alextrader79 / Profil

alextrader79

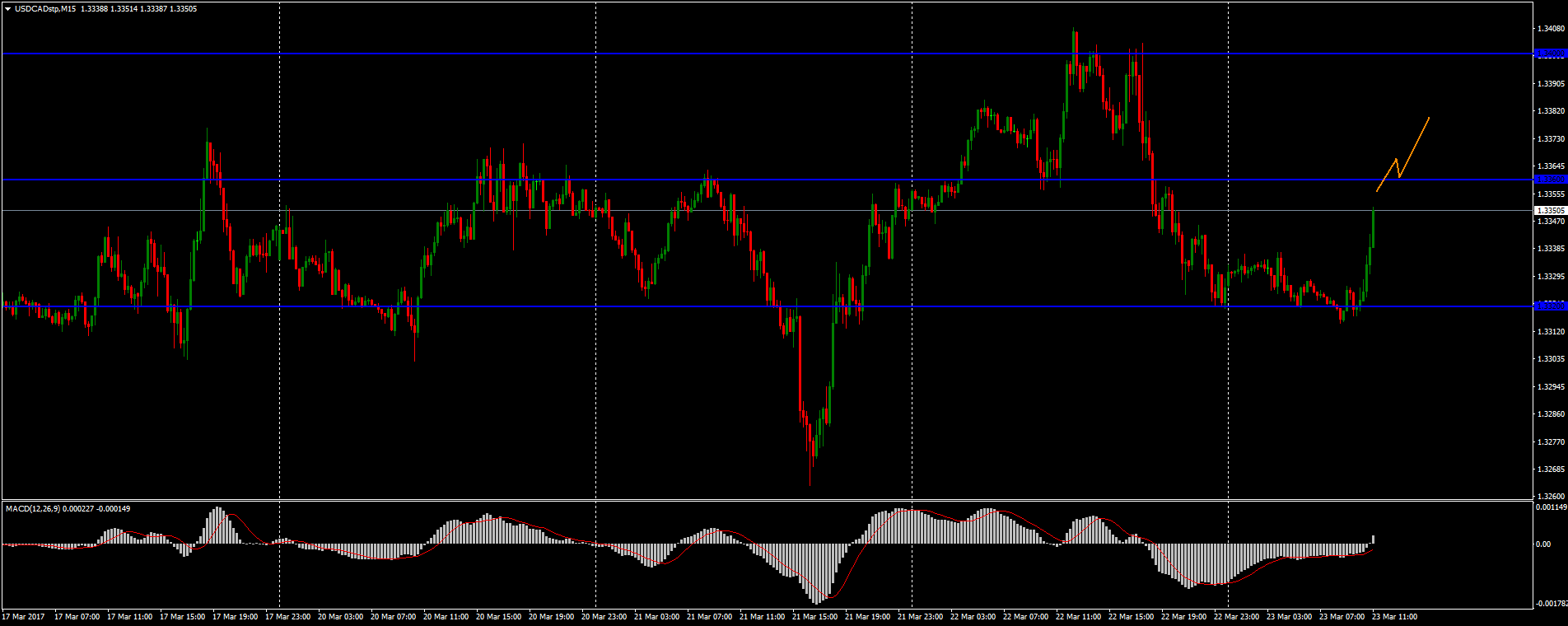

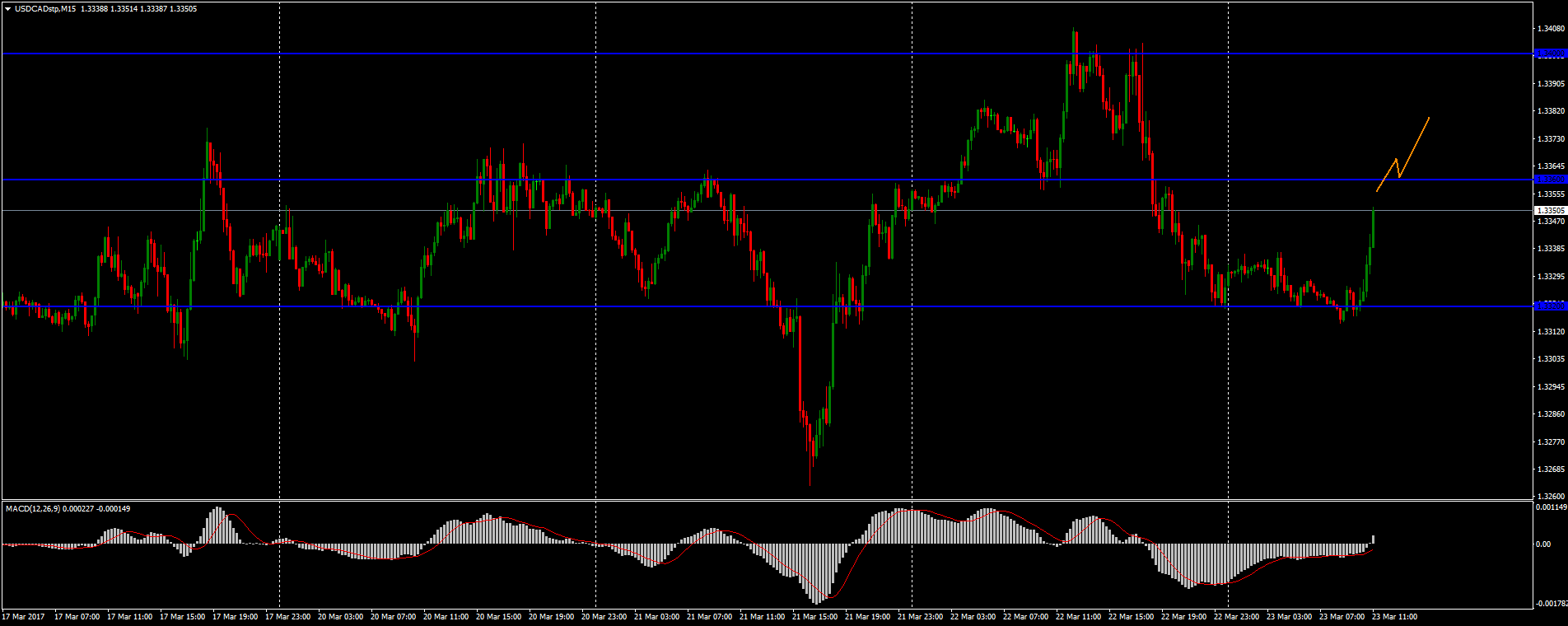

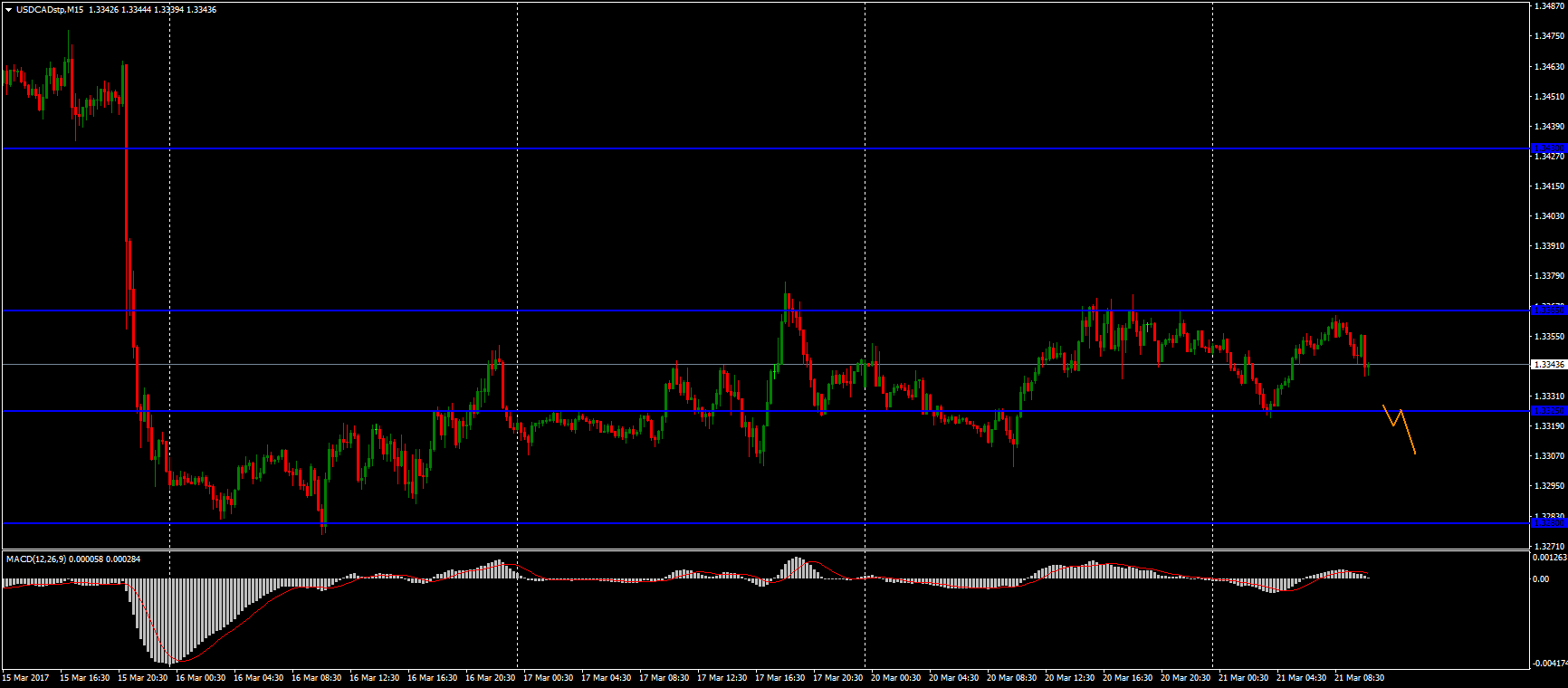

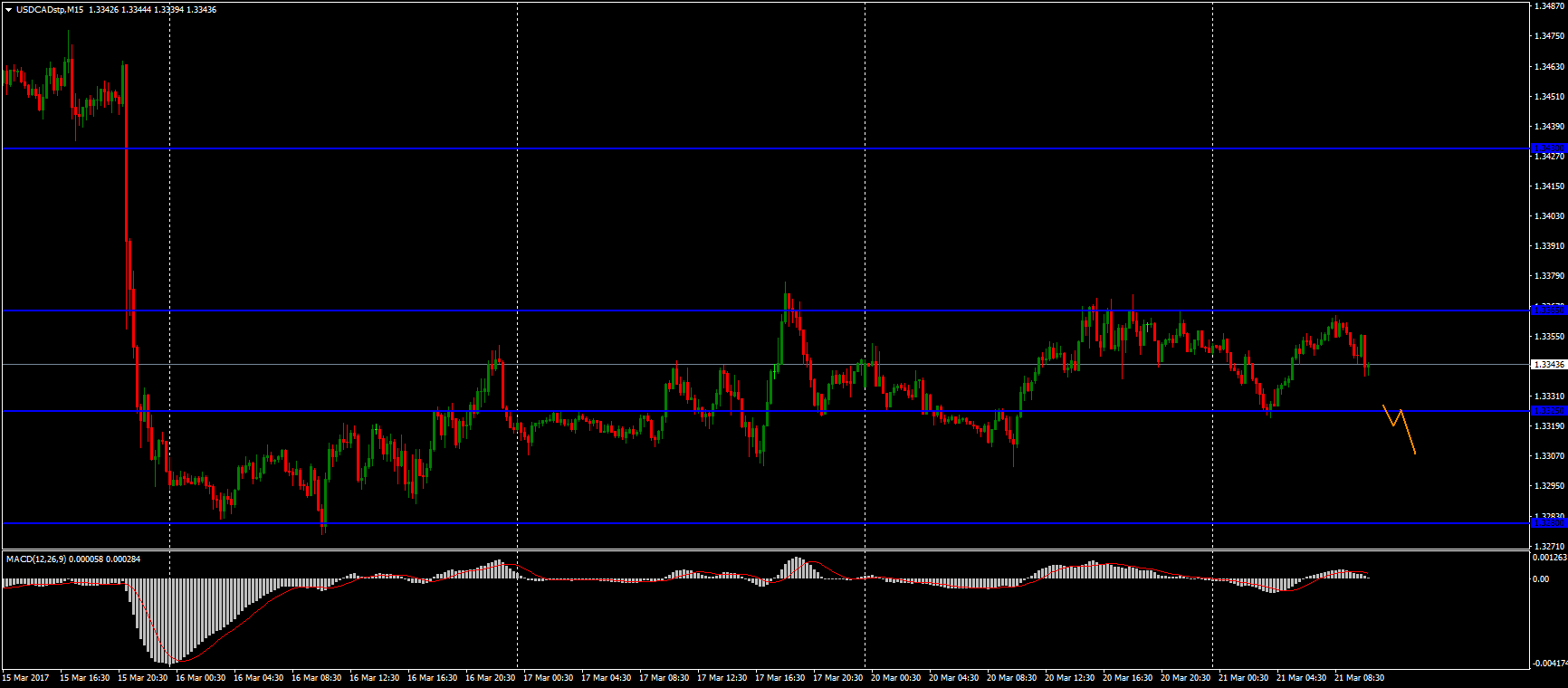

The technical pattern on USD/CAD indicates the "bullish" sentiment now. The currency has held the 1.3320 local support level. The nearest resistance is 1.3360. I’ll buy USD/CAD, if the price fixes above this level. Potential movement - to the 1.3400 round level.

alextrader79

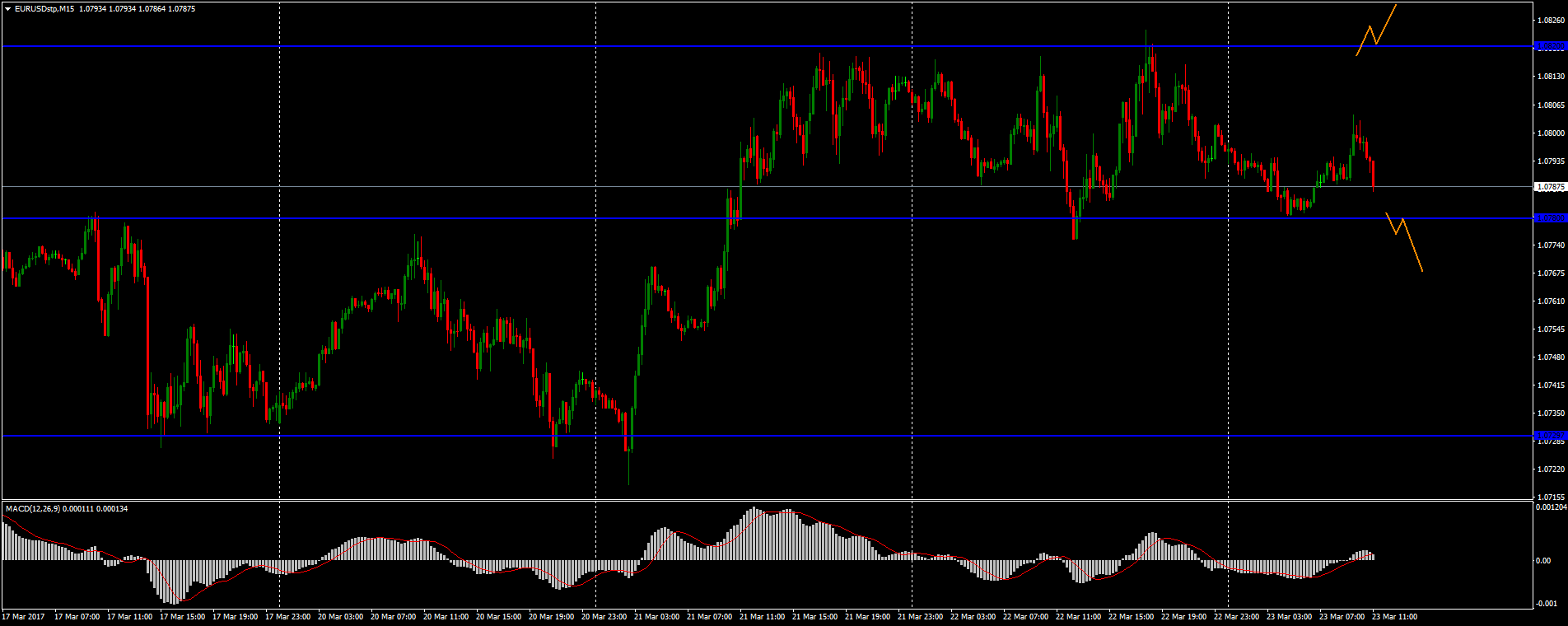

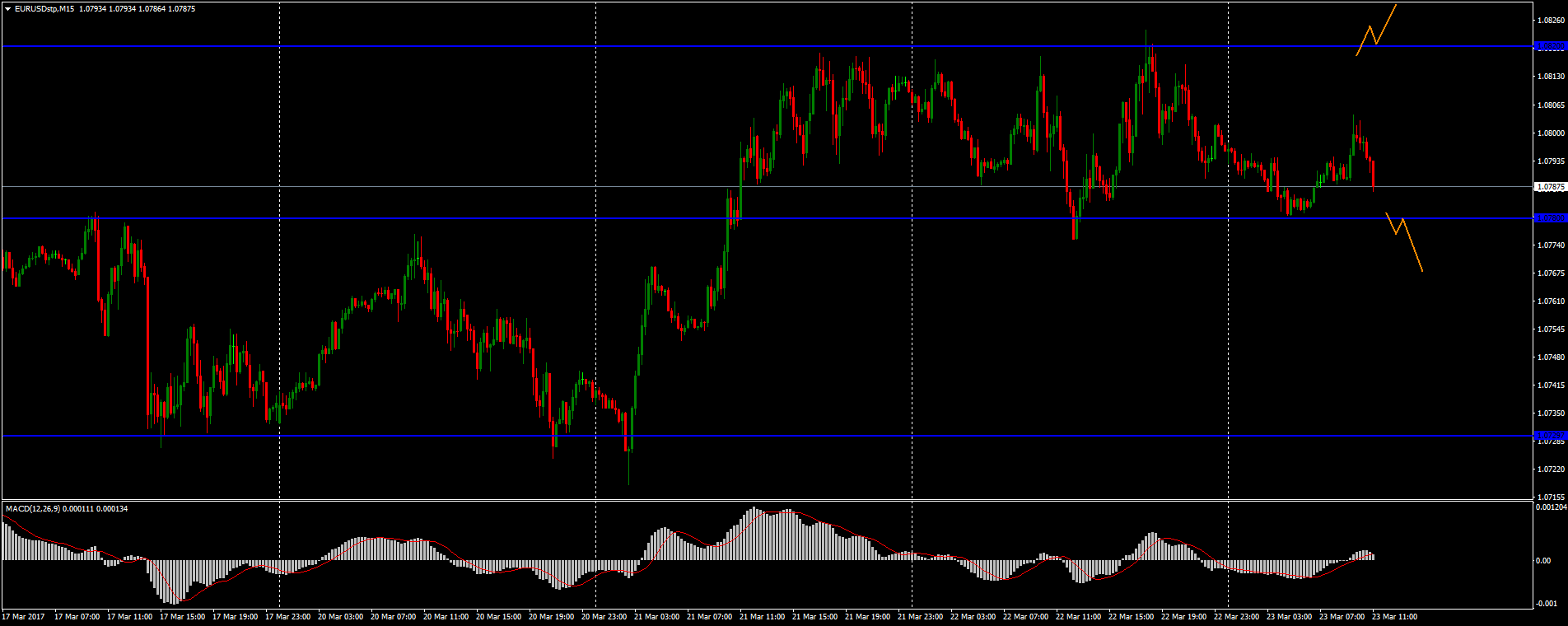

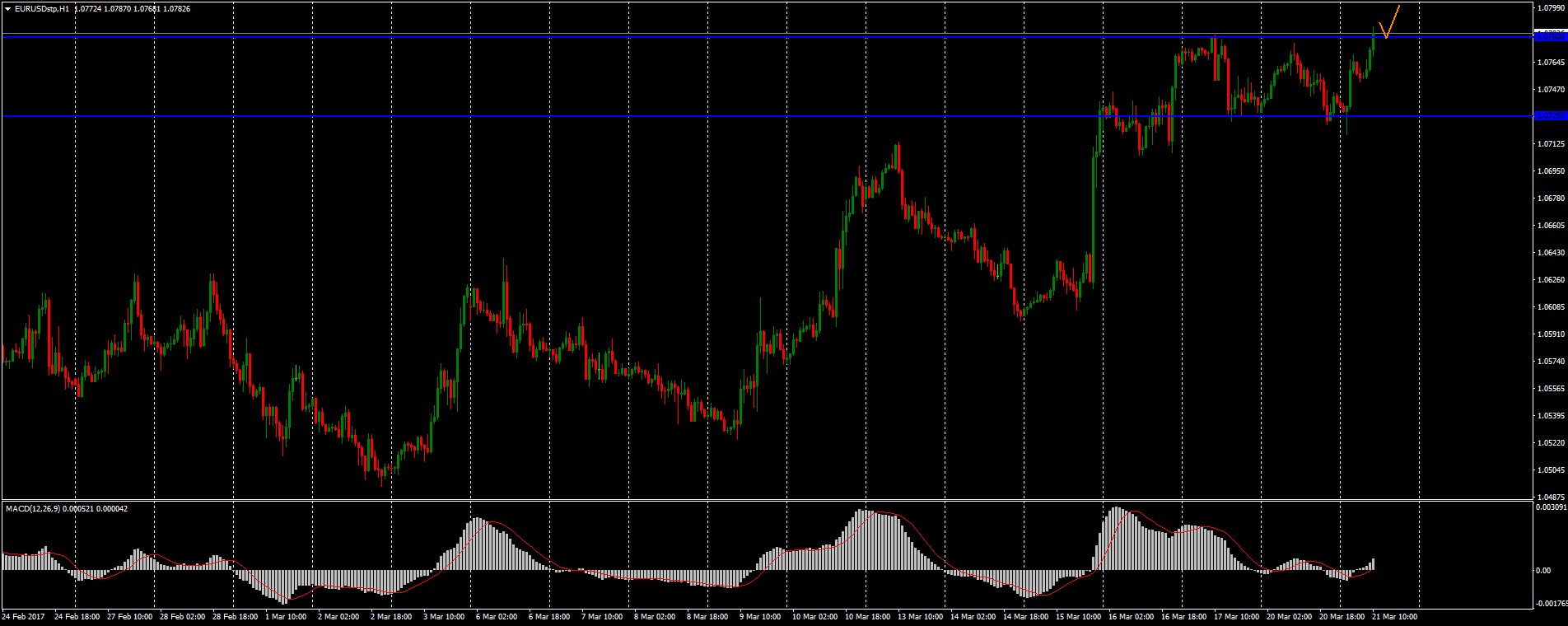

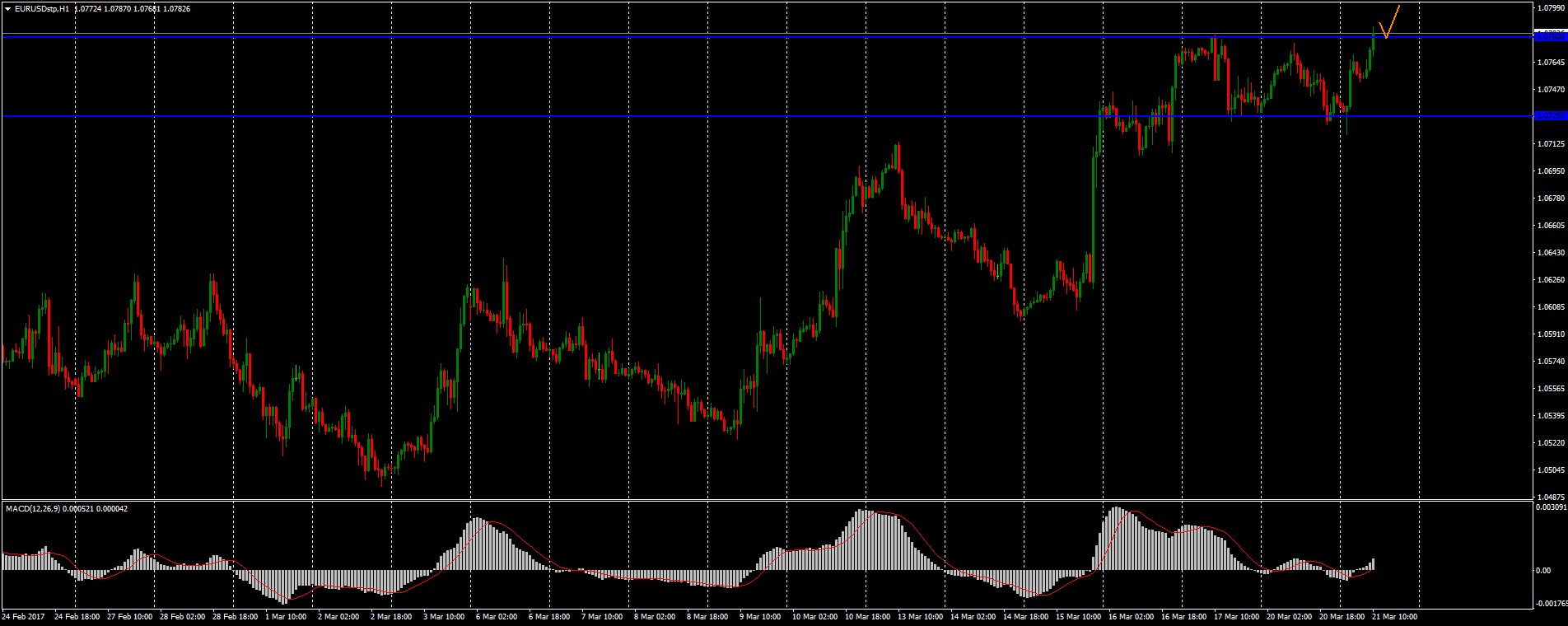

EUR/USD is in sideways motion at the moment. I can identify the key support and resistance levels: 1.0780 and 1.0820. I plan to open transactions after the breakthrough and retest of these levels. The market is waiting for the speech of the Fed chairman.

I’ll buy EUR/USD to 1.0850-1.0875, if the price fixes above the 1.0820 level.

I’ll sell it to 1.0750-1.0725, if the price fixes below the level of 1.0780.

I’ll buy EUR/USD to 1.0850-1.0875, if the price fixes above the 1.0820 level.

I’ll sell it to 1.0750-1.0725, if the price fixes below the level of 1.0780.

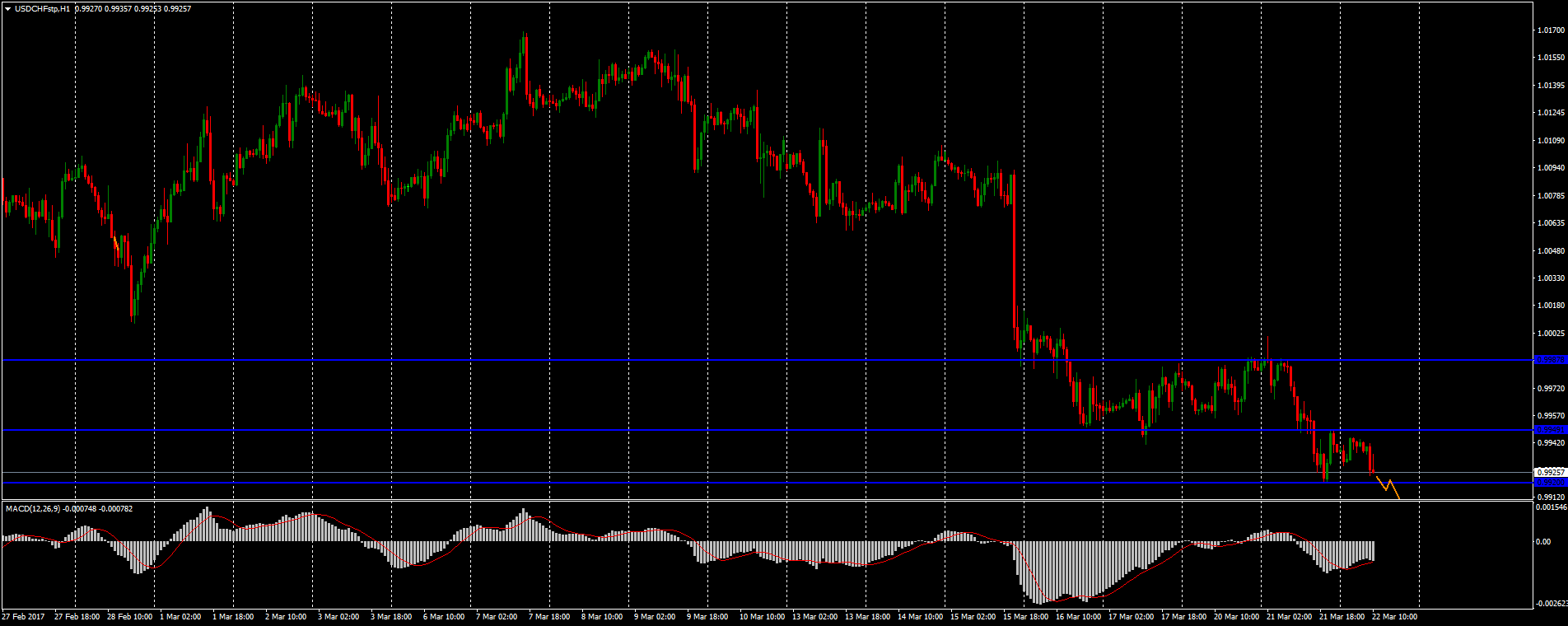

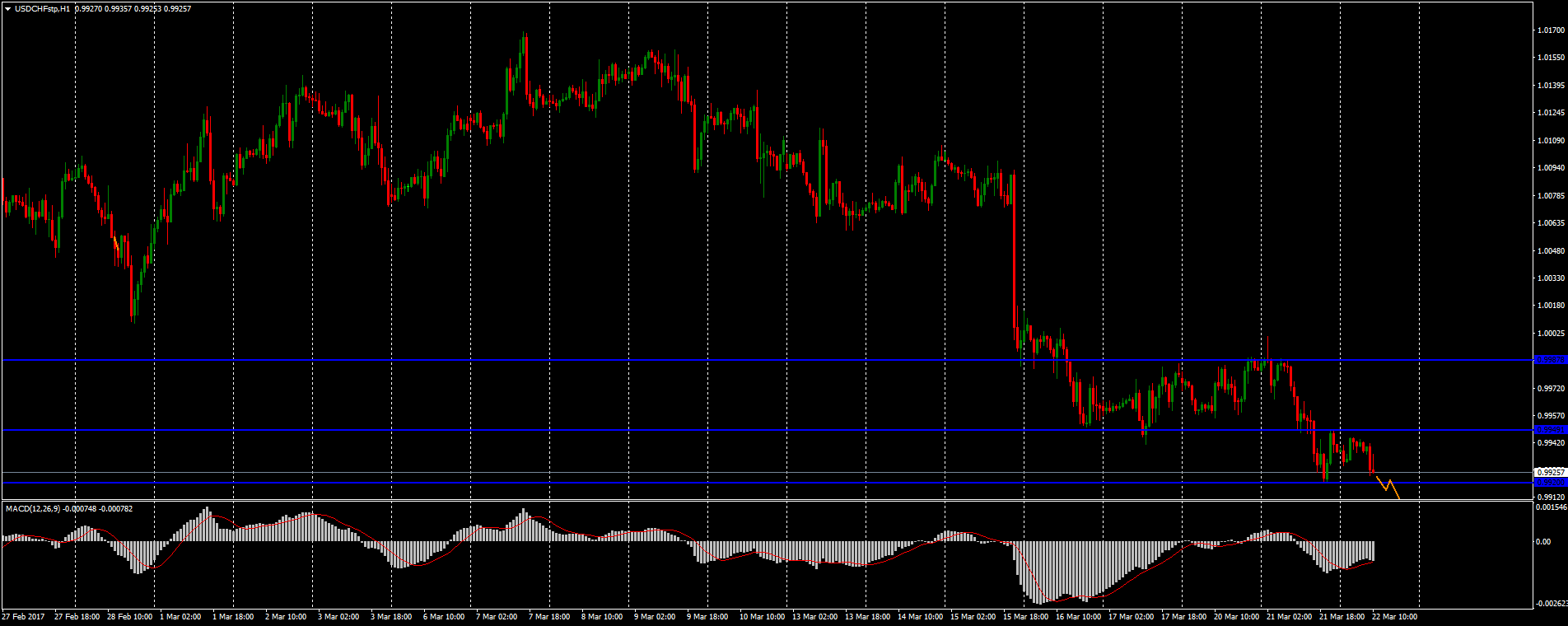

alextrader79

Sellers dominate on USD/CHF now. I plan to open deals in the current trend’s direction. The currency is testing the 0.9920 local support at the moment. I’ll sell it, if the price fixes below this level. Potential movement - to 0.9875-0.9850.

alextrader79

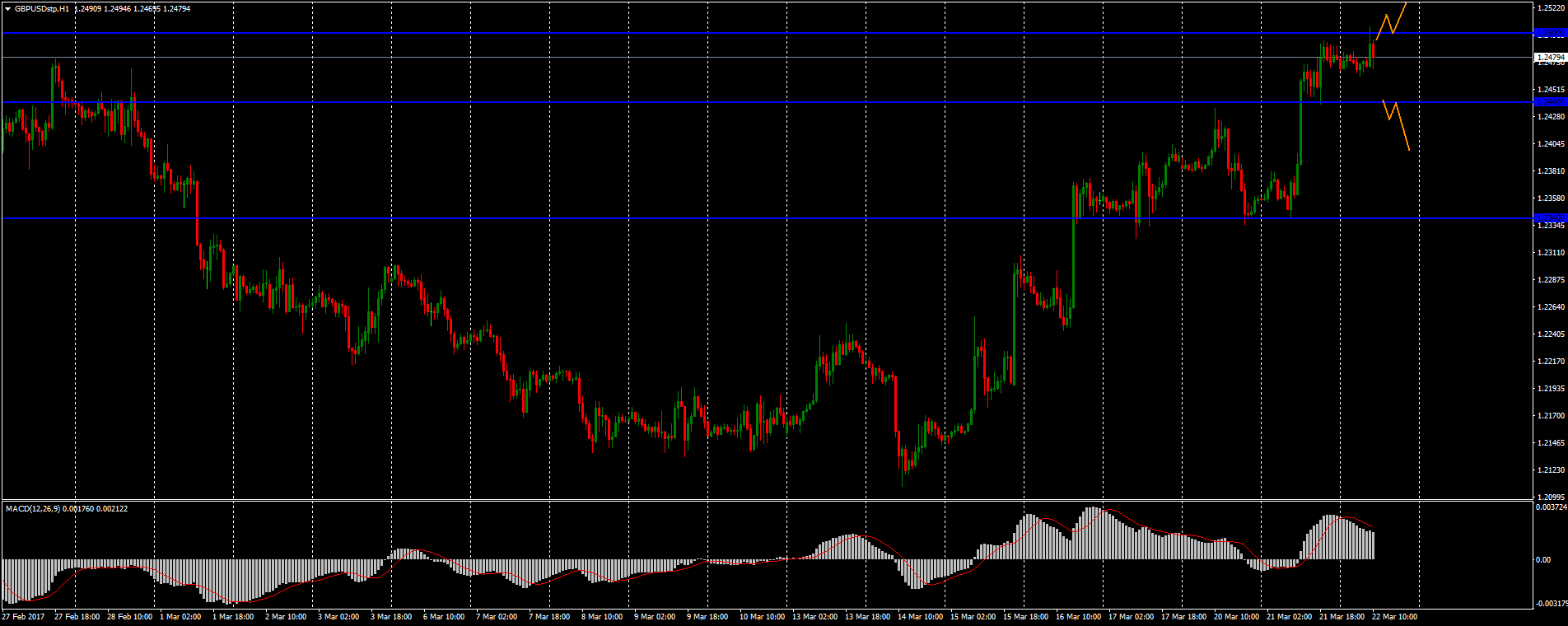

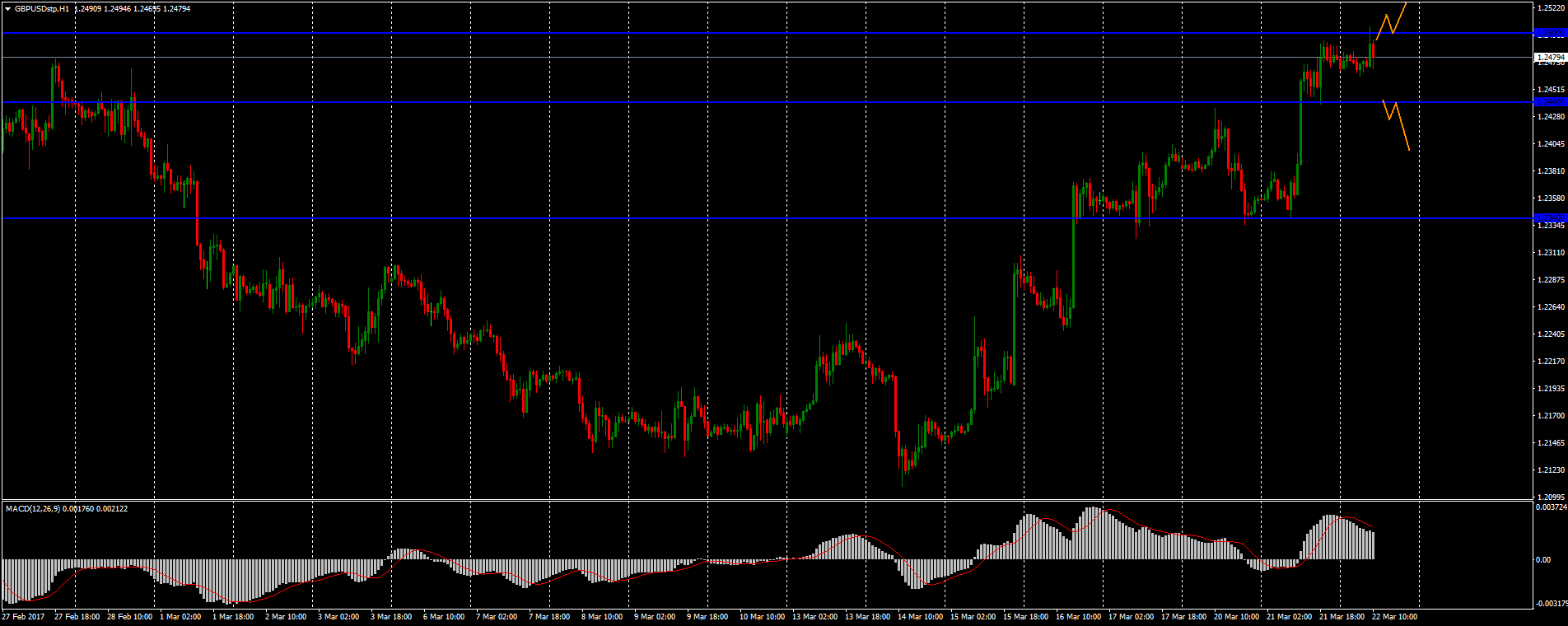

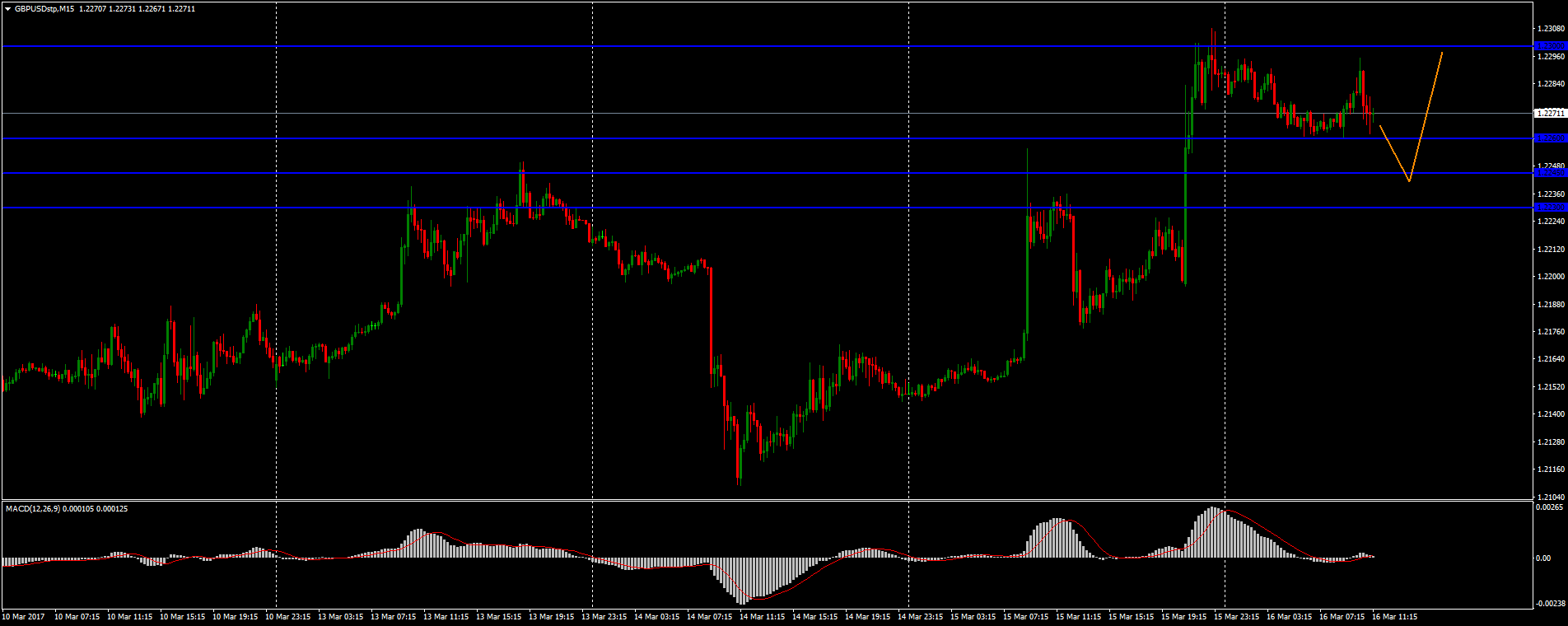

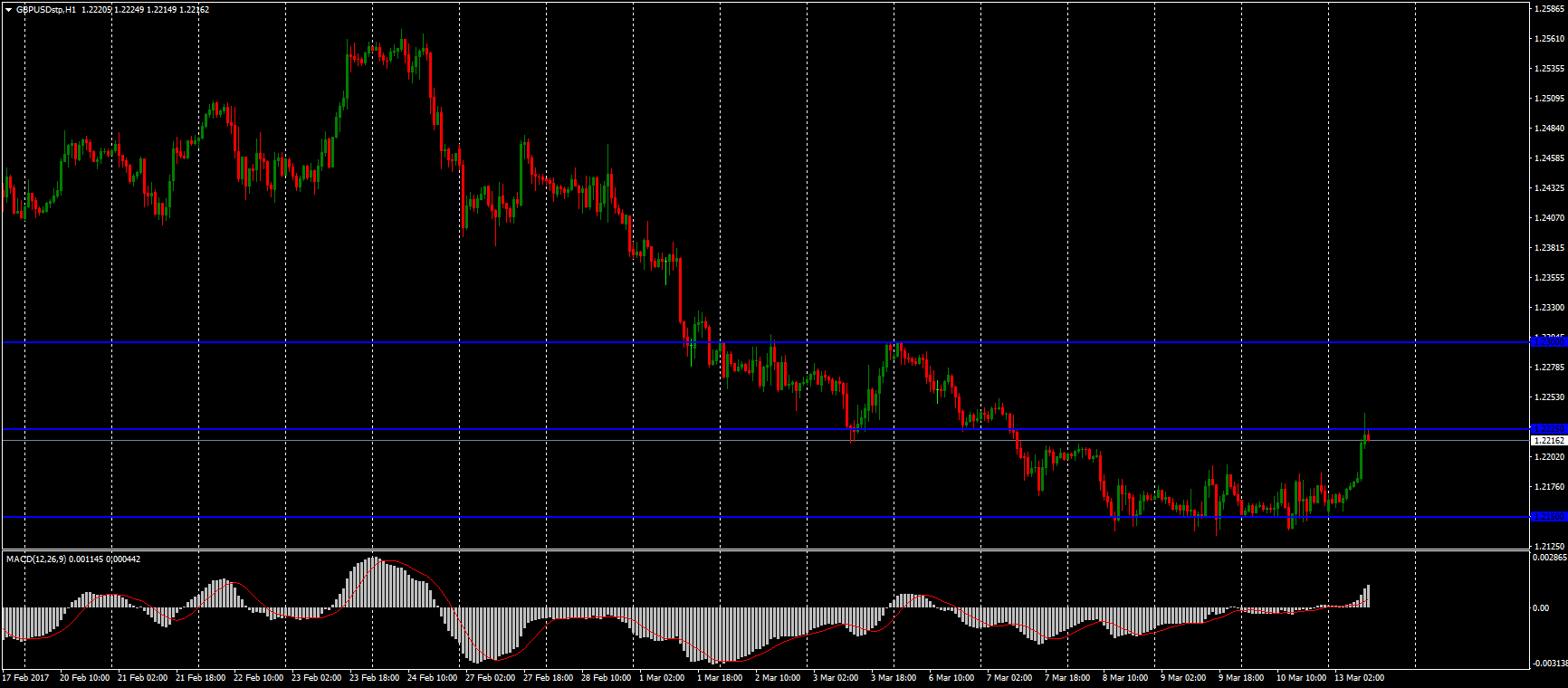

The pound has increased in its value over the past week. The GBP/USD currency pair has reached a rather strong resistance zone. The technical pattern is ambiguous for me at the moment. I don’t exclude a correction on GBP/USD in the nearest future. I’ve identified the following levels:

Support - 1.2440

Resistance - 1.2500

I plan to open positions after the breakthrough and retest of these levels. Confirmations and entry points can be found on the smaller timeframes.

Support - 1.2440

Resistance - 1.2500

I plan to open positions after the breakthrough and retest of these levels. Confirmations and entry points can be found on the smaller timeframes.

alextrader79

The USD/CAD pair has held its local resistance at 1.3365. I plan to sell it, if the price fixes below 1.3325. The immediate goal for taking profit is 1.3280. I’ll use a trailing stop here. I think that the currency can reach the 1.3200 round level.

alextrader79

Purchases dominate on EUR/USD now. The euro has overcame the 1.0780 local resistance. The Fed representative, Charles Evans, said that the regulator won’t rush to raise the rates. I’d buy the pair after the retest of the 1.0780 "mirror" support level. Potential movement - to 1.0825-1.0850.

alextrader79

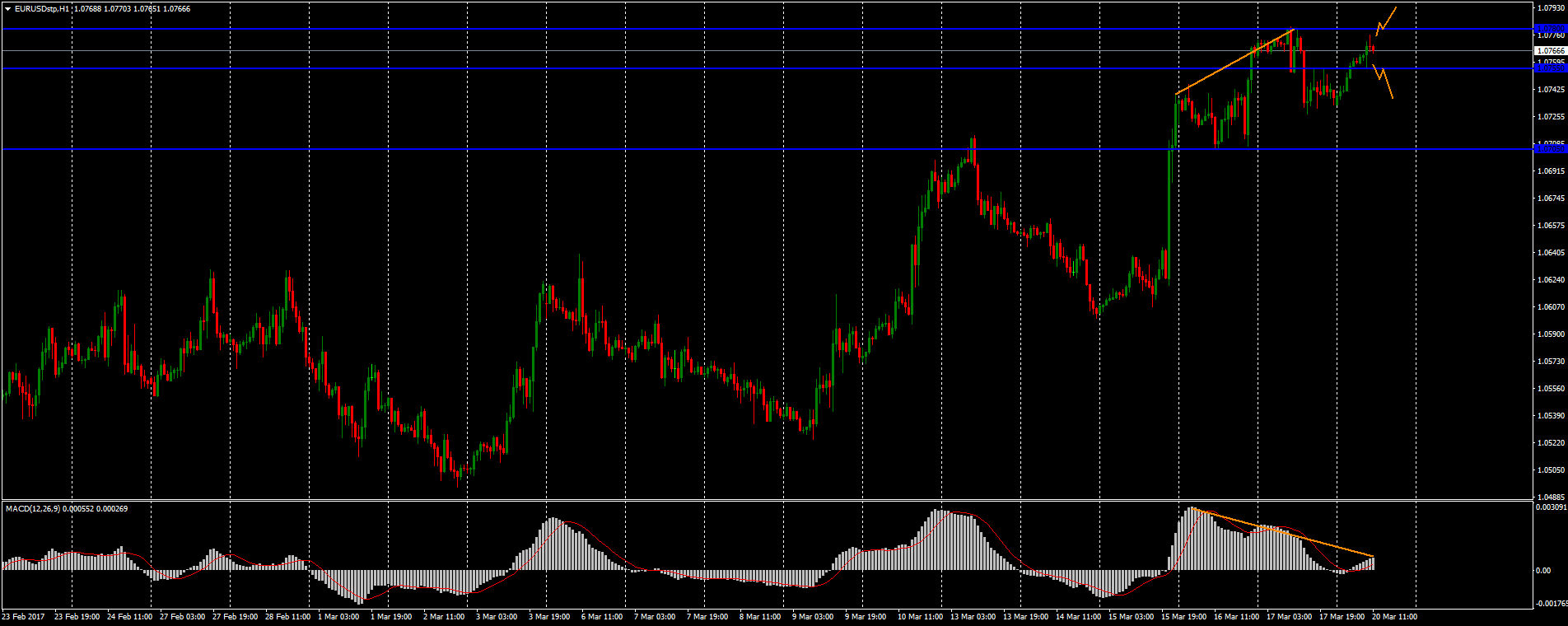

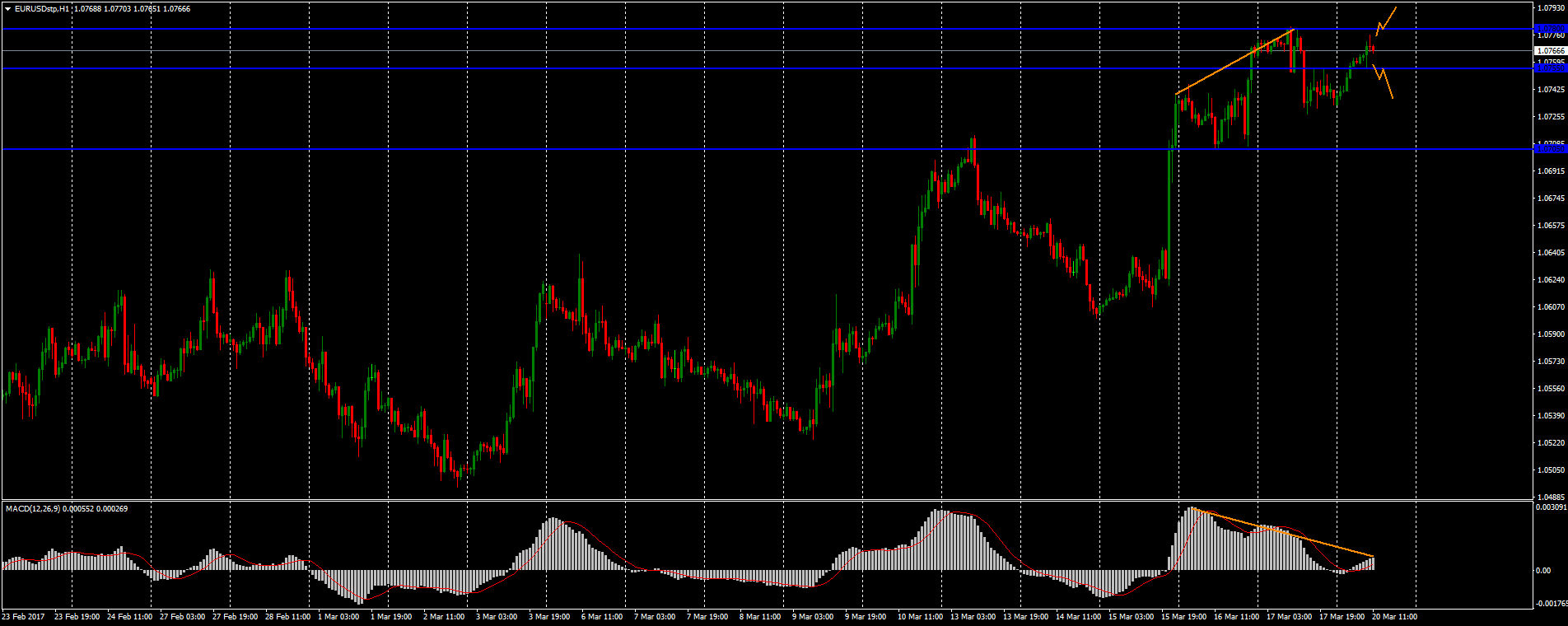

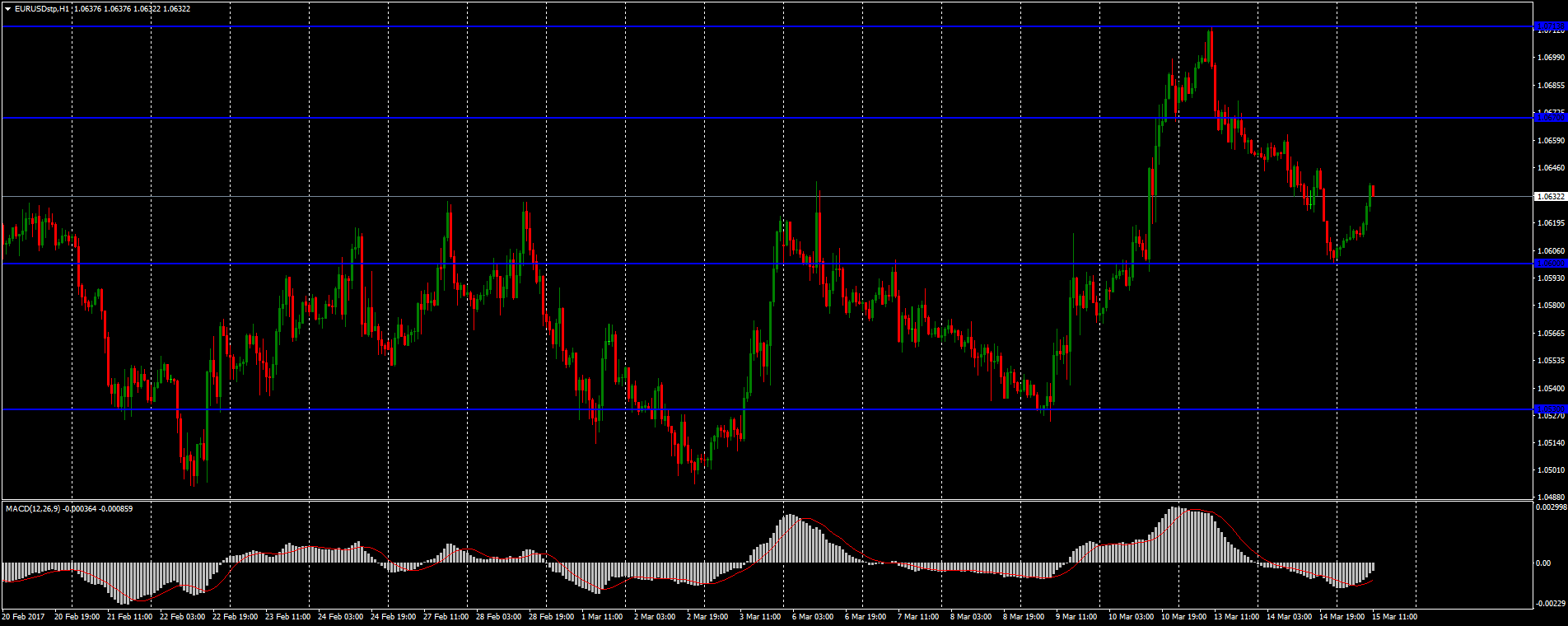

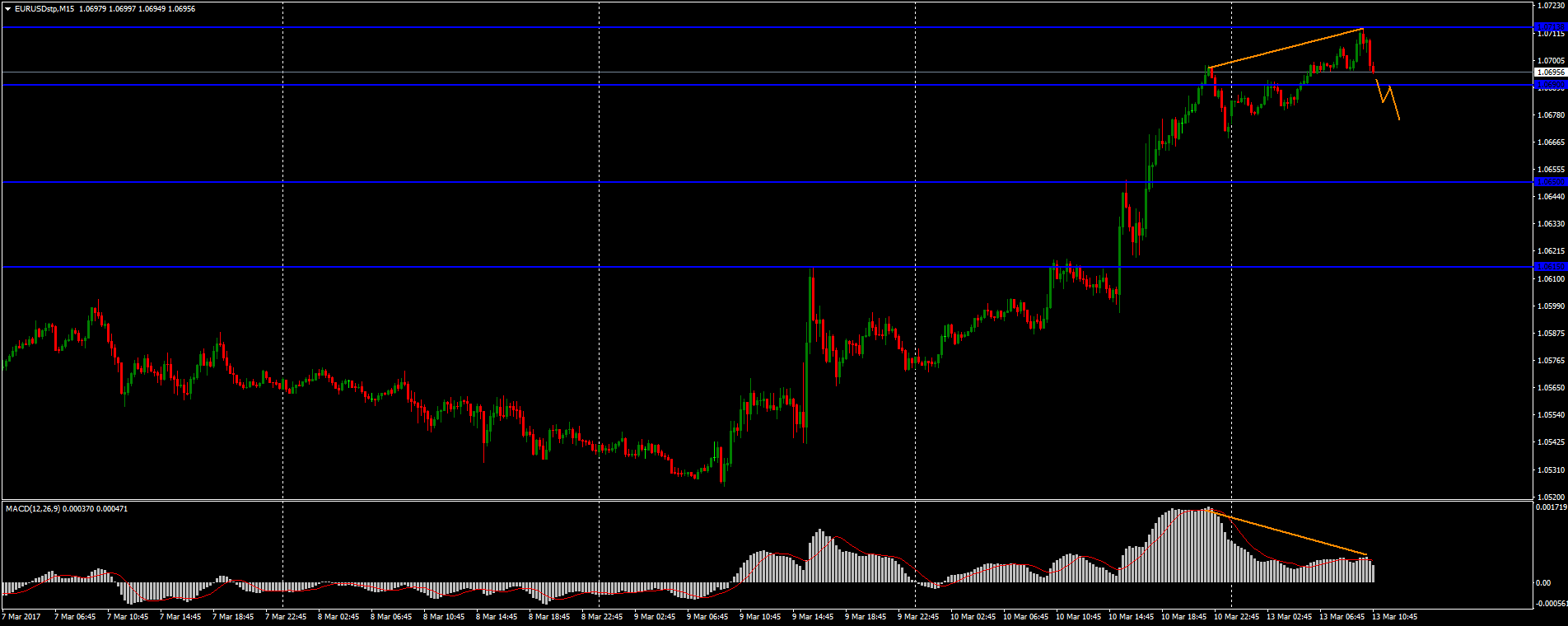

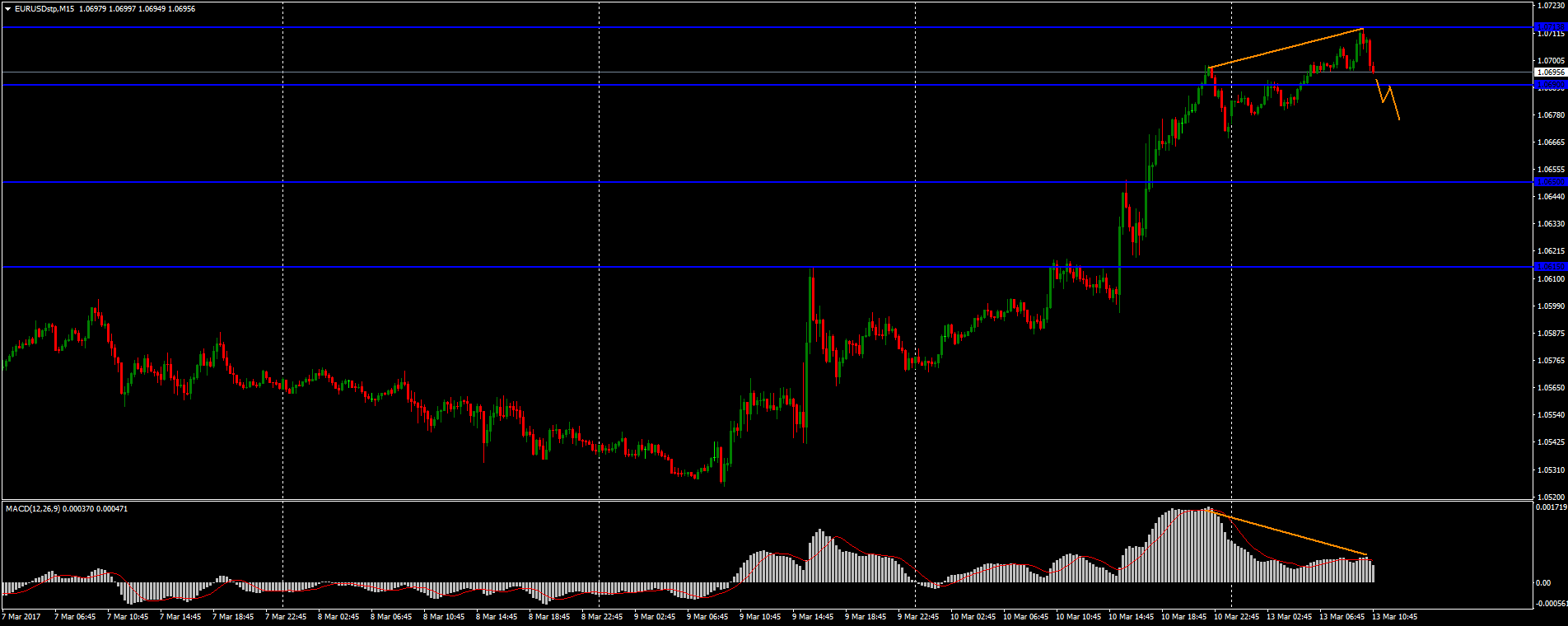

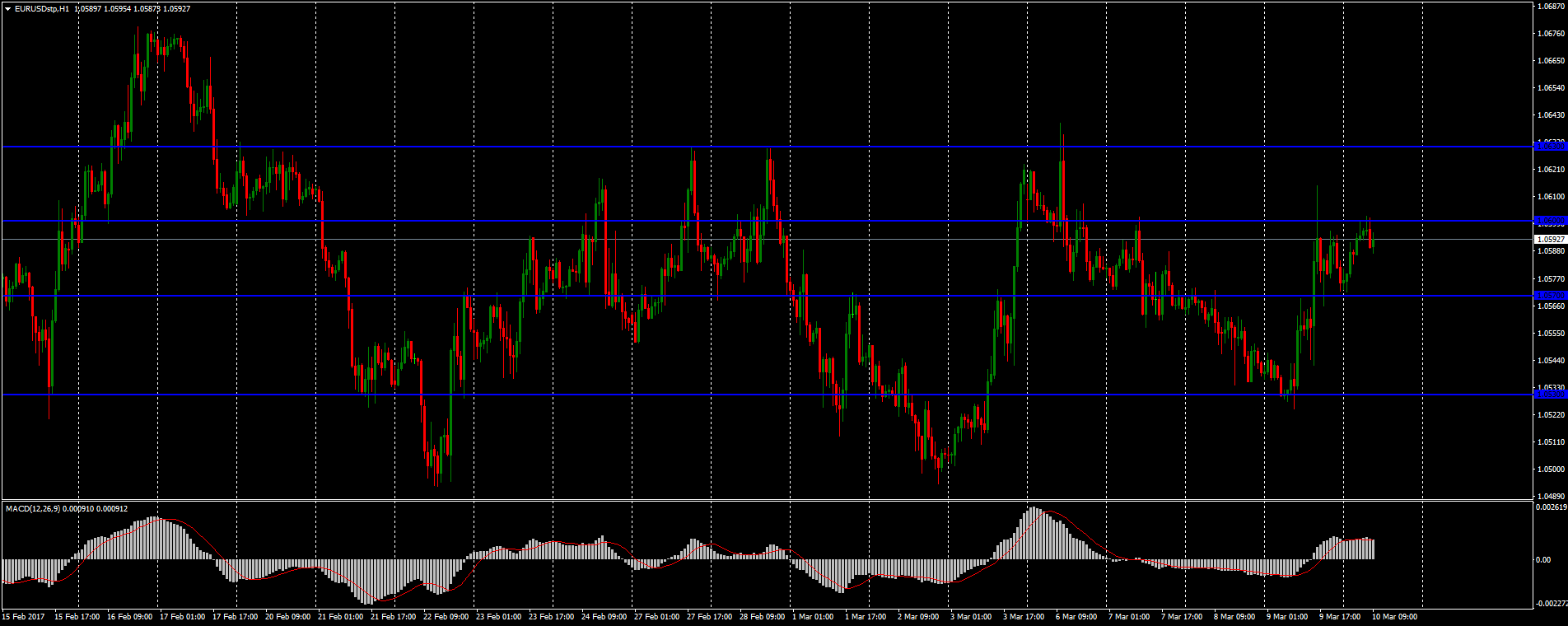

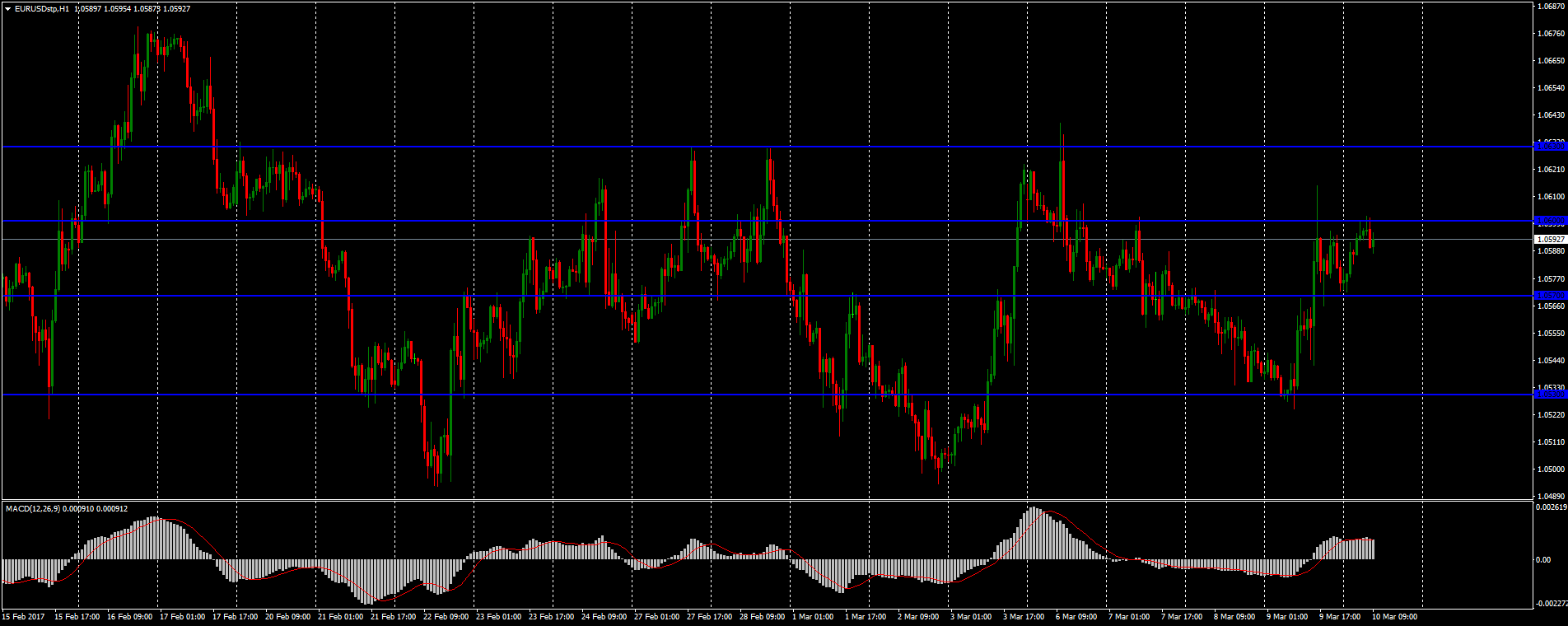

The technical pattern on EUR/USD is mixed for me. I highlighted the following key levels:

Support - 1.0755;

Resistance - 1.0780.

Strong reversal formations (the price divergence and the MACD histogram) were formed on the market. I’d sell EUR/USD, if the price fixes below the 1.0755 level. Potential movement - to 1.0705.

At the same time, I do not exclude the further growth of the EUR/USD quotations. I’d buy it, if the price overcomes the 1.0780 local resistance level. The immediate goal for taking profit is 1.0825.

Support - 1.0755;

Resistance - 1.0780.

Strong reversal formations (the price divergence and the MACD histogram) were formed on the market. I’d sell EUR/USD, if the price fixes below the 1.0755 level. Potential movement - to 1.0705.

At the same time, I do not exclude the further growth of the EUR/USD quotations. I’d buy it, if the price overcomes the 1.0780 local resistance level. The immediate goal for taking profit is 1.0825.

alextrader79

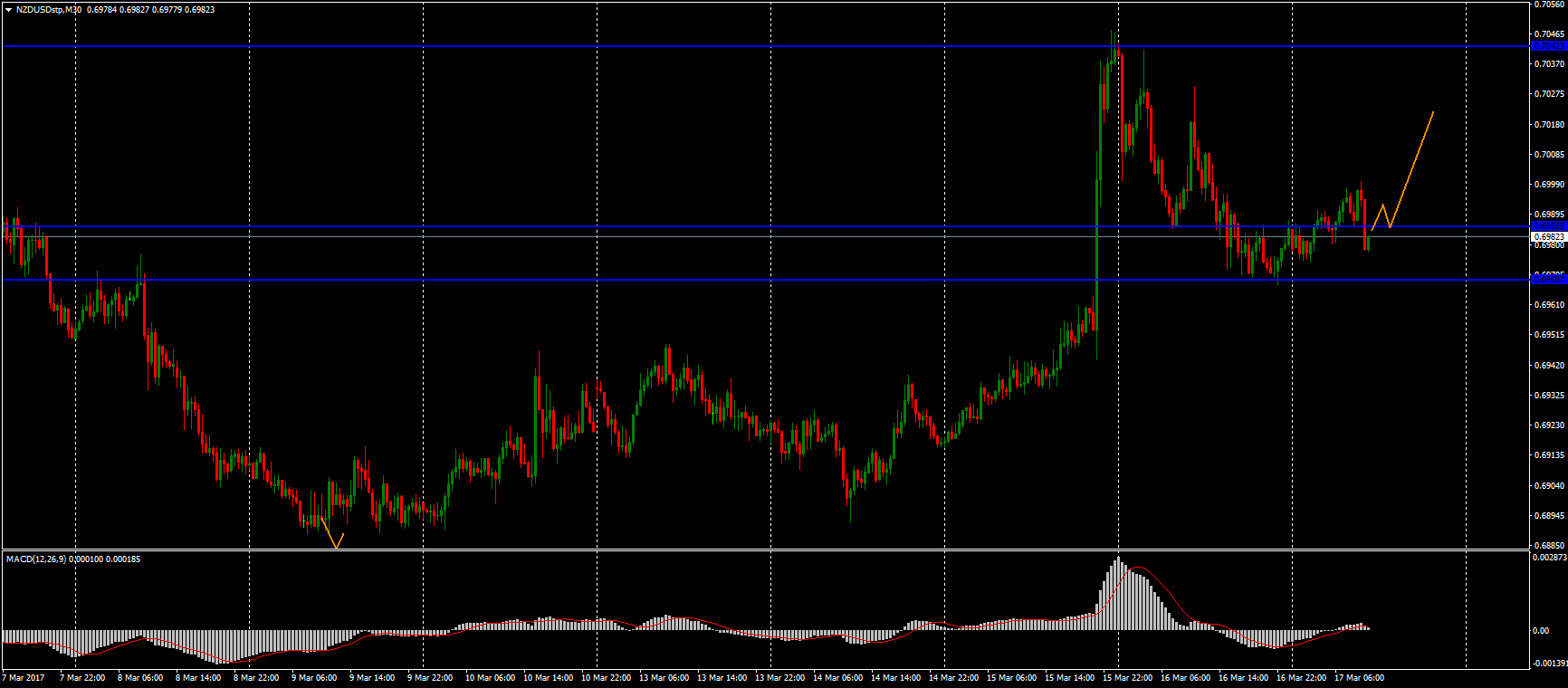

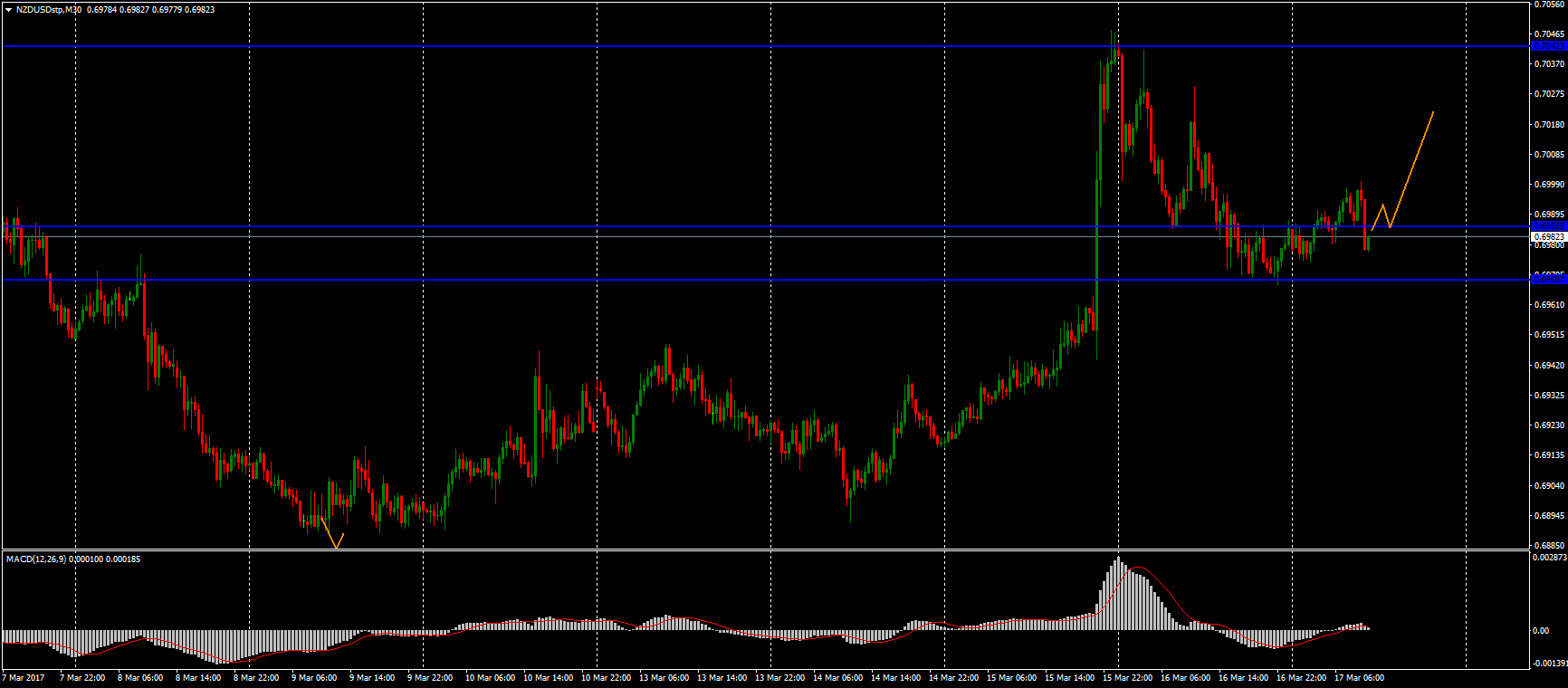

There are "bullish" sentiments on NZD/USD at the moment. The growth of quotations exceeded 60 points during the Asian trading session. The currency has found its resistance at 0.7070. I plan to open deals in the current trend’s direction. I’ll buy the pair, if the price fixes above the 0.7070 mark. Potential movement - to 0.7100-0.7125.

alextrader79

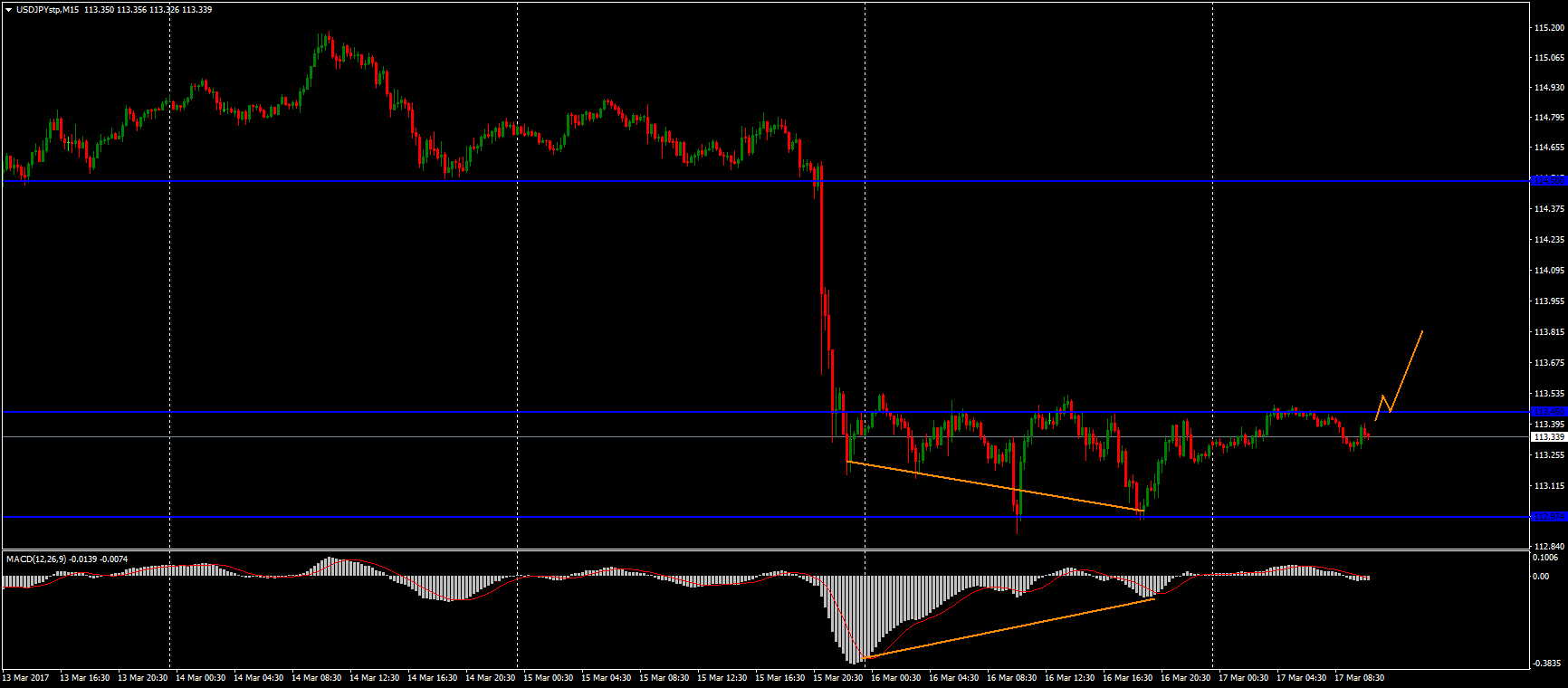

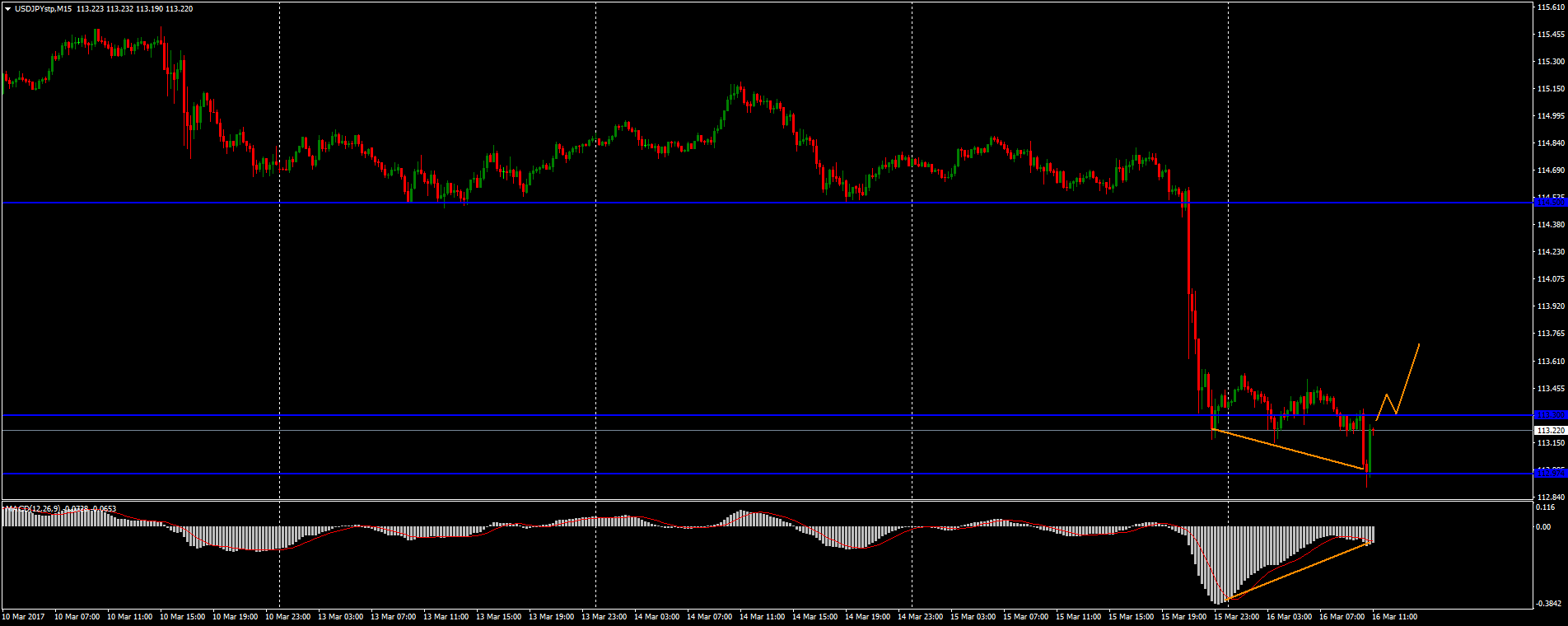

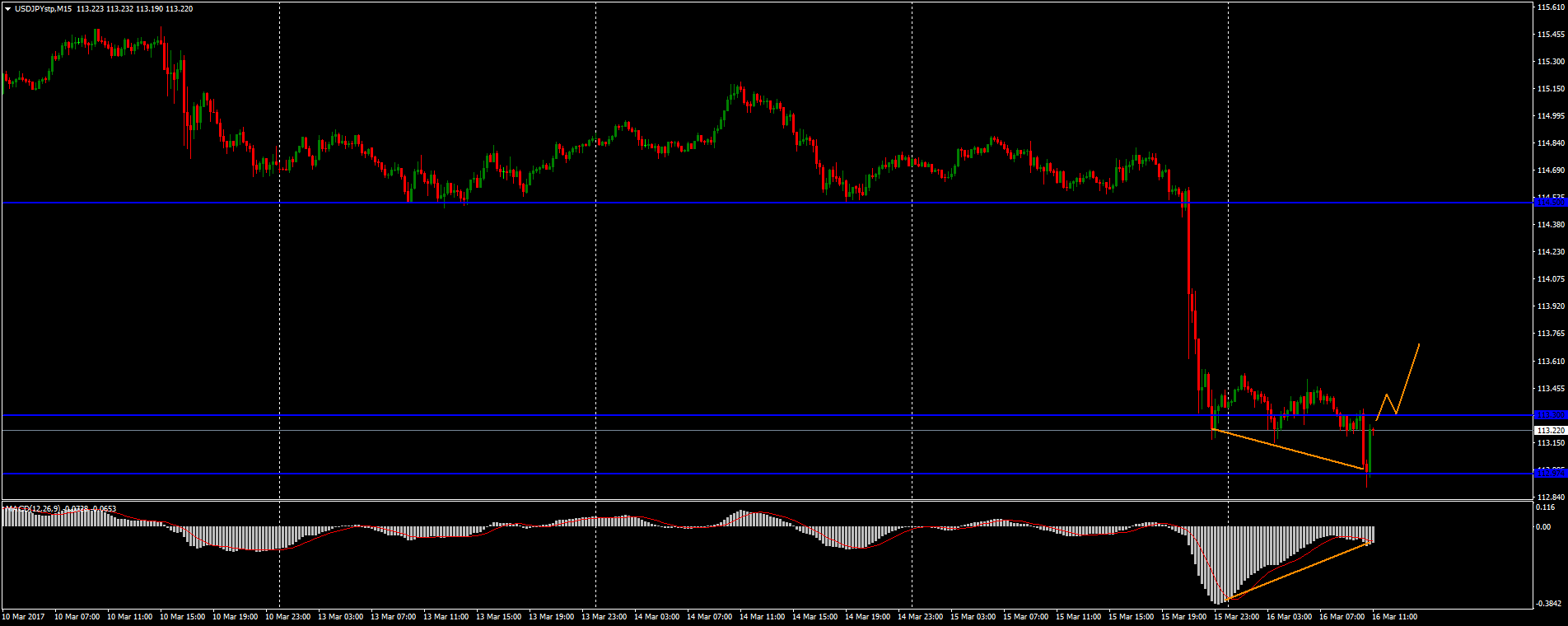

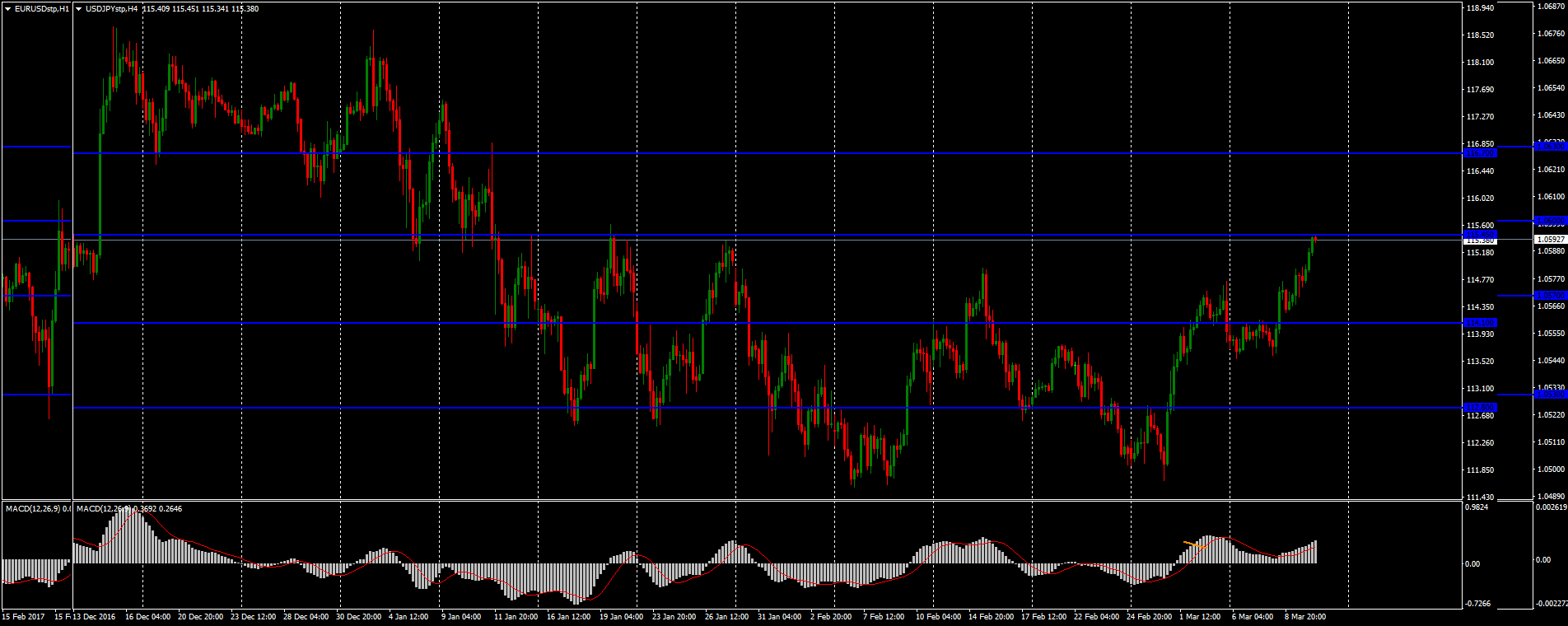

The divergence of the price and the MACD histogram continued yesterday. I am still waiting for a correction on USD/JPY. The demand for the US dollar is supported due to the yesterday’s positive statistics and the growth of the government bonds’ yield. I’d buy USD/JPY after the price fixes above the 113.45 mark. Potential movement – to 114.00-114.25.

alextrader79

The NZD/USD currency pair has been strongly adjusted after a significant growth on Wednesday, March 15. I’d buy NZD/USD, if the price fixes above the 0.6985 local resistance. Potential movement - to 0.6940. I‘ll use a trailing stop for this position.

alextrader79

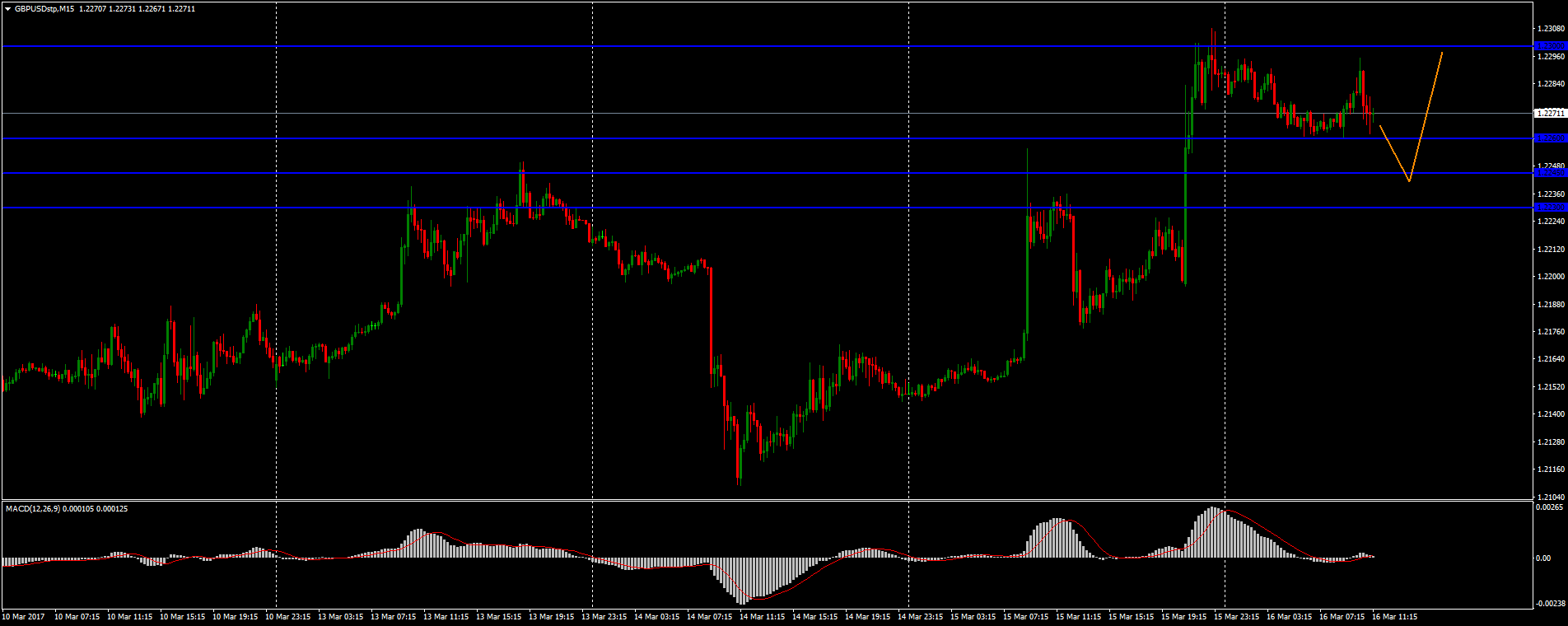

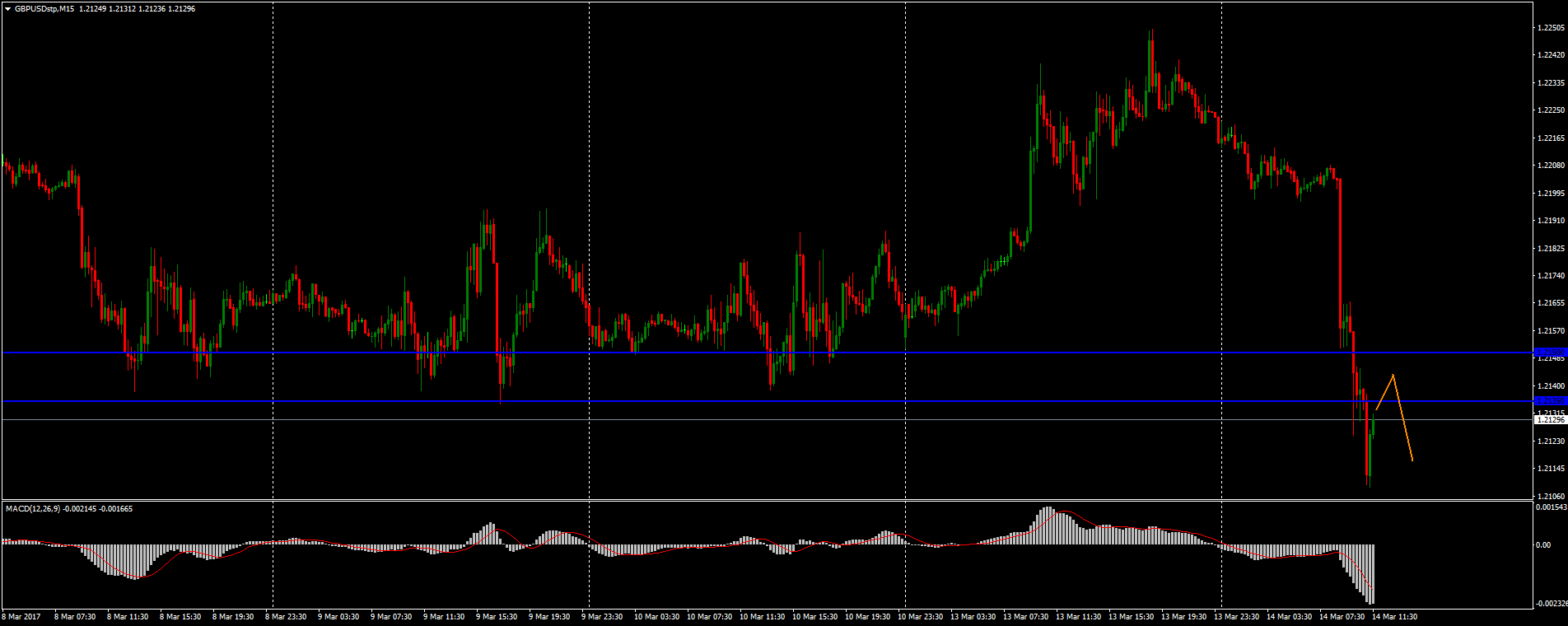

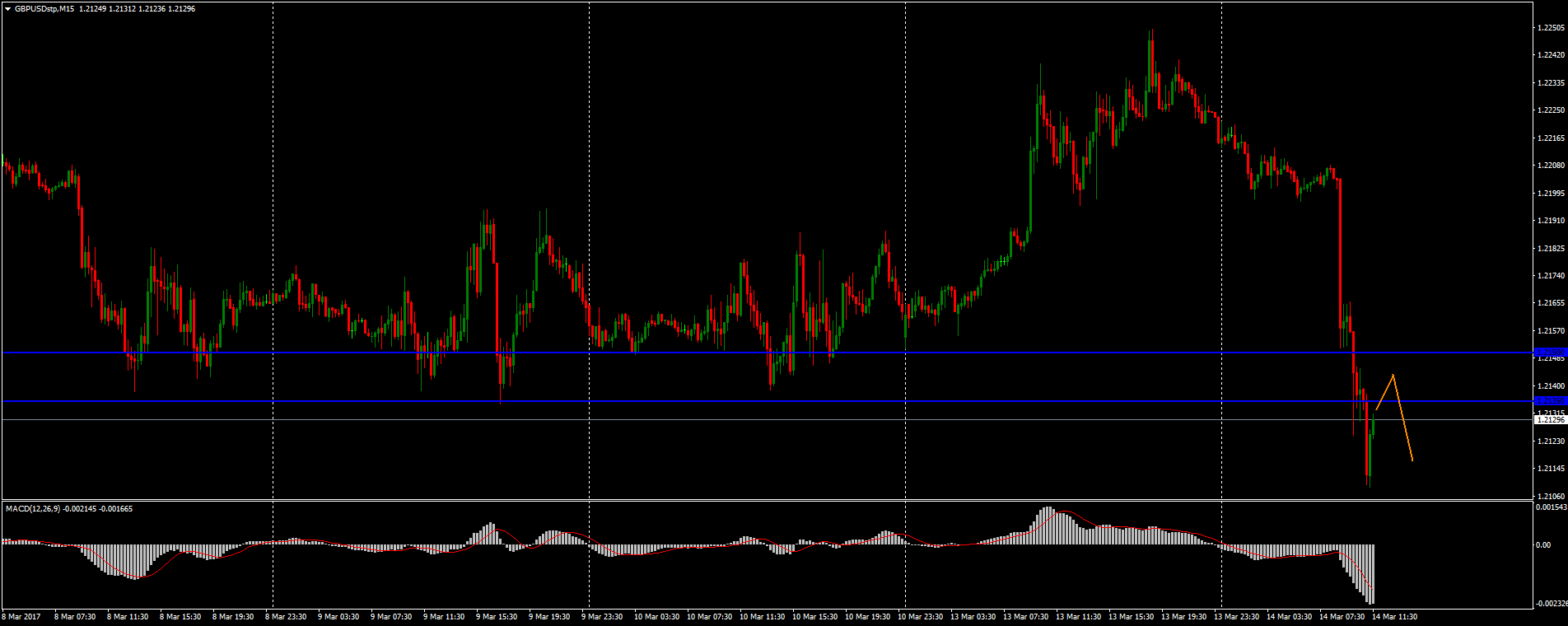

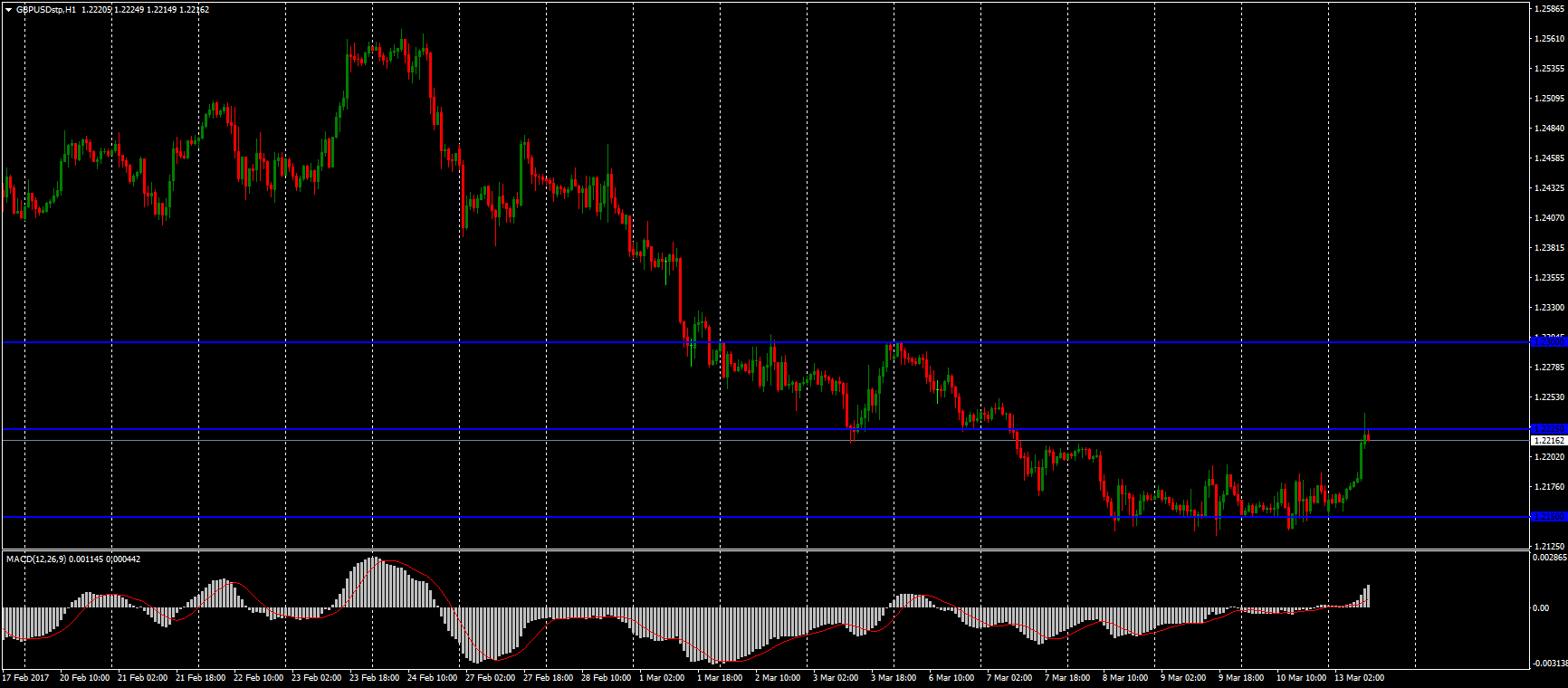

The aggressive buying was observed on GBP/USD yesterday. 1.2300 if the closest resistance level. There is also a correction on this pair. I plan to wait for the price to roll back to the 1.2245-1.2230 area. I’ll look for the entry points for opening long positions, if the price reaches that zone. Potential movement - to 1.2300-1.2325.

alextrader79

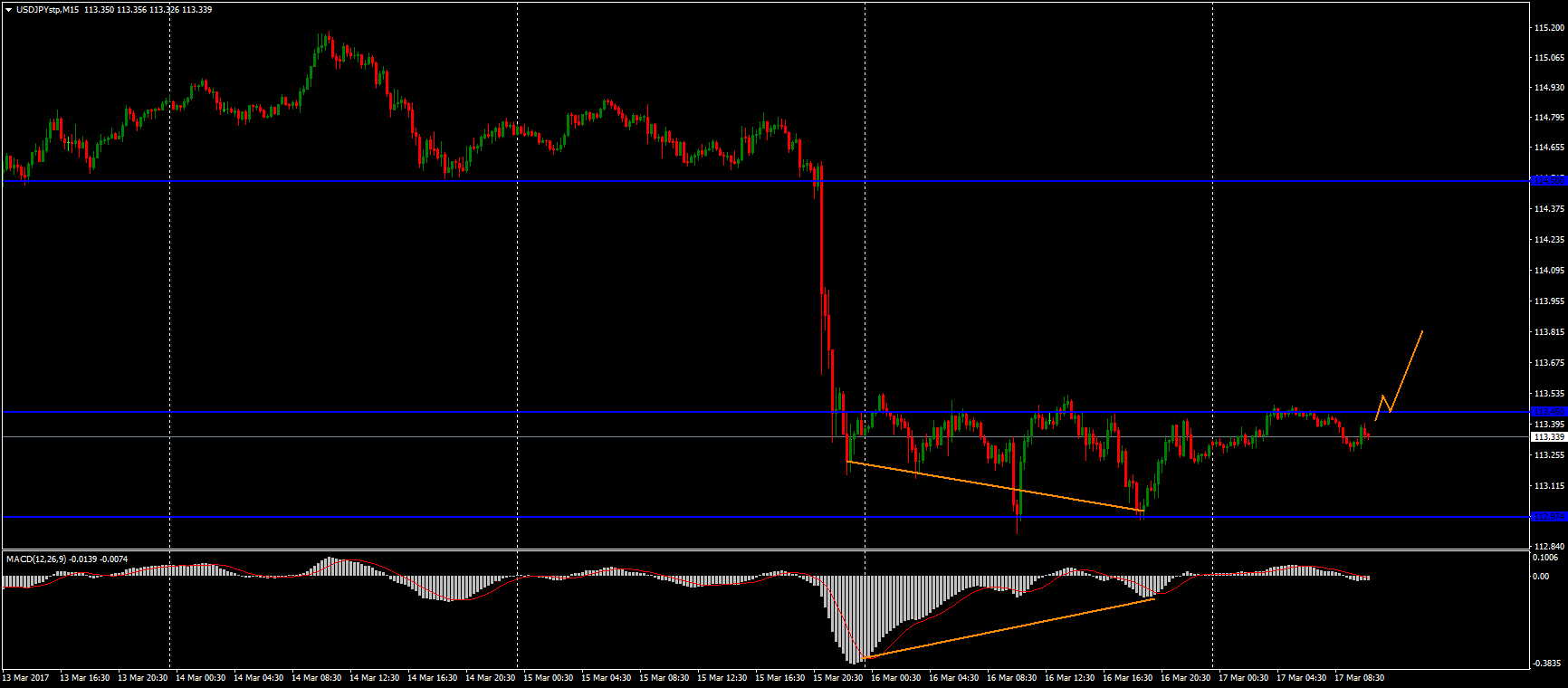

The Fed raised the interest rate by 25 basis points yesterday. At the same time, the US dollar weakened against major world currencies. I’ve already wrote that a possible increase in rates is already “priced-in”. It seems to me that the US currency was under pressure, as Yellen's speech was not strong and aggressive enough.

The technical correction indicates a possible correction on USD/JPY. The strongest reversal formations of technical analysis, the price divergence and the MACD histogram, have formed on the market. I’d buy the pair after the price fixes above the 113.30 level. Potential movement - to the 114.00 round level.

The technical correction indicates a possible correction on USD/JPY. The strongest reversal formations of technical analysis, the price divergence and the MACD histogram, have formed on the market. I’d buy the pair after the price fixes above the 113.30 level. Potential movement - to the 114.00 round level.

alextrader79

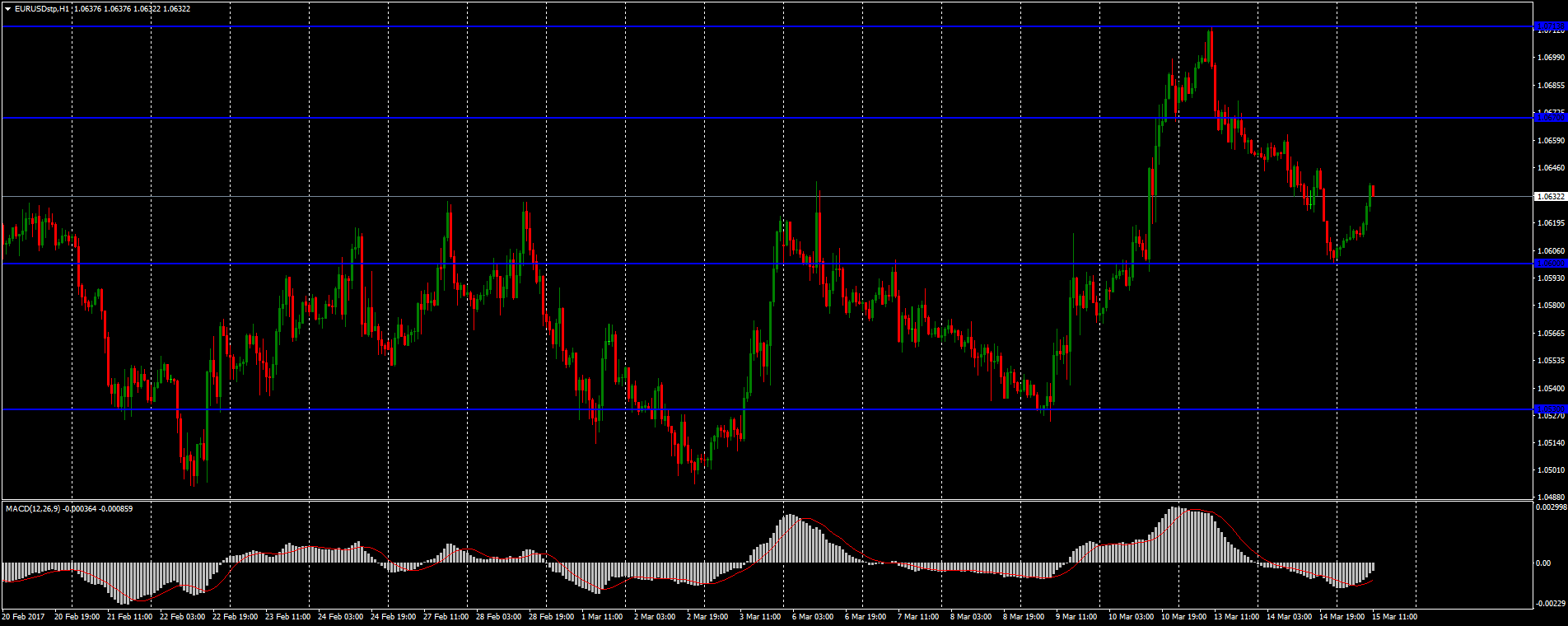

This day will be full of important economic reports and news from the United States. The US Federal Reserve may raise the interest rates for the first time in 2017. The FedWatch Tool is at 90.8% now. It seems to me that the regulator is likely to tighten the monetary policy. At the same time, this event has already been added to the price. It is necessary to monitor the comments of the Fed representatives. The demand for the US dollar will grow, in case if the regulator announces another possible increase of the interest rates.

I won’t open any deals today as I’m planning to wait for the Fed’s decision. I'll be back to trading tomorrow. For now, I’ve identified the following key levels and I’m going to watch how the price reacts to them. Wish you all high profits! :)

EUR/USD

Support levels: 1.0600, 1.0530

Resistance levels: 1.0670, 1.0710

I won’t open any deals today as I’m planning to wait for the Fed’s decision. I'll be back to trading tomorrow. For now, I’ve identified the following key levels and I’m going to watch how the price reacts to them. Wish you all high profits! :)

EUR/USD

Support levels: 1.0600, 1.0530

Resistance levels: 1.0670, 1.0710

alextrader79

USDCAD is traded near the 1.3455 mirror resistance level at the moment. I’ll look for the entry points into the market to buy the pair, if the price fixes at that mark. Potential movement - to the next round level of 1.3500. The demand for the dollar is supported by the growth of profitability of US government bonds.

alextrader79

The aggressive buying is observed on GBPUSD today. The pound has weakened against the US dollar by more than 90 pips. I’ll open transactions in the current trend’s direction. I plan to wait for a correction to the 1.2135-1.2150 demand zone. Potential movement – to 1.2100-1.2075.

alextrader79

The technical pattern on GBPUSD indicates the buyers’ strength. The price has held the 1.2150 key support level. The MACD histogram began to rise. I will buy it, if the price overcomes the 1.2225 local resistance level. Potential movement - to 1.2300. I will use a trailing stop here.

alextrader79

I expect a correction on EURUSD at the moment. A strong reversal formation, the divergence of the price and the MACD histogram, has appeared. I’ll sell the pair after the price fixes below the 1.0690 level. Potential movement - to 1.0650 and 1.0615.

alextrader79

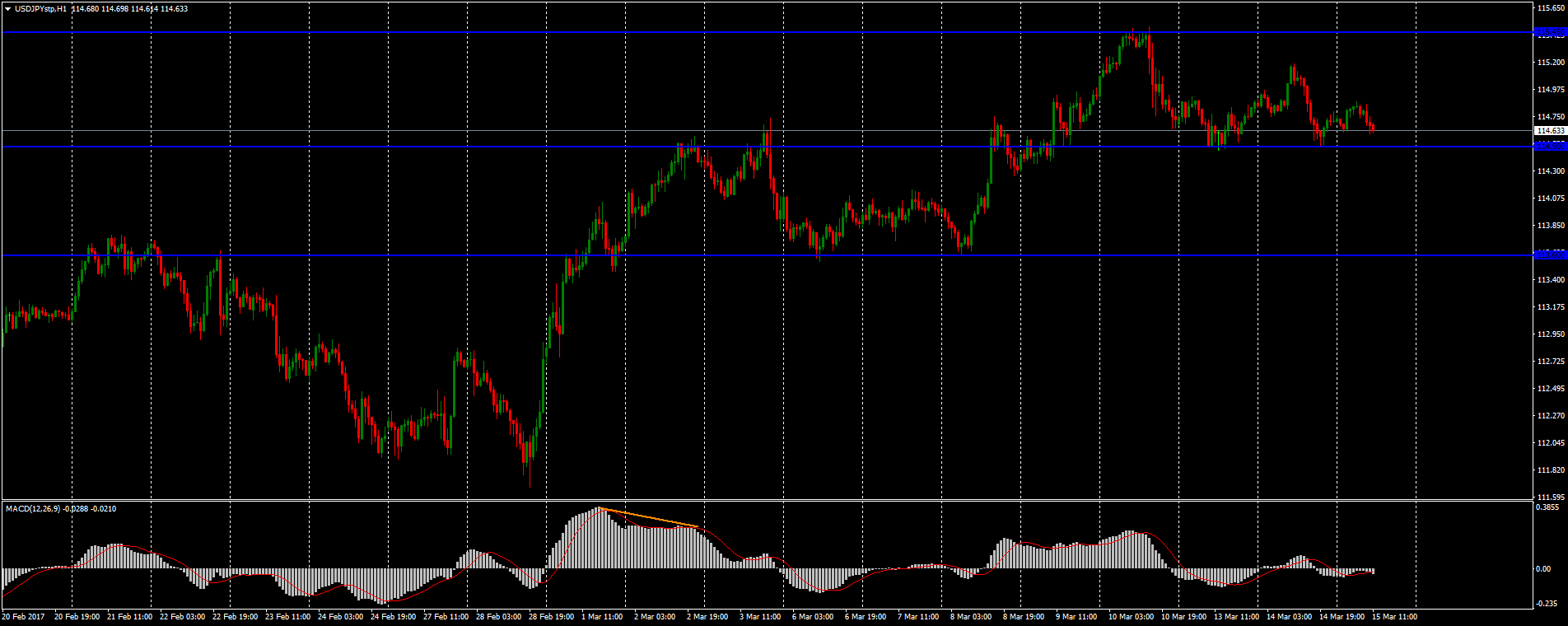

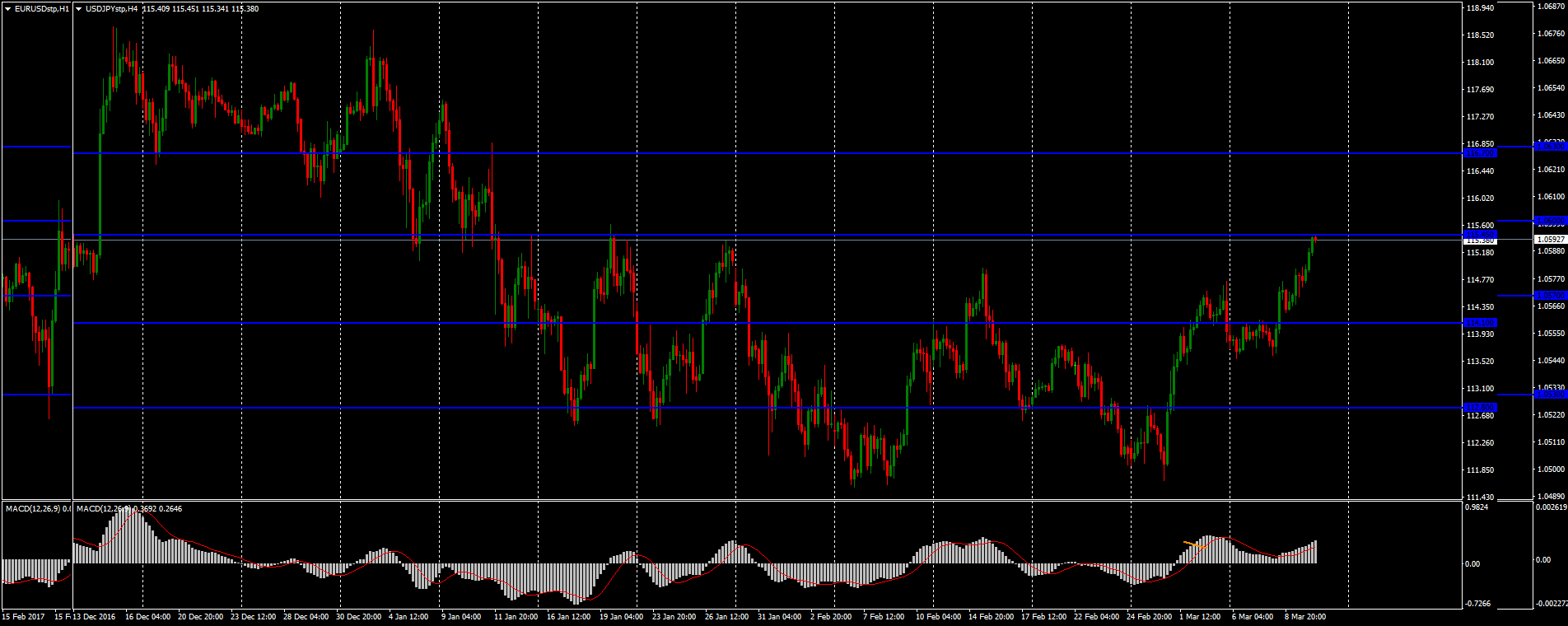

USD/JPY

support - 114.10, 112.80

resistance - 115.45, 116.70

I’m going to watch how the price would react to those marks. I’ll be back to trading on Monday.

Wish you all high profits!

support - 114.10, 112.80

resistance - 115.45, 116.70

I’m going to watch how the price would react to those marks. I’ll be back to trading on Monday.

Wish you all high profits!

alextrader79

The report on the US labor market is at the center of attention today. The preliminary data indicates the positive statistics. I also expect a strong report. Nevertheless, I usually don’t trade during such days. I have identified the following key levels:

EUR/USD

Support - 1.0570, 1.0530

Resistance - 1.0600, 1.0630

EUR/USD

Support - 1.0570, 1.0530

Resistance - 1.0600, 1.0630

: