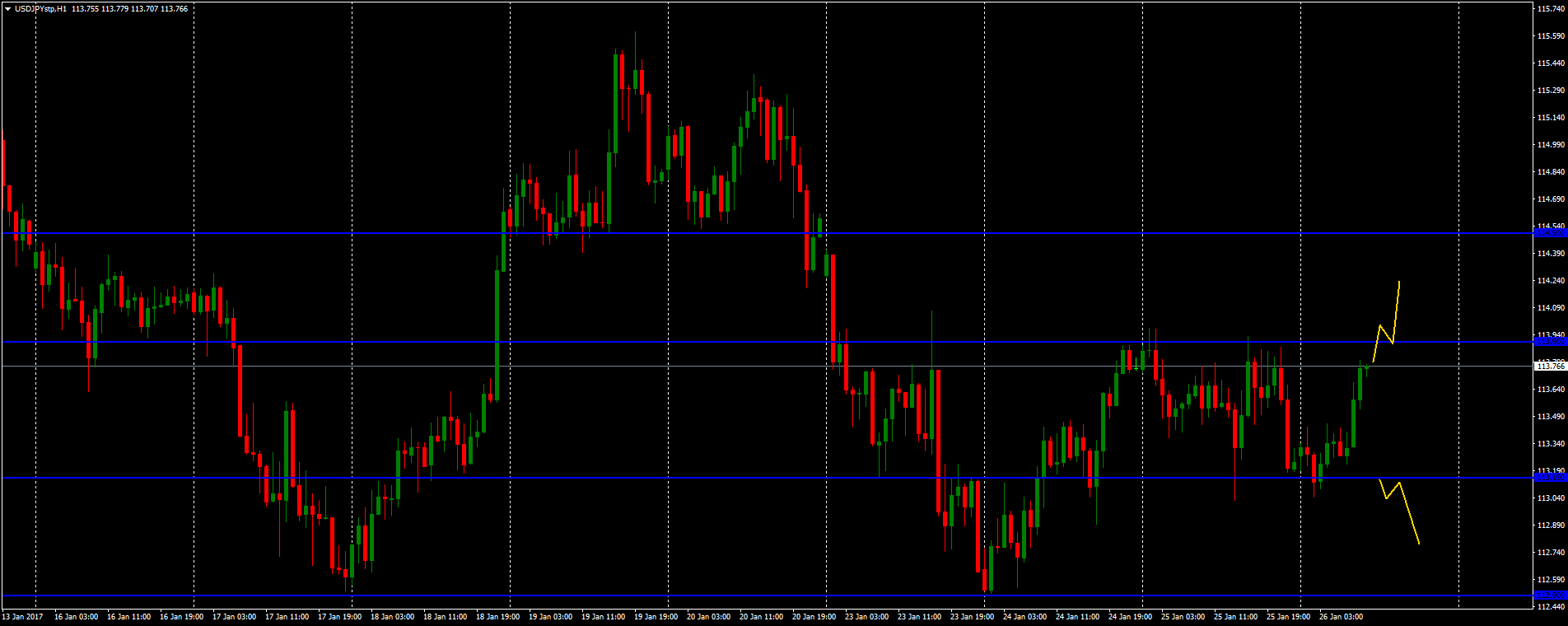

USD/JPY

Support: 113.15, 112.60

Resistance: 113.85, 114.40

Trump criticizes the strong dollar. How soon will the US Federal Reserve increase the rate? Or should we expect another vector of events development?

Wish you all good profits!

Support: 113.15, 112.60

Resistance: 113.85, 114.40

Trump criticizes the strong dollar. How soon will the US Federal Reserve increase the rate? Or should we expect another vector of events development?

Wish you all good profits!

alextrader79

The US dollar weakened against the "majors" yesterday. The first Fed meeting of the year will be held today. Experts assume that the rate will remain unchanged. There hardly will be strong trending movements before the decision of the US Central Bank. I highlighted the key levels for opening short-term speculative positions. Let’s do some scalping today ;)

EUR/USD

Support: 1.0775, 1.0735

Resistance: 1.0810, 1.0850

EUR/USD

Support: 1.0775, 1.0735

Resistance: 1.0810, 1.0850

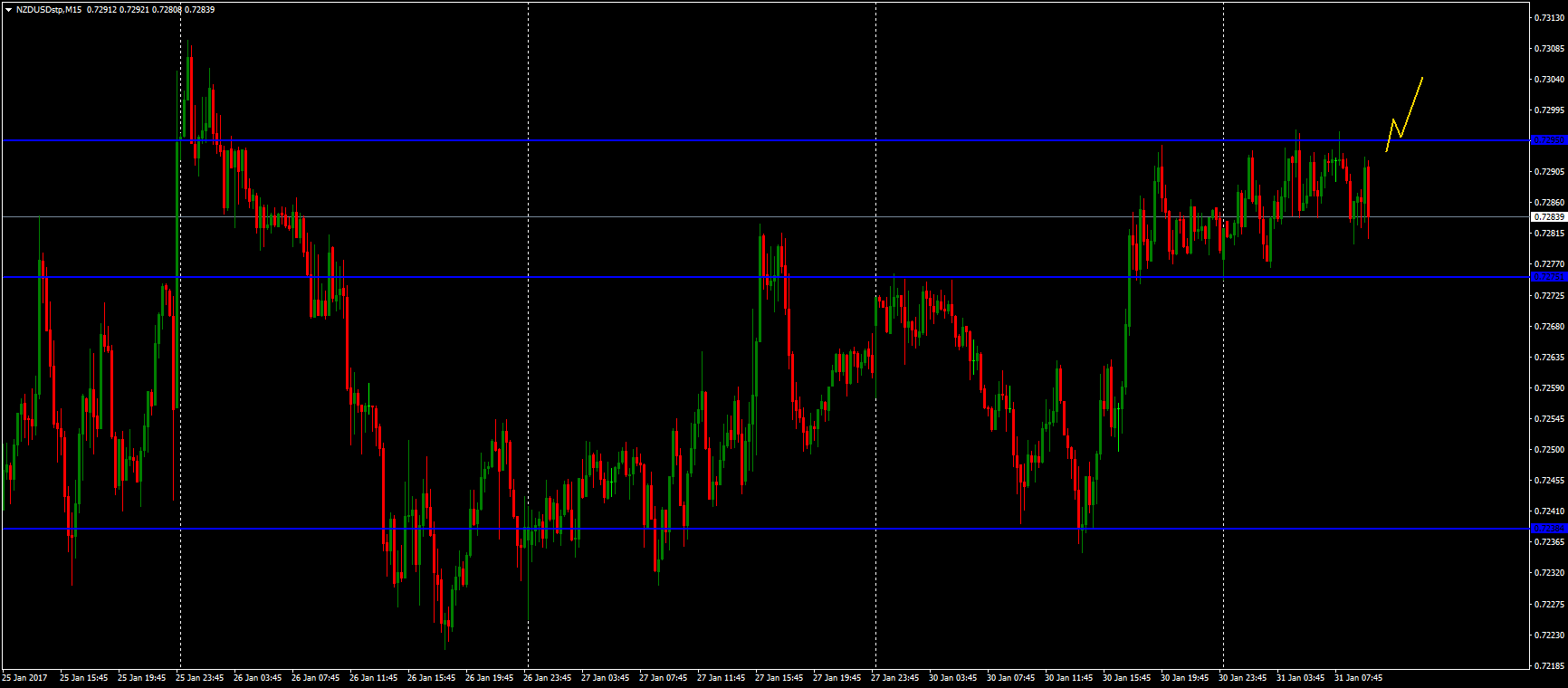

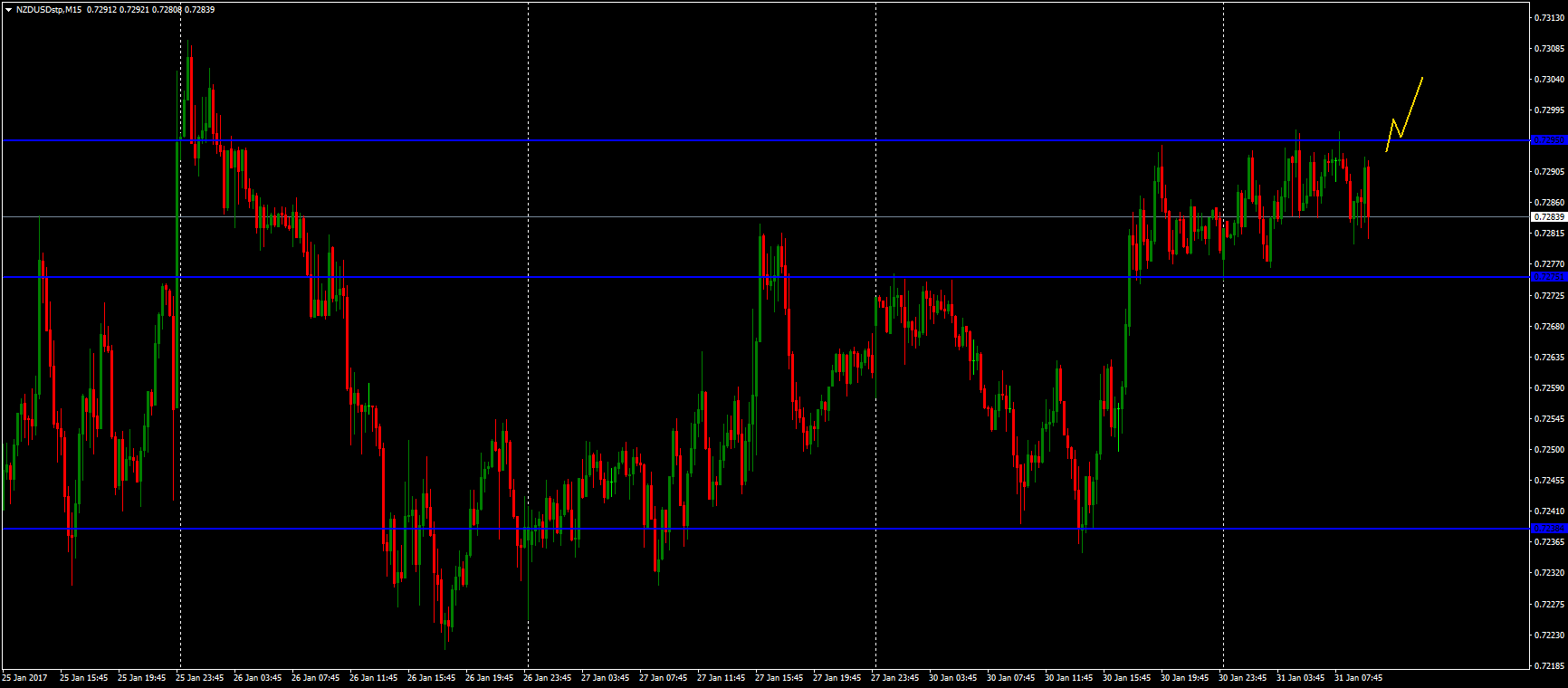

alextrader79

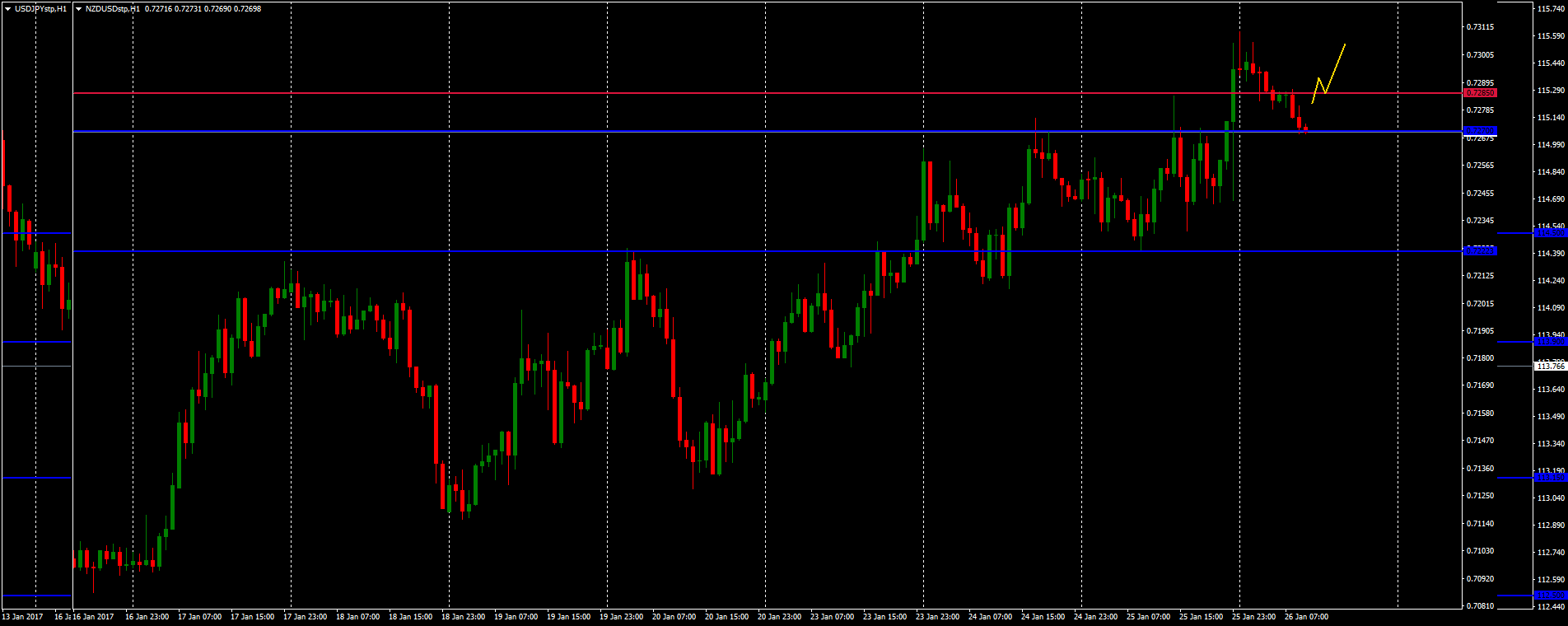

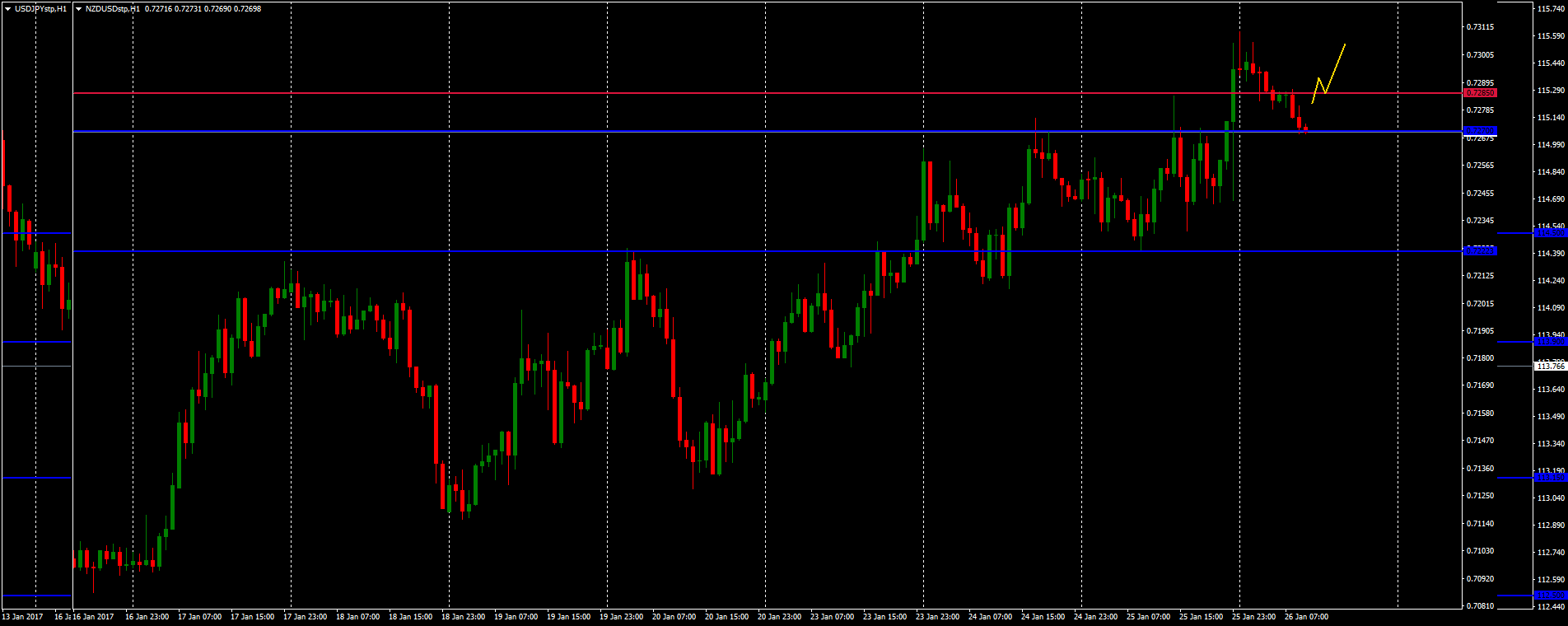

The aggressive buying was observed on the NZD/USD pair yesterday. The currency has formed the 0.7295 local resistance level. I plan to look for entry points for opening long positions. I am waiting for the breakout and retest of the 0.7295 mark. The potential for movement - to the nearest round number 0.7350.

alextrader79

My expectations regarding USD/JPY have confirmed. The yen continued to strengthen against the US currency. Trump’s immigration policy supports safe assets. I expect further growth in demand for the yen. I will sell USD/JPY, if the price fixes below 113.30. Potential movement - to 112.60. The transaction may last for a few days.

alextrader79

The USD/JPY currency pair is testing the 114.900 local resistance level at the moment. I’m going to sell it if the price fixes below 114.60. The nearest goal for taking profit is 113.85.

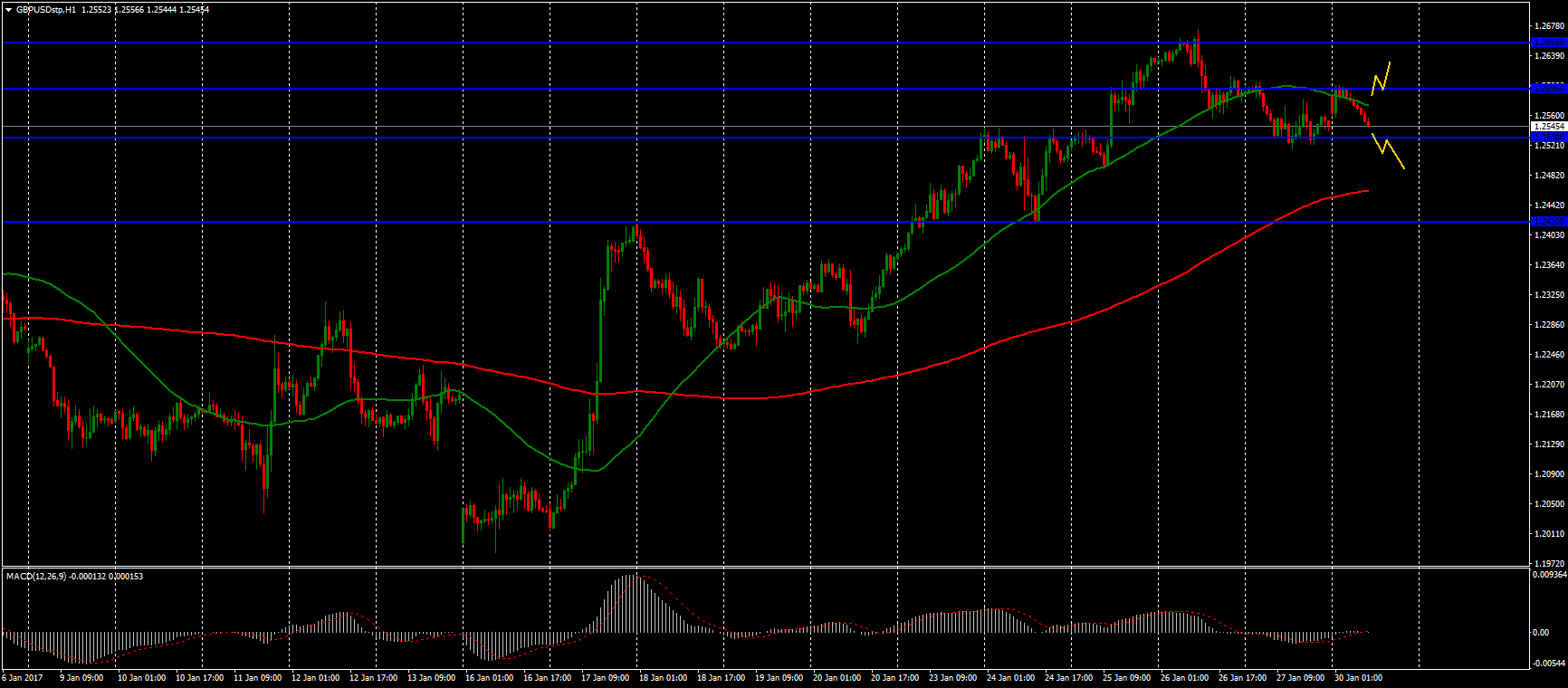

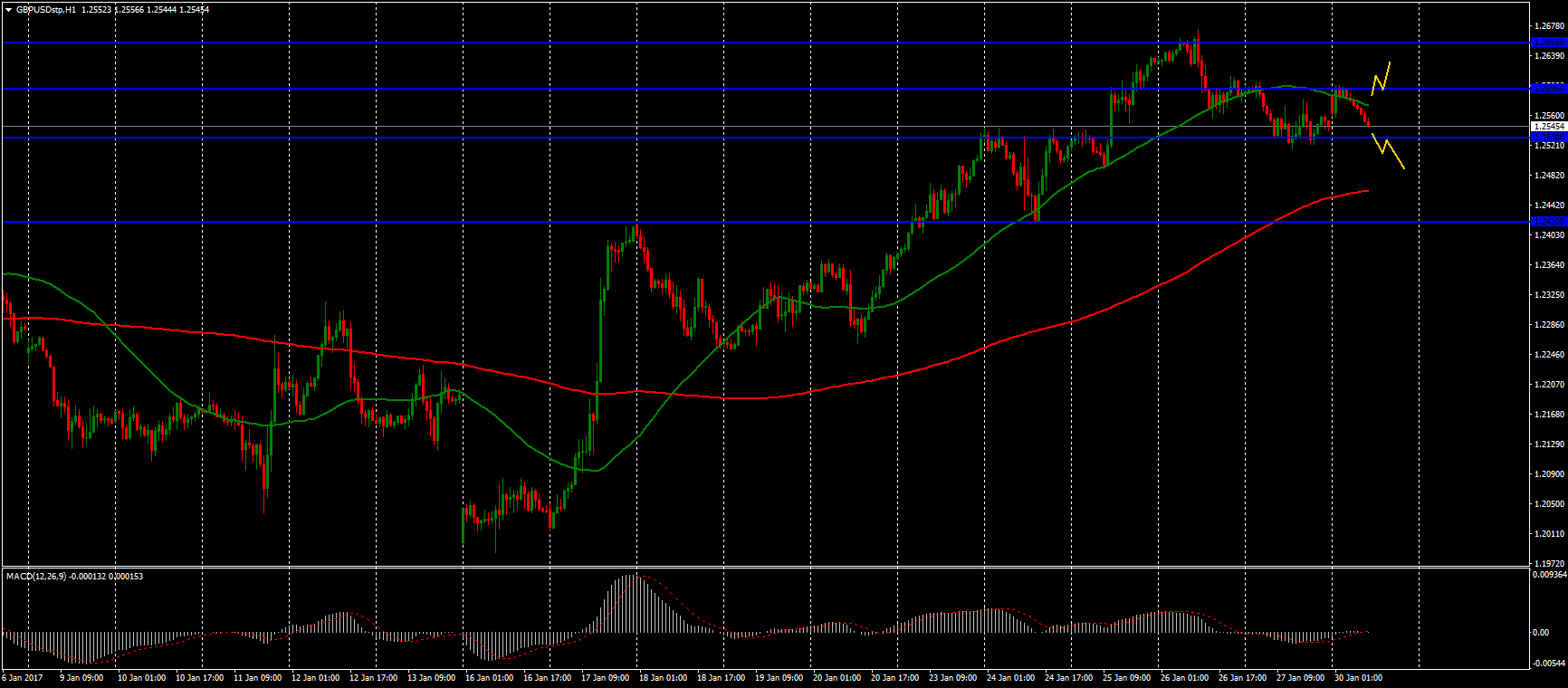

alextrader79

The technical pattern on GBP/USD is mixed now. Indicators don’t show any precise signals. The price is between 50 mA and 200 mA. The MACD histogram started to decline and moved into the negative zone. I identified the following key levels:

support: 1.2530; 1.2420

resistance: 1.2595; 1.2655

If the price fixes above the 1.2595 level, I will buy GBP/USD. Potential movement - to 1.2655.

If the price fixes below 1.2530, I’ll sell it. Potential movement - to 1.2420.

support: 1.2530; 1.2420

resistance: 1.2595; 1.2655

If the price fixes above the 1.2595 level, I will buy GBP/USD. Potential movement - to 1.2655.

If the price fixes below 1.2530, I’ll sell it. Potential movement - to 1.2420.

alextrader79

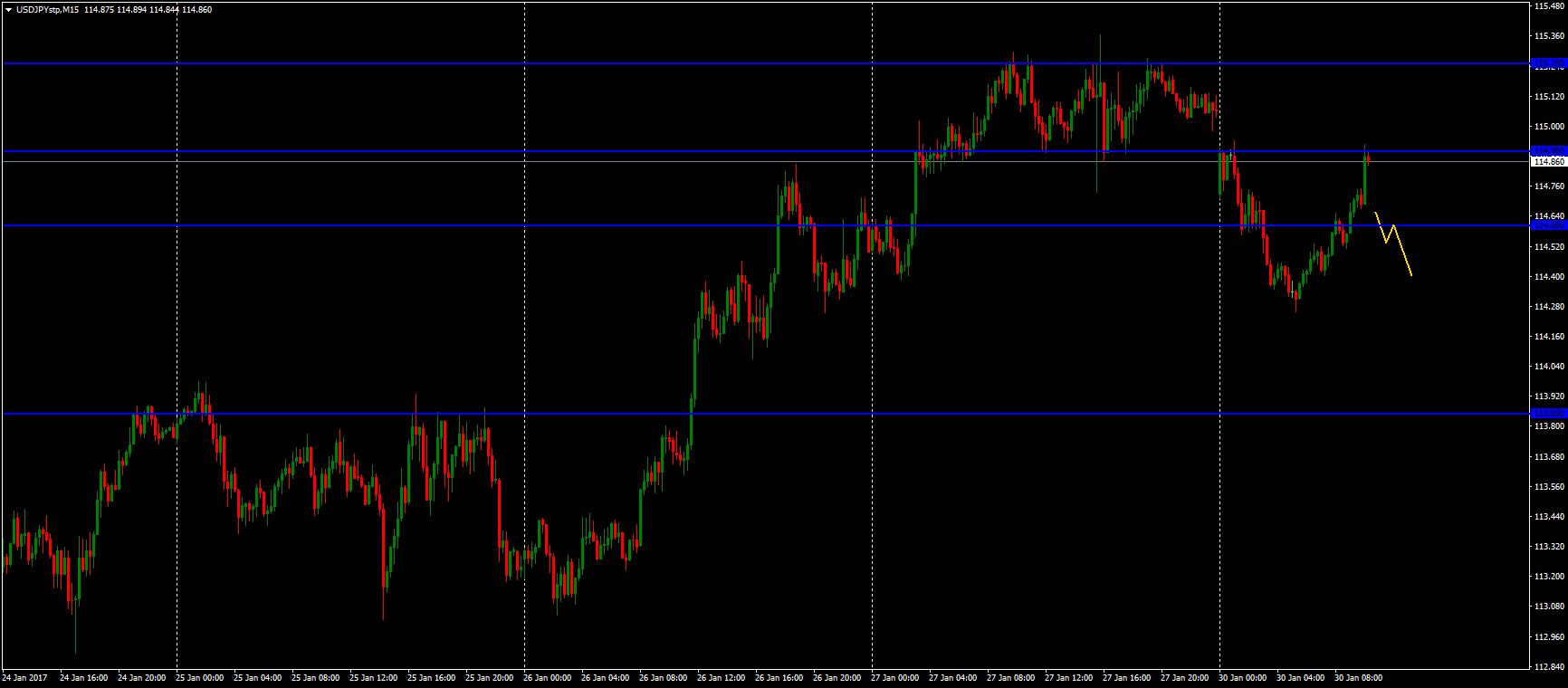

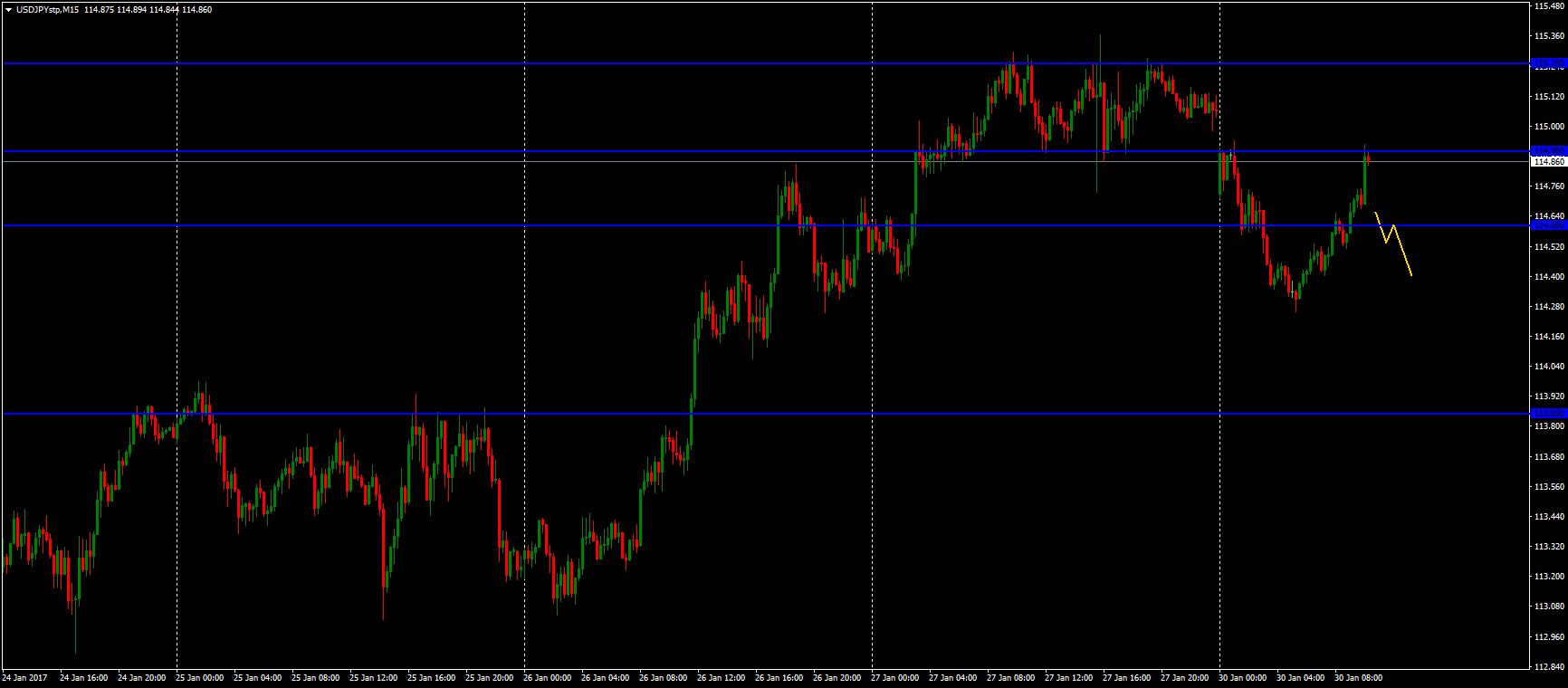

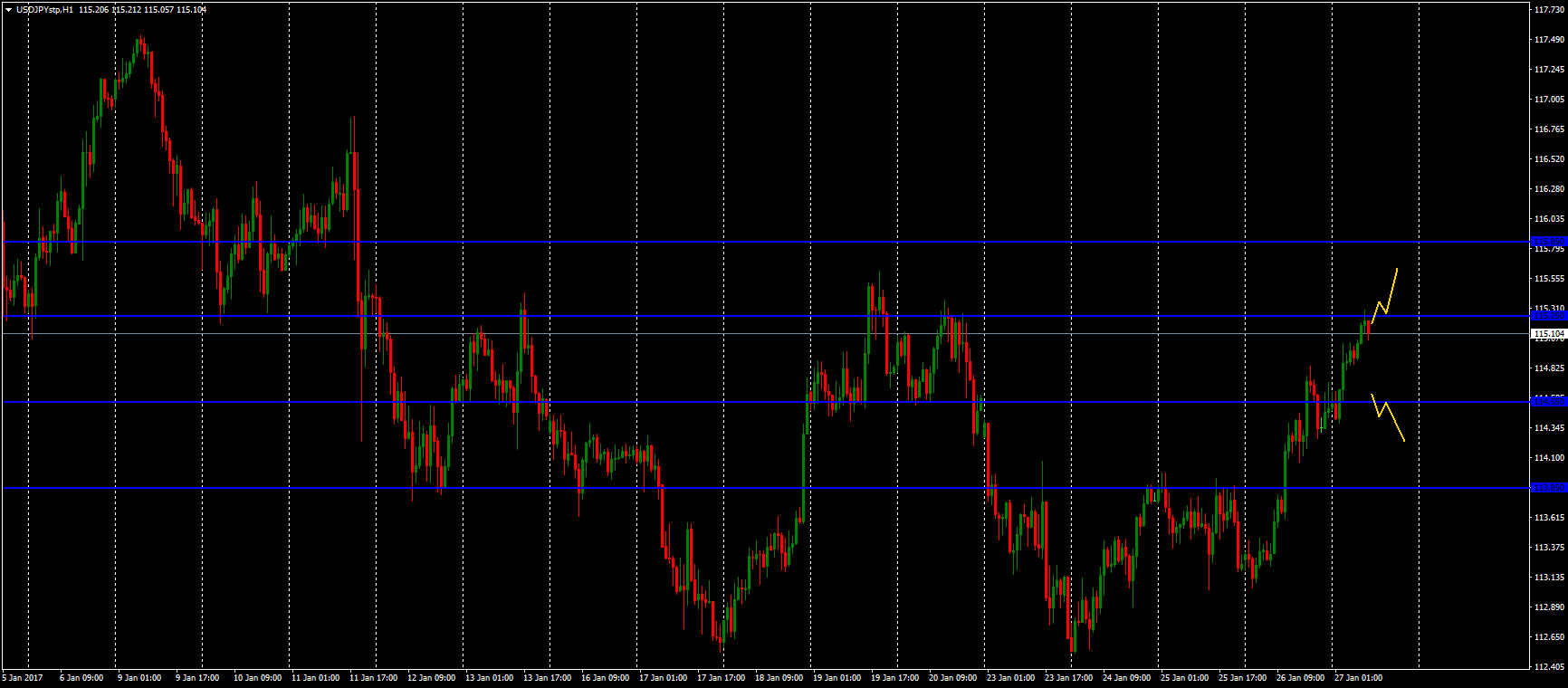

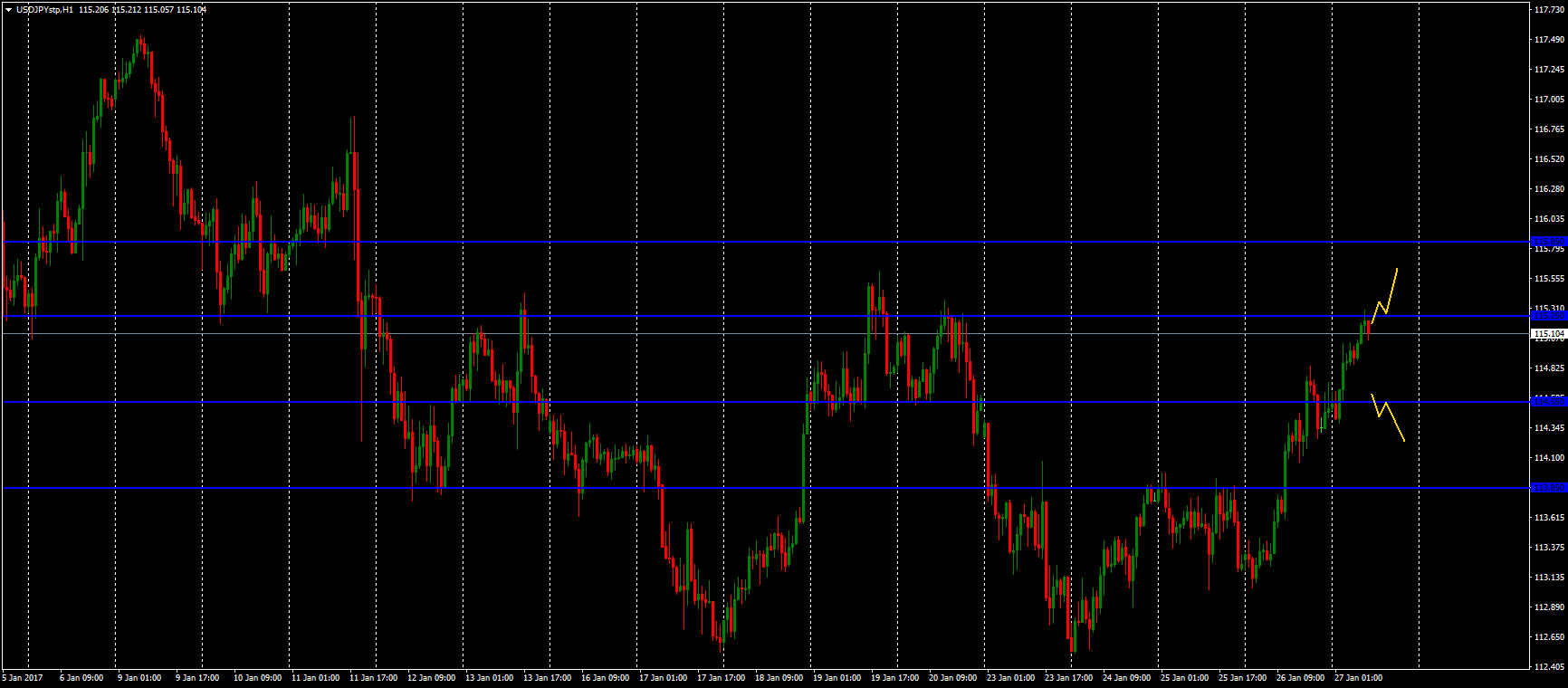

USD/JPY

Support: 114.55, 113.85

Resistance: 115.25, 115.85

If the price fixes above 115.25, I will buy USD/JPY to 115.85.

If the price fixes below 114.55, I will sell it to around 113.85.

Support: 114.55, 113.85

Resistance: 115.25, 115.85

If the price fixes above 115.25, I will buy USD/JPY to 115.85.

If the price fixes below 114.55, I will sell it to around 113.85.

alextrader79

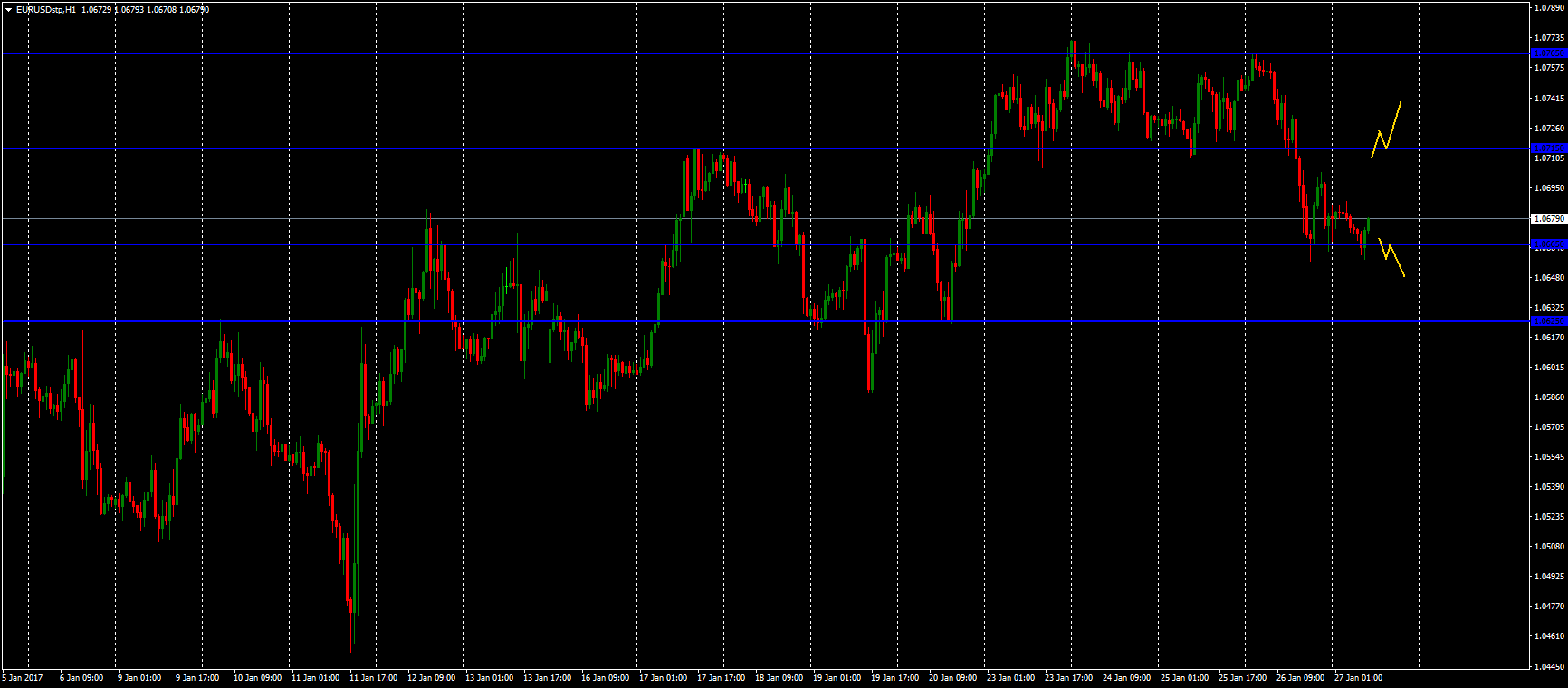

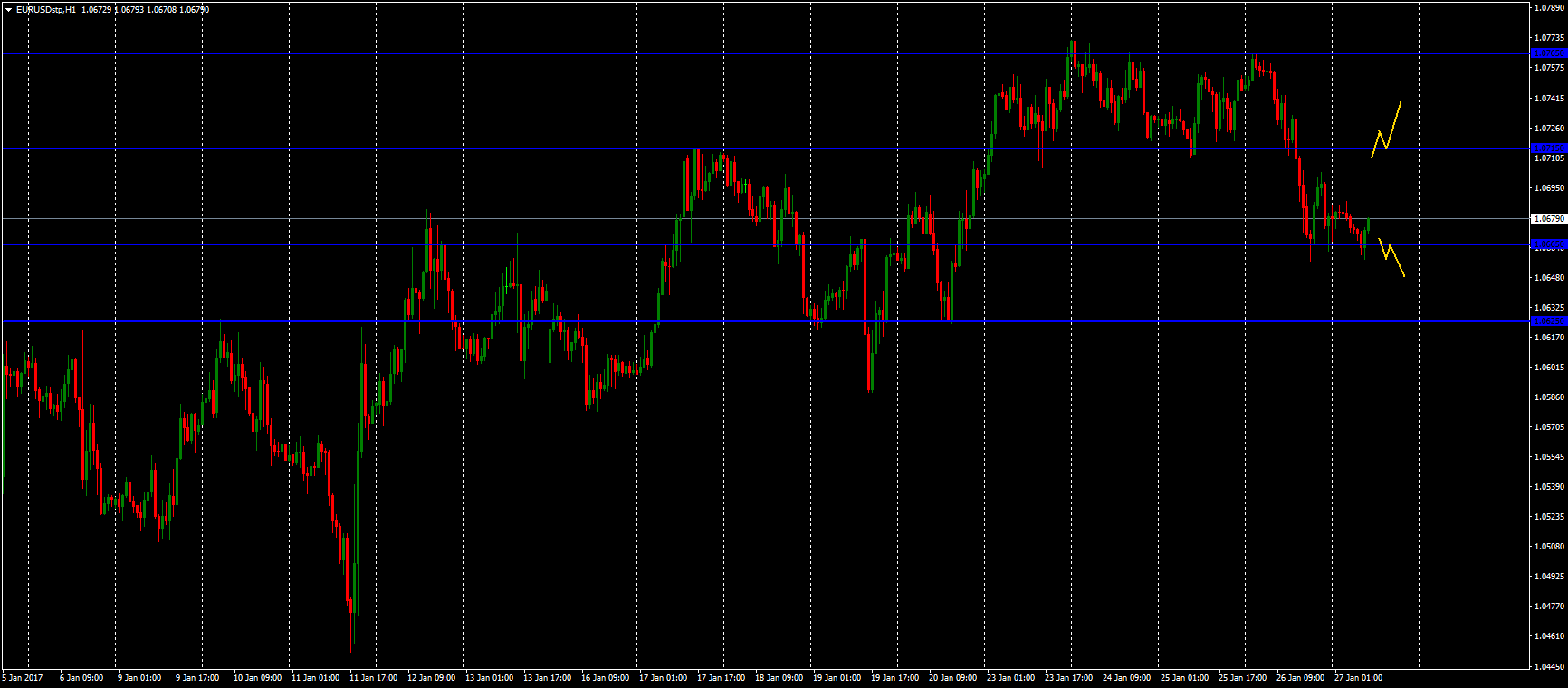

EUR/USD. The US dollar rose against major world currencies yesterday. Very important economic data from the US will be published today. The data on the GDP of the country will be announced at 13:30 (GMT).

The technical picture on the "majors" is ambiguous for me at the moment. I highlighted the key levels. I plan to wait for the statistics and watch how the market will react to it.

Support: 1.0665, 1.0625

Resistance: 1.0715, 1.0765

If the price fixes above the 1.0715 level, I’ll buy the EUR/USD to the 1.0765 mark.

If the price fixes below 1.0665, I’ll sell it to the 1.0625 mark.

The technical picture on the "majors" is ambiguous for me at the moment. I highlighted the key levels. I plan to wait for the statistics and watch how the market will react to it.

Support: 1.0665, 1.0625

Resistance: 1.0715, 1.0765

If the price fixes above the 1.0715 level, I’ll buy the EUR/USD to the 1.0765 mark.

If the price fixes below 1.0665, I’ll sell it to the 1.0625 mark.

alextrader79

There is an upward trend on the NZD/USD currency pair. The growth of quotes exceeded 120 points since the beginning of this week. I plan to open positions in the current trend direction. So, I’ll buy it after the price fixes above the 0.7285 level. Potential movement - to 0.7325-0.7350.

alextrader79

The technical picture on USD/JPY is ambiguous for me at the moment. I have identified the following key levels:

Support - 113.15

Resistance - 113.90

I’ll open orders after the breakout and retest of these levels.

If the price fixes above 113.90, I’ll buy USD/JPY to the 114.50 mark.

If the price goes through the 113.15 support, I’ll open short positions. Potential movement - to 112.50.

Potential entry points can be formed in a few days.

I'll check the news from the US fund today.

Support - 113.15

Resistance - 113.90

I’ll open orders after the breakout and retest of these levels.

If the price fixes above 113.90, I’ll buy USD/JPY to the 114.50 mark.

If the price goes through the 113.15 support, I’ll open short positions. Potential movement - to 112.50.

Potential entry points can be formed in a few days.

I'll check the news from the US fund today.

alextrader79

The Aussie fell due to the weak data on the consumer price index In Asian trading session. I plan to open transactions towards the current trend. If the price exceeds the 0.7520 level, I will look for an entry point to open short positions. My next target for taking profit is 0.7465.

alextrader79

The technical picture on EUR/USD indicates the correction development. The euro is traded near the 1.0715 support level. I’m going to sell EUR/USD if the price fixes below this mark. Potential movement - to 1.0665.

: